Summary

Proxy voting allows shareholders the chance to effect change at the companies they invest in. In this summary, we highlight some of Beutel Goodman’s voting decisions in 2025, both supporting and opposing the respective management teams.

As a value manager, Beutel Goodman’s (BG) primary objective is to deliver superior risk-adjusted financial performance to our clients over the long term. We pursue this through the ownership of debt and equity positions in high-quality companies. We have long advocated for sound corporate governance, which we believe is the foundation of the responsible management of a company, including its environmental and social practices.

The exercise of rights to vote on proxies is a critical pillar in our active ownership approach. Guided by BG’s Proxy Voting Guidelines, we conduct a thorough analysis of each ballot item and seek alignment with long-term shareholder value creation. Our proxy service provider, Glass Lewis, provides recommendations that we consider in our research process, however we make our own independent decisions. In addition, our investment teams assess steps that a company may have made in relation to proxy issues and may engage with boards on proxy-related matters and discuss vote recommendations with our proxy adviser. We then make an independent voting decision and monitor voting results and progress over time. If sufficient progress is not shown over a reasonable timeframe, it is incorporated into our research and our proxy voting process.

Exhibit 1: Beutel Goodman Proxy Voting Record in 2025 (to July 31, 2025). The table below gives a breakdown of BG’s proxy voting record to July 31, 2025, including when we have voted with or against the recommendations of management and our proxy service provider, Glass Lewis.

| Proposal Category Type | With Management[1] | Against Management | No action / unvoted | Against Policy | Total |

