Despite the disruption of the trade war, global equity markets have delivered strong performance in 2025 with major indices reaching record highs.

The reasons for this rally, as well as the risks, were discussed in the latest edition of our 3 Key Questions webinar series, which featured Steve Arpin, Manager Director, Canadian Equities and KC Parker, Vice President, Global Equities in conversation with host Marcia Wisniewski, Vice President, Private Client Group.

This recording took place on October 27, 2025. The following transcript is edited for clarity.

Note: The information in this transcript and recording is not intended, and should not be relied upon, to provide legal, financial, accounting, tax, investment or other advice. This is not an invitation to purchase or trade any securities. Beutel, Goodman & Company Ltd. does not endorse or recommend any referenced securities.

Marcia Wisniewski: Hello everyone and thank you for joining us for the latest in the Beutel Goodman 3 Key Questions series. I’m Marcia Wisniewski, Vice President with the Beutel Goodman Private Client Group.

Before we begin, we would like to acknowledge the land we are on is the traditional territory of many nations, including the Mississaugas of the Credit, the Anishnabe, the Chippewa, the Haudenosaunee and the Wendat peoples and is now the home to many diverse First Nations, Inuit and Metis peoples. We also acknowledge that Toronto is covered by Treaty 13 with the Mississaugas of the Credit and the Williams Treaties signed with multiple Mississaugas and Chippewa bands.

I would also like to share a brief legal disclaimer from our compliance team. The information in this webinar is not intended and should not be relied upon to provide legal, financial, accounting, tax, investment, or other advice. This is not an invitation to purchase or trade any securities. Beutel Goodman & Company does not endorse or recommend any referenced securities.

Thank you all for joining us for this discussion of global equity markets. It certainly has been an eventful year for investors. Despite ongoing trade tensions and policy uncertainty, 2025 has been a strong year with global indices at record levels.

We know many of you are watching these developments closely and wondering what might come next. So today’s discussion is designed to help put that in perspective. Today, I am delighted to be joined by two of my colleagues, Steve Arpin, Managing Director of Canadian Equities, and KC Parker, Vice President, Global Equities. Together, we’ll explore three key questions shaping the equity landscape this year.

Following our discussion, we’ll open the floor for a brief Q&A, and you can participate by typing your questions in the Q&A box at the bottom of your screen.

