– By Beutel Goodman’s U.S. & International Equities team

At Beutel Goodman, we search for businesses that will offer high and sustainable returns, with clear alignment between their business managers and long-term shareholders. Our approach to building portfolios is guided by our extensive research process, our strict investment guidelines, and our buy/sell discipline. Further, we only invest in these attractive, high-quality businesses that pass our high hurdles when suitable valuation opportunities present themselves.

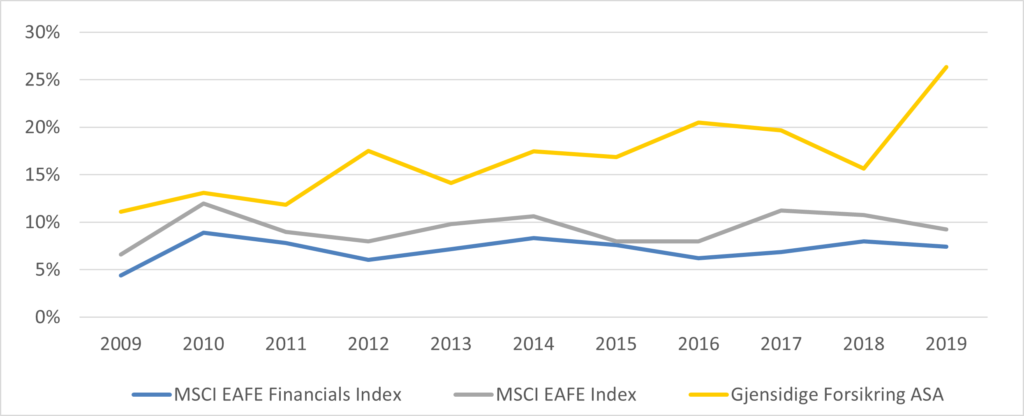

We do not believe the approach of investing based on what appear to be low valuations without regard for business quality is an acceptable way to invest on behalf of our clients. We would further posit that stocks with chronically low valuations can often reflect businesses with low return potential or intolerable risks. Using the example of Gjensidige Forsikring ASA, a Norwegian insurer that we successfully owned despite continuous underperformance of the EAFE (Europe, Australasia, Far East) Financials sector relative to the benchmark, we will highlight several aspects of our process, which we believe leads to constructing robust portfolios for long-term investors.

Setting the Stage: the EAFE Financials Sector

In our search for new investment opportunities, we prioritize business quality and pay little attention to index configuration. Historically, the Financials sector has comprised the highest weight in the MSCI EAFE Index, ranging from 18% to 26% over the 10-year period ending December 2019[1]. During this same time span, the sector has somewhat consistently underperformed the broader index, with annualized underperformance of 202 basis points.

Given their modest valuations relative to present business performance – and the broader EAFE market – a cursory review of EAFE Financials stocks could suggest that the sector holds significant opportunity for value-oriented investors. However, at Beutel Goodman we conduct deep fundamental research which has historically aided in avoiding vulnerabilities in the Financials sector and generated long-term returns exceeding benchmark sector performance. A discussion around the sector’s composition and risks will illustrate this.

The Financials sector consists primarily of banks and insurance companies, which together account for over three-quarters of the sector’s weight in the MSCI EAFE Index. Generally speaking, banks are highly leveraged, capital-intensive, low-return businesses. Across many countries in the EAFE region, banks operate within competitive markets, with little differentiation among peers and with uncontrolled external pressures, such as interest-rate and regulatory changes. As a result, many struggle to earn even a 10% return on equity over the course of an economic cycle. Another significant subsector of Financials, life insurance companies, is structurally prone to similar headwinds – tremendous long-term uncertainty, high regulation, high capital intensity, with a similar end-result of structurally low returns on capital.

Value investors potentially prioritizing current multiples ahead of business quality may have been lured to the sector. We, on the other hand, have been extremely selective, seeking out only what we consider exceptional firms such as Gjensidige. Over the six years to December 2020, the Beutel Goodman International Equity strategy has been consistently at least 30% underweight Financials relative to the MSCI EAFE Index and consistently at least 20% underweight relative to the median value-investing peer[2].

