Summary

As active owners of the companies in our investment portfolios, proxy voting allows us and other shareholders the chance to have our voices heard. In this summary, we highlight some of our voting decisions in 2024, both supporting and opposing the respective management teams.

As a value manager, Beutel Goodman’s primary objective is to deliver superior risk-adjusted financial performance to our clients over the long term. We pursue this through the ownership of debt and equity positions in high-quality companies. We have long advocated for sound corporate governance, which we believe is the foundation of the responsible management of a company, including its environmental and social practices.

The exercise of rights to vote on proxies is a critical pillar in our active ownership approach. Guided by Beutel Goodman’s Proxy Voting Guidelines, we conduct a thorough analysis of each ballot item and seek alignment with long-term shareholder value creation. Our proxy service provider, Glass Lewis, provides recommendations that we consider in our research process. In addition, our investment teams assess steps that a company may have made in relation to proxy issues, and may engage with boards on proxy-related matters and discuss vote recommendations with our proxy adviser. We then make an independent voting decision and monitor voting results and progress over time. If sufficient progress is not shown over a reasonable timeframe, it is incorporated into our research and our proxy voting.

Exhibit 1: Beutel Goodman Proxy Voting Record in 2024 (to July 31, 2024). The table below gives a breakdown of our proxy voting record to July 31, 2024, including when we have voted with or against the recommendations of management and our proxy service provider, Glass Lewis.

| Proposal Category Type | With Management[1] | Against Management | No action / unvoted | Against Policy | Total |

| Totals | 1545 | 62 | 0 | 57 | 1607 |

| Audit/Financials | 161 | 0 | 0 | 0 | 161 |

| Board Related | 1035 | 40 | 0 | 40 | 1075 |

| Capital Management | 59 | 2 | 0 | 2 | 61 |

| Changes to Company Statutes | 28 | 2 | 0 | 1 | 30 |

| Compensation | 158 | 12 | 0 | 10 | 170 |

| M&A | 1 | 0 | 0 | 0 | 1 |

| Meeting Administration | 21 | 1 | 0 | 0 | 22 |

| Other | 9 | 0 | 0 | 0 | 9 |

| SHP: Compensation | 11 | 0 | 0 | 1 | 11 |

| SHP: Environment | 22 | 1 | 0 | 2 | 23 |

| SHP: Governance | 26 | 3 | 0 | 1 | 29 |

| SHP: Social | 14 | 1 | 0 | 0 | 15 |

[1] Management did not provide voting recommendations for six proposals. Two of the six proposals were withdrawn, and we voted all six proposals in line with Glass Lewis’s recommendations.

Source: Beutel Goodman, Glass Lewis, as at July 31, 2024.

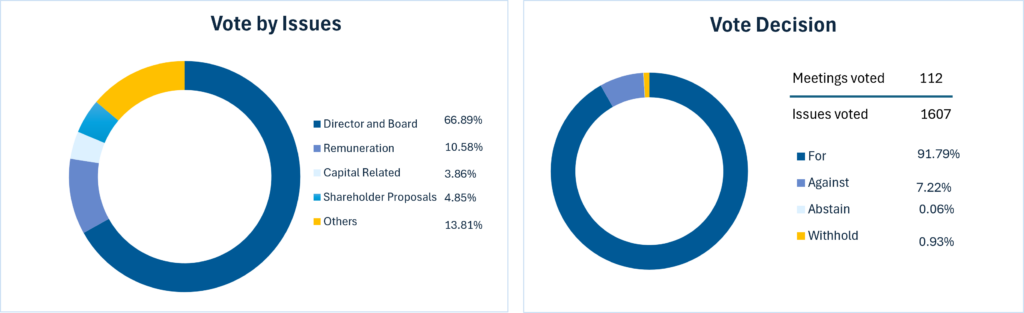

Exhibit 2: Proxy Issues & Decisions. These graphs show different issues we have voted on to July 31, 2024 and when the vote went for/against management’s recommendation.

Source: Beutel Goodman, Glass Lewis, as at July 31, 2024.

Here we highlight some of our notable voting decisions, along with our voting guidelines during the 2024 proxy-voting season.

