Summary

Monetary policy has been a major driver of market performance since central banks around the globe began hiking rates in early 2022. Now that the tightening cycle may be over, Beutel Goodman’s Fixed Income Team looks ahead at what the Federal Reserve’s policies could mean for markets and the economy in 2024.

By the Beutel Goodman Fixed Income Team

The first month of 2024 is in the books, rounded off by the latest interest rate decision by the Federal Reserve (Fed) at its January 31 Federal Open Market Committee (FOMC) meeting. The Fed kept rates as is, which was expected by markets, and indicated it would ease policy in the coming year.

Looking at inflation data, it is apparent that monetary policy tightening measures have had a significant impact on cooling price pressures, although inflation remains above target levels. According to the Commerce Department’s Bureau of Economic Analysis, the Personal Consumption Expenditures Price Index (PCE) — the Fed’s preferred measure of inflation — recorded a year-over-year increase of 2.6% in December.

On the growth front, the U.S. economy remains in robust health, delivering annualized GDP growth of 3.3% in Q4/2023. This was the sixth straight quarter where GDP growth has exceeded 2%, which is highly atypical of a period of rate tightening.

The Fed Path

A strong economy, alongside inflation that is close to the Fed’s 2% target, has increased the likelihood of achieving an economic soft landing. Fed Chair Jerome Powell remains reluctant to declare victory just yet, however, as engineering a soft landing means striking a difficult balance between cutting rates enough to let growth continue at a measured pace, but not so much as to reignite inflation.

At the January 31 FOMC press conference, Chair Powell noted that “it will likely be appropriate to begin dialing back policy restraint at some point this year”, but that the Fed is “not looking for a weaker labor market” and that “the timing of [rate cuts] is going to be linked to our gaining confidence that inflation is on a sustainable path down to 2%.”

We believe the Fed is telegraphing that rate cuts in 2024 will be “maintenance cuts”, not a shift to an easing policy. The difference between a maintenance cut and a switch to easing can be determined by the real rate, which is the nominal interest rate adjusted for inflation. The goal of easing policy is to lower the real rate to stimulate the economy, while the goal of a maintenance cut is to maintain a consistent real rate as inflation comes down.

Presently, and given the Fed’s January guidance, it appears likely that we will see maintenance cuts around the middle of 2024, so long as the economy maintains its recent growth and inflation continues to trend downwards.

Maintenance and Easing

Given the lagged effects of monetary policy, keeping rates at current higher levels could harm the economy, but at the same time, cutting rates too soon could cause another spike in inflation.

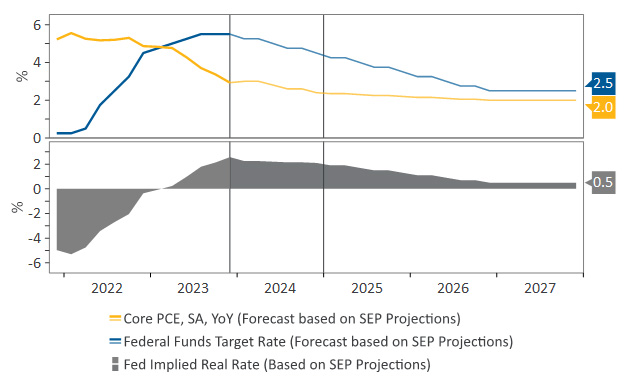

In its most recent Summary of Economic Projections (SEP), the Fed forecasts that core PCE and the Federal Funds Rate will both fall by 75 bps in 2024 (see Exhibit 1). Notable in this chart is the fact that the real rate is expected to move somewhat sideways and is not projected by the Fed to ease meaningfully in the next 12 months. This is important because it indicates that the Fed’s projections for cuts in 2024 are consistent with maintenance cuts and not an explicit easing of policy to stimulate the economy, which is not forecast to begin until 2025.

Exhibit 1: Fed Summary of Economic Projections (SEP). This chart maps out the projections for both personal consumption expenditures, excluding Food & Energy (core PCE) and the Federal Funds Target rate. The grey pane takes the difference between the two, which can be interpreted as a proxy for the expected real rate.

Bond Market Pricing and Borrowing Costs

At its January meeting, the Fed gave guidance that cuts were in the pipeline, but not as early as markets had priced in during the rally that ended 2023. At the press conference, Chair Powell said it was “not likely the committee will be confident enough by March to cut rates”, citing the need for “greater confidence” that inflation was headed for the Fed’s 2% target.