The Needle in the Haystack: Gjensidige Forsikring ASA

At Beutel Goodman, we dedicate our time to selecting a concentrated number of companies that our research process assesses will offer a sustainable competitive advantage, solid balance sheets, and a management team that is aligned with shareholders’ long-term interests. Ultimately, these companies should produce a high and sustainable return on capital across an economic cycle. Further, we only invest when the high-quality companies we have identified are attractively valued, and we believe based on our extensive analysis that the investment will produce a 50% total return over three years. We do not find compromising on any of these attributes (balance sheet, profitability, valuation) to be a risk worth taking. We did not compromise on Gjensidige.

Gjensidige is the largest property and casualty insurer in Norway, controlling a 26% market share at the time of investment in April 2013. Starting with its insuring practices, the business is mostly basic motor, property, and accident & health coverage. The majority of its policies are written against short-tailed risks, mostly home and motor, and therefore the firm does not face the uncertainties associated with the less predictable long-tailed risks. In addition to an effective reinsurance program, the company has limited exposure to complex insurance policies that can surprise investors when large claims previously believed to be on the fringe of possibility turn out to be insufficiently reserved for. Gjensidige’s core business, Norwegian non-life insurance, is highly consolidated, with four established players commanding a combined 80% market share and protected by a long history of rational pricing behaviour, high barriers to entry, and a solid economic backdrop.

Return on Common Equity (2009–2019)

Source: Bloomberg Finance L.P., Beutel Goodman

Gjensidige’s profitability is consistently above the sector median. This is both a result of market structure and the company’s management, in our view. For various reasons, select property insurance markets have not globalized and distinct regional markets remain with several advantages. The Norwegian market has stable competition with little incentive to drive market share gains through price competition and reduced underwriting profitability. For comparison, in other regions, such as the U.S., insurance is still typically priced so lean that companies rely heavily on investment income above insurance underwriting results to generate profits, a practice that Gjensidige’s management ended long ago.

Through a unique shareholding structure related to its past as a mutual company, Gjensidige’s policyholders are also company owners who receive dividends, which effectively provides them with a discount on their insurance, driving healthy customer loyalty metrics and retention rates. Operating expense ratios are also well contained with Gjensidige. The majority of its product distribution occurs directly through its own salesforce with less selling through intermediaries than in other regional markets, resulting in above-average profitability.

Our Journey of Ownership

We first met company management in 2012 on a customized investor tour of the Nordic countries, an area with numerous high-quality companies despite its relatively small size. After that meeting, we continued to build a knowledge base about the company and industry, eventually concluding that it was a worthy candidate for review under the Beutel Goodman investment process. Rigorous and multi-stage by design, this process focuses our research efforts and ensures that only the best ideas qualify for consideration in our portfolios. It starts with an initial assessment by the entire U.S. & International Equities team, from which an idea moves forward only if all members agree on its preliminary investment merits. In total, it took the better part of four months for Gjensidige to make it through all stages of our research process, and only with shares available at a suitable price, to qualify for the portfolio.

We commenced our investment in April 2013 at a reasonable valuation of 13x forward earnings, with stock price support from its high and sustainable dividend yield – at 7% one of the highest among the Nordic stocks – and a consistently high dividend payout ratio of around 80%. The balance sheet also had considerable excess capital and management’s intention was to eventually return it to shareholders. There were no expectations for the business to significantly invest for expansion either internationally (sacrificing the beneficial Norwegian market conditions) or by product offering (accepting higher risks), and we agreed with management’s capital allocation strategy. Business proceeded steadily during our investment, and eventually the share price increased beyond where we expected further excess returns. We exited the stock in 2016 at a valuation of 17x forward earnings.

We were then attracted back into Gjensidige in the first quarter of 2017, when the stock dipped nearly 20%, due in part to concerns around auto-claims inflation in Norway, and possibly because of sector rotation out of more defensive Financials stocks. Our fundamental review on the business showed that the oligopolistic market structure of the Norwegian property & casualty market, and Gjensidige’s leading market position, would likely allow it to recapture most or all of the claims inflation within one year. We therefore viewed this situation as manageable and considered the price dip as an opportune re-entry point for this high-quality franchise.