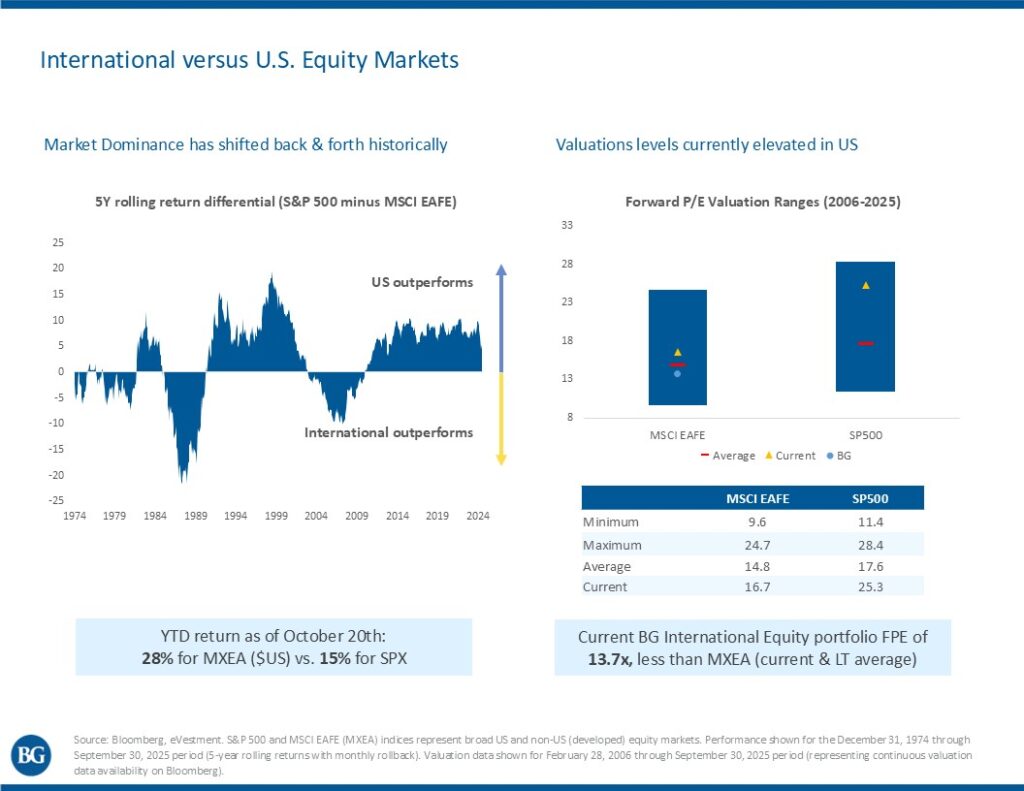

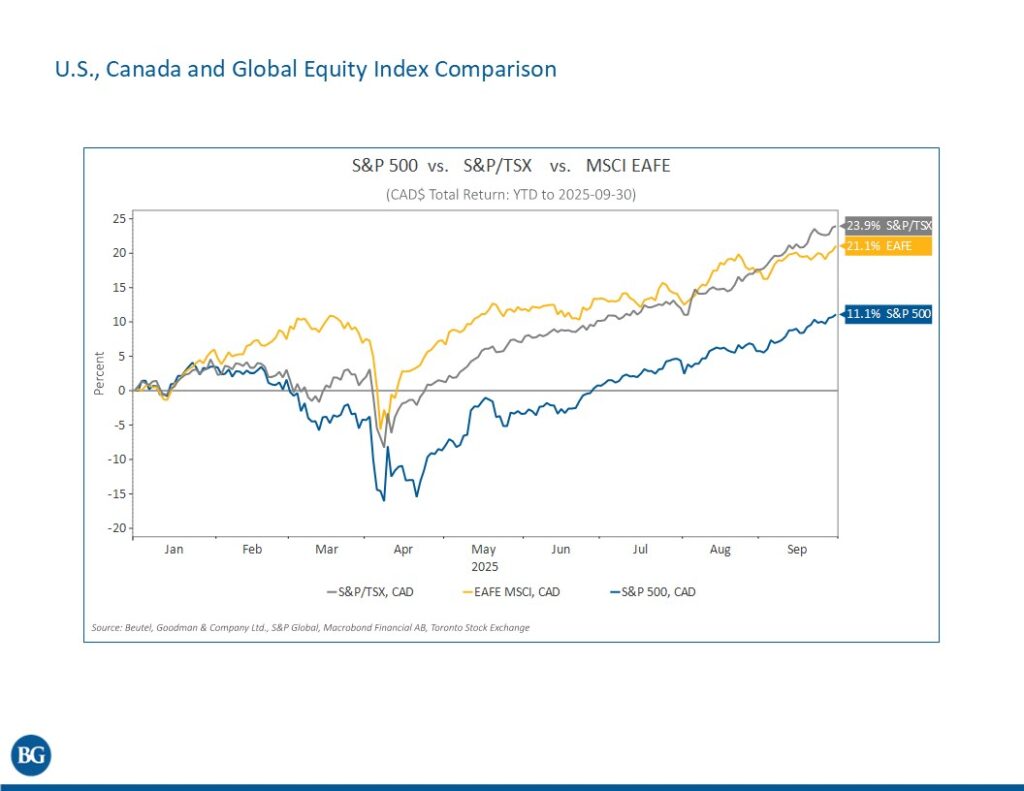

Without any further delay, let’s start with a look at international equities. Global developed markets outside of North America are outperforming the U.S. this year, even in what has been a very strong period for the S&P 500. Specifically, the MSCI-EAFE, the Morgan Stanley Index of Europe, Australasia, and the Far East, was up 21% year to date at the end of September on a Canadian dollar basis, compared to the S&P 500, which was only up 11% on a Canadian dollar basis. That’s nearly double. So, KC…

What do you think international markets have in store for us? Do they have more room to run?

