The bond market plays a unique role in the ESG (Environmental, Social, Governance) investing world, as entities can issue bonds to fund an ESG-related project or goal.

The World Bank issued the first ever green bond in 2008 and Électricité de France S.A. issued the first green corporate bond in 2013. Since then, the market for sustainable investment has grown exponentially not only for green bond issuance, but also to include blue bonds (water), social bonds, sustainable bonds, sustainability-linked bonds and loans, and at some future date, transition bonds. The first quarter of 2021 has seen a continuation of the rapid growth, with ESG-labelled debt supply totaling over US$275 billion in global issuance across all currencies. This represents a 47% increase over the previous quarter[1].

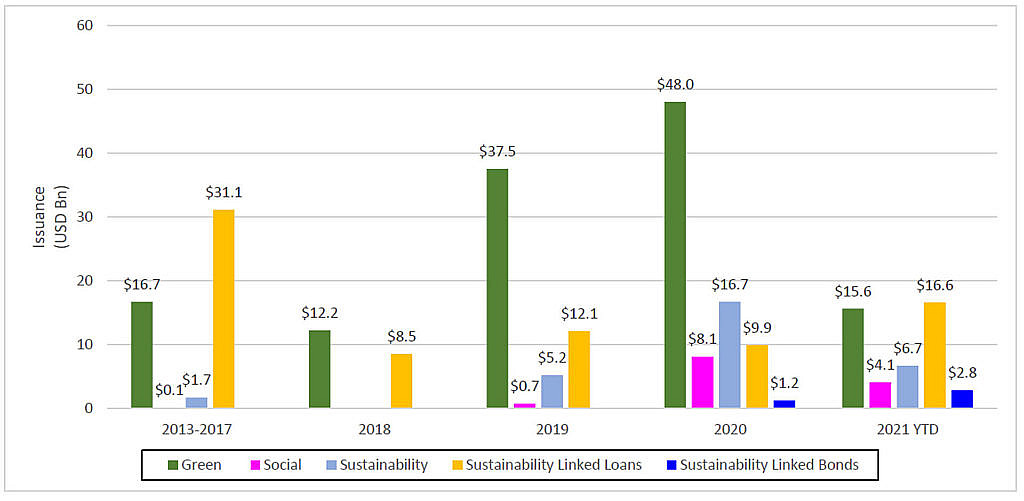

The Evolution of ESG Related Financing

Sources: Bloomberg, Company reports, and National Bank Financial Research. YTD 2021 as of 19 April 2021.

The growth of sustainable finance is fueled by both supply and demand. As companies transition to a lower carbon world and commit to net-zero GHG (greenhouse gas) emissions by 2050, a tremendous amount of investment will be required to facilitate the transition. Investments in renewable power; battery technology; electric vehicles; hydrogen production and transportation; green buildings; and carbon capture, utilization and storage (CCUS) will all be required, and these investments will need to be financed. In the power sector alone, the International Renewable Energy Agency (IRENA) estimates that the global energy transformation will require investment of nearly US$22.5 trillion in new renewable installed capacity through 2050. This would imply at least a doubling of annual investments compared to the current levels, from almost US$310 billion to over US$660 billion.[2]

On the demand side, the proliferation of funds with an ESG focus, both passive and active, continue to attract significant inflows. The UN-convened Net-Zero Asset Owner Alliance, which calls for investors to align their portfolios with a maximum 1.5-degree increase in global temperatures scenario, already represents US$5.7 trillion assets under management.[3] In addition, global banks have committed substantial funds to sustainable investing. JPMorgan Chase & Co. has introduced a sustainable finance goal of US$2.5 trillion by 2030. The program is focused on green, development and community development projects. Citigroup Inc. has committed US$250 billion in environmental finance to help accelerate the transition to a low-carbon economy. In Canada, Royal Bank has committed to mobilizing $500 billion in sustainable finance by 2025 and TD Bank has targeted $100 billion in low-carbon lending, financing and other programs by 2030.