With the benefit of time and other positive developments, including the sale of its fledgling banking operations, the stock reflected what we believed to be a full valuation of 22x forward earnings, up substantially from our purchase valuation of 15x. With seriously capped upside potential, we trimmed and finally liquidated our position in the third quarter of 2019.

Share Price and Major Transactions of Gjensidige Forsikring ASA, 2013 to 2019

Source: Refinitiv Datastream

A Focused Portfolio of “Gems”

Gjensidige is one example of the Beutel Goodman approach to navigating EAFE financials. Our other Financials sector investments since the full inception of our process in the EAFE portfolio (2015) fit this strategy as well. The following are brief descriptions of select other Financials sector EAFE investments over this period:

- Deutsche Boerse AG (sold from the portfolio in 2017) as an exchange is neither a lender nor life insurer, avoiding the quality/profitability tradeoffs inherent in many EAFE Financials. We viewed this investment as more of a technology company owning and operating critical financial-markets infrastructure in an industry where high barriers to entry and low capital requirements drive consistently high returns on capital.

- Julius Baer Group (in our portfolio as at the time of publication), as a pure-play private bank/wealth manager, avoids the challenges faced by many EAFE banks. Julius Baer’s private banking business generates consistently high returns through a loyal high-net-worth customer base in core markets protected by reputation, and a scale that requires low capital intensity. The majority of the bank’s earnings are derived from wealth management, with additional interest income earned from a captive and high-quality loan book. As a pure-play private bank, it is not burdened with a capital-intensive, volatile, and low-return investment-banking business as are its major Swiss peers.

- DBS Group (in our portfolio as at the time of publication) benefits from the market structure of Singaporean banking in a manner similar to what Gjensidige does with Norwegian non-life insurance. The company has shown unrelenting alignment with long-term shareholders through its strategy of generating healthy profits and growth within its core oligopolistic market. This strategy stands in contrast with many banks’ far-flung “empire-building” initiatives, which can lead to cost inefficiencies, regulatory issues, and unnecessary complexity.

An Enduring Process

As ever, we remain tirelessly focused on our search for companies that offer quality, growth prospects, and compelling value, from which we build our portfolios within the confines of our strict buy/sell discipline. We invite readers to refer to a previous whitepaper entitled Undefining Value Investing for a more fulsome description of our approach, which we firmly believe will continue to deliver compelling results for our clients over the long term.

[1] We are illustrating market composition over a 10-year period to December 2019 before COVID impacts on markets.

[2] Source: eVestment; peer group is EAFE value equity (roll-up universe consisting of 94 to 104 products); looking at year-end Financials sector weight 2015-20.

Download PDF

Related Topics and Links of Interest:

©2022 Beutel, Goodman & Company Ltd. Do not sell or modify this document without the prior written consent of Beutel, Goodman & Company Ltd.

All opinions and estimates expressed in this document are as at the time of its publication and are subject to change without notice. This document is not intended, and should not be relied upon, to provide legal, financial, accounting, tax, investment or other advice. This is not an invitation to purchase or trade any securities. Beutel, Goodman & Company Ltd. does not endorse or recommend any securities referenced in this document.

The index information contained in this document has been obtained from sources believed to be reliable, but we do not represent that it is accurate or complete and it should not be relied upon as such. Neither MSCI nor any other party involved in or related to compiling, computing or creating the MSCI data makes any express or implied warranties or representations with respect to such data (or the results to be obtained by the use thereof), and all such parties hereby expressly disclaim all warranties of originality, accuracy, completeness, merchantability or fitness for a particular purpose with respect to any such data. Without limiting any of the foregoing, in no event shall MSCI, any of its affiliates, or any third party involved in or related to compiling, computing or creating the data have any liability for any direct, indirect, special, punitive, consequential or any damages (including lost profits) even if notified of the possibility of such damages. No further distribution or dissemination of the MSCI data is permitted without MSCI’s express written consent.