| Totals | 1588 | 79 | 0 | 66 | 1667 |

| Audit/Financials | 175 | 2 | 0 | 1 | 177 |

| Board Related | 1042 | 36 | 0 | 44 | 1078 |

| Capital Management | 65 | 2 | 0 | 2 | 67 |

| Changes to Company Statutes | 28 | 0 | 0 | 1 | 28 |

| Compensation | 170 | 12 | 0 | 9 | 182 |

| M&A | 7 | 0 | 0 | 0 | 7 |

| Meeting Administration | 24 | 2 | 0 | 0 | 26 |

| Other | 10 | 0 | 0 | 0 | 10 |

| SHP: Compensation | 7 | 0 | 0 | 0 | 7 |

| SHP: Environment | 15 | 0 | 0 | 0 | 15 |

| SHP: Governance | 35 | 23 | 0 | 7 | 58 |

| SHP: Misc | 2 | 0 | 0 | 1 | 2 |

| SHP: Social | 8 | 2 | 0 | 1 | 10 |

Source: Beutel Goodman, Glass Lewis, as at July 31, 2025

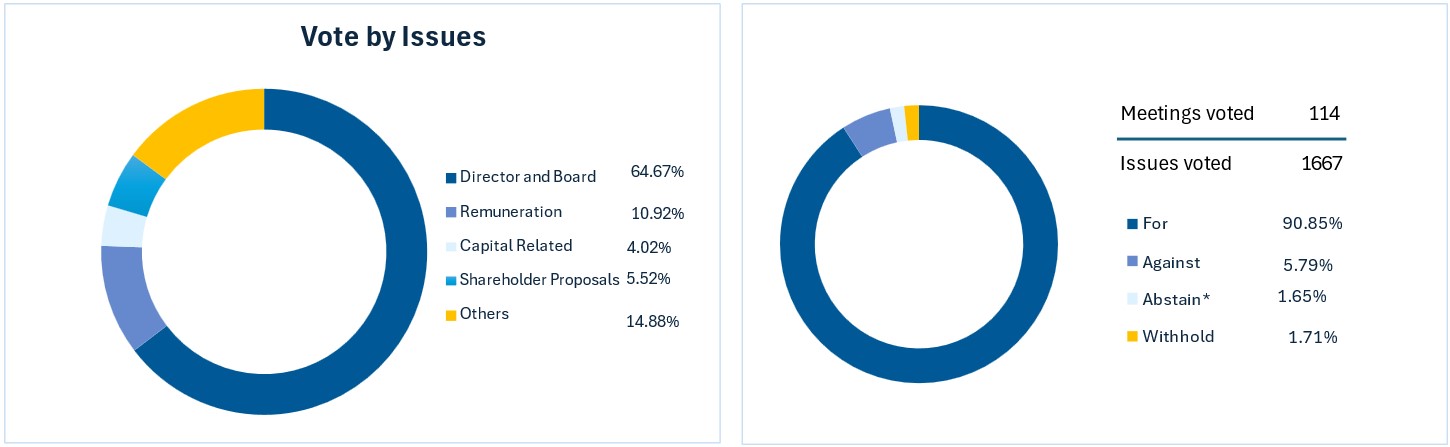

Exhibit 2: Proxy Issues & Decisions. These graphs show different issues BG has voted on to July 31, 2025 and when the vote went for/against management’s recommendation.

Source: Beutel Goodman, Glass Lewis, as at July 31, 2025

* We decided to “TAKE NO ACTION” on 27 proposals for two contested meetings in line with Glass Lewis’s recommendation; these proposals did not count toward the total proposals we voted on.

Here we highlight some of our notable voting decisions along with our voting guidelines during the 2025 proxy-voting season.

1.0 BOARD EFFECTIVENESS

Board and management alignment with shareholders is critical to shareholder value creation. Among other factors, we believe that key components of effective governance include:

- Management compensation structures that align strategic decisions and outcomes with the interests of shareholders and incentivize disciplined capital allocation decisions;

- Competence, independence and diversity of thought at the board level; and

- Share ownership and voting structures that afford the ability as shareholders to seek to effect change via engagement and proxy voting.

Corporate boards play a crucial role in overseeing a company’s strategic activities, and their decisions can significantly impact a company’s long-term value. We generally support well-run boards that are aligned with the interests of shareholders. In cases where we disagree or find misalignment, we will typically voice our concerns by voting against or withholding votes from directors. In 2025, we voted AGAINST or WITHHELD votes for 41 directors.

These voting decisions were based on potential misalignments between management and shareholder interests. Fundamental concerns include:

- Directors serving on an excessive number of boards (overboarded directors);

- Long tenured directors with a high average age (board entrenchment);

- Lack of gender diversity on the board;

- Concerns related to compensation structure;

- Concerns around an affiliate or insider director sitting on a committee;

- Insufficient board independence;

- Lack of independent chair;

- CEO/Chair duality with no independent lead or presiding director;

- Multi-class share structure with unequal voting rights;

- Director experience or expertise;

- Disappointment by overall lack of oversight and governance in operations and strategic direction;

- Lack of or poor visibility on CEO succession plan; and

- Contested election of directors.

We review the voting results of meetings of shareholders when they are posted. If directors received low support, we typically engage with the company to confirm that shareholders’ concerns are being considered by the board. We view a result of greater than 20% of votes against a director nominee as an indication of shareholder dissent that should be discussed further.

1.1 Board and Committee Independence

Boards of directors that are independent of management add to the board’s effectiveness in oversight and protect shareholder interests. In our view, best practice is for the Audit, Nominating and Compensation Committees of a non-controlled company to be comprised of independent directors.

We also voted AGAINST or WITHHELD votes for directors at several companies across our equity portfolios due to our assessment of board independence; governance, compensation or audit committee independence; and/or not having an independent lead or presiding director.

1.2 Board Diversity

Diversity of thought enhances decision making and thus having a diverse set of directors on a board is relevant to good corporate governance. It is generally recognized by the market that at least 30% of female directors on a board represents best practice. Although we agree with this standard, we will also consider a company’s progress toward diversity, as well as other aspects of diversity and overall board quality.

