By Beutel Goodman’s U.S. & International Equities team

The past year has proven volatile for equity markets and this turbulence has reignited the debate of “Growth versus Value” investing. Since the start of the new millennium, both investment disciplines have had sustained periods leading equity indices—Value prospered after the Dot-com crash of 2000, while Growth pulled ahead following the Global Financial Crisis (GFC) of 2008.

The post-GFC period was characterized by historically low interest rates, and this was a key factor in Growth stocks generally outperforming Value. Rates close to zero now appear to be a thing of the past, though, as central banks worldwide have committed to combating spiralling inflation. As rates rapidly rose in 2022, so too did the prospects for Value stocks, with many of their Growth counterparts moving in the opposite direction.

Investor interest has picked up on this latest style rotation, but as active Value managers, we at Beutel Goodman prefer not to make predictions on which investment approach will provide higher returns in a given year. Furthermore, benchmark indices do not define our investment approach. Rather, we use a fundamental, bottom-up process to select high-quality businesses that are trading at a discount to their intrinsic value. It is our position that valuations – not short-term trends – are what really matter over the long term.

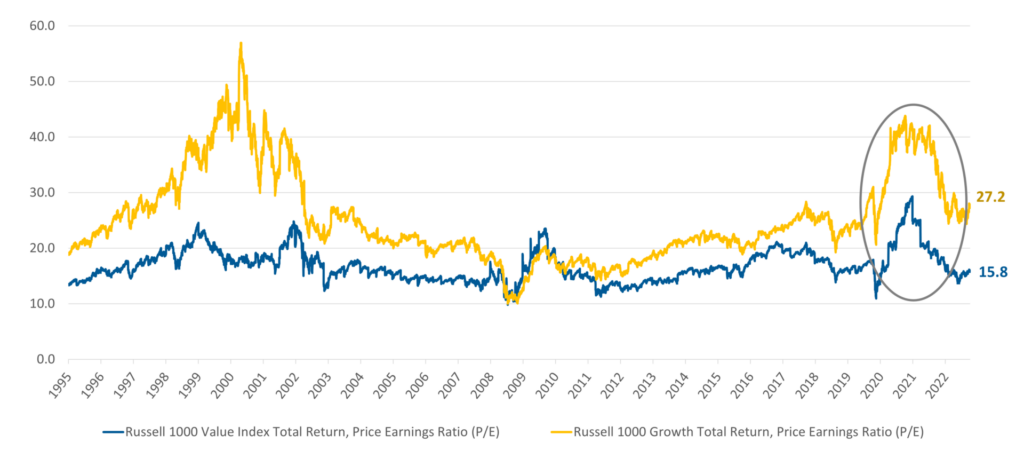

The historically long bull run of 2009 to 2022 saw valuations soar, and in certain cases, decouple from fundamentals. This, in turn, led to the valuation spread between Value and Growth reaching its highest level since the Dot-com crash. It is our view that Growth stocks continue to be exposed to higher drawdown risk as a result of these elevated valuations.

Exhibit 1: Growth vs Value. Soaring valuation levels in Growth stocks in the first two years of the COVID-19 pandemic have led to a wide divergence with Value names.

Source: Beutel Goodman, Macrobond, Bloomberg L.P., as at February 10, 2023

Reframing the Growth vs. Value Debate

Investing requires nuance, and in our view the Growth versus Value debate can often prove simplistic. For that reason, we believe a more detailed discourse on the meaning of Value investing, the interplay of Growth and Value factors in our approach, and what this ultimately means for an investment portfolio is warranted.

There are two main reasons we think the Growth versus Value debate should be reframed. The first is that there are many definitions of Value investing. Following are some of the broad categories of Value investment styles:

- Deep Value: With Deep-Value investing, the focus tends to be on present valuation, as opposed to factors such as quality, balance-sheet strength, alignment with shareholders, competitive position, and industry structure. A deeply discounted valuation is thought to already reflect the perceived failings of the balance sheet, competitive position or industry structure, and thereby provides a margin of safety on the downside, as well as the potential for significant upside if the situation improves.

- Relative Value: This approach aims more for relative outperformance of a stock compared to its peers. The focus is much less on absolute value and more related to buying a business that trades at a discount to what the market is willing to pay for a similar one.

- Closet Value Indexers: There are also large swathes of Value investors who use a combination of Relative and Deep Value, but actually invest with a keen eye on their Value benchmarks and rationalize decisions based on being “overweight” or “underweight” a stock or sector. In essence, they are macro investors who impose their macroeconomic or sector allocation viewpoints on a Value benchmark map.

Beutel Goodman does not fit any of these traditional value investing “molds”.

The second reason that we do not engage in the Growth versus Value debate is that we run concentrated and high-conviction portfolios that are unique compared to any benchmark, including Value benchmarks. Put simply, we do not own the market. We own 25 to 35 businesses that, in our view, have strong fundamentals and great potential. As such, our active share is consistently high against any benchmark. For instance, our U.S. equity portfolio will be almost as different from the Russell 1000 Value Index as it will be from the Russell 1000 Growth Index. Therefore, if Value greatly underperforms Growth, it does not mean that we, as value investors, will necessarily underperform Growth (and vice versa). We take an absolute approach to investing, with the goal of providing downside protection and superior risk-adjusted returns over the long term.

