Summary

Facing weak economic growth forecasts for 2024 (as at November 30, 2023), Beutel Goodman’s Fixed Income Team assess credit spread expectations in both the U.S. and Canada and how this is affecting their investing.

By Beutel Goodman Fixed Income Team

As we approach the end of 2023, it is natural to look ahead to the new year. Forecasting is an essential element of fixed income analysis, but as any meteorologist will tell you, it is far from easy. There are few certainties in life (or investing), so we analyze the available data to identify trends, and through that, select holdings we believe can create value for our portfolios.

In our experience, investing effectively requires discipline: past performance is no guarantee of future results, but observing long-term trends helps us prepare for whatever bumps in the road may lie ahead.

Growth Expectations for 2024

GDP growth in both Canada and the United States is expected to be weak in the coming year. In Bloomberg News’ November Economic Forecast Survey, Canada’s economy is predicted to expand by 1.1% in 2023, 0.6% in 2024 and 1.9% in 2025. The U.S., meanwhile, is forecast to expand by 2.4% in 2023, 1.2% in 2024 and 1.7% in 2025.

Canada is expected to underperform the United States, primarily due to its economy having more exposure to the interest rate hikes of the past 18 months, particularly its housing market. Mindful of the relative value of the Canadian dollar, the Bank of Canada (BoC) will likely be hesitant to stray too far from the monetary policy path taken by the U.S. Federal Reserve (Fed). This means the BoC could limit stimulus to the Canadian economy, unless the Fed is also providing stimulus, which is unlikely if the U.S. economy is growing, or if inflation remains above the Fed’s 2% target.

The Bloomberg News’ November Economic Forecast Survey also anticipates GDP in Canada will be flat over the next two quarters (Q4/2023 and Q1/2024), coming off the back of a weak Q3/2023. The United States, in contrast, has produced better-than-expected economic growth recently, and its GDP is expected to come in below 1.2% for the next three quarters.

False Signal for 2023

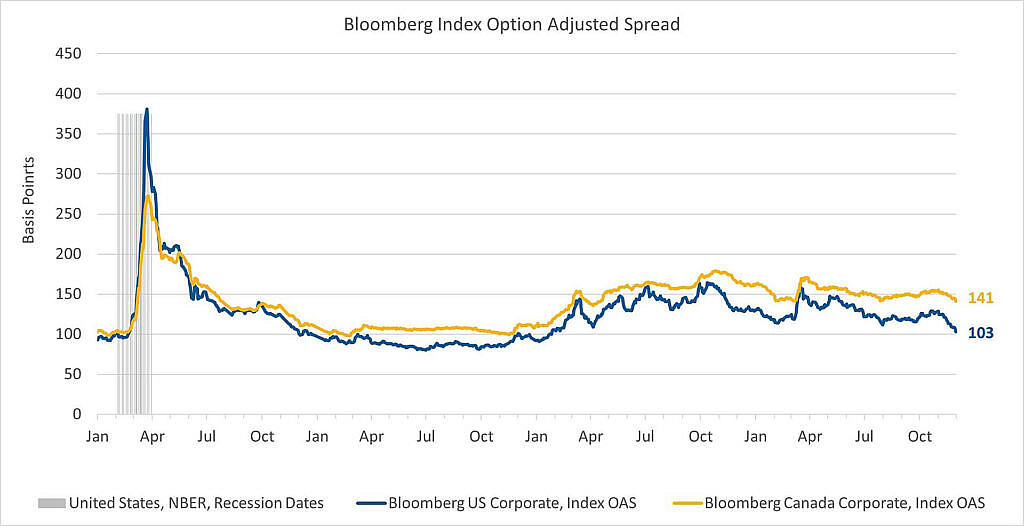

Credit spreads (spreads are the difference in yield between corporate bonds and government bonds of the same maturity) entered 2023 wider than in recent years, as shown in Exhibit 1. Higher interest rates typically lead to a weaker economy, resulting in wider credit spreads. This year, however, higher rates have had less of an effect on the economy than what we have witnessed in previous tightening cycles, while corporate earnings have generally confounded expectations. In March 2023, we saw a regional bank crisis in the U.S., when spreads were close to their widest levels since May 2020. Spreads then tightened through the summer and fall and are now at their tightest levels since early 2022. Overall, credit spreads have outperformed expectations. The outperformance of the economy has also pushed out the possibility of recession, which in turn has led to risk assets performing well in 2023.

Credit spreads are currently tight in the United States compared to historical levels, while Canadian spreads are close to the historical average. The difference in spreads between Canada and the U.S. has increased compared to the historical average, with wider Canadian spreads suggesting there is more value in Canadian credit spreads (refer to Exhibit 1).

Exhibit 1. U.S. and Canada – Historical Credit Spreads. This chart shows credit spreads in both the U.S. and Canada since 2020, with Canada now more attractive.

