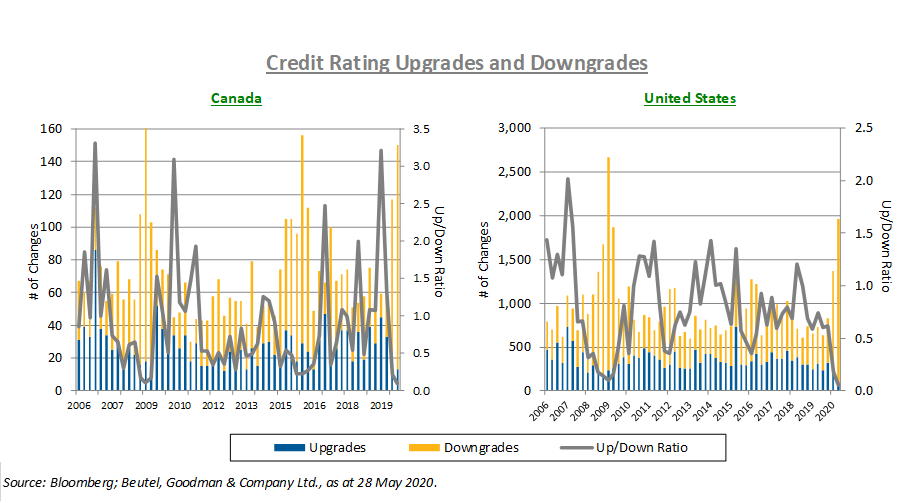

Since the pandemic crisis started in February 2020, we have seen a significant number of credit-rating downgrades by all four of the major credit-rating agencies in Canada and the U.S. Four months into this credit cycle, we have almost reached the downgrade highs experienced during the entire commodity crunch of 2016 and the global financial crisis (GFC) of 2008/09.

Often criticized for being late to act during the GFC and at times complicit, credit-rating agencies have been quick to take a hatchet to credit ratings this cycle. Rating agencies are not looking across the economic recession valley to the recovery phase of the crisis; instead they are reacting quickly to increased pressure on balance sheets and credit metrics. Typically, rating agencies balance the stability of ratings (i.e., no whipsaw in ratings) against the embarrassment of an investment grade default (e.g., Enron).

Bank of America Global Research estimates that net investment-grade downgrades (downgrades less upgrades) since the end of February have totaled US$1,136 billion in the U.S.1 At the sector level, banks and brokers have seen the most downgrades since the end of February, followed by energy and autos. Certain sectors, such as lodging, leisure, autos, entertainment, energy, homebuilders, and real estate, are highly affected by physical distancing measures and travel bans. Even with a record amount of stimulus provided by governments and central banks, the effects of the lockdown will likely cause lasting damage to corporate balance sheets. There will also likely be long-term effects from changes in consumer behaviour regarding travel, vacation and working from home. Energy, meanwhile, was hit hard by the double impact of decreased demand from the pandemic and the Russia-Saudi Arabia price war.

Liquidity is the name of the game as companies respond to the crisis with various measures, including trimming capital expenditures, reducing corporate costs, selling non-core assets, cutting or cancelling dividends, suspending share buyback programs, and increasing available cash through bond issuance and/or larger credit facilities. The levering up of balance sheets with record new bond issuance will likely have longer-term negative impacts on credit metrics, which could also lead to more credit rating downgrades.

Credit-Rating Actions Have Consequences

A consequence of the credit-rating actions has been an increase in the number of fallen angels. Fallen angels is a term used to describe investment-grade issuers (i.e., BBB- or higher and equivalent) that have been downgraded to high yield (i.e., BB+ or lower and equivalent). Bank of America Global Research estimates fallen angels in the U.S. since the end of February represent US$118 billion in total debt since the end of February, more than the total aggregate debt of fallen angels over the past two years. Large companies such as Ford, Occidental Petroleum, Kraft-Heinz, Pemex, Western Midstream and Continental Resources have all been downgraded to high yield in the year to date. Analyst estimates on the total debt of fallen angels we will see for this cycle is astonishing, ranging from US$300 billion to US$500 billion. There are 223 BBB issuers in the Bloomberg Barclays U.S. Investment Grade Corporate Index with a Negative or Credit Watch Negative outlook. In Canada, there are 34 BBB issuers in the FTSE Canada All Corporate Index with Negative or Credit Watch Negative outlooks.

Fallen angels are relevant to monitor as there is always concern about the high yield market’s ability to absorb the newly downgraded debt. The extension of the U.S. Federal Reserve corporate bond-buying program to include fallen angels that were still rated investment grade as at March 21 partially eased the market impact of the downgrades. However, the size of the investment-grade corporate market dwarfs the high yield market.