KC Parker: Thanks for the question, Marcia.

As shown in the blue-shaded box on the bottom left of the slide, MSCI-EAFE has significantly outperformed the U.S. market in in 2025 thus far; the outperformance has been both epic and surprising. I say epic because as of last week, the 28% return for MSCI-EAFE is almost double that of the S&P 500 at 15% as Marcia had said. It is also epic because this magnitude of outperformance was last seen in 1993 when Jurassic Park was the highest grossing movie. But it’s surprising for a few reasons. First, consider the weight of technology in the MSCI-EAFE is only 8%. That is only slightly bigger than the weight of just NVIDIA in the S&P 500. It’s also surprising because the narratives that have been used to justify the portfolio positioning during this 15-year run of rolling underperformance remain true. Europe is still full of Europeans. Many countries within Europe and developed Asia continue to face the same fiscal and demographic challenges. And these same countries remain highly dependent on energy from outside the region. But we believe that a bottom-up approach is the way to do equity investing, not macro tourism.

As a case in point, what do those narratives have to do with the fact that Roche and Novartis, both of which we own, are two of the five largest most profitable pharmaceutical companies in the world. Some investors have long confused where and how companies make money with the location of their primary listing. A global pharmaceutical giant headquartered in Switzerland is still a global pharmaceutical giant. To be sure, we have bemoaned that the significant, absolute, and relative valuation gaps have been compelling for as long as I can remember. As a case in point, let us consider one of our holdings, Heidelberg Materials, whose products are as basic as you can get, cement and aggregates. The stock is up 380% in three years, but the forward PE is under 15 times today. That means in 2022, you were paying three times what the company will now earn in the next 12 months. Anecdotally, I can tell you that companies outside of the U.S. have never been more shareholder friendly than today. We are seeing many instances where some of our holdings in Europe are acting more shareholder friendly than many companies in the U.S. In Japan, the awakening of a shareholder mindset that began in 2012 continues today, but still badly lags Europe, in my opinion.

We don’t know if international markets have more room to run, but as shown on the five-year rolling return chart on the left, historically, one region can outperform the other for long stretches, and 2025 may mark the beginning of a reversal of recent trends. Let us now focus on the chart on the top right of the slide titled forward PE evaluation ranges, and specifically, comparing the two yellow triangles within the two dark blue bars. This shows that the valuation discount of MSCI-EAFE compared to the U.S. is quite sizable. Now, if we go one step further, the blue circle is the valuation of the BG International fund, which is not only cheaper than both indices, but it’s also cheaper today than the long-term average for both indices. Of course, a value manager will tell you that paying less is great. But let’s go one step farther and compare the quality of the fund to the MSCI-EAFE index. We think that return on equity is a good proxy for this, and the fund’s return on equity is 200 basis points higher than the index or 16.9% versus 14. 8%. So our portfolio trades at a discount to the market, while simultaneously sporting a higher return on equity. Higher quality at a lower price.

Marcia Wisniewski: Great. Thank you, KC. It’s really fascinating to understand how industry and market leadership stretches very well beyond the U.S. and also what that could mean for portfolio diversification. With that in mind, let’s turn to the Canadian market. As we do so, I’d like to share a chart showing the performance of the three major developed market indices year to date to the end of September.

As we see in this chart, not only are international stocks performing well, as shown by the MSCI-EAFE line, Canadian equities are also strongly outperforming the U.S. market, even though the S&P 500 was up 11% on a Canadian-dollar basis to the end of September. Steve…

What do you attribute this Canadian market strength to and how are these the prevailing investment themes now influencing our Canadian equity portfolios?