1.0 BOARD EFFECTIVENESS

Board and management alignment with shareholders is critical to shareholder value creation. Among other factors, we believe that key components of effective governance include:

- Management compensation structures that align strategic decisions and outcomes with the interests of shareholders and incentivize disciplined capital allocation decisions;

- Competence, independence and diversity of thought at the board level; and

- Share ownership and voting structures that afford the ability as shareholders to seek to effect change via engagement and proxy voting.

Corporate boards play a crucial role in overseeing a company’s strategic activities, and their decisions can significantly impact a company’s long-term value. We generally support well-run boards that are aligned with the interests of shareholders. In cases where we disagree or find misalignment, we will typically voice our concerns by voting against or withholding votes from directors. In 2024, we voted AGAINST or WITHHELD votes for 35 directors.

These voting decisions were based on potential misalignments between management and shareholder interests. Fundamental concerns include those related to:

- Compensation;

- Director experience;

- Directors serving on an excessive number of boards (overboarded directors);

- Governance breaches;

- Insufficient board independence;

- Lack of gender diversity on the board;

- Low meeting participation;

- Material weakness in the company’s financial reporting;

- Multi-class share structure with unequal voting rights; and

- Nominating and audit committee independence.

We review the voting results of meetings of shareholders when they are posted. If directors received low support, we typically engage with the company to confirm that shareholders’ concerns are being considered by the board. We view a result of greater than 20% of votes against a director nominee as an indication of shareholder dissent that should be discussed further.

1.1 Board and Committee Independence

Boards of directors that are independent of management add to the board’s effectiveness in oversight and protect shareholder interests. In our view, best practice is for the Audit, Nominating and Compensation Committees of a non-controlled company to be comprised of independent directors.

We also voted AGAINST or WITHHELD votes for directors at several companies across our equity portfolios due to our assessment of board independence; governance, compensation or audit committee independence; and/or not having an independent lead or presiding director.

1.2 CEO/Chair Duality

Generally, an independent board chair is indicative of a sound governance structure. A combined CEO/chair role can call into question the effectiveness and integrity of the board, particularly in areas such as the oversight of management’s execution of corporate strategy and its alignment with shareholder interests. We note, however, that we examine all shareholder proposals regarding an independent chair in the context of a company’s overall governance structure, with particular consideration of management alignment, including compensation and track record of long-term shareholder value creation.

We cast our votes according to this holistic assessment of a company’s governance program. We voted FOR the Shareholder Proposal Regarding Independent Chair at the Annual General Meetings (AGMs) of two companies:

U.S. Equity

| Company | Proposal | Rationale (For) |

| Cummins Inc. | Shareholder Proposal Regarding Independent Chair | We have raised this multiple times with the company and provided feedback that the outgoing CEO should have been the last person to hold both roles. |

| Kellanova | Shareholder Proposal Regarding Independent Chair | A single person with both executive and board leadership concentrates too much responsibility with a single person and inhibits independent board oversight of executives on behalf of shareholders. |

We also engaged and provided feedback on this topic with several of our holding companies.

However, there are cases where we assess that a company has already demonstrated strong alignment with shareholders and has a well-designed incentive structure for senior management, so the value-add from an independent chair may be diminished. Our votes AGAINST the shareholder proposals for an independent chair reflect that assessment at the following companies:

Canadian Equity

| Company | Proposal | Rationale (Against) |

| Restaurant Brands International Inc. | Shareholder Proposal Regarding Independent Chair | Given his unique value to Restaurant Brands we are comfortable with Patrick Doyle not being independent in his role as Executive Chair. We note that this is an exception to the company’s recent history where the previous board chair was independent. |

U.S. Equity

| Company | Proposal | Rationale (Against) |

| BlackRock Inc. | Shareholder Proposal Regarding Independent Chair | While we support the principle of an independent chair, we believe this proposal is too prescriptive and does not best serve shareholder interests. |

| Interpublic Group of Companies Inc. | Shareholder Proposal Regarding Independent Chair | We agree with Glass Lewis that given the company has an independent chair, we are unconvinced that adoption of this proposal would effect any kind of meaningful change in the company’s leadership structure and thus do not believe support is warranted at this time. |

1.3 Board Diversity

Diversity of thought enhances decision making and thus having a diverse set of directors on a board is relevant to good corporate governance. It is generally recognized by the market that at least 30% of female directors on a board represents best practice. Although we agree with this standard, we will also consider a company’s progress toward diversity, as well as other aspects of diversity and overall board quality.

