Summary

The credit market has bounced back from the disruption brought on by “Liberation Day”. In this piece, the Beutel Goodman Fixed Income team looks at the factors that have contributed to spreads tightening, the likelihood of spreads staying at those levels and the areas where the team is seeing value in corporate bonds.

By Beutel Goodman Fixed Income Team (as at August 31, 2025)

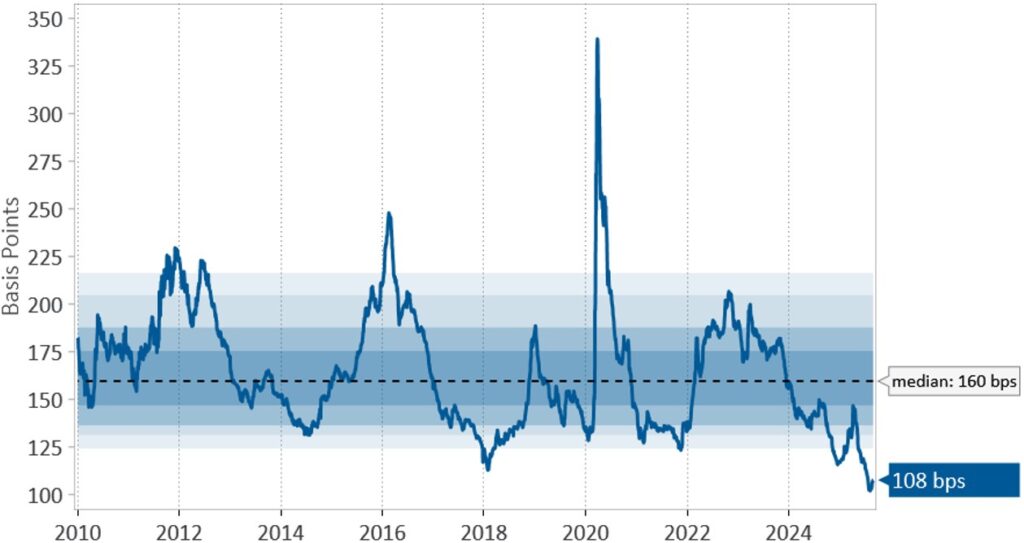

The slow march toward tighter credit spreads has continued into Q3/2025, following the peak spread-widening in the wake of the “Liberation Day” announcements. Amid a bull market for credit, Canadian corporate spreads are 8 basis points (bps) tighter quarter to date and 34 bps tighter from the tariff-induced widening in early April (see Exhibit 1).

Exhibit 1: Tightening of Canadian Corporate Spreads. The chart below shows the reaction of credit spreads in Canada to Liberation Day and how they have tightened since that brief market shock.

January 1, 2010 – August 31, 2025.

Sources: Beutel, Goodman & Company Ltd., Bloomberg. As of August 31, 2025.

In our analysis, there have been three powerful tailwinds contributing to tighter credit spreads and sustaining them there.

Firstly, all-in yields remain attractive. The current yield-to-worst on the Bloomberg Canadian Corporate Index is approximately 4%, which is roughly 75 bps higher than the 15-year median for the index. Canadian BBB all-in yields are similarly attractive in a historical context and are also roughly 76 bps above their median level (see Exhibit 2).

Exhibit 2: Corporate BBB Yields. The chart below shows the BBB Corporate Yield-to-Worst in Canada, which is the lowest potential yield for a bond investor.

January 1, 2010 – August 31, 2025.

Sources: Beutel, Goodman & Company Ltd., Bloomberg. As of August 31, 2025.

Secondly, supply and demand for longer-dated corporate bonds (20 years+) can often be mismatched, causing the market to deviate significantly from fair value. This is known as a “technical market” because corporate spreads are reacting to inflows or outflows rather than fundamentals, and long corporate bonds are now in a technical market. While there has been $13.3 billion of long corporate issuance year to date, $6.8 billion of that issuance has come from hybrid securities — these have 30-year legal maturities but have 5- or 10-year call features, making their effective duration significantly shorter. Net of this hybrid issuance, Canada has had only $6.5 billion of “true” long corporate issuance. At the same time, Canadian telecom companies have tendered for large swaths of bonds in the long end to optimally reduce their leverage and ratings pressure. The three largest Canadian telcos collectively have taken $4.42 billion of long bonds out of the market in 2025. Altogether, the Canadian market has had only ~$2 billion of long-end corporate issuance so far in 2025. For context, each of 2023 and 2024 each saw approximately $10 billion of long-end corporate issuance. Lack of corporate bonds in the long end has resulted in a flattening of 10-30 curves across sectors, which in turn has pulled down-spreads in other tenors and acted as a further tailwind to credit spreads.

