This is confidential for internal use by advisors only. Not for external distribution to an investor or potential investor.

Beutel Goodman Small Cap Fund

AI isn’t the only growth story this year

While mega-cap tech stocks dominate the headlines, small caps have quietly delivered an impressive 39.4% return year to date.1 They’re often home to innovative businesses that tend to fly under the radar and may offer compelling upside.

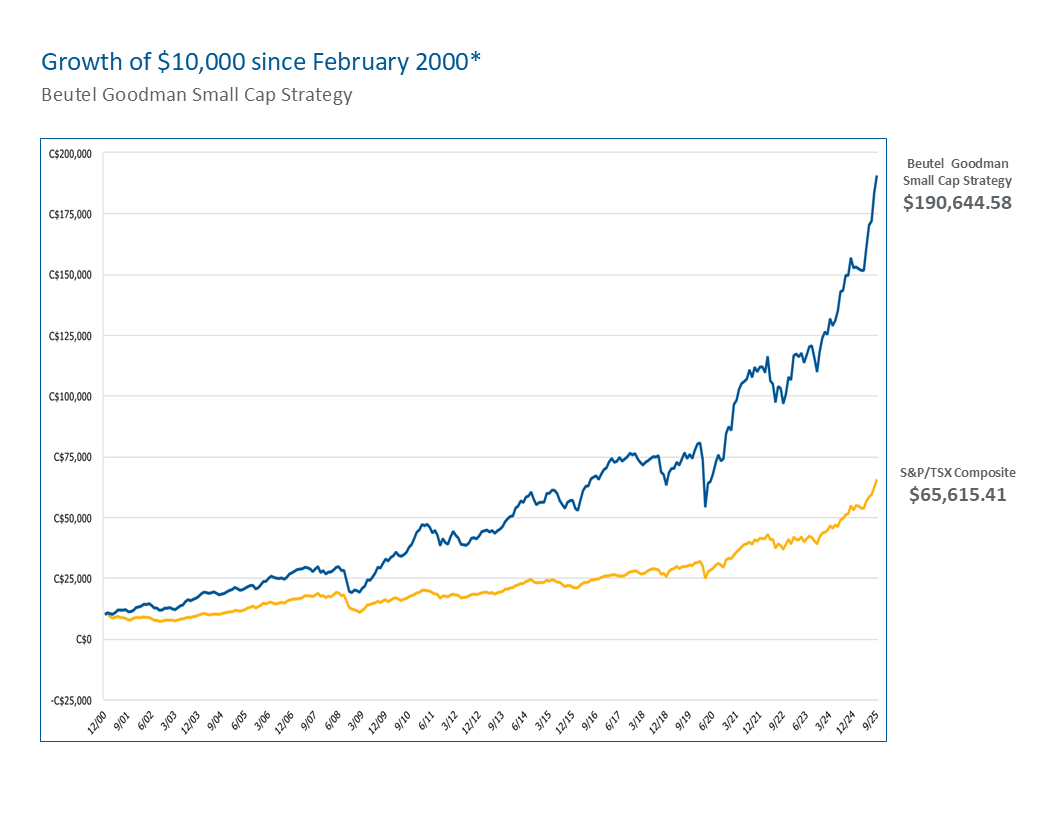

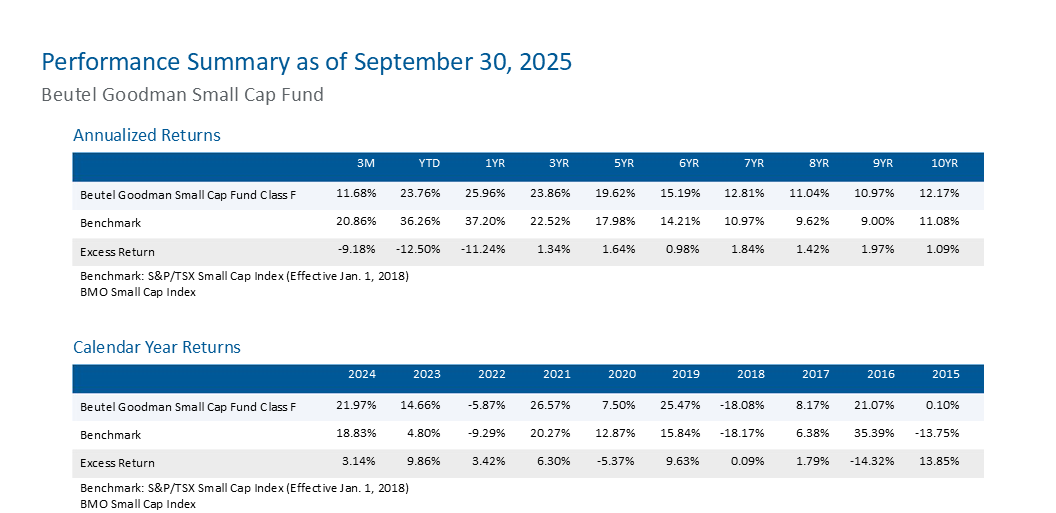

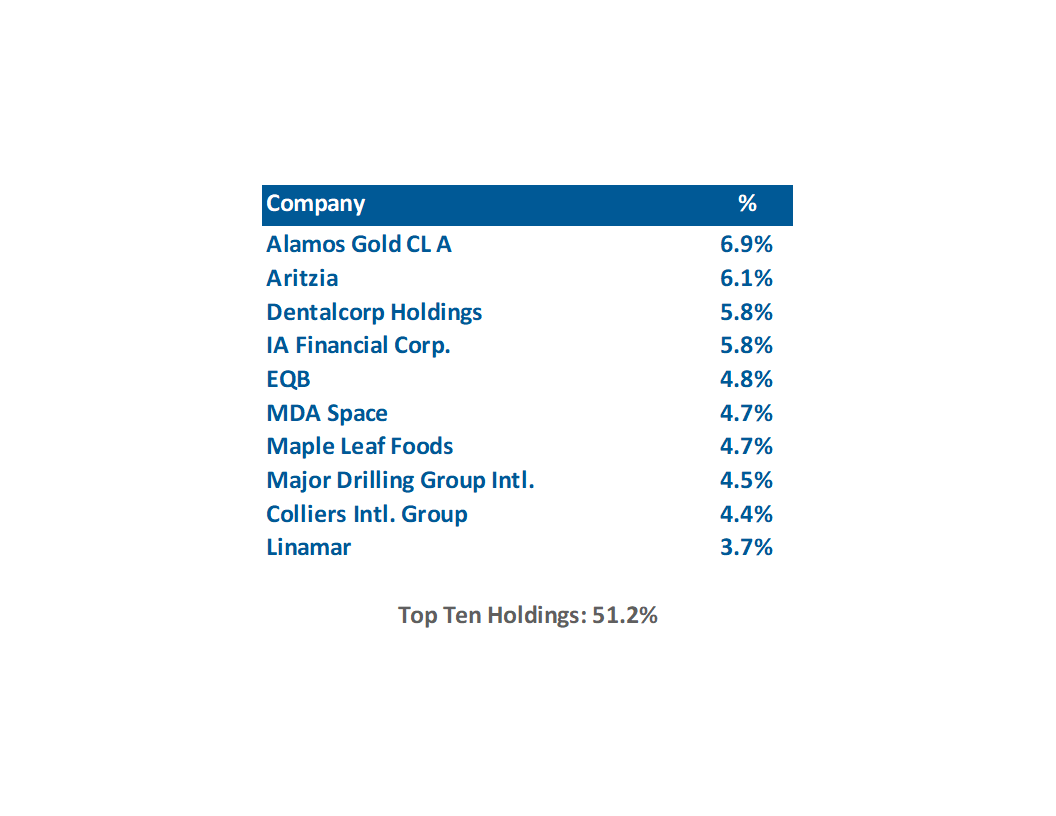

For its part, Beutel Goodman Small Cap Fund has attractive, long-term risk-adjusted performance since its inception. (See performance summary below.) The portfolio is built using bottom-up, fundamental research; the focus is on investing in quality companies with stable, growing businesses and strong balance sheets at discounts to their business value.

We believe this focus, combined with our process-driven buy/sell discipline, can provide a margin of safety and help mitigate the potential of capital loss*.*

1 S&P/TSX Small Cap Index performance January 1, 2025 - October 31, 2025 *There is no assurance that this strategy will mitigate downside risk or achieve its investment goals.

Source: eVestment February 1, 2000 - September 30, 2025

* February 1, 2000 is the commencement date of tracking of S&P/TSX Small Cap Index by eVestment.

Returns shown are gross of investment management fees and expenses, and based on a representative account. The graph shown is used only to illustrate the effects of the compound growth rate and the historical performance of a hypothetical investment in the small-cap strategy, and is not intended to reflect future values or returns on investment of the strategy. Past performance does not guarantee future results. Invested capital is at risk of loss.

Class F returns are net of fees. Commissions, trailing commissions, management fees and expenses all may be associated with mutual fund investments. Please read the prospectus before investing. The indicated rates of return are the historical annual compounded total returns including changes in unit value and reinvestment of all distributions and do not take into account sales, redemptions, distributions or optional charges or income taxes payable by any securityholder that would have reduced returns. Mutual funds are not guaranteed, their values change frequently and past performance may not be repeated.