Steve Arpin: Thanks for the question, Marcia. So, as KC has been talking about, other markets, including Canada, which is traditionally a strong market, has actually been a very strong market. It outperformed the S&P 500 this year by more than 12% in Canadian dollars. And that’s at the end of Q3.

And as mentioned, it’s been a good year for U.S. stocks. So it’s been very strong for markets outside the U.S. The TSX returned almost 24% year to date as of September 30. This is coming on the back of a 21.7% return in 2024. It’s really been a strong run in Canadian equities. The only excitement, I would say there was a brief, albeit sharp, dip in April as investors were reacting to the U.S. administration’s Liberation Day tariff announcement, which, of course, was a huge change in trade policy and does have implications for Canada. Canada because we are obviously very, very impacted by the U.S., we’re within their trade sphere of influence, and really, we’re the logical trading partner for them. The market disruption that was caused by tariffs at the beginning of the second quarter dissipated really quickly. Retail investors bought the dip, and the Trump administration started to step back and negotiate lower than threatened tariffs.

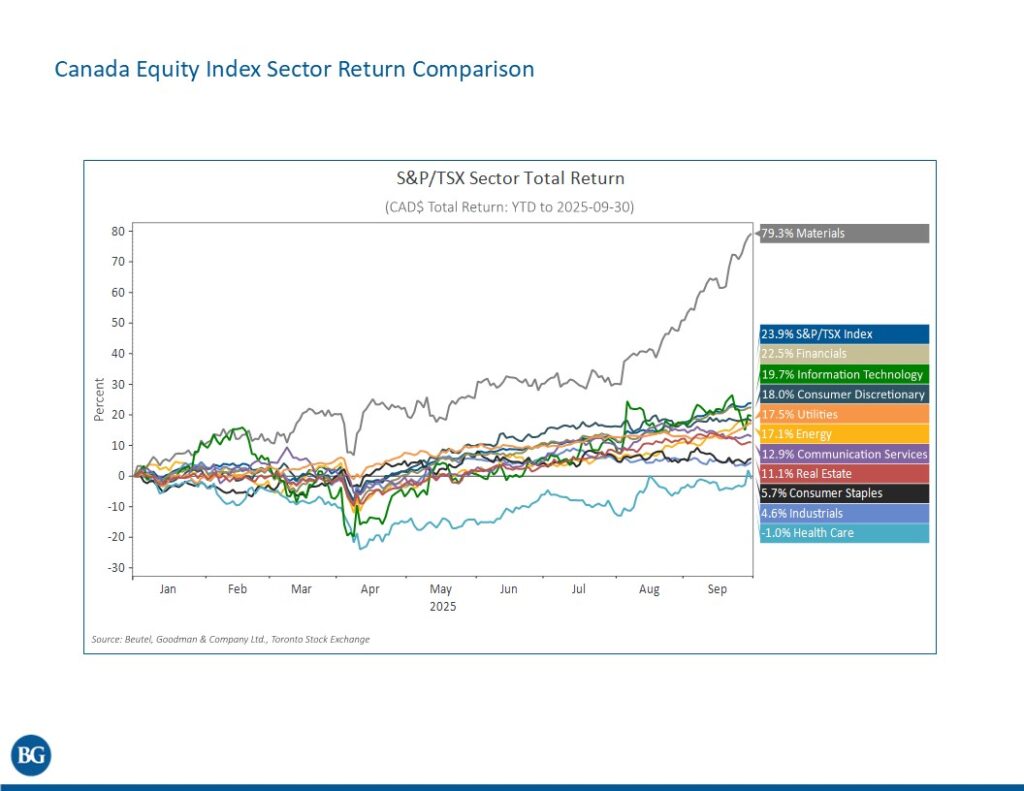

Of course, the TSX reached record highs most recently in Q3. The main driver of the TSX, as you can see on this chart and year to date, has been Materials, which is up 80%, driven principally by gold prices, which are up more than 40%. This rally in gold, the price of gold can be attributed to several factors, including economic uncertainty, weakness in the U.S. dollar versus a global currency basket, central bank buying, and gold’s perceived safe-haven status. Declining real rates are typically a stimulus for gold and the Materials sector, and a rising gold price has historically shown correlation with interest rate cuts. Moving beyond the Materials sector, despite the fact we’ve had an uncertain macro environment, really the anticipation of interest rate cuts and a better economic backdrop than I think people were expecting has resulted in the Big Six banks delivering strong fiscal Q3 2025 results. They’ve also been able to ease reserves slightly because obviously they had reserved against a very pessimistic backdrop, and they struck a more positive tone in Q3.

But looking at all the sectors, we’ve seen positive returns apart from Health Care. This even includes Energy, which has been able to have positive returns in spite of commodity price headwinds with both oil and natural gas, although we have benefited economically from a relatively weak Canadian dollar, which really helps Energy prices in Canada. The market, other than the gold trade, doesn’t seem to be reflecting much in the way of risks, but the tariff threat does remain a clear headwind in Canada. The Canadian