Summary

Corporate hybrid securities have both debt- and equity-like characteristics, providing another investment option for fixed income investors. In this piece, the Beutel Goodman Fixed Income team analyzes the emergence of corporate hybrids in Canada and some of their benefits and risks.

By Beutel Goodman Fixed Income team

If inflation was the major theme affecting markets in 2022 and 2023, and 2024 was the year of interest rate cuts, tariffs look set to dominate investor sentiment in 2025. Volatility has been pronounced in bond markets so far this year, but interestingly, the high yield market has been mostly immune to this turbulence, at least so far.

For the most part, we are finding that the high yield market is not compensating investors for the inherent risks in those investments. However, there is another subsector of the credit market where we have been finding attractive risk-adjusted returns — non-financial corporate hybrid bonds (“corporate hybrids”).

Coincidentally, the 10-year anniversary of the launch of the first corporate hybrid by a Canadian domiciled issuer is approaching. We would therefore like to examine the role these instruments have played within the Canadian fixed income landscape over the past decade, looking at how their structures have evolved, the recent proliferation of issuance, as well as why we believe they may offer good value at this point in the economic cycle.

This Insight piece is a high-level overview of corporate hybrid securities. In actuality, each corporate hybrid security is unique and must be analyzed in the context of its structural nuances relative to other similar instruments.

What is a Corporate Hybrid?

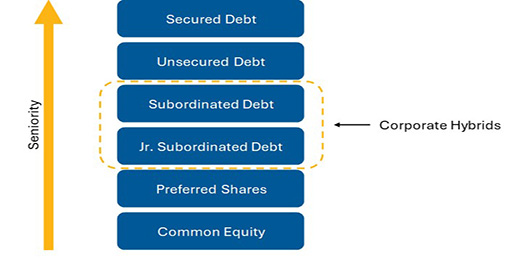

The term “hybrid” stems from the fact that these securities have both debt- and equity-like characteristics. They essentially sit at the cross-section of bonds and equity within an issuer’s capital structure. More specifically, they are subordinated in payment rank to an issuer’s senior unsecured bonds but are senior to its equity securities (see Exhibit 1).

Exhibit 1: Capital Structure. The graphic below illustrates the ranking for different securities in the capital structure, with corporate hybrids in the middle in seniority.

Source: Beutel, Goodman & Company Ltd.

In the event of issuer default, corporate hybrid bondholders would typically recover less than senior unsecured bondholders, but more than holders of preferred shares and equity. For this reason, rating agencies typically rate corporate hybrids one or two notches below an issuer’s unsecured debt and treat a percentage of their value as equity when calculating their leverage (usually 50% of the hybrid’s outstanding principal amount).

In addition to having a payment rank above equity, other typical debt-like characteristics of corporate hybrids include:

- Formal call dates (e.g. five or ten years after issuance)

- Legal final maturities (usually 30 or 60 years, although some older corporate hybrids were issued with indefinite/perpetual maturities)

- Contractual tax-deductible coupons

- Over-the-counter trading

Moreover, most corporate hybrids contain language preventing the payment of equity dividends if their own coupons have been deferred (known as a “dividend stopper”).

Equity-like features of corporate hybrids include:

- the option to defer coupon payments alongside the dividend stopper (although coupons remain payable at a later date, unlike dividends which are not recouped following a suspension)

- the ability to extend the effective maturity beyond the initial call date (i.e. the date when a callable bond can be redeemed for a specific call price before its maturity date) according to a pre-determined call schedule.

Benefits of Corporate Hybrids

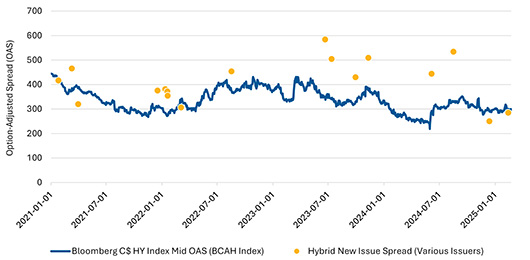

Corporate hybrids carry many benefits. The largest driver of demand from investors relates to the additional spread they provide relative to an issuer’s senior unsecured bonds. Corporate hybrids essentially provide investors with the opportunity to purchase bonds from well-established investment grade companies at higher spread levels, like those offered by high yield bonds (see Exhibit 2).