We Define Value on our Terms

We take a unique approach to investing that starts with the mindset that we are looking for exceptional businesses that we can own forever (as long as their valuations do not become excessive). If our investment theses on most of those undervalued quality businesses are correct and we have limited the downside on the ones we get wrong (which is an inevitability of investing), then we will meet our clients’ goals over the long term.

We believe this simple perspective is incredibly powerful. It keeps us intensely focused on our current holdings and our search for the next 25-35 prospective opportunities that may meet our high investment hurdle rates. We spend little to no time worried about what we do not own, and pass on stocks that do well frequently. If the quality of the business does not meet our high thresholds, or the margin of safety (in terms of downside protection) is not high enough, we move on to the next idea. Making sure the stocks we own are the right fit for our portfolios is always the priority.

The Beutel Goodman Value Equation

Our definition of Value means a great franchise that is trading at a significant discount to intrinsic value. But what exactly makes a great franchise and how do you quantify a significant discount?

Emphasize Value, but Never Sacrifice Quality

A great franchise is a business that generates high and sustainable free cash flows over a business cycle. Many companies can generate high free cash flows over brief periods, so this is where “quality” becomes important. Quality companies can sustain high returns on capital and, therefore, high free cash flows, over longer periods of time. Our view of quality is based on the following financial and competitive principles.

- The less capital and the less leverage (debt) required to generate high and sustainable free cash flows, the more attractive the business is to us. That is, we look for high return-on-capital businesses and companies that limit the use of leverage as an operational tool; leverage may, over the long term, magnify risk more than it magnifies earnings. The attractiveness of high-return businesses is easy to explain—a business that requires $4 of investment to deliver $1 in free cash flows is far more attractive than a business that requires $8 of investment to deliver $1 in free cash flows. This differential in returns on invested capital tends to be reflected in higher-valuation multiples. For every dollar of incremental investment, there is more free cash flow available to compound shareholder value via reinvestments in the business, increased dividends, share buybacks and acquisitions of other companies.

- The ability to sustain high cash flows and returns is a critical variable in our definition of a great franchise. Sustainability comes from having a strong competitive position with a wide protective moat. We like companies that operate in oligopolistic markets. Companies without fragmented competition, that dominate a specific market niche or that have high structural barriers to entry, can sustain high returns over long periods.

- Another critical defining factor of a great franchise is management alignment. The free cash flow a business generates is useless if bad management fritters it away on ill-thought acquisitions or by investing in the wrong areas. This happens more often when management is not in alignment with shareholders’ interests. We believe that if management teams are paid to grow at any cost, they will invest whatever capital is necessary to reach growth targets, no matter how destructive it is to the balance sheet or long-term sustainability of the business.

Significant Discount = 50% Return to Intrinsic Value

Relative valuation approaches are relative by definition: they change with time and views on value shift based on where markets drift. We are absolute investors. We focus on absolute share prices and are not occupied with broad market movements. We do our best to deal with what we can directly control and limit factoring in variables that are out of our control. If we are content with the absolute returns offered in quality businesses, we do not need to “time” when markets are willing to overpay for stocks. We know what we do not know. That is, we know that there are too many variables involved to make the correct call on how valuations will move in the near term. The greater the number of variables, the lower the probability of success. We do not like probabilities that get close to zero. In our view, the best way to win is to refrain from betting.

We, therefore, focus on what is most in our control as investors: intrinsic value, which we define as the present value of sustainable free cash flows. A significant discount to intrinsic value is a 1/3 discount over a three-year investment cycle, or stated differently, a 50% return to intrinsic value. We do not invest in any stock for which we cannot envision this return to our target price.

We deliberately set a high return threshold of 50%, both to ensure that only the best ideas qualify for our portfolios, and to protect our downside risk. Specifically, it is our view that if a franchise is trading at a 50% discount to our estimate of its intrinsic value, its downside should be limited. We look for a 3:1 upside-to-downside ratio to provide a margin of safety that we deem adequate. It is our experience that this 50% threshold has served our clients well over the long term.

Focusing on the Right Question

Rather than focusing on whether Growth investing is better than Value investing and vice versa, we believe the debate should revolve around the coexistence of Growth, Quality and Value factors in investing. All three of these factors are critically important.

As Value investors, our defence of Growth may appear to be incongruent. To be clear, we are not defending high-multiple stocks that discount high and long-term future growth estimates that may prove difficult to achieve. We are defending the notion that Growth is important for value creation and in determining business value. We do not invest in declining franchises, but we will not hesitate to invest in companies that face declines due to end-market cyclicality, as long as the company’s long-term growth prospects appear to be clear and positive. It is our view that Growth is essential as a lever to, at a minimum, maintain profitability and cash flows, and can act as a multiplier that assists in compounding returns via better leverage of operating and capital costs.

Quality is also essential, in our view, as high-return companies are worth more to us than low-return companies. The stock price of a company that generates high returns can be deemed inexpensive if it trades at 13x free cash flows, while the stock price of a low-return company can be deemed expensive if it trades at 8x free cash flows. At returns below the cost of capital, the faster a bad business grows, the less it is worth!