1.4 Multi-Class Share Structures

Glass Lewis continues to recommend voting against the Head of the Governance Committee across all companies that have multi-class share structures with unequal voting rights. While we recognize that such structures limit shareholder influence on a company, multi-class share structures are legal, continue to be employed in new listings and can provide controlling shareholders with the ability to make informed strategic decisions that serve the best interests of shareholders. Although we support the principle of one share, one vote, we do not preclude investment in companies with such structures. We evaluate proposals to collapse a multiple voting share structure and would vote in favour if it was in the best interest of shareholders.

1.5 Significant Governance Breach

Strong governance is the fundamental basis for a company’s success and share-value creation. A significant breach in governance could signal a board-level emphasis on short-term financial gains over long-term shareholder value creation. In such cases, we may use proxy voting to voice our concerns.

An example of this occurred this year (and in 2023) with Hakuhodo DY Holdings, when we voted AGAINST all insider directors (executives) and the Chair of the board. This was based on governance concerns around several issues, including allegations of bid rigging and bribery in connection with the Tokyo Olympics; a majority non-independent board; cross-shareholdings in other public Japanese companies; and insufficient shareholder disclosure and communications.

BG’s votes against directors in the 2024 proxy season are summarized below.

Canadian Equity

| Company | Proposal | Rationale (Against or Withheld) |

| Bank of Montreal | Elect Madhu Ranganathan | Overboarding concerns. |

| Restaurant Brands International Inc. | Elect Jordana Fribourg | Concerns around limited experience, family relationship and independence. |

| Elect Marc Lemann | Concerns around affiliation to 3G Capital (3G is the beneficial owner of ~27% voting power, and Marc Lemann is the son of the founder), and experience. |

Canadian Small Cap Equity

| Company | Proposal | Rationale (Against or Withheld) |

| Enerflex Ltd. | Elect James C. Gouin | Reporting of ongoing material weakness. |

| Elect Mona Hale | Reporting of ongoing material weakness. | |

| Elect Michael A. Weill | Reporting of ongoing material weakness. | |

| Enghouse Systems Ltd. | Elect Pierre Lassonde | Concerns regarding compensation program. |

| Elect Melissa Sonberg | Concerns regarding compensation program. | |

| Elect Paul Stoyan | Concerns regarding compensation program. | |

| GDI Integrated Facility Services | Elect David G. Samuel | Multi-class share structure with unequal voting rights. |

| Elect Robert J. McGuire | Multi-class share structure with unequal voting rights. | |

| Elect Anne Ristic | Multi-class share structure with unequal voting rights. | |

| Leon’s Furniture Ltd. | Elect Terrence T. Leon | Board gender diversity <30%. |

| Elect Mary Ann Leon | Affiliate/Insider on audit committee. | |

| Linamar Corporation | Elect Mark Stoddart | Board independence is 50%, below optimal for a non-controlled company. |

| Elect Terry Reidel | CEO/Chair duality with no independent lead director. | |

| NFI Group Inc. | Elect Adam L. Gray | Board meeting attendance <75%. |

| Superior Plus Corp. | Elect Douglas J. Harrison | Concerns regarding compensation program – disconnect between pay and performance. |

| TELUS International (Cda) Inc. | Elect Madhuri A. Andrews | Overboarding concerns. |

| Elect Tony Geheran | Multi-class share structure. |

U.S. Equity

| Company | Proposal | Rationale (Against or Withheld) |

| Comcast Corp. | Elect Kenneth J. Bacon | Overboarding concerns. |

| Elect Thomas J. Baltimore, Jr. | Overboarding concerns. |

International Equity

| Company | Proposal | Rationale (Against or Withheld) |

| DBS Group Holdings Ltd. | Elect CHNG Kai Fong | Insufficient independence on audit committee. |

| Hakuhodo DY Holdings Inc. | Elect Hirokazu Toda | Governance concerns around allegations of bid rigging, non-independent board, cross shareholdings, insufficient shareholder disclosure, entrenched director. |

| Elect Masayuki Mizushima | Governance concerns around allegations of bid rigging, non-independent board, cross shareholdings, insufficient shareholder disclosure. | |