Beutel Goodman Unique Value Process

Disciplined, bottom-up value investor

Concentrated, conviction-weighted portfolio

Preservation of capital is paramount

Research-driven buy / sell process seeks to capture upside and mitigate risk

Stability and Experience

The portfolio is co-led by two of Beutel Goodman’s longest-tenured and experienced portfolio managers. Together they bring over 60 years of industry experience and tenure at Beutel Goodman to the Small Cap Fund.

Stephen joined Beutel Goodman in 1993 and has over 25 years of investment experience. He is a portfolio manager with equity research responsibilities in the areas of small cap, technology, consumer discretionary and energy. Steve is a graduate of Queen's University and a CFA charterholder.

Managing Director, Head of Canadian Equities

Bill joined Beutel Goodman in 1995 and has over 30 years of investment experience. He is a small cap portfolio manager and has equity research responsibilities in the areas of metals, minerals, golds, printing, steel and fertilizer. Prior to working at Beutel Goodman, Bill worked at La Caisse de Dépôt et Placement du Québec as an equity analyst. Bill is a graduate of McGill University and a CFA charterholder.

Vice President, Canadian Equities

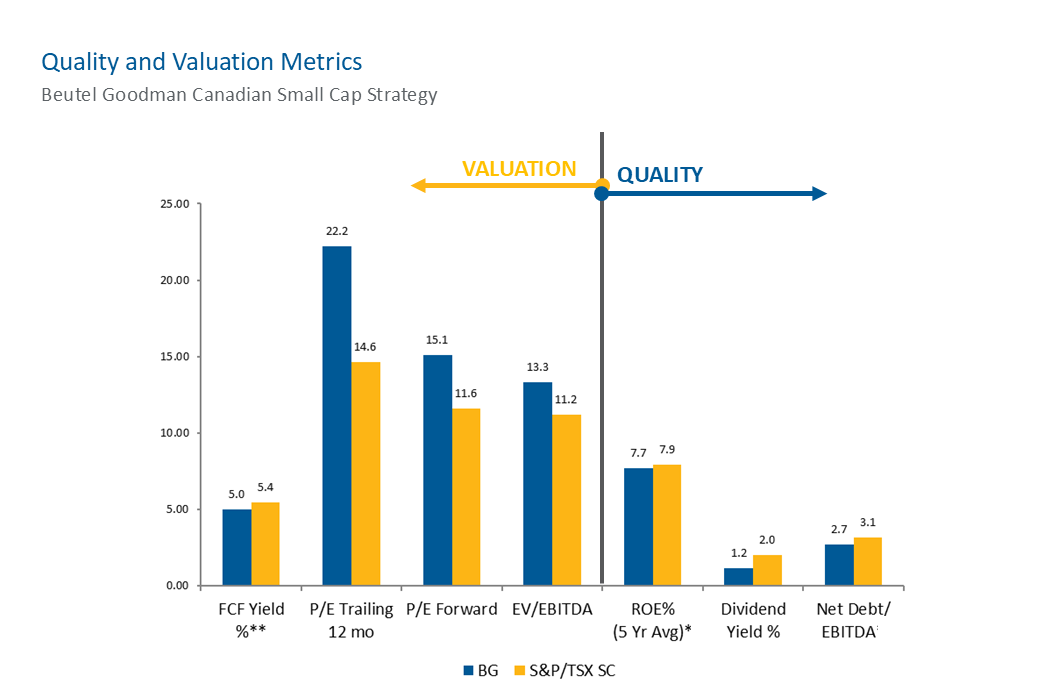

High Quality, High Value

As at September 30, 2025 *Excluding outliers **Excluding banks Source: Refinitiv Eikon as run on October 8, 2025, Beutel Goodman. Past performance does not guarantee future results. Invested capital is at risk of loss. Any securities, sectors or allocations listed should not be perceived as investment recommendations and may no longer be held in an account's portfolio.

More Information

The index information contained on this page has been obtained from sources believed to be reliable, but we do not represent that it is accurate or complete and it should not be relied upon as such.

The S&P/TSX Index data (“Index”) is a product of S&P Dow Jones Indices LLC and TSX Inc. and has been licensed for use by Customer. All rights reserved. S&P® is a registered trademark of S&P. Dow Jones® is a registered trademark of Dow Jones Trademark Holdings LLC (“Dow Jones”). TSX® is a registered trademark of TSX Inc. Neither S&P Dow Jones Indices LLC, S&P, Dow Jones, TSX Inc., their affiliates nor their third party licensors make any representation or warranty, express or implied, as to the ability of any index to accurately represent the asset class or market sector that it purports to represent and none such entities shall have any liability for any errors, omissions, or interruptions of any index or any data related thereto.