Exhibit 2: Corporate Hybrid Spreads vs. High Yield Spreads. This chart shows how corporate hybrid spreads in Canada have historically been close to, or better than, the spreads provided by the high yield (HY) market (HY shown in blue, hybrids in yellow).

Source: Bloomberg Finance L.P. (January 1, 2021 – February 28, 2025)

There are also many structural considerations that may be positive for fixed income investors. If corporate hybrid coupons have been deferred, a dividend stopper will apply meaning an issuer will be prohibited from paying coupons or dividends on securities ranked “pari passu” (those ranking equally and without preference) or more junior (e.g. equity). The length of time that coupons are allowed to be deferred is also typically capped at five years. Deferred coupons are also cumulative (i.e. must eventually be paid), unlike equity dividends, which may be suspended or foregone indefinitely. Moreover, in the event a corporate hybrid is extended beyond its initial call date, the majority have coupons that reset either at:

- A spread above government bonds that is also greater than the initial spread at issuance (known as a “step-up”) or

- At a minimum coupon level that is no less than the initial coupon (known as a “floor”)

Corporate hybrids may also have less interest rate risk than a senior unsecured bond of equivalent duration, and those with investment grade-ratings are eligible for most core and corporate bond indices.

A company’s main incentive for issuing a corporate hybrid typically lies in the equity-like treatment by credit rating agencies. By counting, on average, 50% of a corporate hybrid as equity, they can help issuers keep their leverage down and maintain their credit ratings.

This is a key difference between corporate hybrids and high yield bonds. Corporate hybrid issuers are choosing to fund at high yield spread levels whereas high yield issuers have no choice as their credit quality is much lower. Many issuers choose to keep hybrids as an ongoing part of their capital structure to enhance their funding optionality on a more permanent basis.

The cost to an issuer is another positive factor when considering the issuance of corporate hybrids as compared to equity. Corporate hybrids under most circumstances are a more cost-efficient form of funding than equity, both on an outright basis (i.e. yield) and because their coupons are tax deductible (unlike dividends, which are paid after tax).

Comparison with Bank Capital

You may recall the Beutel Goodman Fixed Income team’s commentary on bank capital from late 2020, The Final Piece of the cApiTa1 Puzzle. In that piece, we walked through the subordinated layers of a bank’s capital structure alongside the advent of limited recourse capital notes (LRCN) in the Canadian market. Corporate hybrids bear many similarities to bank additional tier 1 (AT1) instruments, such as:

- Subordinated to senior unsecured bonds in payment rank and senior to equity

- Offers issuers the benefit of interest deductibility

- Have legally binding final maturities

- Allow for extensions beyond an initial call date

That said, certain structural differences — namely conversion mechanisms, coupon treatment in the event of deferral and/or extension, and issuer call discretion — make corporate hybrids more bondholder-friendly than bank capital securities. These differences are largely a function of the stringent regulatory backdrop for banking in Canada, given how important banks are to the broader economy. Canadian bank regulators impose minimum capital requirements to maintain the stability of the financial system, while corporate hybrid issuance is not mandated by a governing body, but rather it is at the issuer’s discretion.

Market Evolution

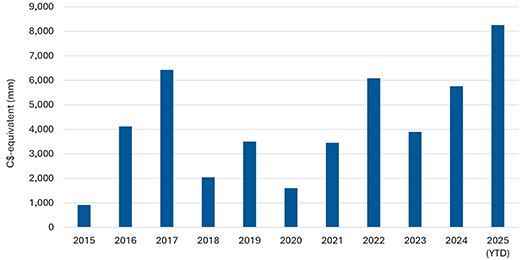

Due to the relative attractiveness of these securities for both investors and issuers, and some more recent rating agency methodology changes, the corporate hybrid market has grown considerably over the last 10 years. They have existed in other jurisdictions for some time, particularly in Europe. In Canada, TC Energy (formerly TransCanada Corporation) became the first Canadian-domiciled issuer to issue a corporate hybrid in 2015. Since then, approximately C$46 billion has been issued by Canadian companies (see Exhibit 3).