Green Bonds

Green bonds were the first sustainable financing product. The use of proceeds from green bonds have been renewable energy, energy efficiency, clean transport, waste and water management, green buildings and climate-change adaptation. In Canada, corporations such as Algonquin Power Corp., Brookfield Renewable Partners L.P., Ontario Power Generation Inc. (OPG), Summit Industrial Income REIT, Allied Properties REIT, Manulife Financial Corp., FortisBC Energy Inc. and TD Bank have all issued green bonds. Provinces and pension funds have also issued green bonds and the Government of Canada has announced that they plan to launch a green bond program in the near future. Thus far, eight developed countries have issued sovereign green bonds, including two recent deals from Italy (US$10.1 billion) and France (US$8.3 billion).

The majority of the bonds are issued within a framework that focuses on transparency, disclosure and reporting. The International Capital Markets Association (ICMA) has produced process guidelines for green, social, and sustainability-linked bonds. While the guidelines are voluntary, they provide a benchmark for evaluating different green bond issuances.

The Centre for International Climate and Environment Research (CICERO) builds on the ICMA guidelines to give investors an indication of how ‘green’ the projects are based on the projects funded. CICERO uses three shades of green:

- Dark green is for projects that correspond to a long-term low carbon and climate resilient future, such as clean, renewable energy;

- Medium green is for projects that represent steps towards a long-term vision, but are not there yet, such as plug-in hybrid buses; and

- Light green is for environmental projects that do not alone contribute to the long-term vision, such as efficient fossil-fuel infrastructure.

Social Bonds

Social bonds raise funds for projects that address or mitigate a specific social issue and/or seek to achieve positive social outcomes. Most social projects include affordable housing and infrastructure (e.g., clean drinking water, sanitation, transport), access to essential services (e.g., health care, financing, education), employment generation, food security and socioeconomic advancement and empowerment.

CIBC issued the first social bond in Canada in September 2018. Proceeds from the three-year $1 billion “Women in Leadership” bonds support the bank’s corporate lending to companies where women make up at least 30% of top executives or board members, or who are signatories of the Catalyst Accord 2022, a movement that aims to advance women in business. In March 2021, BMO issued a five-year $750 million “Women in Business” bond, which allocates the proceeds to women-owned businesses to foster an innovative and inclusive culture and remove systemic barriers stemming from gender bias.

Sustainability Linked Bonds and Loans

Sustainability-linked bonds (SLB) and loans (SLL) are a relatively new class of instruments that provide incentives for issuers and borrowers to set and achieve predetermined sustainability performance targets.

Proceeds from the loans and bonds are not earmarked for specific green and social projects and can be used for general corporate purposes. Instead, the bond coupon may be ratcheted up or down contingent upon the issuer’s ESG performance. Issuers that meet their targets will receive a lower interest rate, while failure to meet a target results in a higher interest rate.

The focus of these bonds and loans is more on the overall ESG output than on financing a particular project. The majority of SLLs and SLBS are linked to Key Performance Indicators (KPIs) tailored to a company’s sustainability strategy; however, some also link to a company’s third-party ESG rating. As per ICMA, the key challenge for issuers will be selecting ESG KPIs that are ambitious, attainable, quantifiable, and material to their business. The penalty for failing to meet the goals set out in the KPIs is not just pecuniary; there is also a reputational risk for non-compliance.

NRG Energy Inc. was the first North American company to issue an SLB in December 2020. The bond was issued to help fund the company’s acquisition of Direct Energy and achieve its climate transition strategy. This strategy includes a 50% reduction in absolute GHG emissions by 2025 and a pledge to be net-zero by 2050. The 2.45% coupon will step up 25 basis points if NRG does not meet its goal to cut Scope 1, 2, and 3[4] emissions by 50% by 2025.

We purchased our first SLB for our fixed income portfolio in March 2021. U.S. poultry producer Pilgrim’s Pride Corp. issued a 10-year high yield bond that provides a direct link to the company’s Sustainability Performance Target (SPT) of achieving a 30% reduction in Scope 1 and 2 GHG emission intensity across the company’s global operations by 2030, from a 2019 baseline. If the company does not meet its interim target of a reduction in GHG emissions intensity of 17.68% by the end of 2025, the interest rate payable on the notes steps up by 0.25% until maturity. The company has published an SLB framework and has committed to an annual update of its KPIs together with a verification report from a third party.

We have not yet seen a sustainability-linked bond in Canada, but several companies recently announced that they have negotiated sustainability-linked loans. In December 2020, OPG issued a US$750-million senior unsecured revolving standby credit facility. This SLL is based on meeting targets related to safety, installation of electric vehicle chargers, trees planted and hydroelectric capacity development. OPG has pledged to be a net-zero company by 2040.