Lastly, we would like to highlight that sentiment remains strong. Stocks continue to price-in optimism and the S&P 500 Index has recorded 23 record closes in 2025 as of the date of writing and continues to have expensive valuation metrics. This is driven by both the AI and soft-landing narratives. Since the early April upheaval, tariffs do not appear to be having a major effect on the economy/corporate earnings, labour market resiliency, etc. In addition, Canada has also had a record summer of corporate issuance, which has been easily absorbed, indicating large amounts of cash (from flows into fixed income) on the sidelines. While we acknowledge positive sentiment can sustain tight credit spreads in the near term, we are skeptical that spreads can materially tighten further from here. For each of the tailwinds identified above, we would therefore like to highlight some caveats.

Government bond yields are doing the heavy lifting in providing investors with historically attractive all-in yields. Credit spreads are only accounting for approximately 20% of Canadian corporate bonds’ all-in yield — a level we haven’t seen since the final quarter of 2007 (see Exhibit 3). A certain type of investor base is less sensitive to ratios such as these, as they are using credit as an offset to a very specific liability. Known as Asset-Liability Matchers (ALM), their chief concern is immunizing a liability (i.e. making sure the liability is “paid” in the future by matching the liability with an asset of similar duration). The ALM investor is a more passive investor and less sensitive to market-value changes as their chief concern is ensuring their liabilities are matched. Active managers cannot afford to discount credit spreads’ contribution to their overall yield and portfolio return. With credit’s contribution to the Bloomberg Canada Corporate Index (see Exhibit 3) at a multi-decade low, at BG, we remain defensive on longer-duration credit.

Exhibit 3: Corporate Spreads and Yield in Canada. The chart below shows credit spreads’ contribution to the Bloomberg Canada Corporate Index’s total yield, which has been declining since peaking during the pandemic.

January 1, 2010 – August 31, 2025.

Sources: Beutel, Goodman & Company Ltd., Bloomberg. As of August 31, 2025.

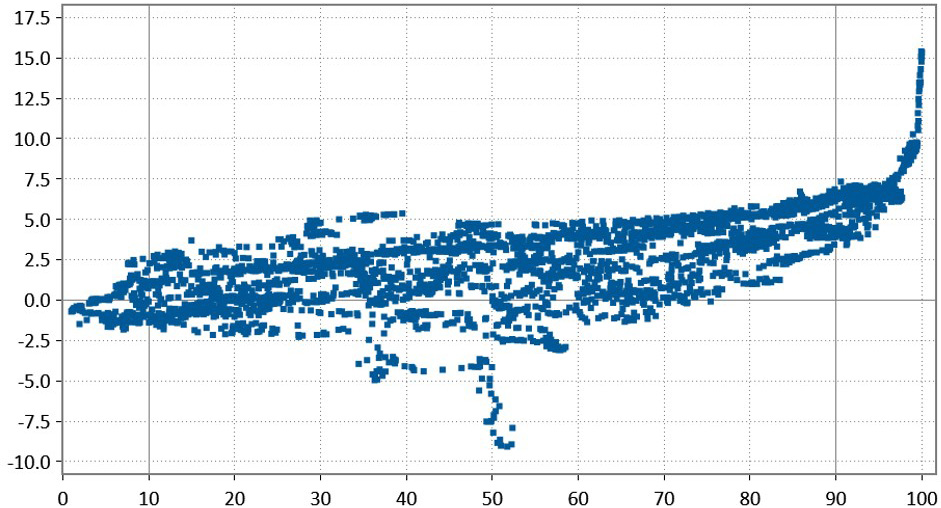

Another caveat is that spreads don’t stay at the lower bound very long. In Exhibit 4, you can see a scatter plot chart that shows the starting spreads inside the 10th percentile lead to 1-year subsequent returns that are marginally positive at best. Most observations are negative, implying some degree of credit-spread widening once historical tight thresholds are reached. While we acknowledge that credit spreads can be maintained in and around these levels, history would suggest this is not the most probable outcome. Further, the credit market is seeing some warning signals associated with a hot market, including:

- International issuers coming to Canada for the first (and possibly only) time;

- Q4/2025 issuance being pre-funded and pulled forward while the funding window is open; and

- Issuers who have predominantly funded through bank loans issuing bonds in the public market because the funding cost is cheaper.

We have also begun to see corporate leverage tick up at the individual company level, ratings actions turn negative (or at least shift from decidedly positive), and recent new issues at the end of August struggling to perform in the market, indicating supply indigestion and some waning demand.

Exhibit 4: Spreads and Corporate Bond Returns. The scatter plot shows the starting spread percentile and subsequent 1-year corporate bond returns. Inside the 10th percentile, most subsequent 1-year returns are lacklustre, implying some degree of credit-spread widening once historical tight thresholds are reached.

Sources: Beutel, Goodman & Company Ltd., Bloomberg. As of August 31, 2025.