Exhibit 3: Issuance. This chart shows corporate hybrid issuance by Canadian companies over the past decade.

Source: Bloomberg Finance L.P. (as at February 28, 2025)

Key Risks

Although we believe there are many benefits to corporate hybrids overall, to properly assess a security’s value, we must also examine the risks. Each individual issuance of a corporate hybrid will have structural nuances that determine its risk profile, but broadly speaking the major risks associated with corporate hybrids include:

Extension risk: The general assumption is that hybrid securities will be called at their first call date, but the issuer typically has the option to extend until the final legal maturity. There are mitigants relevant to an issuer’s decision to extend, such as coupons potentially resetting higher, a decline in the amount of equity credit provided by the rating agencies as the securities age (each agency has a different approach), or reputational risk. If there is an extension, it could materially alter the effective maturity date and investment risk.

Subordination risk: Ranking below senior unsecured debt within an issuer’s capital structure could lead to a reduced recovery rate in the event of issuer default (or even conversion to preferred shares, in certain cases).

Coupon deferral risk: Similar to extension risk, there are mitigants relevant to an issuer’s decision to defer coupons, such as the contractual payment obligation following deferral, dividend stoppers, maximum deferral periods, or reputational risk. If there is a deferral, investors will not receive expected payments for a period of time.

Liquidity risk: Corporate hybrid securities are typically less liquid than senior unsecured bonds, which may be exacerbated during periods of heightened market volatility. Securities rated BBB or higher may be included in an index which does enhance their liquidity, but the corporate hybrid market is not as deep as that of senior unsecured bonds.

Ratings risk: Corporate hybrids carry additional rating risk as issuers tend to prioritize their senior unsecured bond ratings within their capital structure. An issuer could take steps that lead their corporate hybrid ratings to fall below investment grade in order to preserve a higher rating on their senior unsecured debt.

Beutel Goodman Approach

Corporate hybrid issuers are investment grade, with strong underlying issuer fundamentals — which are researched and approved as part of our rigorous credit process — and we generally have a favourable view of their risk/reward profile. We consider them an attractive way to seek to add value in our fixed income strategies without taking undue fundamental credit risk. That said, given the risks and unique nature of each individual issuance, we do not take a decision to invest in these instruments lightly, and not all hybrids are alike.

Having bondholder-friendly features are essential requirements before we approve corporate hybrids for investment, particularly as they pertain to extension and coupon deferral risks. Moreover, we view corporate hybrids mainly as an alternative to high yield investments, particularly when high yield valuations appear stretched. We monitor our aggregate exposure to the combination of these higher risk securities across all our funds on an ongoing basis. Overall, we are finding that corporate hybrids are an investment option worth considering in a diversified fixed income portfolio.

Download PDF

Related Topics and Links of Interest:

©2025 Beutel, Goodman & Company Ltd. Do not sell or modify this document without the prior written consent of Beutel, Goodman & Company Ltd. This commentary represents the views of Beutel, Goodman & Company Ltd. as at the date indicated.

This document is not intended, and should not be relied upon, to provide legal, financial, accounting, tax, investment or other advice.

Certain portions of this report may contain forward-looking statements. Forward-looking statements include statements that are predictive in nature, that depend upon or refer to future events or conditions, or that include words such as “expects”, “anticipates”, “intends”, “plans”, “believes”, “estimates” and other similar forward-looking expressions. In addition, any statement that may be made concerning future performance, strategies or prospects, and possible future action, is also forward-looking statement. Forward-looking statements are based on current expectations and forecasts about future events and are inherently subject to, among other things, risks, uncertainties and assumptions which could cause actual events, results, performance or prospects to be incorrect or to differ materially from those expressed in, or implied by, these forward-looking statements.

These risks, uncertainties and assumptions include, but are not limited to, general economic, political and market factors, domestic and international, interest and foreign exchange rates, equity and capital markets, business competition, technological change, changes in government regulations, unexpected judicial or regulatory proceedings, and catastrophic events. This list of important factors is not exhaustive. Please consider these and other factors carefully before making any investment decisions and avoid placing undue reliance on forward-looking statements Beutel Goodman has no specific intention of updating any forward-looking statements whether as a result of new information, future events or otherwise.