Sources: Beutel, Goodman & Company Ltd., Macrobond, Bloomberg, NBER. As at November 30, 2023

Credit Spread Expectations

The path for credit spreads in 2024 will be determined by the macro backdrop, including whether inflation returns to the central banks’ target. We are currently in a period where central banks haven increased interest rates to slow the economy and reduce inflation, which should lead to wider credit spreads. After inflation has fallen to their target levels, the central banks will be in a better position to provide monetary stimulus to the economy again. At that point, credit spreads should tighten as economic conditions improve. It is our view that in the meantime, the rate hikes of the past 18 months have not yet been fully absorbed by the market and they are likely going to have a negative effect on corporate balance sheets going forward, leading to wider credit spreads.

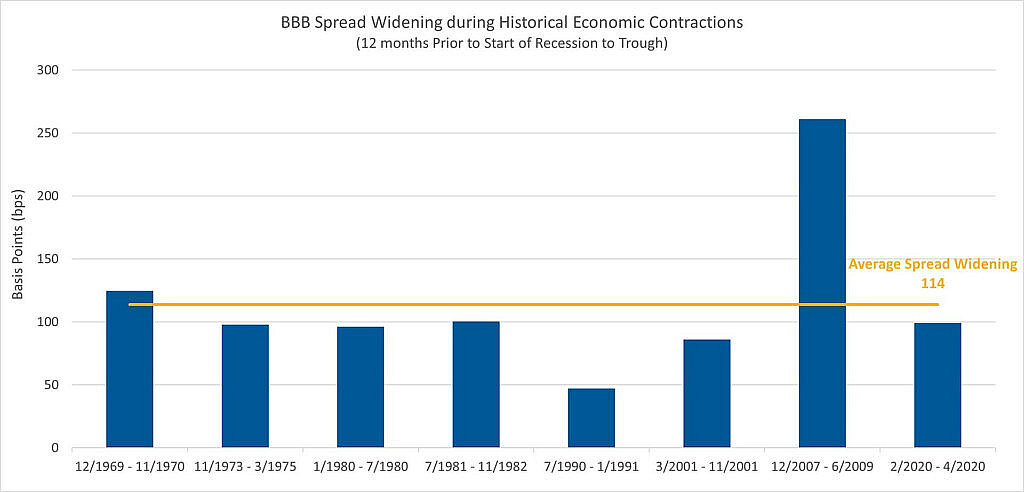

There also remains a possibility of a recession in 2024. As shown in Exhibit 2, in past recessions, BBB spreads widened by 114 bps on average, so there should be a good entry point for investing in corporate credit if a recession occurs.

Exhibit 2. Spread Movement During Previous Contractions. This chart shows previous recessions since the late 1960s and how BBB spread widening has occurred during these recessionary periods.

Sources: Beutel, Goodman & Company Ltd., NBER (National Bureau of Economic Research), Moody’s, Macrobond. As at Novembeer 30, 2023

In previous hiking cycles, against the backdrop of higher yields, we have seen some sectors underperform the market, such as consumer cyclicals, real estate and financial services. In contrast, we typically expect more defensive sectors such as infrastructure and utilities to outperform. Companies that need to issue debt and have higher leverage than their peers will likely underperform as interest coverage ratios (how easily a company can pay interest on its outstanding debt) deteriorate. This could lead to downgrades in their credit ratings.

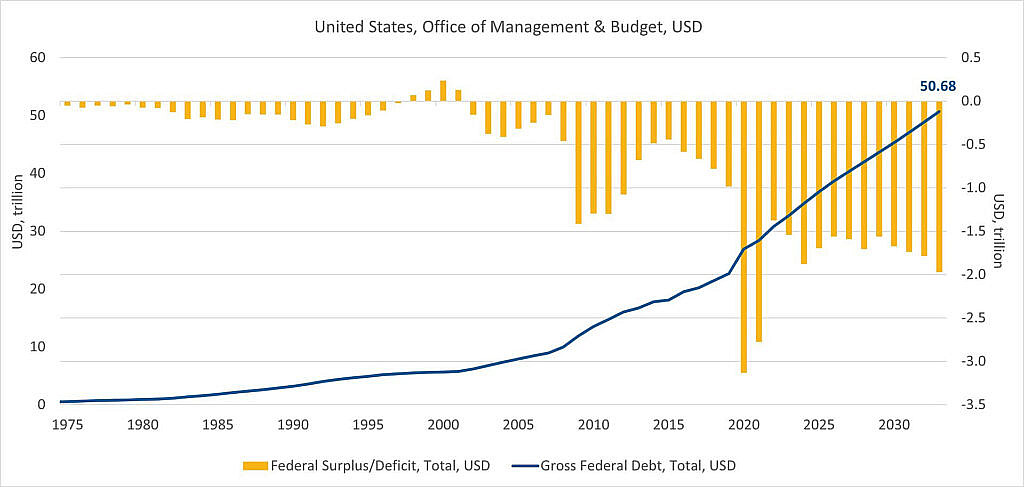

The current investment landscape is somewhat unique in that central banks are trying to orchestrate a soft landing, but given the poor state of government operating budgets, markets and investors are unlikely to be able to count on fiscal stimulus from governments to help the economy grow (refer to Exhibit 3). In the U.S., the election cycle will also likely limit the amount of fiscal stimulus.