Finally, we believe that Value is a critical consideration in deciding where to invest client capital. Investing, in our view, is not just about finding companies with sound business models and wide moats that defend profitability. What you pay for implied growth and profitability is as important in the long term as what the growth and profitability actually become – a simple concept that often gets ignored in momentum markets.

High valuations not only require high growth to endure, they also imply high returns on capital and that these growth and return levels are sustainable over a long-term investment horizon. We believe it is difficult to forecast factors such as the growth of a company, seven years out, with any kind of precision. In addition, the farther out you forecast these high rates of growth and return on capital, the more your margin of safety declines. Fundamentally sound companies can potentially continue to perform well even in situations where they face valuation-multiple compression due, for example, to concerns arising about the rate and longevity of growth and returns. Companies that can compound earnings at 10% and grow at a 25%+ rate of return on invested capital (ROIC) for 20 years are extremely rare, yet large swathes of the market are currently priced for this scenario. Valuation can be ignored for relatively long periods of time, but eventually the “greater fool” theory wanes. When you are trying to sell something that is overpriced, you may run out of greater fools willing to overpay for it.

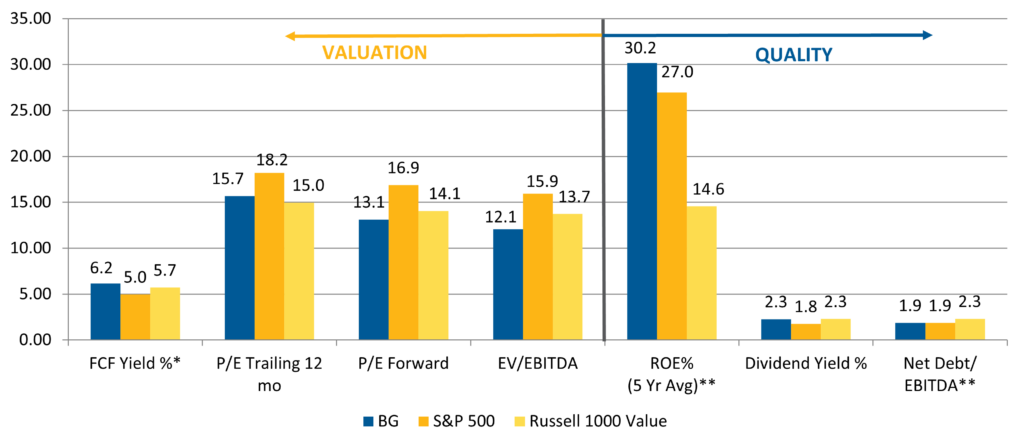

Regardless of who appears to be winning the “Growth versus Value” debate at any given time, we believe that our Value style will continue to deliver strong returns over a cycle while protecting our clients’ capital. As you can see in the chart below, which highlights the portfolio characteristics of our U.S. equity strategy, we are clearly not the market: our portfolios show higher quality at discounted valuations — an attractive position, in our view.

Exhibit 2: Quality & Valuation: This graph shows how the Beutel Goodman U.S. Equity strategy compares with the S&P 500 Index and the Russell 1000 Value Index across several quality and valuation metrics.

As at December 31, 2022.

*Excluding banks **Excluding outliers

Source: Refinitiv Eikon, as run on January 9, 2023; Beutel Goodman

Past performance does not guarantee future results. Invested capital is at risk of loss. Any securities, sectors or allocations listed should not be perceived as investment recommendations and may no longer be held in an account’s portfolio.

Download PDF

Related Topics and Links of Interest

©2023 Beutel, Goodman & Company Ltd. Do not sell or modify this document without the prior written consent of Beutel, Goodman & Company Ltd. This commentary represents the views of Beutel, Goodman & Company Ltd. as at the date indicated.

This document is not intended, and should not be relied upon, to provide legal, financial, accounting, tax, investment or other advice.

Certain portions of this report may contain forward-looking statements. Forward-looking statements include statements that are predictive in nature, that depend upon or refer to future events or conditions, or that include words such as “expects”, “anticipates”, “intends”, “plans”, “believes”, “estimates” and other similar forward-looking expressions. In addition, any statement that may be made concerning future performance, strategies or prospects, and possible future action, is also forward-looking statement. Forward-looking statements are based on current expectations and forecasts about future events and are inherently subject to, among other things, risks, uncertainties and assumptions which could cause actual events, results, performance or prospects to be incorrect or to differ materially from those expressed in, or implied by, these forward-looking statements.

These risks, uncertainties and assumptions include, but are not limited to, general economic, political and market factors, domestic and international, interest and foreign exchange rates, equity and capital markets, business competition, technological change, changes in government regulations, unexpected judicial or regulatory proceedings, and catastrophic events. This list of important factors is not exhaustive. Please consider these and other factors carefully before making any investment decisions and avoid placing undue reliance on forward-looking statements Beutel Goodman has no specific intention of updating any forward-looking statements whether as a result of new information, future events or otherwise.