1.3 Multi-Class Share Structures

Glass Lewis continues to recommend voting against the Head of the Governance Committee across all companies that have multi-class share structures with unequal voting rights. While we recognize that such structures may limit shareholder influence on a company, multi-class share structures are legal, continue to be employed in new listings and can provide controlling shareholders with the ability to make informed strategic decisions that serve the best interests of shareholders. Although we support the principle of one share, one vote, we do not preclude investment in companies with such structures as these structures do not prevent the board and management acting in the best interest of all shareholders. We evaluate proposals to collapse a multiple voting share structure and would vote in favour if it was in the best interest of shareholders.

1.4 Significant Governance Breach

Strong governance is the fundamental basis for a company’s success and share-value creation. A significant breach in governance could signal a board-level emphasis on short-term financial gains over long-term shareholder value creation. In such cases, we may use proxy voting to voice our concerns.

1.5 Contested Election of Directors

In some instances, a shareholder will contest a board’s composition and put forth a case for change. The dissident shareholder may view that a change in the company’s strategy is required to improve value creation based on weak governance, or directors with skills that do not align with company strategy. During 2025 (to July 31, 2025) we had 2 contested ballots at Harley-Davidson Inc. and Parkland Corporation.

Harley-Davidson Inc. had a contested ballot put forward by H Partners Management, LLC, (its second largest shareholder with ~9% stake), which recommended voting a BLUE proxy card, withholding from three directors primarily due to the company’s poor performance and compensation practices, misalignment with shareholders, and the board’s lack of accountability. After engaging with the board and company management, we supported management and voted the WHITE proxy card but WITHHELD from 1 director, the CEO. We believe that it is important to maintain continuity on the board while pushing for the separation of the roles of CEO and chair. An independent chair would be better able to oversee the executives of the company and set a pro-shareholder agenda without the management conflicts that a CEO or other executive insiders would face. We also voted against management on the Advisory Vote on Executive Compensation as detailed below in Section 2.0. In our view the benchmark chosen to determine total shareholder return was inappropriate.

The vote resulted in the three directors targeted by H Partners being re-elected by a close margin; however, all three decided to step down from the board before the next AGM.

Parkland Corporation’s Annual General Meeting involved a contested election of directors by its largest shareholder, Simpson Oil Limited (~19.75% ownership). Simpson Oil solicited votes via a GOLD universal proxy form, nominating nine candidates, and recommending withholding from all Parkland nominees, while management put forward a BLUE proxy card recommending votes for 10 of its nominees as well as three of Parkland’s nominees.

We engaged with Parkland’s board Chair and senior management, as well as with Simpson Oil representatives. After careful consideration, we voted in favour of the dissident, Simpson Oil Limited. We believe Parkland has some very good assets, but the company had been mismanaged and required a refreshed board to extract its value. The main reasons underlying our decision were Parkland’s stock price underperformance, poorly executed M&A, the decision to not negotiate Sunoco LP’s first take-over offer in 2023, lack of responsiveness to meaningful shareholder activism and a lack of succession planning.

Given the board has a fixed size of 13 directors (and Simpson only has nine proposed), we voted for a select group of Parkland’s nominees. We voted in favour of eight of Simpson’s directors and five of Parkland’s. We believe the new slate of directors brings a diverse blend of operational, financial, governance and industry-specific expertise to effectively lead the company forward. Early indications suggested that Simpson’s nominees would hold a majority of the Company’s board seats after the AGM. However, one day prior to the scheduled annual general meeting when the vote was to take place, Parkland announced it was being acquired by Sunoco. The AGM was postponed and later combined with a special meeting to approve the Sunoco transaction, as well as a new slate of directors to be caretakers until the transaction closes. The vote resulted in all of Parkland’s nominees being voted in and approval of the offer to be acquired, expected to close in 2H/2025.

BG’s votes against directors in the 2025 proxy season are summarized below.

