When evaluating both our current and potential investments, the quality of management is a key factor we examine as part of our in-depth, fundamental research. An important aspect of this assessment is determining how a company’s management allocates their capital.

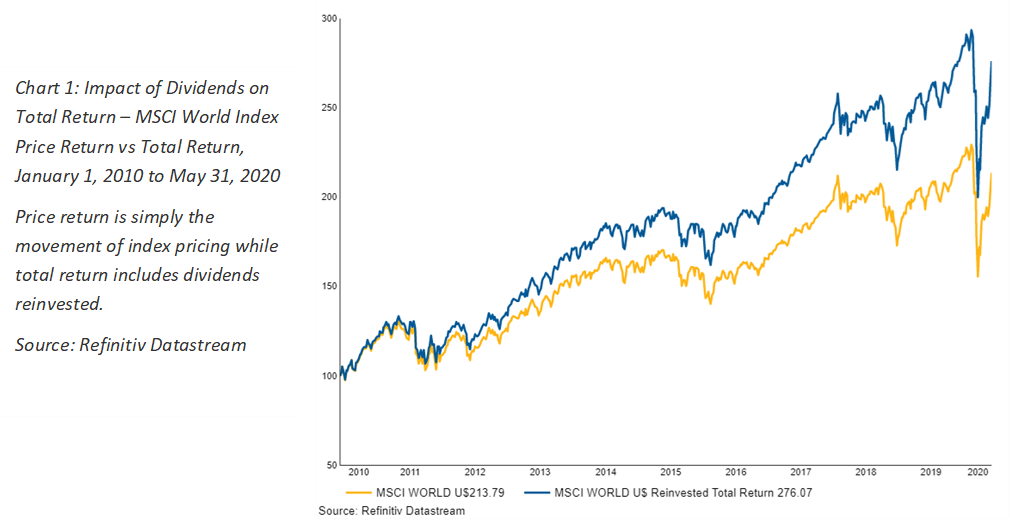

With the cash that a business generates, management has the option of reinvesting in their businesses in areas they believe can generate returns that exceed the cost of that capital; they can pay down debt or accumulate cash; or they can return capital to shareholders in the form of dividends or stock buybacks. There is considerable academic research to show that dividends play a large role in long-term total equity returns, as shown in the chart below. The impact of the COVID-19 pandemic on dividends has thus been a cause for investor concern.

With the initial market mayhem from COVID-19, many of our stocks declined significantly in value. As a key tenet of our investment philosophy is downside protection, our first priority was to immediately review the holdings that we believed could face irreparable financial distress in the case of a long and deep downturn related to COVID-19. When a firm faces financial distress (that is, an over-levered balance sheet), decisions taken by the company, including dividend cuts, are typically less than optimal for shareholders and may have a deep impact on long-term shareholder value. These decisions typically revolve around:

- Raising equity (which dilutes shareholders like us particularly when the value of the equity is already quite low); and/or

- Raising debt (at higher interest rates, which pressures equity values and compounds the balance sheet issues); and/or

- Selling assets (typically, the best assets are first to go for a distressed seller, usually at sub-optimal price levels); and/or

- Deep operational, capital expenditure and capital allocation cuts (especially share buybacks and as mentioned above, dividend cuts).

Global Portfolios Remain Healthy

All of these options typically destroy long-term shareholder value. However, our rigorous investment process helps us avoid businesses that may face these types of issues. As a result, following an investigation into the stocks we prioritized for review in our U.S., international and global portfolios, we are pleased to confirm that the list of holdings of concern was quite small and was dealt with by exiting one position and by resetting target prices for others.

Given the mass uncertainty that existed at the time of Q1 reporting, some companies have postponed their dividend payments. In our view and based on our research, these companies could pay their dividends without impacting long-term value, and chose to postpone them due to uncertainty rather than necessity. As visibility improves, we expect dividend payouts in our holdings to return to normal.

Limited Impact on Dividends in Canadian Large Cap Portfolios

We followed a similar review process in the Canadian large cap portfolios, which resulted in the sale of one stock that subsequently suspended its dividend. A second holding has reduced its dividend and a third has suspended it. In each case, we believed the company’s decision was appropriate given the need to manage leverage. Both remaining holdings are smaller weights and the overall impact of dividend cuts/suspensions is not material to the total returns of the portfolio. Three of our holdings have implemented 2% discounts in their DRIP programs, which will result in the issuance of additional equity. We are not generally in favour of such an approach but at this time we estimate that the resulting dilution should not have a material impact on our target prices.

While the impacts of COVID-19 have yet to fully play out, we have stress-tested our Canadian holdings and believe that they have resilient business models and strong balance sheets that will allow them to weather this crisis. Although dividend suspensions caused by regulatory intervention or other factors can never be ruled out, we think that the current probability of material reductions to the yields of the portfolios is low. Should further dividend reductions or suspensions occur, we think they would be temporary and that our holdings will maintain their capital-generating capabilities over the long-term.

Regardless of the path COVID-19 takes in the weeks and months ahead, we will continue to review the holdings in all our Canadian and global portfolios on an ongoing basis, as per our process.

Dividends — One of Many Factors

Overall, dividends alone are not enough to justify an investment or divestment. We want to ensure any company that we consider for our portfolios has a competitive business model and an aligned management team, can generate and grow their free cash flows, and is currently trading at a minimum 50% discount to our target prices. As such, it is always a positive when we find companies that both meet our strict criteria for investment and also pay an attractive dividend with a healthy payout ratio that will pay us to be a shareholder of the firm while we wait for the gap between our target price and the market value of the stock to close.

Download PDF

Related Topics and Links of Interest:

©2020 Beutel, Goodman & Company Ltd. Do not copy, distribute, sell or modify this document without the prior written consent of Beutel, Goodman & Company Ltd. All opinions and estimates expressed in this document are as at June 4, 2020 and are subject to change without notice.

This document is not intended, and should not be relied upon, to provide legal, financial, accounting, tax, investment or other advice. This is not an invitation to purchase or trade any securities. Beutel, Goodman & Company Ltd. does not endorse or recommend any securities referenced in this document.

Certain portions of this commentary may contain forward-looking statements. Forward-looking statements include statements that are predictive in nature, that depend upon or refer to future events or conditions, or that include words such as “expects”, “anticipates”, “intends”, “plans”, “believes”, “estimates” and other similar forward-looking expressions. In addition, any statement that may be made concerning future performance, strategies or prospects, and possible future portfolio action, is also forward-looking statement. Forward-looking statements are based on current expectations and forecasts about future events and are inherently subject to, among other things, risks, uncertainties and assumptions which could cause actual events, results, performance or prospects to be incorrect or to differ materially from those expressed in, or implied by, these forward-looking statements.

These risks, uncertainties and assumptions include, but are not limited to, general economic, political and market factors, domestic and international, interest and foreign exchange rates, equity and capital markets, business competition, technological change, changes in government regulations, unexpected judicial or regulatory proceedings, and catastrophic events. This list of important factors is not exhaustive. Please consider these and other factors carefully before making any investment decisions and avoid placing undue reliance on forward-looking statements. Beutel Goodman has no specific intention of updating any forward-looking statements whether as a result of new information, future events or otherwise.