The bond market appears to have taken a different view, however, pricing in cuts of 1.5% for 2024 (as noted above, 0.75% would be consistent with maintenance cuts). This implies that markets believe the Fed will need to ease policy this year in response to slowing economic growth. It is our view that risk market valuations are assuming the best of both worlds — pricing assets according to the lower interest rates of the bond market, but with the expectation for an economic soft landing. This incongruity has sent risk asset prices soaring.

Since the bond market has already priced in the expected cuts, there will likely be little impact to borrowing costs i.e., mortgage or borrowing rates, when the expected cuts do occur. In addition, mortgage rates are driven primarily by the prevailing Treasury 10-year rate, not the policy rate directly. Therefore, even with policy rate cuts beginning in 2024, it is not certain that financing conditions will ease.

Quantitative Tightening

Alongside rate cuts, the Fed’s quantitative tightening (QT) program is also likely on borrowed time. As it approaches the ample reserve levels needed to ensure there is enough liquidity in the system, and to avoid any scarcity in reserves available for lenders, the Fed will need to either taper or stop QT.

Reserves in the U.S. banking system are currently concentrated in a few large lenders and it will take time for the reserves to be reallocated, so an earlier taper would provide a longer runway for that to occur. Stopping or tapering QT while reserves are ample is also considered a safer strategy than reducing the balance sheet to a very low level.

We expect that the Fed will lay out its preliminary plan for QT in March, before beginning tapering around the second quarter of 2024, and likely ending QT by year end.

Outlook

We currently expect that the Fed will likely begin its interest rate cutting cycle by the middle of the year. As noted, the bond market has already priced in a substantial number of cuts, perhaps more than what is warranted given the Fed’s maintenance cuts narrative.

We believe there are three possible scenarios:

- The bond market continues the sell-off that began in January until valuations are more consistent with the Fed’s messaging (i.e., the soft-landing narrative); or

- Risk markets digest and understand the Fed’s “higher for longer” real rate message and realize that low interest rates can likely only happen in a recessionary environment; or

- Economic data deteriorates in 2024, and central banks cut rates, to inject easing into the system.

From our perspective, we expect some resolution to the conflicting narratives being priced into both bond and risk markets.

In the short term, we believe that bond markets will move towards pricing in maintenance cuts, which should cause yields to rise. Ultimately, we believe there will likely be a slowdown in economic growth as the year progresses.

Related Topics and Links of Interest:

©2024 Beutel, Goodman & Company Ltd. Do not sell or modify this document without the prior written consent of Beutel, Goodman & Company Ltd. This commentary represents the views of Beutel, Goodman & Company Ltd. as at the date indicated.

This document does not constitute an offer or a solicitation to buy or to sell any security, product or service in any jurisdiction. This document is not available for distribution to people in jurisdictions where such distribution would be prohibited.

This document is not intended, and should not be relied upon, to provide legal, financial, accounting, tax, investment or other advice. Beutel Goodman has taken reasonable steps to provide accurate and reliable information. Beutel Goodman reserves the right, at any time and without notice, to amend or cease publication of the information.

Certain portions of this article may contain forward-looking statements. Forward-looking statements include statements that are predictive in nature, that depend upon or refer to future events or conditions, or that include words such as “expects”, “anticipates”, “intends”, “plans”, “believes”, “estimates” and other similar forward-looking expressions. In addition, any statement that may be made concerning future performance, strategies or prospects, and possible future action, is also forward-looking statement. Forward-looking statements are based on current expectations and forecasts about future events and are inherently subject to, among other things, risks, uncertainties and assumptions which could cause actual events, results, performance or prospects to be incorrect or to differ materially from those expressed in, or implied by, these forward-looking statements.

These risks, uncertainties and assumptions include, but are not limited to, general economic, political and market factors, domestic and international, interest and foreign exchange rates, equity and capital markets, business competition, technological change, changes in government regulations, unexpected judicial or regulatory proceedings, and catastrophic events. This list of important factors is not exhaustive. Please consider these and other factors carefully before making any investment decisions and avoid placing undue reliance on forward-looking statements Beutel Goodman has no specific intention of updating any forward-looking statements whether as a result of new information, future events or otherwise.