The characteristics of the high yield index are also being influenced by the downgrades, including increased sector exposure to energy and consumer cyclicals, lengthened duration, increased single-name weights, and swelling BB weights. For the issuer, the loss of investment-grade ratings leads to higher borrowing costs, a different buyer base, forced selling from investment-grade-only mandates, and sometimes the need to revise contracts with bondholders or counterparties. Non-investment-grade energy companies are typically required to post letters of credit for pipeline and midstream contracts. S&P calculates that the difference in option-adjusted spreads for U.S. corporate entities rated BBB- and BB+ is 234 basis points as at April 30, 20202. We note that fallen-angel risk is likely priced into the majority of the credits that are at risk of a downgrade. The first step in the credit process in this environment is to avoid the initial downgrade to high yield through credit analysis and take the temperature of the rating agencies.

Out of Crisis Comes Opportunity

At Beutel Goodman, we do not see the downgrade risk as doom and gloom, but rather as a significant opportunity. The turn in the credit-rating cycle highlights the need to conduct rigorous credit research, but more importantly it presents an opportunity to add value as credit markets dislocate. This is true for both our investment-grade and high-yield strategies. On the fallen angel front, once a downgrade has occurred, forced selling from non-high-yield players could cause price distortion and a buying opportunity.

In addition, disagreeing with a rating agency’s valuation of a company can also create opportunity. For example, S&P has downgraded a swath of oil and gas companies as they have a fairly dire forecast for commodity prices, particularly crude oil. Coming to a different conclusion on the path of commodity prices can lead to a high-yield company looking more like an investment-grade company. Not every fallen angel is on a continued downward trajectory to default. There are numerous BB companies with good management and solid business models that are caught up investors’ pessimism towards the sector, the industry, or both. These are some of the companies that make up the backbone of the high-yield holdings in our Beutel Goodman Core Plus Bond Fund.

While the market may be happy to throw the baby out with the bathwater and write off entire industries as dead, we continue to look for value in all areas of the bond market. We have been adding corporates to our portfolio where the market is pricing in a much worse outcome than our research assesses. Delving deep into the company’s business risks, its covenants, and in some instances the collateral packages provides us with the basis for taking a contrarian view. We have a list of companies that we have analyzed and liked fundamentally, but were reticent to add to the portfolio as the relative value proposition did not make sense (i.e., the credit spread was not compensating investors for the credit risk involved). With the indiscriminate widening of credit spreads in the wake of the pandemic and the large amount of credit downgrades, certain corporates we were monitoring have begun to look attractive on a relative basis. As the rating agencies seem unwilling to look across valley of the economic damage wrought by COVID-19, it creates opportunity for the patient investor with a longer-term view.

NOTES

[1]“The Bazooka’s Coming Out”, Credit Market Strategist Bank of America Global Securities, 22 May 2020.

[2]“Potential Fallen Angels Hit A Record-High 111” S&P Global Ratings Research, May 14, 2020

Download PDF

Related Topics and Links of Interest:

©2020 Beutel, Goodman & Company Ltd. Do not copy, distribute, sell or modify this document without the prior written consent of Beutel, Goodman & Company Ltd. All opinions and estimates expressed in this document are as at June 4, 2020 and are subject to change without notice.

This document is not intended, and should not be relied upon, to provide legal, financial, accounting, tax, investment or other advice. This is not an invitation to purchase or trade any securities. Beutel, Goodman & Company Ltd. does not endorse or recommend any securities referenced in this document.

Certain portions of this commentary may contain forward-looking statements. Forward-looking statements include statements that are predictive in nature, that depend upon or refer to future events or conditions, or that include words such as “expects”, “anticipates”, “intends”, “plans”, “believes”, “estimates” and other similar forward-looking expressions. In addition, any statement that may be made concerning future performance, strategies or prospects, and possible future portfolio action, is also forward-looking statement. Forward-looking statements are based on current expectations and forecasts about future events and are inherently subject to, among other things, risks, uncertainties and assumptions which could cause actual events, results, performance or prospects to be incorrect or to differ materially from those expressed in, or implied by, these forward-looking statements.

These risks, uncertainties and assumptions include, but are not limited to, general economic, political and market factors, domestic and international, interest and foreign exchange rates, equity and capital markets, business competition, technological change, changes in government regulations, unexpected judicial or regulatory proceedings, and catastrophic events. This list of important factors is not exhaustive. Please consider these and other factors carefully before making any investment decisions and avoid placing undue reliance on forward-looking statements. Beutel Goodman has no specific intention of updating any forward-looking statements whether as a result of new information, future events or otherwise.