“The word bubble creates a mental picture of an expanding soap bubble, which is destined to pop suddenly and irrevocably. But speculative bubbles are not so easily ended; indeed, they may deflate somewhat, as the story changes, and then reflate.”

— Robert J. Shiller

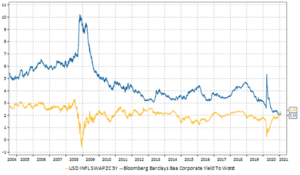

The impressive performance of the equity market during the 2020 pandemic has not only pushed overall valuations to stretched levels but has also reinforced the belief amongst some investors that stocks do not go down. The recent meteoric rise of stocks such as GameStop Corp. and AMC Entertainment Holdings Inc., as well as the move higher in bitcoin and other cryptocurrencies, has significantly increased the risk of targeted asset bubbles. It can even be argued that the bond market has become frothy, specifically within credit markets, where the U.S. BBB Corporate Bond Index is now yielding less than inflation expectations (see Figure 1). This is the first time in the modern era that this has occurred and is a result of the excess supply of liquidity from the U.S. Federal Reserve (Fed), which has pushed interest rates lower and raised inflation expectations in an effort to stimulate the economy.

Figure 1: Chart of the Month – This chart shows that the Bloomberg Barclays Baa Corporate Bond Index, for the first time in its history, is now yielding, as at February 1, 2021, 2.12%, which is lower than the 5-year inflation swap rate of 2.29% (the 5-year inflation swap rate is a measure of inflation expectations). The low yield of Baa Bonds could mean that investors are not being compensated enough to cover the costs of inflation.

Source: Beutel, Goodman & Company Ltd., Macrobond, as at 2/1/2021

Bubbles are natural in financial markets but are very difficult to detect and nearly impossible to time. The last two major bubbles both led to economic recessions:

- The rise of the internet led to a plethora of technology stocks rising to lofty valuations in the late 1990s, many of which had no revenue let alone earnings. This ultimately ended in the Dotcom bust of 2000.

- In addition, a global crash in real estate prices and excess leverage led to the 2008 Global Financial Crisis.

The question now is whether these new, smaller, isolated bubbles can grow large enough to have a major impact on the overall market and ultimately, economic growth.

How Are Bubbles Created?

Some famous examples of financial bubbles are, as noted above, the 2007 real-estate and 2000 dotcom bubbles. Other examples include the 1989 Japanese equities bubble and of course, the historic Tulip bubble in the 17th century in the Netherlands. Bubbles such as these often begin when monetary policy is highly accommodative and real interest rates are relatively low. Low real interest rates drive investors further out in the risk spectrum, driving asset prices higher. The addition of leverage into the equation adds fuel to the fire and further propels prices higher. Investors then begin to explain this exponential price rise as a paradigm shift, which further propels a feedback loop.

Eventually, though, all bubbles burst. The main drivers are usually a combination of valuations and monetary policy. As interest rates rise, leverage becomes significantly more expensive. When combined with already excessive valuations, borrowers subsequently take profits and reduce exposure. This can often lead to a squeeze as multiple players head for the exits at the same time. This pressures the bubble, changes the narrative away from a “paradigm shift” and eventually pops the bubble.

Hyman Minsky’s Financial Instability Hypothesis

No discussion of bubbles is complete without discussion of economist Hyman Minsky’s Financial Instability Hypothesis. His theory hypothesizes that all stable economies sow the seeds of their own destruction as stability induces risk-taking behaviour. This creates financial instability, leading eventually to panic and crisis.