| Elect Hirotake Yajima | Governance concerns around allegations of bid rigging, non-independent board, cross shareholdings, insufficient shareholder disclosure. | |

| Elect Masanori Nishioka | Governance concerns around allegations of bid rigging, non-independent board, cross shareholdings, insufficient shareholder disclosure. | |

| Elect Akihiko Ebana | Governance concerns around allegations of bid rigging, non-independent board, cross shareholdings, insufficient shareholder disclosure. | |

| Elect Motohiro Ando | Governance concerns around allegations of bid rigging, non-independent board, cross shareholdings, insufficient shareholder disclosure. | |

| Elect Nobumichi Hattori | Governance concerns around allegations of bid rigging. | |

| Heidelberg Materials AG | Elect Ludwig Merckle | Affiliates or insiders should not be on the compensation committee. |

| Nippon Telegraph & Telephone Corp. | Elect Tomoki Maeda as Director | No evidence that candidate would bolster corporate governance. |

2.0 EXECUTIVE COMPENSATION

Our preference is for companies that demonstrate alignment between executive compensation and shareholder interests, have suitable performance-based incentives, and can attract and retain top talent. We view these factors as aligned with shareholders’ interests:

- A focus on returns such as ROIC or ROE;

- A tilt to long-term payouts vs short-term payouts;

- Compensation packages that promote pay for performance; and

- Longer vesting periods and non-cash versus cash compensation.

We voted AGAINST certain say-on-pay proposals due to:

- A pay-performance disconnect concerning pay practices;

- Insufficient response to shareholder dissent;

- Insufficient disclosure of elements in the compensation plan;

- Inadequate reduction in CEO’s pay versus seriousness of regulatory violations; and

- Lack of focus on returns.

Canadian Equity

| Company | Proposal | Rationale (Against) |

| Toronto-Dominion Bank | Advisory Vote on Executive Compensation | Reduction in the CEO’s annual incentive compensation payment is inadequate. |

In the case of Toronto-Dominion Bank, we voted AGAINST the Advisory Vote on Executive Compensation, counter to both management and Glass Lewis’ recommendations. We believe that the $1 million reduction in the CEO’s annual incentive compensation payment was inadequate given the seriousness of the regulatory violations that TD is charged with in the United States. It represents only a 6% percent reduction in total compensation for the year. We engaged the board and CEO on the issue and await a resolution regarding the regulatory violations.

Canadian Small Cap Equity

| Company | Proposal | Rationale (Against) |

| Enghouse Systems Ltd. | Advisory Vote on Executive Compensation | Ongoing concerns regarding the company’s compensation program. |

| Superior Plus Corp. | Advisory Vote on Executive Compensation | Disconnect between pay and performance. |

U.S. Equity

| Company | Proposal | Rationale (Against) |

| BlackRock Inc. | Advisory Vote on Executive Compensation | Disconnect between pay and performance and excessive retention awards granted. |

| The Carlyle Group | Advisory Vote on Executive Compensation | Concerning pay practices and pay-for-performance disconnect. |

| Interpublic Group of Companies Inc. | Advisory Vote on Executive Compensation | Lack of direct focus on returns (ROIC or ROE). |

International Equity

| Company | Proposal | Rationale (Against) |

| Atea ASA | Remuneration Report | Inadequate disclosure. |

| BASF SE | Management Board Remuneration Policy | Poor disclosure of performance metrics and rationale for pay-mix rebalance. Concerns on high pension contributions. |

| Remuneration Report | Lack of disclosure to support large severance payment to former management board member in 2023. | |

| Euronext | Remuneration Report | Insufficient justification in relation to the discretionary awards granted and poor disclosure regarding end-of-service arrangements. |

| Gjensidige Forsikring ASA | Remuneration Report | Lack of a long-term incentive plan in the executive remuneration package. |

It is worth mentioning the distinction between voting against directors for election and voting against say-on-pay proposals. While director vote outcomes are binding, say-on-pay vote outcomes are advisory only. When warranted, we may also vote against directors associated with the Remuneration or Compensation Committee to hold them accountable for compensation issues.

In the case of Enghouse and Superior Plus, in addition to voting AGAINST the Advisory Vote on Executive Compensation, we also WITHHELD our votes from directors due to concerns around their compensation programs.

