Institutional Investors

Fixed Income Strategies

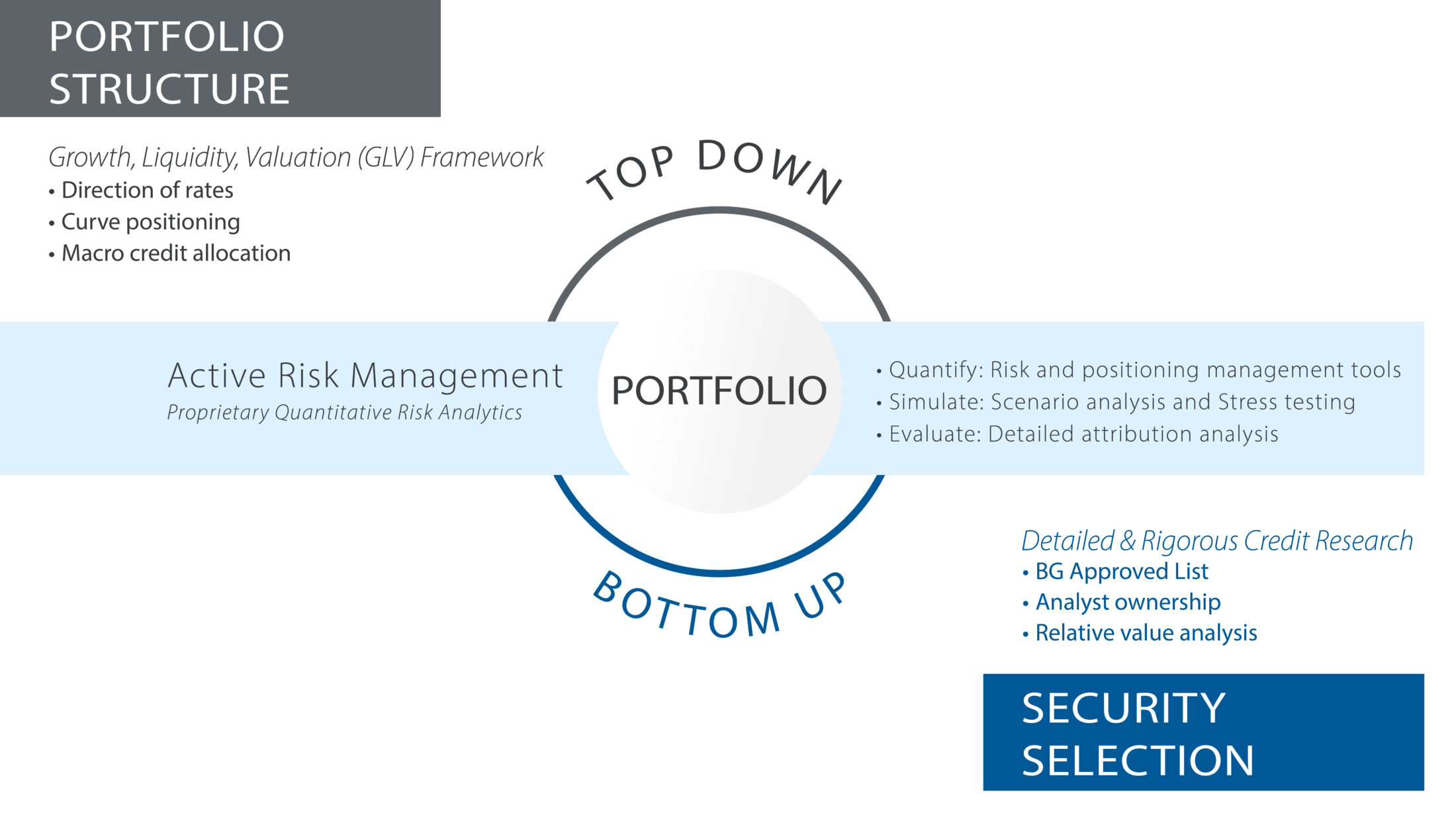

We take a disciplined, team-based approach to our active management of fixed income mandates, seeking to add consistent value relative to portfolios’ benchmarks over a business cycle. The fixed income portfolio construction process is iterative, guiding both initial construction and subsequent modifications of the portfolio.

Our core process consists of the following pillars:

- Interest rate anticipation (duration)

- Yield curve positioning

- Credit sector allocation

- Security selection

- Global Credit (in our Core Plus mandates)

The investment research and portfolio construction methodology begin with the top-down macro-outlook that includes the team’s views on the economy, central bank policy and research into historical cycles. The macro-outlook is based on our Growth, Liquidity and Valuation framework. These three components help the team determine where we are in the business cycle and what portfolio positioning is the most effective at that time.

We use proprietary models to conduct scenario analysis and stress-tests on portfolios to set risk budgets and help determine their optimal structure.

A key advantage of the Beutel Goodman portfolios is the strength and depth of our credit research. Our Fixed Income team has dedicated credit analysts who follow a disciplined and comprehensive approach to the analysis of credit risk. Our analysts act as sector experts and are responsible for assessing credit risk throughout the life cycle of a credit. This includes initiation of coverage and ongoing fundamental and relative value monitoring.