Enbridge Inc. became the first North American energy company to issue an SLL when it announced in February a three-year $1-billion sustainability-linked credit facility that aligns its ESG performance with its funding costs. The company was not specific on what the explicit KPIs and penalties/incentives are, but the SLL followed on the back of Enbridge pledging net-zero by 2050 and setting a near-term emissions intensity reduction target of 35% by 2030. The company also outlined inclusion and diversity targets in November 2020.

In April 2021, Gibson Energy Inc. fully transitioned its $750-million syndicated revolving credit facility into a five-year sustainability-linked revolving credit facility, which includes terms that reduce or increase the company’s borrowing costs based on whether its ESG targets are met. These targets include the reduction of Scope 1 and Scope 2 GHG emissions intensity by 15% by 2025, an increase of females in the workforce to 40%-42%, and an increase in racial and ethnic minority employees in the workforce to 21%-23%. Additional targets include an increase in women on the Board to 40% and at least one member of the Board that identifies as a racial or ethnic minority and/or Indigenous by 2025.

At the end of April 2020, BCE announced a new Sustainable Financing Framework to guide the company’s future issuances of green, social and sustainability bonds and other sustainable financings. The BCE Sustainable Financing Framework has been reviewed by Sustainalytics and aligns with the ICMA Green and Social Bond Principles and Sustainability Bond Guidelines, and links to several of the United Nations Sustainable Development Goals.[5] Perhaps Canada’s first SLB is not that far off.

Transition Bonds

As Kermit the Frog wisely remarked, “It’s not easy being green”. There have been issues in the green bond market relating to “brown” companies issuing green bonds. For example, Spanish oil company Repsol S.A. issued its inaugural green bond in May 2017. The proceeds were earmarked for energy efficiency projects in the firm’s downstream refining and marketing business. However, there was investor pushback against the bond as it was issued by a fossil fuel producer and funded energy efficiency rather than renewable energy.

In order to meet the Paris Agreement climate change goals, a significant amount of financing is going to be required from non-green companies to meet their GHG reduction targets. Enter transition bonds that provide a potential solution by enabling carbon-intensive companies to raise capital and use the proceeds for activities that help them reduce their carbon footprint. A transition bond would aim to cut GHG emissions, but it does not have to use clean technology and does not have to be a green company. UN Special Envoy for Climate Action and Finance Mark Carney has helped lead the charge for “fifty shades of green”. He has stated that for sustainable investment to go truly mainstream, it needs to do more than exclude brown industries and finance new, deep-green technologies. Sustainable investing must catalyze and support all companies that are working to shift from brown to green.[6]

In December 2020, ICMA published the Climate Transition Finance Handbook, which provides a reporting framework for an issuer’s climate transition strategy, with four elements:

- The financing purpose should be for enabling an issuer’s climate transition strategy, which should be aligned with the Paris Agreement’s goal of limiting global warming;

- The issuer’s transition trajectory should be relevant to the issuer’s business model;

- The issuer’s transition trajectory should have measurable and science-based targets, be publicly disclosed, include interim milestones, and be independently verified; and

- The issuer should provide transparency of the underlying investment program, including capital and operational expenditure.

The CSA Group (formerly the Canadian Standards Association) set up a committee in February 2020 to elaborate a taxonomy for transition finance that would consider the specific characteristics of the Canadian economy, including the contribution from the natural resources sector. We have yet to see a transition bond issuance in Canada, but we expect they will play a key role in helping energy companies meet their net zero aspirations. An example of a Canadian transition bond could be a power company financing the conversion of coal-fired generating assets to natural gas or a project financing for a CCUS facility.