Canadian Equity

| Company | Proposal | Rationale (Against or Withheld) |

| Magna International Inc. | Elect William A. Ruh | Concerns around the executive compensation structure. |

| Elect Indira V. Samarasekera | Concerns around the executive compensation structure. | |

| Elect Matthew Tsien | Concerns around the executive compensation structure. | |

| Elect Lisa S. Westlake | Concerns around the executive compensation structure. | |

| Restaurant Brands International Inc. | Elect Jordana Fribourg | Concerns around limited experience, family relationship and independence. |

| Elect Marc Lemann | Concerns around affiliation to 3G Capital (3G is the beneficial owner of ~25.7% voting power, and Marc Lemann is the son of the founder), and experience. | |

| Tourmaline Oil Corp. | Elect Brian G. Robinson | Concerns that the CFO on the board would provide limited input while hindering board independence and oversight. |

Canadian Small Cap Equity

| Company | Proposal | Rationale (Against or Withheld) |

| Dentalcorp Holdings Ltd. | Elect Stacey Mowbray | Concerns on board gender diversity. |

| Enghouse Systems Ltd. | Elect Pierre Lassonde | Concerns regarding compensation program. |

| Elect Melissa Sonberg | Concerns regarding compensation program. | |

| Elect Paul Stoyan | Concerns regarding compensation program. | |

| GDI Integrated Facility Services | Elect Anne Ristic | Lack of an independent lead or presiding director |

| K-Bro Linen Inc. | Elect Matthew B. Hills | Concerns around an affiliate director sitting on a committee. |

| Leon’s Furniture Ltd. | Elect Terrence T. Leon | Concerns around board gender diversity and tenure. |

| Elect Mary Ann Leon | Affiliate/Insider on audit committee. | |

| Linamar Corporation | Elect Mark Stoddart | Board independence is 50%, below optimal for a non-controlled company. |

| Elect Terry Reidel | CEO/Chair duality with no independent lead or presiding director. | |

| Parkland Corp. | Elect Dissident Nominee Jackie Doak | Concerns around appropriate expertise. |

| Elect Management Nominee Nora Duke | We voted the GOLD (dissident) proxy card and WITHHELD from Parkland’s nominees. | |

| Elect Management Nominee Robert Espey | We voted the GOLD (dissident) proxy card and WITHHELD from Parkland’s nominees. | |

| Elect Management Nominee Richard Hookway | We voted the GOLD (dissident) proxy card and WITHHELD from Parkland’s nominees. | |

| Elect Management Nominee Michael Jennings | As part of the 2024 special committee, Mr. Jennings determined that a strategic review was not necessary and has been actively working on a campaign against the Simpson shareholder. We believe a productive relationship with the Simpson slate of directors may be difficult. | |

| Elect Management Nominee James Neate | There is currently sufficient financial experience on the board. Further, as part of the 2024 special committee, Mr. Neate determined that a strategic review was not necessary and has been actively working on a campaign against the Simpson shareholder. We believe a productive relationship with the Simpson slate of directors may be difficult. | |

| Spin Master Corp. | Elect Jeffrey I. Cohen | Concerns around board independence, related-party transactions, affiliate/insider on board committees. |

| Elect Ronnen Harary | Multi-class share structure. | |

| Elect Charles Winograd | Insufficient board gender diversity. | |

| TELUS International (Cda) Inc. | Elect Madhuri A. Andrews | Overboarding concerns. |

| Elect Darren Entwistle | Multi-class share structure. |

U.S. Equity

| Company | Proposal | Rationale (Against or Withheld) |

| American Express Co. | Elect Theodore J. Leonsis | Director independence. |

| Harley-Davidson, Inc. | Election of Jared D. Dourdeville | Director Jared D. Dourdeville resigned from the board in April 2025. |

| Elect Jochen Zeitz | CEO/Chair duality, non-independent chair. | |

| Omnicom Group, Inc. | Elect John D. Wren | Entrenched director, CEO/Chair duality. |

| Elect Mary C. Choksi | Entrenched director, lack of credible succession plan. | |

| Elect Leonard S. Coleman, Jr. | Entrenched director, lack of credible succession plan. | |

| Elect Deborah J. Kissire | Entrenched director, lack of credible succession plan. | |

| Elect Linda Johnson Rice | Entrenched director, lack of credible succession plan. | |

| Elect Valerie M. Williams | Entrenched director, lack of credible succession plan. | |

| Polaris Inc. | Elect Bernd F. Kessler | Missed an opportunity to add a female director and the company has been poorly managed. |

| PPG Industries Inc. | Elect Guillermo Novo | Affiliate/Insider on a committee. |