Our credit research process includes:

- Proprietary Financial Models

- Industry Analysis

- Management Interviews

- Strategy Critique

- Credit Ratings and

- Environmental, Social and Governance (ESG) Review

Inception date: January 1, 1985

Benchmark: FTSE Canada Universe Bond Index

Lead Portfolio Manager(s): Derek Brown and Sue McNamara

Objective: The Canada Universe Fixed Income strategy seeks to maximize portfolio returns through capital enhancement and investment income.

Composition: The strategy is a well-diversified portfolio of Canadian government and Canadian corporate bonds of various maturities. The bonds will usually have a credit rating of BBB or higher by a recognized rating agency. The average minimum quality of the fixed income portfolio will be A. The duration of the portfolio will not exceed 1.5 duration years above or below that of the benchmark.

Vehicles:

|

Segregated account |

Mutual Fund, Institutional Class |

|

|

Canadian institutions |

|

|

|

Global institutions |

|

Inception date: October 1, 1999

Benchmark: FTSE Canada Universe Bond Index

Lead Portfolio Manager(s): Derek Brown and Sue McNamara

Objective: The Core Plus Fixed Income strategy seeks to maximize portfolio returns through capital enhancement and investment income.

Composition: The strategy is a well-diversified portfolio of Canadian government and Canadian corporate bonds of various maturities. The corporate bonds have an average credit rating of BBB or higher by a recognized rating agency. The Fund may invest a portion of its assets in bonds that are rated below BBB, in other Canadian and non-Canadian evidences of indebtedness and in exchange-traded funds. The minimum credit rating at the time of purchase for a corporate bond is B.

Vehicles:

|

Segregated account |

Mutual Fund, Institutional Class |

|

|

Canadian institutions |

|

|

|

Global institutions |

|

Inception date: April 12, 2021

Benchmark: Bloomberg Barclays U.S. Aggregate Bond Index

Lead Portfolio Manager(s): Derek Brown, Sue McNamara and Neil McCabe

Objective: The Core Plus Fixed Income strategy seeks to maximize total return and provide income and capital growth by investing primarily in a diversified portfolio of fixed-income securities across investment-grade, high-yield and non-traditional fixed-income asset classes.

Composition: The strategy is a well-diversified portfolio of U.S. government and investment-grade, high-yield and non-traditional fixed-income asset classes of various maturities. The corporate bonds will have an average credit rating of BBB or higher by a recognized rating agency. The Fund may invest a portion of its assets in bonds that are rated below BBB or in other evidences of indebtedness.

Vehicles:

|

Segregated account |

’40 Act Fund [1] |

|

|

Canadian institutions |

|

|

|

U.S. institutions |

|

|

|

Global institutions |

|

In addition to our Canadian managed-account and fund offerings, Beutel Goodman also serves as the sub-advisor for AMG Beutel Goodman Core Plus Bond Fund, a ’40 Act fund distributed in the United States by AMG Distributors, Inc. This statement does not constitute an offer or solicitation to sell or a solicitation of an offer to buy any shares of any fund (nor shall any such shares be offered or sold to any person) in any jurisdiction in which an offer, solicitation, purchase or sale would be unlawful under the securities law of that jurisdiction, and is by way of information only.

Inception date: July 1, 2006

Benchmark: FTSE Canada Short Term Bond Index

Lead Portfolio Manager(s): Derek Brown and Sue McNamara

Objective: The Canada Short Term Fixed Income strategy seeks to maximize portfolio returns through capital enhancement and investment income.

Composition: The strategy invests primarily in a well-diversified portfolio of short-term fixed-income securities of Canadian government and corporate issuers. The bonds have a minimum credit rating of BBB or higher by a recognized agency. The portfolio duration will not exceed 0.5 duration years above or below that of the benchmark.

Vehicles:

|

Segregated account |

Mutual Fund, Institutional Class |

|

|

Canadian institutions |

|

|

|

Global institutions |

|

Inception date: May 1, 1999

Benchmark: FTSE Canada Long Term Bond Index

Lead Portfolio Manager(s): Derek Brown and Sue McNamara

Objective: The Canada Long Term Fixed Income strategy seeks to maximize portfolio returns through capital enhancement and investment income.

Composition: The strategy is comprised of a well-diversified portfolio of Canadian government and Canadian corporate bonds. The corporate bonds have a credit rating of BBB or higher by a recognized rating agency. The average minimum quality of the portfolio will be A. The duration of the fixed income portfolio will not exceed 1.5 duration years above or below that of the benchmark

Vehicles:

|

Segregated account |

Mutual Fund, Institutional Class |

|

|

Canadian institutions |

|

|

|

Global institutions |

|

Inception date: January 1, 1991

Benchmark: FTSE Canada 91 Day T-Bill Index

Lead Portfolio Manager(s): Derek Brown and Sue McNamara

Objective: The Canada Money Market strategy seeks to maximize portfolio returns and maintain a high level of liquidity by investing in high quality Canadian money market instruments with terms to maturity not exceeding one year.

Composition: The strategy will invest in a variety of instruments, such as Government of Canada treasury bills, short-term government and corporate bonds, commercial paper, chartered bank or trust company deposit receipts with a rating of A-1 or R-1 (low) depending on the rating agency, with a term to maturity of less than a year. The Fund is conservatively managed with an average term to maturity of less than 180 days.

Vehicles:

|

Segregated account |

Mutual Fund, Institutional Class |

|

|

Canadian institutions |

|

|

|

Global institutions |

|