economy contracted in the second quarter. We’ve had significant levies on steel, aluminum, and copper. Obviously, there’s been a lot of threats made about the automotive business. I would say at this point, the damage from this is more related to capital spending intentions, which have been really weak in Canada for a while. Even though we still enjoy a very low, actually the lowest effective tariff rate for any partner of the U.S., we’re still facing the USMCA review in 2026, and maintaining a constructive relationship with the U.S. is going to be really critical for Canada’s exports and the overall economy. We’ll discuss gold later, but what we are maintaining our focus on the holdings of our portfolios and prospective new investments.

We’re still finding opportunities, and we’re looking for companies that have strong fundamentals, which we can understand, that generate strong and stable sustainable free cash flow and protect on the downside. And ultimately, that’s going to lead to attractive long-term returns for investors.

Marcia Wisniewski: That’s great. Thank you, Steve. I think that’s fantastic insight into what’s been driving performance so far this year and how we’re positioning on the Canadian side. Thank you. Let’s turn to our final question, which looks at the potential in emerging markets. More than half of the world’s population resides in emerging markets, and these economies often grow faster than developed ones. As at the end of September, the MSCI Emerging Markets Index has shown nine months of consecutive gains, which is the longest winning streak for this index in more than 21 years. The question is…

Why does the Beutel Goodman International Equity portfolio currently hold no companies based in an emerging market economy?

KC, you’re the natural person to answer this. Could you share your thoughts on this one?

KC Parker: Thanks, Marcia. This is a very typical but also very fair question.

For context, the strategy can have up to 15 % of the fund in emerging markets, and we have had exposure in the past, but it’s been quite some time. As a reminder, we don’t go seeking exposure to a theme, for example, AI, which, of course, is very topical today, or a sector, or geography. We are looking to assemble a diversified set of around 30 names, and we use the same criteria regardless of the company’s sector or geographic headquarters. We don’t lower the bar because we really want to own a utility, and we don’t lower the bar because India is a large populous democratic country that posted 6 % GDP growth last year. As this indicates, the emerging market, if we look at the slide, you can see that the market itself is very large, both in value and in number of names. So the emerging market pond that we can go fishing in is massive. Just to repeat, the market cap is $10 trillion for emerging markets versus is 20 trillion for MSCI-EAFE.