Value at the Lower Bound

One of the many benefits of being an active, alpha-seeking manager is independent thought. At BG, our process allows us to think differently and come to our own conclusions; we can make investments in parts of the market where we see the most value and where risk is being attractively priced. Despite credit spreads being where they are currently, we continue to find pockets of value in the Canadian bond market. Namely:

- Front-end corporate bonds. Short-dated corporate bonds have good “carry” and excellent “break-evens”. Carry is when the yield to maturity and the current yield is attractive vs. that of the overall index and these bonds help portfolios to out-yield their index. The concept of break-even uses credit spread and duration to answer the question “how many bps of widening until the benefit of this corporate bond vs. a risk-free Government of Canada bond is neutralized?” For example, with a Ford 6.326% bond due in November 2026 and with a credit spread of approximately 140 bps and a duration of 1.1 years, this would mean credit spreads would need to widen by more than 127 bps before the marginal benefit from that Ford bond over the next year has been lost. The break-evens for long corporate bonds are considerably worse. Using a long 407 International bond as an example, a credit spread widening of a mere 8 bps is enough to wipe out the next year’s worth of marginal benefit that investors were due to receive compared to a Government of Canada bond.

- Corporate hybrid bonds. Corporate hybrid bonds are subordinated securities from investment-grade issuers in the Canadian market. Issuers in the midstream and telecommunicators sectors have been the most frequent issuers of these structures; Limited Recourse Capital Notes (LRCNs) is a comparable structure for financial issuers. Hybrid bonds offer investors the opportunity to buy bonds with high-yield (HY) spreads from parents with investment-grade (IG) balance sheets, and the coupon reset formulas (known as “back-ends”) are a strong incentive to call the bonds at their first call date.

- Municipal and Provincial bonds. Municipal bonds occupy a space in between corporate bonds and provincial bonds — they often have similar spread/yields as corporate bonds, but ratings that are more akin to provincial bonds. We feel these types of issuers are overlooked in corporate and core plus portfolios as they don’t get a lot of coverage from government or corporate bond desks. With so few eyes on municipal bonds’ spreads and relationships, we see them as a source of value.

Setting the Narrative

The market is often driven by a succession of narratives. Heading into 2025, the prevailing narrative was one of optimism. After recovering from the Liberation Day fall-out, that narrative seems intact, with Fed Chair Jerome Powell’s final speech at Jackson Hole representing a dovish pivot that opened the door to a September cut; the Canadian rates market meanwhile is pricing in further monetary easing.

Given the tight level of credit spreads, our portfolios are positioned defensively, holding mostly higher-rated credit, with a bias towards less cyclical sectors. We anticipate this positioning will change as spreads move wider and opportunities arise to add higher-beta credit. Our current holdings of high-beta investment-grade and high-yield credits are concentrated in the front end of the curve in shorter maturities. Our portfolios remain positioned to quickly take advantage of shifting narratives and material risk-off events as the impacts of tariffs work their way through the G7 economies and labour markets.

Download PDF

Related Topics and Links of Interest:

©2025 Beutel, Goodman & Company Ltd. Do not sell or modify this document without the prior written consent of Beutel, Goodman & Company Ltd. This commentary represents the views of Beutel, Goodman & Company Ltd. as at the date indicated. This document is not intended, and should not be relied upon, to provide legal, financial, accounting, tax, investment or other advice.

Bloomberg Index Services Limited. BLOOMBERG® is a trademark and service mark of Bloomberg Finance L.P. and its affiliates (collectively “Bloomberg”). Bloomberg or Bloomberg’s licensors own all proprietary rights in the Bloomberg Indices. Bloomberg does not approve or endorse this material, or guarantee the accuracy or completeness of any information herein, or make any warranty, express or implied, as to the results to be obtained therefrom and, to the maximum extent allowed by law, it shall not have any liability or responsibility for injury or damages arising in connection therewith.

Certain portions of this report may contain forward-looking statements. Forward-looking statements include statements that are predictive in nature, that depend upon or refer to future events or conditions, or that include words such as “expects”, “anticipates”, “intends”, “plans”, “believes”, “estimates” and other similar forward-looking expressions. In addition, any statement that may be made concerning future performance, strategies or prospects, and possible future action, is also forward-looking statement. Forward-looking statements are based on current expectations and forecasts about future events and are inherently subject to, among other things, risks, uncertainties and assumptions which could cause actual events, results, performance or prospects to be incorrect or to differ materially from those expressed in, or implied by, these forward-looking statements.

These risks, uncertainties and assumptions include, but are not limited to, general economic, political and market factors, domestic and international, interest and foreign exchange rates, equity and capital markets, business competition, technological change, changes in government regulations, unexpected judicial or regulatory proceedings, and catastrophic events. This list of important factors is not exhaustive. Please consider these and other factors carefully before making any investment decisions and avoid placing undue reliance on forward-looking statements Beutel Goodman has no specific intention of updating any forward-looking statements whether as a result of new information, future events or otherwise.