The expression “may you live in interesting times”, originally an ancient Chinese curse, may be a fitting analogy to describe life in a pandemic over the past year. The reverberations on individuals and the economy will be felt for years to come. Financial markets have been tumultuous, providing us with both lessons and perspective to share. Perhaps the most important of these lessons is the value of predictability.

At Beutel Goodman, we have always believed in building concentrated portfolios of undervalued businesses. Despite our best efforts though, sometimes market inefficiencies, external events and management actions inevitably result in discrepancies in the valuations and prospective returns to the target prices we set for our portfolio companies.

During the initial phase of COVID-19, some of the businesses we owned benefited while others suffered. In our Canadian Equity strategy, for example, grocers such as Metro Inc. were deemed essential while competition from restaurants was supressed. An auto-parts manufacturer such as Magna International Inc., on the other hand, was hurt as car dealerships closed and demand, albeit temporarily, dropped drastically.

As the pandemic progressed, markets rewarded companies that benefitted or appeared to benefit from emerging trends, with little regard for valuation. The pandemic did drive people around the globe to work and shop exclusively from home, relying more on technology to remain connected and productive during lockdowns. However, market valuations implied that these trends were absolute and permanent.

Our Process Always Guides Us

We have seen this story before, and we will likely see it again. In recent years, the market has focused on segments such as blockchain and cannabis, which many believe will continue to provide superior returns despite lofty valuations. Free online trading platforms that flourished during the lockdown added fuel to the fire. Huge investor interest, trading volumes and stock-price volatility were created in companies such as GameStop Corp., with little focus on the business and valuation fundamentals of the company itself.

As value investors, investing without regard to valuation is antithetical to our disciplined process, which is centered on finding quality companies trading at a minimum one-third discount to our estimate of their intrinsic value.

What do we mean by quality? We define a quality business as one that has a strong position in its industry, has a good balance sheet, and generates steady and growing free cash flows that should result in increased business value over time. We seek companies that are run by capable management teams with appropriate incentives in place to allocate capital in the best interest of shareholders. We believe that a portfolio with attractive valuations and high-quality businesses will result in long-term outperformance as strong fundamentals will (eventually) be recognized by the market.

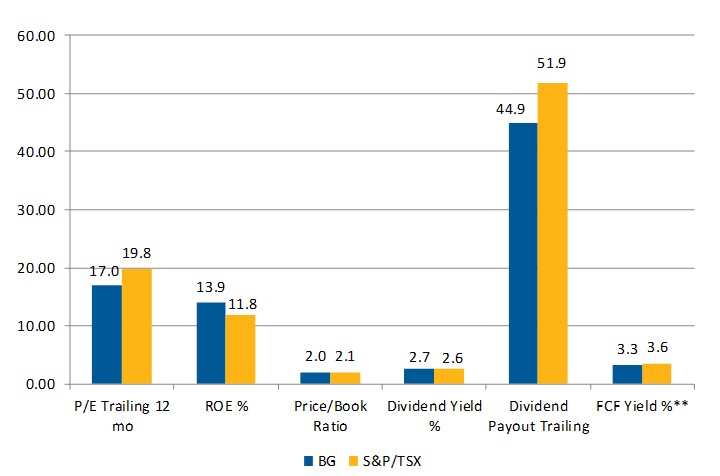

Figure 1 shows how our Canadian Equity portfolio compares to that of the benchmark index, the S&P/TSX Composite, on selected quantitative measures that can be indicative of quality. In aggregate, our portfolio is priced cheaper than the index, while having a return on equity that is superior to the index, with similar yield metrics, but paying out less of our earnings to shareholders, allowing for greater levels of reinvestment into the companies we hold.

Figure 1: Beutel Goodman Canadian Equity portfolio vs S&P/TSX Composite Index

Source: Beutel Goodman, Refinitiv Eikon. As at June 30, 2021. **Free Cash Flow Yield excludes Financials.

Volatility is a Long-Term Investor’s Friend

We added five new companies to our Canadian Equity portfolio in 2020, which represents a relatively high level of new investment activity for us. We also had the same number of stocks reach our target prices, prompting us to reduce the weights of those positions by one-third each in what we refer to as process-driven sales. We subsequently reallocated the proceeds of those sales into new or existing positions that, in our view, had higher return potential relative to their target prices. Although we were underperforming at the time, we remained focused on positioning our portfolio to deliver superior long-term returns in the future.

While this level of activity is unusual, it is comparable to previous periods of heightened volatility. After the Global Financial Crisis in 2008, our investment team added eight new companies to our Canadian Equity portfolio. In 2011, during the European Debt Crisis, we added seven new companies.

By comparison, in the subsequent seven years (2013-2019), the team only added an average of one company per year as the relatively calm market meant the number of high-quality companies meeting our strict investment criteria in terms of valuation was much more limited, as opposed to an environment when there is a broad market sell-off and opportunities are generally more plentiful.

Building a quality portfolio of undervalued businesses in times of uncertainty is what, in our view, will drive portfolio performance in the future. Maintaining that focus means understanding that short-term underperformance (relative to a benchmark) must be differentiated from poor performance. All companies and investors will underperform the market at some point, but the most disciplined can largely avoid poor performance.