Even by number of names, 1,200 versus 700. So there’s a lot to choose from. But we’re very picky. I mean, disciplined is a more professional sounding word, but I think picky is also appropriate. So our portfolio is currently 32 names, which represents only 1. 5% of the possible names available in those two indices combined. And we’re very excited about those names, and if we weren’t, they wouldn’t be there. So as shown on the middle of the triangle, we consider both quality and valuation for a new position, which breaks into four main quantifiable criteria. One, we look for balance sheet strength. Two, a normalized double-digit return on capital or return on equity is a good proxy for whether the company is well-managed and in a good industry. Three, we want the management team to be aligned with shareholders. And fourth, obviously as value managers, the valuation we pay is very important. Those factors are considered in isolation, but also relative to the portfolio, as the addition of that name must make the overall portfolio more attractive. Otherwise, there’s no point. I’m not going to pretend that we have opinions on all 1,200 names in emerging markets, nor the 700 in EAFE for that matter.

Our four-point framework, previously mentioned, quickly whittles that list down for new ideas to add to our existing watch lists. I thought it might be helpful to demonstrate how we look at the two largest names in emerging markets. The first one is Saudi Aramco. For context, we own zero oil-producing companies, even though they trade at dramatically lower valuations with higher dividend yields, and they are not vessels of a government the way Saudi Aramco is with its 2% public float. We don’t typically invest in commodity companies to start with, so adding some of the idiosyncratic risks that come along with Saudi Aramco makes that practically impossible. Switching gears to Taiwan Semiconductor or TSMC, this is a business that broadly meets all of our criteria. Our challenge with this is that 90% of the company’s production is in Taiwan. Without wading too much into the geopolitics of this, let’s say there are clouds of uncertainty given both China’s view of Taiwan and the importance of TSMC to the global economy. Let’s say we own the stock already and there was a military kerfuffle in the South China Sea that sent the stock down 50%. How could we add to that position or continue to own it, except on the idea that peace always finds a way. But to flip this around and to show that we do have an open mindset, let’s say 70-75% of the company’s production was outside of Taiwan. Then we could likely be comfortable with modeling out and being proud owners, subject to valuation, of course.

I hope that that helps demonstrate that the way we look at emerging markets is no different than how we look at other markets for new ideas. We are absolutely open to them, subject to our high standards. A final note is that, of course, some of our existing holdings have sizable positions within these emerging market economies. Carlsberg, for example, is a number one or two premium player within its submarkets of India, China, Vietnam, and Kazakhstan, to name a few. Konecranes is the global leader in premium industrial hoists in just about all markets, including in China. Finally, Infineon, which is a power semiconductor manufacturer, has a sizable business in China, serving both western companies operating in China, but also Chinese companies. In summary, we are purposely picky, but we are open to any great opportunity that meets our criteria, whether it’s in Italy or India.

Marcia Wisniewski: Great. Thank you, KC. That was an excellent overview of how we assess risks and opportunities across different regions, and also how we gain exposure to emerging markets’ growth in a more selective way through strong global companies with meaningful revenues in those regions without taking on the added risk of owning those businesses based there directly.

We’ve covered our three key questions, and now I’d like to move on to some of yours. We’ve received some excellent questions from participants, and I would like to highlight at least a couple before we wrap up today. The first question is a two-part question that we received from a participant last week when they registered for the call. The question is …

Is the U.S. dollar in a long-term decline versus other major developed country currencies? And do you see gold and crypto as serious alternatives?

I think, Steve, this is one for you to take. If you don’t mind.

Steve Arpin: Thanks, Marcia. So obviously, people are aware that the U.S. as a policy, has been looking for a weaker dollar, and the U.S. dollar has fallen in value by about 10 % this year versus the DXY, which is a representative basket of currencies.

But it does remain in its longer term band, so I wouldn’t describe this as anything extraordinary. Now, as you can see in this slide, the U.S. dollar is still the dominant currency in global FX markets. Now, this slide sums to 200% because there’s two sides to a FX transaction. You can see the U.S. is present in 88% of transactions. We elected to use this slide, but I have another one which shows that the dominance of the U.S. dollar has actually been rising consistently over the past decade, and 2025 is no different in that respect. The euro and the pound have both lost ground from a transaction standpoint again this year. Now, why does all this matter? To provide some context for the liquidity that’s provided by the U.S. dollar, every day, there’s trade of nine and a half trillion dollars using the USD in the FX market.

