“It’s tough to make predictions, especially about the future” – Yogi Berra

As 2020 – a year for the record books – comes to an end, we are taking this time to consider our outlook for 2021. As Beutel Goodman’s fixed income portfolio managers, part of our job is to (admittedly, futilely) try to predict the future, and allocate assets accordingly. What follows is our current predictions, broken down into three sections. The first section lays out our economic outlook, which is the starting point that feeds into the second section, our interest rate outlook, and the third section, our credit outlook.

Economic Outlook

In 2021, we expect the economy will continue to rebound from the depressed levels caused by the COVID-19 pandemic. Most of the monetary- and fiscal-response tools used during the financial crisis were deployed very quickly, which has helped the economy bounce back somewhat from the second-quarter depths. Central banks have continued with their messaging of not raising rates or tapering purchases of financial assets until inflation is strongly visible and above trend. As a result, economic growth should continue to have the tailwind of monetary policy. Fiscal stimulus also remains in place as governments maintain aid to the sectors hit hardest by the crisis.

In addition, consumers’ levels of savings are at an all-time high as everyone remains, for the most part, stuck at home. We believe this pent-up demand should be released in 2021 as the vaccine makes it easier for consumers to emerge from their forced hibernation.

With the massive amount of stimulus, pent-up demand and excess savings, we believe that inflation will likely rise next year. However, the uptick will likely be transitory in nature; i.e., it will rise for a short time before falling back to central banks’ long-term target range.

Figure 1: This graph of the Conference Board’s CEO Confidence Survey (a measure of the CEO Confidence Index) and U.S. GDP (total, constant prices) between 1978 and 2020 shows CEO confidence in the U.S. has historically led economic growth. The CEO Confidence Index currently sits at 64, up from the mid-30 range, pointing to a potential strong rebound in 2021.

Source: Beutel, Goodman and Company Ltd., Macrobond, TCB. BEA, SPDJI, as at 11/26/2020

Figure 2: This graph of Canada, CANSIM, Current & Capital Accounts shows the pent-up Canadian household savings, which currently sits at about $207 billion (as at November 2020) – much higher than the approximately $30 billion we started 2020 at – and should translate to stronger consumer demand in 2021.

Source: Beutel, Goodman and Company Ltd., Macrobond, StatCan, as at 12/2/2020

Where We Are in the Cycle

For fixed income investments, an expansion phase can typically be broken down into three consecutive stages:

| Wave | Action | Where We Are in the Cycle |

| 1 | Credit rallies significantly; value remains but only in more cyclical sectors or in junior debt (AT1, NVCC, Hybrids). | Achieved |

| 2 | Long end yields rise and the curve (both the 2-year/10-year and the 5-year/30-year) steepens as the market prices in the recovery of growth and inflation.

|

Likely to occur in the first half of 2021 |

| 3 | Central banks see sustained low unemployment, building inflationary pressures and bubble-like activity, so they begin raising interest rates.

As central banks begin to signal a hiking cycle, the curve will flatten aggressively between 5-year and 30-year bonds, and credit spreads will remain rangebound or potentially move wider. Volatility increases. |

Likely to occur in 2023 |

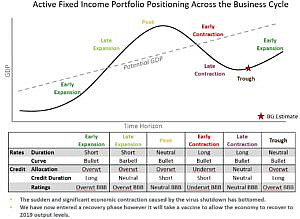

Beutel Goodman Infographic of the Business Cycle: This infographic is a stylized depiction of the economic cycle and our current estimate of where we are. The graphic depicts the cycle as a curve, which includes a rise in GDP during the early and late expansion phases, through to the peak, then a fall in GDP during the early and late contraction phases, ending in the trough. We believe that the sudden and significant economic contraction caused by the COVID-19 shutdown has bottomed, and that we have now entered a recovery phase. However, we expect that widespread vaccination will need to be achieved to allow the economy to recover to 2019 output levels.

Source: Beutel Goodman, 2020. Note: The above chart represents a stylized representation of the business cycle. It is meant to be viewed as a decision-making framework and is not indicative of exact portfolio positioning.

Interest Rate Outlook

We continue to believe that interest rates are poised to rise in 2021. Interest rates are driven by expectations of two main factors – real growth and inflation. A third, more esoteric factor – the term premium – compensates investors for taking risk in longer-maturity debt.

We believe the first two factors, real interest rates and inflation, should continue to increase in 2021. In the U.S., inflation expectations (as measured by the CPI SWAP Rate[1] in Figure 3 below) have rebounded since March and are now close to the U.S. Federal Reserve’s target of 2%.

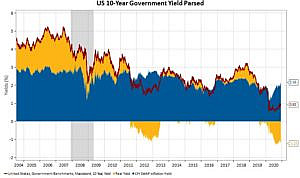

Figure 3: This graph shows the parsing of the U.S. 10-year interest rate by inflation (as measured by the 10-year CPI SWAP rate) and real yields. Inflation expectations are now back to 2%, but real yields are at all-time lows, at -1.23% as at December 9, 2020.

Source: Beutel, Goodman and Company Ltd., Macrobond, Federal Reserve Bank of New York, Federal Reserve Bank of San Francisco, Fed, BEA, as at 12/9/2020

As mentioned in the economic section above, demand will likely increase and monetary and fiscal stimulus should push debt levels higher, which should provide a tailwind for inflation. Added to this, we are likely to see a reworking of global supply chains, and this could increase inflationary pressures as nations realize the importance of domestic manufacturing. Moving production to Canada will be more expensive than off-shore production in lower-labour-cost countries such as China and will likely drive prices up and cause inflation to rise.