International Equity

| Company | Proposal | Rationale (Against or Withheld) |

| Gjensidige Forsikring ASA | Elect Trine Riis Groven | Lack of response from the board given the significant minority shareholder dissent against the election of directors. |

| Shionogi & Co. Ltd. | Elect Fumi Takatsuki

|

Inappropriate for audit committee given in our view the director is not independent. |

1.5 CEO/Chair Duality

Generally, an independent board chair is indicative of a sound governance structure. A combined CEO/Chair role can call into question the effectiveness and integrity of the board, particularly in areas such as the oversight of management’s execution of corporate strategy and its alignment with shareholder interests. We note, however, that we examine all shareholder proposals regarding an independent chair in the context of a company’s overall governance structure, with particular consideration given to management alignment, including compensation and track record of long-term shareholder value creation.

We cast our votes according to this holistic assessment of a company’s governance program. As we generally believe an independent chair enhances governance practices and is better able to provide effective oversight of the executives of a company and set a pro-shareholder agenda, we voted FOR the Shareholder Proposal Regarding Independent Chair at the Annual General Meetings (AGMs) of three companies:

U.S. Equity

| Company | Proposal | Rationale (For) |

| Cummins Inc. | Shareholder Proposal Regarding Independent Chair | We support the separation of Chair and CEO and are disappointed that the company did not make this move when the former CEO transitioned out. |

| Comcast Corp. | Shareholder Proposal Regarding Independent Chair | We support the separation of Chair and CEO. |

| Omnicom Group Inc. | Shareholder Proposal Regarding Independent Chair | We are concerned with board entrenchment and the lack of separation between the chair and CEO roles. |

We also engaged and provided feedback on this topic with several of our holding companies.

2.0 EXECUTIVE COMPENSATION

Our preference is for companies that demonstrate alignment between executive compensation and shareholder interests, have suitable performance-based incentives, and can attract and retain top talent. We view these factors as aligned with shareholders’ interests:

- Compensation packages that promote pay for performance;

- A focus on returns such as ROIC or ROE;

- A tilt to long-term payouts vs short-term payouts; and

- Longer vesting periods and non-cash versus cash compensation.

We voted AGAINST certain say-on-pay proposals due to:

- A pay-performance disconnect concerning pay practices;

- Absolute quantum significantly above relevant peers;

- Lack of focus on returns;

- Insufficient response to shareholder dissent;

- Insufficient disclosure of elements in the compensation plan; and

- Benchmark chosen to determine total shareholder return is inappropriate.

Canadian Equity

| Company | Proposal | Rationale (Against) |

| GFL Environmental Inc. | Advisory Vote on Executive Compensation | Absolute quantum is significantly above relevant peers. |

| Magna International Inc. | Advisory Vote on Executive Compensation | Reservations about changes to the compensation structure. |

| Quebecor Inc. | Advisory Vote on Executive Compensation | Concerns on changes to CEO’s compensation structure |

Canadian Small Cap Equity

| Company | Proposal | Rationale (Against) |

| Enghouse Systems Ltd. | Advisory Vote on Executive Compensation | Ongoing concerns regarding the company’s compensation program. |

U.S. Equity

| Company | Proposal | Rationale (Against) |

| Harley-Davidson, Inc. | Advisory Vote on Executive Compensation | Benchmark chosen to determine total shareholder return is inappropriate. |

| Interpublic Group of Companies Inc. | Advisory Vote on Golden Parachutes | Values look excessive. |

International Equity

| Company | Proposal | Rationale (Against) |

| Euronext NV | Remuneration Report | Concerns around the Supervisory Board’s use of upward discretion to adjust LTI and inadequate response to shareholder dissent to last year’s remuneration report. Insufficient justification in relation to the discretionary awards granted and poor disclosure regarding end-of-service arrangements. |

| Gjensidige Forsikring ASA | Remuneration Report | Lack of a long-term incentive plan in the executive remuneration package and inadequate response to dissent expressed by free float shareholders in last year’s AGM to executive remuneration. |

It is worth mentioning the distinction between voting against directors for election and voting against say-on-pay proposals. While director vote outcomes are binding, say-on-pay vote outcomes are advisory only. When warranted, we may also vote against directors associated with the Remuneration or Compensation Committee to hold them accountable for compensation issues.