If we were to take the entire value of all physical gold assets in the world, it’s around US$30 trillion today. There’s 218,000 tonnes of gold above ground. Bitcoin, meanwhile, is even further off the scale with a market cap of approximately US$2 trillion. So, the liquidity that’s provided by the U.S. dollar is absolutely immense. And that really means that it’s absolutely critical to a functioning global economy. Now, as I’d mentioned previously, when we were talking about the TSX, I mean, the good news is that that returns have actually been really good across a number of sectors, and I think most importantly, Financials. But clearly, Materials are driving the performance and really outperforming the index. Gold has had a major impact on the TSX this year, with Materials being the standout sector by far. This has left gold stocks at close to a record weight in the main Canadian index, and gold prices have also reached all time highs on an inflation adjusted basis. This is even compared to the 1970s when we had a pretty serious inflation problem, which was driven by rising energy prices. I think we’ve established that gold will not replace the U.S. dollar for commercial transactions, and that means that gold is being purchased by investors as a store of value.

With that said, there’s three main drivers of the gold price this year, and really, generally speaking. The first has been the currency debasement trade, which I’m going to discuss. The second is central bank buying, and the third is investment demand through ETFs. So, if we focus for a minute on debasement, this has been talked about quite a bit. I want to be clear that mathematically, for example, if inflation runs at 3% instead of 2%, which is still normally the central bank’s target, we believe that over a decade, that would imply that gold would have to be priced about 15% higher to adjust for that debasement. But quantitative debasement, no matter how you analyze it, does not explain gold prices. I know there’s a narrative about inflation, and clearly, we did have higher inflation post-COVID related to both money supply and also difficulty producing goods. But there is no quantitative explanation for what’s occurring. So, the second factor has been central bank buying, which has largely been led by China, and frankly, may be a reaction to some of the actions around confiscating Russian assets. And central bank buying of gold has really increased from about 500 tonnes per year to 1,000 tonnes per year in recent years.

This is an increase of about 12.5% of total supply. Supply of gold is about 3,000 tonnes per year. That’s from mining, and then another 1,000 tonnes from scrap. That is having an impact on price, but it’s difficult to quantify. It’s also not a new theme. It’s been present for the last four years. We are going to point our finger at the final factor here, which is investor demand, which may or may not prove to be speculative, but in particular, it’s come through gold ETFs, and it’s reached new highs in 2022. ETF demand and gold prices have been strongly correlated, and we believe that they are the overwhelming factor that is driving gold prices. Now, the funny thing about this is that there’s an interesting chart, which I haven’t included here, but it basically shows that the holdings by central banks, because a big theme is central banks are diversifying away from the U.S. dollar and buying gold, and there’s some truth to that. But central banks also have an asset mix, which they target. And the value of their gold holdings is now equivalent to U.S. Treasuries across the central banks. So, the irony is, if the gold price continues to rise, central banks may end up becoming sellers because they have excess gold reserve value versus what they would reasonably target as a percentage of their asset base.

And remember that central banks have to have adequate currency reserves because they have to be able to function within the fiat currency market. So, with all these comments in mind, and bringing it around to the original question, I think we’re comfortable saying that the U.S. dollar will not be replaced by gold or Bitcoin in the near future, and its status as a world’s reserve currency looks pretty secure.

Marcia Wisniewski: Thanks, Steve. I appreciate that. I really appreciate your perspective there as well. You gave us a lot to think about, and I think there was quite a lot to digest that you covered.

The second question of our follow-up question is on the subject of artificial intelligence, which has been a prevailing market theme since early 2023, and it’s driven a great deal of investment, leading to what some would call a very frothy market. I understand that our global equity team has an upcoming paper on AI, covering our thoughts on the technology, the financial ecosystem around it, and its impact on market concentration and valuations, as well as our exposure within our portfolios. So, KC, I wonder if you could give us a little colour on this.