The real interest rate should also rise as growth returns to something closer to normal. It is difficult to believe that real growth and the related real interest rates would remain negative for the next 10 years, especially considering that real interest rates are at all-time lows.

The main driver of the current depressed interest rates is that government bonds are considered “safe-haven” assets, and the term premium (illustrated in Figure 4) tends to fall before a recession, when markets are declining and risk assets are selling off. Alternatively, the term premium tends to rise once the dust of the recession has settled and money flows out of government bonds back into riskier assets. This is likely where we are heading in the cycle in 2021.

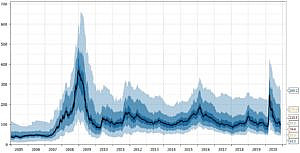

Figure 4: This graph depicts various measures of U.S. 10-year term premiums. The term premium is the premium awarded to investors for buying longer-term bonds versus shorter-term ones. The term premium tends to fall during financial crises and is currently negative and near its all-time low.

Source: Beutel, Goodman and Company Ltd., Macrobond, Federal Reserve Bank of New York, Federal Reserve Bank of San Francisco, Fed, BEA, as at 12/2/2020

Our current view is that long-term rates will rise while the front end of the curve will be anchored. At this point, our portfolios are short duration relative to their benchmarks, with lower exposure in the 20-year and longer-dated bonds. We will likely move further underweight when and if interest rates rally.

Credit Outlook

Credit spreads were not spared the wild ride of 2020. As shown in Figure 5, the median spread of over 200 Canadian credit bonds with five-year terms is now very close to the median level that they started the year at. The same optimism about the vaccine that is the backdrop for our economic outlook has driven credit spreads tighter from their March highs. However, the dispersion of spreads remains relatively wide as some industries that have been more affected by the pandemic, such as commercial real estate, leisure, and air transportation, have not narrowed from their pandemic wide levels.

This wide dispersion means there still may be attractive opportunities within the credit universe. Sectors in which we are looking for pockets of value include Energy and Real Estate. As credit analysts, we are predisposed to see risk everywhere and are monitoring some credit-negative trends such as increasing leverage, deteriorating credit metrics, and rising merger-and-acquisition activity. Overall, though, the central bank backdrop of liquidity, combined with the expected rollout of the vaccine, provides a constructive environment for credit spreads. We also expect that new issuance will be lower in 2021 compared with 2020 as record new issuance this year was driven by a need to shore up liquidity and prefinance 2021 maturities. We will remain very selective in where we take our credit exposure in 2021 and may choose to reduce overall exposure if spreads become too tight.

Figure 5: This fan chart shows the percentiles of over 200 five-year term credit bond spreads (all bonds excluding Government of Canada Treasuries). While the median spread of the constituents is now close to the long-term average, the dispersion of spreads remains wide.

Source: Beutel, Goodman and Company Ltd., Macrobond, as at 11/26/2020

Conclusion

As vaccines are rolled out to the populations of the world, we would expect life to return to relative normal sometime in 2021. Central banks continue to suppress the level of interest rates. Although liquidity measures will be rolled back eventually, attempting to time this rollback by central banks will be difficult, as doing so too early could push us back into recession and going too slow could lead to bubbles.

As a result, we expect the tapering of liquidity measures to take place later in 2021, and interest rates will likely rise in anticipation of this event earlier in the year. We believe that the economic backdrop remains largely positive and that credit spreads will continue to grind tighter; however, credit selection will likely remain an important differentiating factor.

Download PDF

Related Topics and Links of Interest

- The U.S. Election: Looking Beyond the Confusion

- The Canadian Economy 2009-2019

- Beutel Goodman mutual funds

©2020 Beutel, Goodman & Company Ltd. Do not sell or modify this document without the prior written consent of Beutel, Goodman & Company Ltd. This commentary represents the views of Beutel, Goodman & Company Ltd. as at the date indicated.

This document is not intended, and should not be relied upon, to provide legal, financial, accounting, tax, investment or other advice.

Certain portions of this report may contain forward-looking statements. Forward-looking statements include statements that are predictive in nature, that depend upon or refer to future events or conditions, or that include words such as “expects”, “anticipates”, “intends”, “plans”, “believes”, “estimates” and other similar forward-looking expressions. In addition, any statement that may be made concerning future performance, strategies or prospects, and possible future action, is also forward-looking statement. Forward-looking statements are based on current expectations and forecasts about future events and are inherently subject to, among other things, risks, uncertainties and assumptions which could cause actual events, results, performance or prospects to be incorrect or to differ materially from those expressed in, or implied by, these forward-looking statements.

These risks, uncertainties and assumptions include, but are not limited to, general economic, political and market factors, domestic and international, interest and foreign exchange rates, equity and capital markets, business competition, technological change, changes in government regulations, unexpected judicial or regulatory proceedings, and catastrophic events. This list of important factors is not exhaustive. Please consider these and other factors carefully before making any investment decisions and avoid placing undue reliance on forward-looking statements Beutel Goodman has no specific intention of updating any forward-looking statements whether as a result of new information, future events or otherwise.