Exhibit 3. U.S. Deficit by Year. This chart shows the U.S. deficit each year since 1975 and the cumulative amount of debt.

Sources: Beutel, Goodman & Company Ltd., U.S. Office of Management & Budget, Macrobond. As at November 30, 2023

Opportunities in 2024

When credit spreads move wider, opportunities to add value to our portfolios arise, such as:

- Widening credit spreads provide a better entry point for purchasing corporate credit compared to government securities.

- Within sectors, company spreads tend to move together regardless of individual credit profiles. This can allow for investing in stronger companies at better spreads compared to their peers.

- Companies that are viewed as weak due to an increase in leverage or a potential credit rating downgrade can become attractive as the market oversells these companies, creating potential upside compared to peers if their credit profiles improve.

Indicators We Are Following

We are always monitoring key data points to keep our forecasts up to date. In particular:

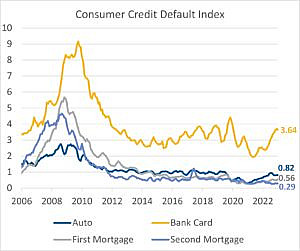

- We examine the financial health of consumers, looking at the labour market to see if unemployment or jobless claims are rising and checking for any growth in consumer defaults (refer to Exhibit 4). We also closely examine declines in financial metrics such as interest coverage ratios and household wealth.

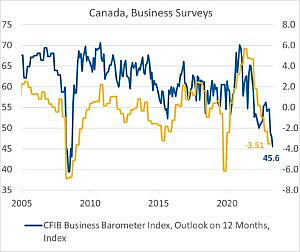

- We monitor the financial health of businesses by looking at business outlook surveys (refer to Exhibit 5), M&A activities, the Purchasing Managers’ Index, and retail sales data.

- We track inflation and its trajectory, looking at price pressures in both goods and services while also tracking wage growth and input prices in the Producer Price Index.

- We monitor the prevailing financial conditions for changes in support from governments and/or central banks that could provide upside or downside movement towards stocks and bonds.

Exhibit 4. Consumer Default Index. This chart shows consumer credit defaults for different types of debt, with bank card debt increasing the most.

Sources: Beutel, Goodman & Company Ltd., S&P/Experian, Bloomberg. As at November 30, 2023

Exhibit 5. Canadian Business Surveys. This chart shows business surveys conducted in Canada and currently points to declining expectations for growth in the Canadian economy.

Sources: Beutel, Goodman & Company Ltd., Canadian Federation of Independent Business (CFIB), Bank of Canada, Macrobond. As at November 30, 2023

Defensive Positioning

Heading into 2024, investors are expecting weaker growth in both Canada and the United States. We are investing defensively, holding mostly higher-rated credit, with a bias towards less cyclical sectors. We anticipate that this positioning could change as spreads move wider and opportunities arise to add investment grade and high yield credits, while not materially increasing credit risk.

Download PDF

Related Topics and Links of Interest:

©2023 Beutel, Goodman & Company Ltd. Do not sell or modify this document without the prior written consent of Beutel, Goodman & Company Ltd. This commentary represents the views of Beutel, Goodman & Company Ltd. as at the date indicated.

This document does not constitute an offer or a solicitation to buy or to sell any security, product or service in any jurisdiction. This document is not available for distribution to people in jurisdictions where such distribution would be prohibited.

This document is not intended, and should not be relied upon, to provide legal, financial, accounting, tax, investment or other advice. Beutel Goodman has taken reasonable steps to provide accurate and reliable information. Beutel Goodman reserves the right, at any time and without notice, to amend or cease publication of the information.

Certain portions of this report may contain forward-looking statements. Forward-looking statements include statements that are predictive in nature, that depend upon or refer to future events or conditions, or that include words such as “expects”, “anticipates”, “intends”, “plans”, “believes”, “estimates” and other similar forward-looking expressions. In addition, any statement that may be made concerning future performance, strategies or prospects, and possible future action, is also forward-looking statement. Forward-looking statements are based on current expectations and forecasts about future events and are inherently subject to, among other things, risks, uncertainties and assumptions which could cause actual events, results, performance or prospects to be incorrect or to differ materially from those expressed in, or implied by, these forward-looking statements.

These risks, uncertainties and assumptions include, but are not limited to, general economic, political and market factors, domestic and international, interest and foreign exchange rates, equity and capital markets, business competition, technological change, changes in government regulations, unexpected judicial or regulatory proceedings, and catastrophic events. This list of important factors is not exhaustive. Please consider these and other factors carefully before making any investment decisions and avoid placing undue reliance on forward-looking statements Beutel Goodman has no specific intention of updating any forward-looking statements whether as a result of new information, future events or otherwise.