Failed votes on executive compensation prompted engagement with boards on how to improve compensation packages to better align with pay-for-performance and with shareholders.

To date, there have been three compensation programs in our portfolios that a majority voted against:

| Company | Proposal | Votes FOR | Votes AGAINST/ABSTAIN |

| Enerflex Ltd. | Advisory Vote on Executive Compensation | 31.8% | 68.2% |

| Euronext | Remuneration Report | 44.5% | 55.5% |

| Harley-Davidson Inc. | Advisory Vote on Executive Compensation | 49.7% | 50.3% |

Enerflex, Euronext and Harley-Davidson proposals on executive compensation did not receive approval from 50% of shareholders and therefore failed to pass. We will engage with these boards to understand the key issues, as well as plans to improve the compensation programs.

3.0 CAPITAL RELATED VOTES

3.1 Capital Allocation

We view capital allocation decisions as a key engagement topic and essential to long-term shareholder value creation. In the event of proposed transformational acquisitions or transactions, we conduct a complete company review. We review and assess the merits of the transaction and its potential impact on the risk/reward of the investment. We engage with stakeholders, typically including senior management, board members, industry experts and other shareholders. We thoroughly discuss issues to inform our research. To date in 2024, we have not had any proposals regarding acquisitions or transformational transactions.

3.2 Equity Issuance

We generally do not favour equity issuance as part of a company’s capital allocation plan, as it dilutes shareholder ownership and, in most cases, negatively impacts valuation.

4.0 SHAREHOLDER PROPOSALS

We evaluate shareholder proposals based on whether the proposal aligns with the interests of shareholders, encourages value creation, and is consistent with our objective of advancing companies’ performance, including any material ESG factors identified in our investment process. We also consider initiatives and progress that a company may already have taken to address the issues raised in the proposal.

There has been an increase in the number of environmental and social shareholder proposals received for our portfolio companies, and we actively engage with stakeholders to understand these proposals. We engage directly with our investee companies and at times, with the shareholders filing proposals. These conversations give us more context and inform our decisions to seek alignment with shareholder interests. In the first half of 2024, we conducted proxy-related engagements with 26 companies, a modest increase from 20 engagements across equity strategies in the same period in 2023.

Of the 38 environmental and social shareholder proposals assessed in the 2024 proxy season to July 31, 2024, we voted FOR one at Flowserve, in line with Glass Lewis but against management recommendations. The proposal was regarding a Political Contributions and Expenditures Report and in our view the increased disclosure would allow shareholders to more fully assess risks presented by the Company’s political spending.

Two proposals, at Restaurant Brands and Power Corp. of Canada, were voted with management but against Glass Lewis recommendations. At Restaurant Brands, Glass Lewis recommended a vote FOR the Shareholder Proposal Regarding Report on Supply Chain Water Risk Exposure. Based on our engagement with the company, we believe that Restaurant Brands is progressing in its efforts to more broadly assess and report on the impact of water risk to its business and that the shareholder proposal was therefore unnecessary at this time. We will continue to monitor progress on this issue, especially in terms of disclosure.

At Power Corp. of Canada, Glass Lewis recommended a vote FOR the shareholder proposal regarding the Disclosure of Financed Emissions, for which we voted AGAINST. While we agree disclosure of financed emissions facilitate shareholders to understand a company’s exposure to climate-related financing risks, Power Corp. is a holding company with no holdings in fossil fuel assets, and no direct environmental footprint aside from its head office operations. We have reviewed the company’s climate-related disclosures, including absolute Scopes 1, 2, and 3 GHG emissions, and believe the current disclosure is appropriate.

In most cases, we found companies’ disclosures and monitoring of issues highlighted in shareholder proposals were sufficient, and additional disclosure in accordance with the shareholder proposals would not in our view provide additional material benefit to shareholders. All of these shareholder proposals failed to pass the shareholder vote.

Interestingly, despite support from both management and Glass Lewis, the Canadian Pacific Kansas City (CPKC) Advisory Vote on Approach to Climate Change was defeated, with only 42.4% shareholder support. We voted FOR, and expected this proposal to pass; however, there is concern around the Board of CPKC yielding responsibility and accountability of the company’s strategy to shareholders. While it is important to keep shareholders informed on the company’s climate actions and strategy, asking shareholders to vote on say-on-climate could be construed as the board absolving itself of accountability for the company’s climate strategy. This may explain why several shareholders voted against this proposal. We plan to discuss this in our next board engagement.