Sustainable Investing at Beutel Goodman

We have bought green, social and sustainability-linked bonds across all of our fixed income portfolios and are ready to evaluate transition bonds, when and if they are issued. As value – not “values” – investors, we do not buy any issue simply because it is labelled as part of the sustainable finance spectrum. First, thorough due diligence on the issuer must be performed and the issuer must be on our Approved List. Second, thorough due diligence must be performed on the use of proceeds and the framework from which the bond was issued. To avoid instances of “greenwashing”[7], the sustainable finance bonds we buy must be issued out of a framework in line with what ICMA recommends, whereby there is a process for review, continuous reporting and audit of the use of proceeds. Third, the relative value proposition has to be attractive.

| Green Bond Principles | Social Bond Principles | |

| Issued | June 2018 | June 2020 |

| Use of Proceeds | All designated Green Projects should provide clear environmental benefits which will be assessed and, where feasible, quantified by the issuer. | All designated Social Projects should provide clear social benefits, which will be assessed and, where feasible, quantified by the issuer. |

| Categories of Eligibility | Climate change mitigation, climate change adaptation, natural resource conservation, biodiversity conservation, and pollution prevention and control. | Affordable basic infrastracture, access to essential services, affordable housing, employment generation, food security and sustainable food systems, and socioeconomic advancement and emporwerment. |

| Process for Project Evaluation and Selection | The issuer of a Green Bond should clearly communicate to investors: the environmental sustainability objectives; the process by which the issuer determines how the projects fit within the eligible Green Projects categories; and the related eligibility criteria. | The issuer of a Social Bond should clearly communicate to investors: the social objectives; the process by which the issuer determines how the projects fit within the eligible Social Project categories identified above; and the related eligibility criteria. |

| Management of Proceeds | The net proceeds of the Green Bond, should be credited to a sub-account, moved to a sub-portfolio or otherwise tracked by the issuer in an appropriate manner, and attested to by the issuer in a formal internal process linked to the issuer’s lending and invetment operations for Green Projects. | The net proceeds of the Social Bond should be credited to a sub-account, moved to a sub-portfolio or otherwise tracked by the issuer in an appropriate manner, and attested to by the issuer in a formal internal process linked to the issuer’s lending and investment operations for Social Projects. |

| External Review | The GBP encourage a high level of transparency and recommend that an issuer’s management of proceeds be supplemented by the use of an auditor, or other third party, to verify the internal tracking method and the allocation of funds from the Green Bond proceeds. | The SBP encourage a high level of transparency and recommend that an issuer’s management of proceeds be supplemented by the use of an auditor, or other third party, to verify the internal tracking method and the allocation of funds from the Social Bond proceeds. |

| Reporting | Issuers should make, and keep, readily available up to date information on the use of proceeds to be renewed annually until full allocation, and on a timely basis in case of material developments. The annual report should include a list of the projects to which Green Bond proceeds have been allocated, as well as a brief description of the projects and the amounts allocated, and their expected impact. | Issuers should make, and keep, readily available up to date information on the use of proceeds to be renewed annually until full allocation, and on a timely basis in the case of material developments. The annual report should include a list of the projects to which Social Bond proceeds have been allocated, as well as a brief description of the projects and the amounts allocated, and their expected impact. |

Sources: International Capital Market Association

| Sustainability Linked | |

| Issued | June 2020 |

| Selection of Key Performance Indicators | The KPIs should be material to the issuer’s core sustainability and business strategy and address relevant environmental, social and/or governance challenges of the industry sector and be under management’s control. The KPIs should be: (1) relevant, core and material to the issuer’s overall business, and of high strategic significance to the issuer’s current and/or future operations; (2) measurable or quantifiable on a consistent methodological basis; (3) externally verifiable; and (4) able to be benchmarked. |

| Calibration of Sustainability Performance Targets | The Sustainability Performance Targets (SPT) must be set in good faith and the issuer should disclose strategic information that may decisively impact the achievement of the SPTs. The SPTs should be ambitious, i.e.: – represent a material improvement in the respective KPIs and be beyond a “Business as Usual” trajectory; – where possible be compared to a benchmark or an external reference; – be consistent with the issuers’ overall strategic sustainability/ESG strategy; and – be determined on a predefined timeline, set before (or concurrently with) the issuance of the bond. |

| Bond Characteristics | The cornerstone of a SLB is that the bond’s financial and/or structural characteristics can vary depending on whether the selected KPS(s) reach (or not) the predefined SPT(s), i.e. the SLB will need to include a financial and/or structural impact involving trigger event(s). The potential variation of the coupon is the most common example, but it is also possible to consider the variation of the other SLB’s financial and/or structural characteristics. It is recommended the variation of the bond financial and/or structural characteristics should be commensurate and meaningful relative to the issuer’s original bond financial characteristics. |