Minsky broke the process down to three types of debt stages – hedge, speculative and Ponzi – that build upon each other. The economic stability of stage 1, where all debt is matched with cash flows, leads to speculation in stage 2 as borrowers believe that the value of their collateral will not decline and interest rates will not rise. Stage 3 is the peak of the bubble, where borrowers are solely dependent on rising asset prices to keep afloat. It could be argued that we are in stage 2. Minsky’s work received renewed attention during the Global Financial Crisis, when the term “Minsky Moment” was coined. The moment refers to a sudden collapse of the market following a long period of unsustainable speculative activity involving high levels of indebtedness. While certain markets may be frothing towards their Minsky moments, the key question is whether their bursting will be significant enough to materially impact the whole economy.

Are Current Small Bubbles Cause for Concern?

Currently, we believe the risk of tightening monetary policy by either rising interest rates or a reduction of asset purchases is a long way off. U.S. Federal Reserve Chair Jerome Powell, in his press conference on January 27 this year, reiterated that any talks of ending quantitative easing were “premature”. He continued to state that the economy remains in a precarious position, with “considerable downside risks” as unemployment is still high, inflation remains weak and any rise in inflation would likely be transitory. He also mentioned that while the Fed monitors bubbles, it was unlikely to adjust its policy at this time to address them. The Fed seems to be drawing on its former Chair Alan Greenspan’s thoughts that a bubble is very difficult to identify until after the fact, when the bursting has confirmed its existence.

With the Fed maintaining its easing bias, targeted bubbles will continue to grow in 2021. While the rise of micro stocks has created headlines, we do not believe these small outliers are cause for concern for the broader markets yet. Cash on the sideline remains relatively high when looking at retail investment data. High cash levels mean there is still a lot of potential money that can be put to work. Margins, while rising, also remain below historical averages and are not in excess. The bottom line is that there is still appears to be a lot more room for risk assets to outperform.

Portfolio Positioning

Credit provides a premium and being short credit is a dangerous proposition. Like a broken clock, which is right twice a day, being short credit has slightly better odds but is right once a cycle. Quarterly excess return data for the U.S. corporate index is positive over 60% of the time and the average excess return per quarter is around 20 basis points, making going short credit an expensive proposition.

With respect to our own fixed income portfolio positioning, we remain overweight credit, but have pared back some of the risk in our portfolios. While overall valuations are stretched, we continue to believe that there are pockets of value and as asset managers, we keep our eyes open for attractive investments. We continue to diversify into these pockets of value, which we expect should provide a buffer against any bubble popping while at the same time maintain strong upside potential should a risk-on environment continue.

Download PDF

Related Topics and Links of Interest

- Economic, Interest Rate and Credit Outlook 2021

- The U.S. Election: Looking Beyond the Confusion

- Beutel Goodman mutual funds

©2021 Beutel, Goodman & Company Ltd. Do not sell or modify this document without the prior written consent of Beutel, Goodman & Company Ltd. This commentary represents the views of Beutel, Goodman & Company Ltd. as at the date indicated.

This document is not intended, and should not be relied upon, to provide legal, financial, accounting, tax, investment or other advice.

Certain portions of this report may contain forward-looking statements. Forward-looking statements include statements that are predictive in nature, that depend upon or refer to future events or conditions, or that include words such as “expects”, “anticipates”, “intends”, “plans”, “believes”, “estimates” and other similar forward-looking expressions. In addition, any statement that may be made concerning future performance, strategies or prospects, and possible future action, is also forward-looking statement. Forward-looking statements are based on current expectations and forecasts about future events and are inherently subject to, among other things, risks, uncertainties and assumptions which could cause actual events, results, performance or prospects to be incorrect or to differ materially from those expressed in, or implied by, these forward-looking statements.

These risks, uncertainties and assumptions include, but are not limited to, general economic, political and market factors, domestic and international, interest and foreign exchange rates, equity and capital markets, business competition, technological change, changes in government regulations, unexpected judicial or regulatory proceedings, and catastrophic events. This list of important factors is not exhaustive. Please consider these and other factors carefully before making any investment decisions and avoid placing undue reliance on forward-looking statements Beutel Goodman has no specific intention of updating any forward-looking statements whether as a result of new information, future events or otherwise.