How are the rest of our equity research team thinking about AI as an investment theme and what is the broader impact of AI?

KC Parker: Okay, great. I promise that I won’t use ChatGPT to answer this. While there are sensible ideas about how the technology AI may be promising for businesses, the scale of the buildout is worrying in the absence of proven economics. The market has also jumped to conclusions about who the winners and losers are, which is truly unknowable today as we are still in the early phases of the technology’s adoption. We can even see this within the international fund. For example, France-based Capgemini, which is a global consulting giant, is seen by some as the equivalent of a buggy whip manufacturer, as companies will never need strategic or technological transformation again as AI can do everything. So we disagree and think the impact is far more nuanced as the power of AI will present both opportunities and risks. But at 10 times earnings, we think the future return potential on Capgemini is substantial. Another investment we’d like to highlight is one which we believe is getting zero AI credit. The company is Atea. It’s a Norway-based hardware software distributor. It across the Nordics and Baltics. The company is sitting on record earnings. It has no debt, and it’s the market leader by a substantial margin. It’s 10 times bigger than its next competitor. The company has a network of data centers across its footprint where the leading private and public companies within the Nordic countries are storing and accessing their data and systems. The problem with Atea is that it’s downplaying the short-term benefit from AI while saying that AI will be a huge driver for them over the long run. Their take is that their customers are all dipping their toes in the water and figuring out what AI can do and how they can best use it. They believe significant customer investments will follow this period of serious introspection, which of course makes sense. My running joke with the company is that if they borrowed significant sums and incurred massive financial losses to invest ahead of actual customer demand, that the stock would likely double. Of course, we wouldn’t own it in that instance because it would no longer meet our strict criteria. Sometimes we just tell ourselves jokes to feel better. But by the way, for both of these stocks, we continue to be patient as we wait for the market to see that Capgemini is not an AI loser, and that Atea is likely a long-term AI winner.

Marcia Wisniewski: Thank you very much, KC. Very, very insightful. I think now we are one minute past our usual end time, so I will say thank you again to our speakers, Steve Arpin and KC Parker. Thank you to all of you for joining us today. We hope you found this conversation helpful, providing perspectives as you think about your investments. On behalf of all of us at Beutel Goodman, thank you for your time and continued trust.

Related Topics and Links of Interests

©2025 Beutel, Goodman & Company Ltd. Do not copy, distribute, sell or modify this transcript of a recorded discussion without the prior written consent of Beutel, Goodman & Company Ltd. All information in this transcript represents the views of Beutel, Goodman & Company Ltd. as at the date indicated.

This information in this transcript and recording is not intended, and should not be relied upon, to provide legal, financial, accounting, tax, investment or other advice.

Certain portions of this commentary may contain forward-looking statements. Forward-looking statements include statements that are predictive in nature, that depend upon or refer to future events or conditions, or that include words such as “expects”, “anticipates”, “intends”, “plans”, “believes”, “estimates” and other similar forward-looking expressions. In addition, any statement that may be made concerning future performance, strategies or prospects, and possible future action, is also forward-looking statement. Forward-looking statements are based on current expectations and forecasts about future events and are inherently subject to, among other things, risks, uncertainties and assumptions which could cause actual events, results, performance or prospects to be incorrect or to differ materially from those expressed in, or implied by, these forward-looking statements.

These risks, uncertainties and assumptions include, but are not limited to, general economic, political and market factors, domestic and international, interest and foreign exchange rates, equity and capital markets, business competition, technological change, changes in government regulations, unexpected judicial or regulatory proceedings, and catastrophic events. This list of important factors is not exhaustive. Please consider these and other factors carefully before making any investment decisions and avoid placing undue reliance on forward-looking statements. Beutel Goodman has no specific intention of updating any forward-looking statements whether as a result of new information, future events or otherwise.