| Reporting | Issuers of SLB should publish up-to-date information on the performance of the selected KPI(s), including baselines where relevant. The issuer should publish a verification assurance report relative to the SPT outlining the performance against the SPTs and the related impact, and timing of such impact, on the bond’s financial and/or structural characteristics. The issuer should also make availbale any information enabling investors to monitor the level of ambition of the KPIs. This reporting should be published regularly, at least annually. |

| Verification | Issuers should seek independend and external verification (for example limited or reasonable assurance) of their performnace level against each SPT for each KPI by a qualified external reviewer with relevant expertise, such as an auditor or an environmental consultatnt, at least once a year, and in any case for any date/period relevant for assessing the SPT performance leading to a potential adjustment of the SLB financial and/or structural characteristics,until after the last SPT trigger event of the bond has been reached. |

Sources: International Capital Market Association

Download PDF

[1] “Global Fixed Income & ESG Strategy”, Morgan Stanley Research, April 8, 2021.

[2] “Global Energy Transformation: A Roadmap to 2050,” International Renewable Energy Agency, April 2019. (https://www.irena.org/publications/2019/Apr/Global-energy-transformation-A-roadmap-to-2050-2019Edition)

[3] “Net-zero Asset Owner Alliance More Than Triples Membership to 37 Since 2019 Launch”, UN PRI, April 21, 2021. (https://www.unepfi.org/news/themes/climate-change/net-zero-asset-owner-alliance-more-than-triples-membership-to-37-since-2019-launch/).

[4] “Greenhouse gas emissions are categorised into three groups or ‘Scopes’ by the most widely-used international accounting tool, the Greenhouse Gas (GHG) Protocol. Scope 1 covers direct emissions from owned or controlled sources. Scope 2 covers indirect emissions from the generation of purchased electricity, steam, heating and cooling consumed by the reporting company. Scope 3 includes all other indirect emissions that occur in a company’s value chain.” Source: https://www.carbontrust.com/

[5] “Bell Announces Sustainable Financing Framework” 29 April 2021 https://www.bce.ca/news-and-media/releases/show/BCE-announces-Sustainable-Financing-Framework?page=1&month=&year=&perpage=25

[6] “Fifty Shades of Green”, Mark Carney, Finance & Development, December 2019 (https://www.imf.org/external/pubs/ft/fandd/2019/12/a-new-sustainable-financial-system-to-stop-climate-change-carney.htm)

[7] “Greenwashing is the process of conveying a false impression or providing misleading information about how a company’s products are more environmentally sound.” Source: Investopedia (https://www.investopedia.com/terms/g/greenwashing.asp#:~:text=Greenwashing%20is%20the%20process%20of,company’s%20products%20are%20environmentally%20friendly).

©2021 Beutel, Goodman & Company Ltd. Do not sell or modify this document without the prior written consent of Beutel, Goodman & Company Ltd. This commentary represents the views of Beutel, Goodman & Company Ltd. as at the date indicated.

All opinions and estimates expressed in this article are as at May 11, 2021 and are subject to change without notice.

This is not an invitation to purchase or trade any securities. Beutel, Goodman & Company Ltd. does not endorse or recommend any securities referenced in this document.

This document is not intended, and should not be relied upon, to provide legal, financial, accounting, tax, investment or other advice.

Certain portions of this report may contain forward-looking statements. Forward-looking statements include statements that are predictive in nature, that depend upon or refer to future events or conditions, or that include words such as “expects”, “anticipates”, “intends”, “plans”, “believes”, “estimates” and other similar forward-looking expressions. In addition, any statement that may be made concerning future performance, strategies or prospects, and possible future action, is also forward-looking statement. Forward-looking statements are based on current expectations and forecasts about future events and are inherently subject to, among other things, risks, uncertainties and assumptions which could cause actual events, results, performance or prospects to be incorrect or to differ materially from those expressed in, or implied by, these forward-looking statements.

These risks, uncertainties and assumptions include, but are not limited to, general economic, political and market factors, domestic and international, interest and foreign exchange rates, equity and capital markets, business competition, technological change, changes in government regulations, unexpected judicial or regulatory proceedings, and catastrophic events. This list of important factors is not exhaustive. Please consider these and other factors carefully before making any investment decisions and avoid placing undue reliance on forward-looking statements Beutel Goodman has no specific intention of updating any forward-looking statements whether as a result of new information, future events or otherwise.