In the case of Enghouse and Magna, in addition to voting AGAINST the Advisory Vote on Executive Compensation, we also WITHHELD our votes from directors due to concerns around their compensation programs.

Failed votes on executive compensation prompted engagement with boards on how to improve compensation packages to better align with pay-for-performance and with shareholders.

To date, there has been one executive compensation program in our portfolios that a majority voted against:

| Company | Proposal | Votes FOR | Votes AGAINST/ABSTAIN |

| Euronext | Remuneration Report | 38.9% | 61.14% |

Euronext’s Renumeration Report proposal on executive compensation did not receive approval from 50% of shareholders and therefore failed to pass. We will engage with the board to understand the key issues, as well as plans to improve the compensation programs.

3.0 CAPITAL RELATED VOTES

3.1 Capital Allocation

We view capital allocation decisions as a key engagement topic and essential to long-term shareholder value creation. In the event of proposed transformational acquisitions or transactions, we conduct a complete company review. We review and assess the merits of the transaction and its potential impact on the risk/reward of the investment. We engage with stakeholders, typically including senior management, board members, industry experts and other shareholders. We thoroughly discuss issues to inform our research. To date in 2025, we have had proposals regarding acquisitions/mergers at:

– Interpublic Group of Cos., Inc. to be acquired by Omnicom Group Inc.

– Omnicom Group Inc. to acquire Interpublic Group of Companies

– Parkland Corp. to be acquired by Sunoco LP

– Softchoice Corporation, to be acquired by World Wide Technology Holding Co.

| Company | Proposal | Vote Decision |

| Interpublic Group of Cos., Inc. | Omnicom Transaction

|

FOR |

| Omnicom Group, Inc. | IPG Issuance | FOR |

| Parkland Corp | Merger (Acquisition by Sunoco LP) | FOR |

| Softchoice Corporation | Acquisition by World Wide Technology Holding Co., LLC and 2672989 Alberta ULC

|

FOR |

3.2 Equity Issuance

On the equity side, we generally do not favour equity issuance as part of a company’s capital allocation plan, as it dilutes shareholder ownership and, in most cases, negatively impacts valuation. However, with respect to the Omnicom transaction (an all-stock deal), we see great merit in the tie-up and believe it can create significant value for the combined company through scale benefits, synergies and portfolio advantages from the combination. As we hold both Omnicom Group Inc. and Interpublic Group of Cos. in our portfolios, we have been engaged with both regarding the transaction.

4.0 SHAREHOLDER PROPOSALS

We evaluate shareholder proposals based on whether the proposal aligns with the interests of shareholders, encourages value creation, and is consistent with our objective of advancing companies’ performance, including any material ESG factors identified in our investment process. We also consider initiatives and progress that a company may already have taken to address the issues raised in the proposal.

There has been a decline in the number of environmental and social shareholder proposals received by our portfolio companies this year. In the U.S. the number of shareholder proposals has been impacted by the political backlash against ESG and changes in the SEC’s no-action request process, with new restrictions on resolutions at annual meetings, reducing the scope of what is permissible and giving boards more power. We actively engage with our investee companies and at times with the shareholders filing proposals to gain a better understanding of the company’s practices and the filers’ intentions for these proposals. These conversations give us more context and inform our decisions to seek alignment with shareholder interests. In the first half of 2025, we conducted proxy-related engagements with 11 companies, a significant decrease from 26 engagements across equity strategies in the same period in 2024. This was most likely due to the fewer proposals received this year.