We understand, however, that for many, even though market underperformance often presents a great investment opportunity, negative investment returns at any moment in time are psychologically challenging. As value investors, we always act in our clients’ best interest and aim to look through the short-term fear in the markets to estimate the long-term impact on our portfolio companies. The uneven effect of the pandemic ultimately presented us with an opportunity to buy new businesses whose valuations had in our assessment been overly discounted by the market.

We think of an investment in our portfolios as an investment in the businesses we own. We set target prices to help curb behavioural biases and focus less on the day-to-day share price movements of the companies in our portfolios and more on their long-term ability to increase business value. Following our investment process, regardless of what is happening in the market around us, is what drives the success of our firm and the success of our clients. Our clients know that no matter what is happening, our investment focus is always on finding high-quality businesses trading at discounts to what we assess is their intrinsic value.

Patience Often Pays When Investing

Our investment philosophy has been successful in the past, and we expect it will continue to be rewarded in the future. For example, as set out in the performance table below, to illustrate the potential value of staying invested through volatile markets, we looked at a hypothetical investor who invested in our Canadian Equity portfolio at the start of the fourth quarter of 1999.

We found that in six months, at the end of the first quarter of 2000, their investment would have trailed the returns of the TSX by 43 percentage points* (that is not a typo). If, however, that client remained steadfast and remained invested, they would have been rewarded with returns that just one year later, by the end of the first quarter of 2001, were ahead of the benchmark over the entire 18-month time period.

For clarification, here is the performance breakdown:

| Name | Total Return 1999-10-01 to 2000-03-31 |

Total Return 2000-04-01 to 2001-03-31 |

Total Return 1999-10-01 to 2001-03-31 |

| Beutel Goodman Canadian Equity Fund | -6.76 | 24.09 | 10.21 |

| S&P/TSX Composite TR | 36.90 | -18.61 | 7.48 |

Source: Morningstar Direct, Beutel Goodman. All returns in Canadian dollars, and all returns for periods greater than one year are annualized.

*This comparison is provided for illustrative purposes of volatility only and is a gross of fees comparison to the benchmark. The actual difference after fees would have been lower.

Similarly, in 2020 during the pandemic, our Canadian Equity portfolio was underperforming the TSX by over 8% at the end of June 2020. Then, over the next four quarters ending June 30, 2021, this portfolio outperformed the TSX by just under 11%. History may not repeat, but it certainly rhymes.

It may seem cliché, especially in the age of cryptocurrencies and Gamestop, but long-term views rooted in deep, fundamental analysis, which form the bedrock of our process, are often rewarded in ways that are impossible to time. Research from Morningstar shows that for a fund that outperforms over a 15-year period, on average, fewer than 5% of the months (that is, fewer than nine individual months) in that timeframe account for its outperformance[1].

These facts reveal two important lessons to us. First, the tide can change quickly in the relative performance of an investment and remaining invested is critical. Second, we must ensure that our clients can continue to count on us to follow our investment process as we have always done.

There is real value in the reliability and predictability of our actions. The market may move in ways we could never imagine, but our process will stay the same because as history has shown, over time, it works.

Performance Table:

| Fund | QTD | YTD | 1 Year | 3 Years | 5 Years | 10 Years | Since Inception | Inception Date |

| Beutel Goodman Canadian Equity Fund Class B | 6.33% | 16.95% | 41.74% | 6.69% | 8.32% | 7.23% | 7.56% | 2010-09-01 |

| Beutel Goodman Canadian Equity Fund Class D | 6.54% | 17.40% | 42.83% | 7.51% | 9.15% | 8.04% | 8.45% | 1991-01-01 |

| Beutel Goodman Canadian Equity Fund Class F | 6.61% | 17.56% | 43.24% | 7.81% | 9.46% | 8.34% | 7.49% | 2006-05-01 |

Source: Beutel Goodman. As at June 30, 2021. All returns in Canadian dollars, and all returns for periods greater than one year are annualized.

Download PDF

[1] Kaplan and Kowara, “Is there a ‘Good’ time to buy or sell actively managed funds? Staying Invested is the name of the game”, Morningstar, July 11, 2019

©2021 Beutel, Goodman & Company Ltd. Do not sell or modify this document without the prior written consent of Beutel, Goodman & Company Ltd. This commentary represents the views of Beutel, Goodman & Company Ltd. as at the date indicated.

This document is not intended, and should not be relied upon, to provide legal, financial, accounting, tax, investment or other advice.

This is not an invitation to purchase or trade any securities. Beutel, Goodman & Company Ltd. does not endorse or recommend any securities referenced in this document.

The index information contained in this document has been obtained from sources believed to be reliable, but we do not represent that it is accurate or complete and it should not be relied upon as such.

Commissions, trailing commissions, management fees and expenses all may be associated with mutual fund investments. Please read the prospectus before investing. Mutual funds are not guaranteed, their values change frequently, and past performance may not be repeated.

These risks, uncertainties and assumptions include, but are not limited to, general economic, political and market factors, domestic and international, interest and foreign exchange rates, equity and capital markets, business competition, technological change, changes in government regulations, unexpected judicial or regulatory proceedings, and catastrophic events. This list of important factors is not exhaustive. Please consider these and other factors carefully before making any investment decisions and avoid placing undue reliance on forward-looking statements Beutel Goodman has no specific intention of updating any forward-looking statements whether as a result of new information, future events or otherwise.