For the period under review (year to date to July 31, 2024), three shareholder proposals regarding In-Person Shareholder Meetings passed, despite recommendations against, from management and Glass Lewis. We voted AGAINST these proposals. Bank of Montreal currently offers both in-person and virtual options for shareholders to participate while iA Financial intends to do so, so there are adequate in-person alternatives. For Metro, its current virtual meeting policies provide appropriate safeguards and protection for shareholders, making adoption of the resolution unnecessary at this time.

For Masco, the Shareholder Proposal Regarding Simple Majority Vote received overwhelming support. Management did not provide any recommendation for this proposal, but Glass Lewis supported the proposal. We voted FOR this proposal as we agree that supermajority vote requirements can impede shareholders’ ability to approve ballot items that are in their interests.

| Company | Proposal | Votes FOR | Votes AGAINST/ABSTAIN |

| Metro Inc. | Shareholder Proposal Regarding In-Person Shareholder Meetings | 53.8% | 46.2% |

| iA Financial Corporation Inc. | Shareholder Proposal Regarding In-Person Shareholder Meetings | 53.2% | 46.8% |

| Bank of Montreal | Shareholder Proposal Regarding In-Person Shareholder Meetings | 50.5% | 49.5% |

| Masco Corp. | Shareholder Proposal Regarding Simple Majority Vote | 94.4% | 5.6% |

Proxy voting remains a key focus in Beutel Goodman’s active ownership approach. We share our voting decisions and rationales (when we vote against management or Glass Lewis, and on ESG proposals) on our website shortly following the meeting. For a general overview of the factors we consider when casting our votes, please see our Proxy Voting Guidelines.

Download PDF

This report has been prepared for informational purposes only and may not be reproduced, distributed or published without the prior written consent of Beutel, Goodman & Company Ltd. (“Beutel Goodman”). This document does not constitute an offer or a solicitation to buy or to sell any security, product or service in any jurisdiction. This document is not intended, and should not be relied upon, to provide legal, financial, accounting, tax, investment or other advice. This document is not available for distribution to people in jurisdictions where such distribution would be prohibited.

The information provided is as at July 31, 2024. Beutel Goodman has taken reasonable steps to provide accurate and reliable information. Beutel Goodman reserves the right, at any time and without notice, to amend or cease publication of the information.

Please note Beutel Goodman’s ESG and responsible investment approach may evolve over time. This report refers to progress made and activities performed during the first seven months of 2024. Also note that the integration of ESG and responsible investment considerations does not guarantee positive returns. Past performance does not guarantee future results.

For more information on our approach to ESG and Responsible Investing, please visit https://www.beutelgoodman. com/about-us/responsible-investing/. Certain portions of this document may contain forward-looking statements. Forward-looking statements include statements that are predictive in nature, that depend upon or refer to future events or conditions, or that include words such as “expects”, “anticipates”, “intends”, “plans”, “believes”, “estimates” and other similar forward-looking expressions. In addition, any statement that may be made concerning future performance, strategies or prospects, and possible future action, is also forward-looking statement. Forward-looking statements are based on current expectations and forecasts about future events and are inherently subject to, among other things, risks, uncertainties and assumptions which could cause actual events, results, performance or prospects to be incorrect or to differ materially from those expressed in, or implied by, these forward-looking statements.

These risks, uncertainties and assumptions include, but are not limited to, general economic, political and market factors, domestic and international, interest and foreign exchange rates, equity and capital markets, business competition, technological change, changes in government regulations, unexpected judicial or regulatory proceedings, and catastrophic events. This list of important factors is not exhaustive. Please consider these and other factors carefully before making any investment decisions and avoid placing undue reliance on forward-looking statements. Beutel Goodman has no specific intention of updating any forward-looking statements whether as a result of new information, future events or otherwise.

©2024 Beutel, Goodman & Company Ltd. Do not copy, distribute, sell or modify this document without the prior written consent of Beutel, Goodman & Company Ltd.