Of the 25 environmental and social shareholder proposals assessed in the 2025 proxy season to July 31, 2025, we voted FOR the Shareholder Proposal Regarding Racial Equity Audit at Bank of Nova Scotia, in line with Glass Lewis but AGAINST management recommendations. In our view, a racial equity audit is in line with existing best practices and would help the bank identify and mitigate potentially significant risks associated with systemic discrimination. Glass Lewis recommended a vote FOR the Shareholder Proposal Regarding Report on Tax Transparency at Merck & Co.; however, we voted AGAINST as we are comfortable with the company’s existing disclosure policies and procedures as they relate to its global tax structure. Glass Lewis also recommended voting FOR a Shareholder Proposal Regarding Report on Indigenous Standards of Practice at EQB Inc. We abstained as this proposal was withdrawn.

In most cases, we found companies’ disclosures and monitoring of issues highlighted in shareholder proposals were sufficient. In our view, additional disclosure in accordance with the shareholder proposals would not provide additional material benefit to shareholders.

Proxy voting remains a key focus in Beutel Goodman’s active ownership approach. We share our voting decisions and rationales (when we vote against management or Glass Lewis, and on ESG proposals) on our website shortly following the meeting. For a general overview of the factors we consider when casting our votes, please see our Proxy Voting Guidelines.

[1] Management did not provide voting recommendation for 3 proposals. We voted all 3 proposals in line with Glass Lewis’ recommendations although 1 proposal was later withdrawn. Additionally, for 13 proposals which were classified as mixed (Harley-Davidson’s contested proxy where we voted the management proxy card), 10 were voted in line with management and 3 were voted counter to management.

Download PDF

This report has been prepared for informational purposes only and may not be reproduced, distributed or published without the prior written consent of Beutel, Goodman & Company Ltd. (“Beutel Goodman”). This document does not constitute an offer or a solicitation to buy or to sell any security, product or service in any jurisdiction. This document is not intended, and should not be relied upon, to provide legal, financial, accounting, tax, investment or other advice. This document is not available for distribution to people in jurisdictions where such distribution would be prohibited.

The information provided is as at July 31, 2025. Beutel Goodman has taken reasonable steps to provide accurate and reliable information. Beutel Goodman reserves the right, at any time and without notice, to amend or cease publication of the information.

Please note Beutel Goodman’s ESG and responsible investment approach may evolve over time. This report refers to progress made and activities performed during the first seven months of 2025. Also note that the integration of ESG and responsible investment considerations does not guarantee positive returns. Past performance does not guarantee future results.

For more information on our approach to ESG and Responsible Investing, please visit https://www.beutelgoodman. com/about-us/responsible-investing/. Certain portions of this document may contain forward-looking statements. Forward-looking statements include statements that are predictive in nature, that depend upon or refer to future events or conditions, or that include words such as “expects”, “anticipates”, “intends”, “plans”, “believes”, “estimates” and other similar forward-looking expressions. In addition, any statement that may be made concerning future performance, strategies or prospects, and possible future action, is also forward-looking statement. Forward-looking statements are based on current expectations and forecasts about future events and are inherently subject to, among other things, risks, uncertainties and assumptions which could cause actual events, results, performance or prospects to be incorrect or to differ materially from those expressed in, or implied by, these forward-looking statements.

These risks, uncertainties and assumptions include, but are not limited to, general economic, political and market factors, domestic and international, interest and foreign exchange rates, equity and capital markets, business competition, technological change, changes in government regulations, unexpected judicial or regulatory proceedings, and catastrophic events. This list of important factors is not exhaustive. Please consider these and other factors carefully before making any investment decisions and avoid placing undue reliance on forward-looking statements. Beutel Goodman has no specific intention of updating any forward-looking statements whether as a result of new information, future events or otherwise.

©2025 Beutel, Goodman & Company Ltd. Do not copy, distribute, sell or modify this document without the prior written consent of Beutel, Goodman & Company Ltd.