On July 14, 2020, the Office of the Superintendent of Financial Institutions (OSFI) published a ruling on their acceptance of a new type of hybrid capital security in Canada. This paper outlines the details of this new hybrid structure, the rationale behind the launch and regulatory approval, the potential size of the market opportunity and our current outlook for the asset class.

On July 21, 2020, Royal Bank officially launched the inaugural domestic Canadian-dollar Additional Tier 1 (AT1) transaction. This follows similar issuances — albeit with certain key differences — from Scotiabank and BMO south of the border. The notes have an initial maturity date of November 24, 2080, are callable every five years, and were priced with a spread of +415 basis points (bps) above the Government of Canada (GoC) five-year rate, to yield 4.50%. This is 50 bps tighter than where a new-issue preferred share might currently price, and represents an incremental spread of approximately 260 bps as compared to Royal Bank’s outstanding Tier 2 non-viability contingent capital (NVCC) instruments.

The Canadian federal government and OSFI have finally come to terms with a structure that will allow for interest deductibility and qualify as hybrid capital. The notes have been labelled Limited Recourse Capital Notes (LRCNs), and permitted issuers include all federally regulated financial institutions, including insurance companies (although for the purposes of this note, we will focus on the “Big Six” banks). LRCNs will not be eligible for index inclusion, however, unlike previously issued bank hybrid securities, as FTSE Russell views the coupon structure and call profile to be incongruent with existing index requirements. This may change in the future, as was the case with Tier 2 NVCC bonds (which were also deemed ineligible when first issued), but it is impossible to accurately predict if and when that might happen.

Why Now?

Banks have historically issued hybrid instruments — that is, securities with both debt- and equity-like features — within their capital structures in order to meet their regulatory minimum levels of capital, while also minimizing funding costs. However, over the past decade, and following the implementation of the Bank for International Settlements’ Basel III banking accord, global regulators have refined their capital-adequacy frameworks to the point where the majority of previously issued hybrid securities contain structural deficiencies that no longer qualify them as capital instruments.

Until OSFI’s ruling to permit LRCNs, Canadian banks had only been able to satisfy their hybrid limits in the Canadian marketplace through the issuance of NVCC preferred shares. Due to a combination of persistently low interest rates and retail investor fatigue, the preferred share market has become decidedly less efficient over the last few years, perhaps compelling OSFI to accept these new LRCNs as a means for Canadian banking institutions to continue meeting their ever-increasing capital standards.

OSFI and global banking regulators have also been looking to shift the risks associated with hybrid instruments away from the preferred share retail investor base given their volatility and complexity. LRCNs largely target the more sophisticated institutional market, providing further support for the introduction of LRCNs.

How Do LRCNs Compare to Preferred Shares?

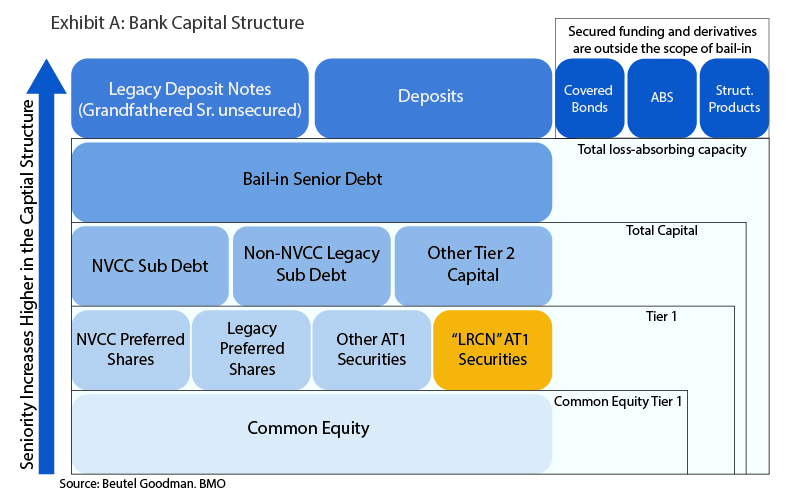

While similar in payment rank to preferred shares within the capital structure (see Exhibit A), several important features will distinguish LRCNs in the market. From the buyer’s perspective, these will be targeted at institutional investors, and come with minimum par values above those of preferred shares in the retail market (i.e., $1,000 vs. $25) as well as minimum purchase quantities ($200,000 and integral multiples of $1,000 in excess thereof). From the bank’s perspective, these will count as equivalent, in capital quality, to preferred shares, but coupons will be considered interest for accounting purposes. This will allow them to be deducted from earnings before taxes rather than after, which is also the case with preferred share dividends.

What Are the Essential Characteristics of an LRCN?

In addition to the above-mentioned features when compared to preferred shares, and without diving too deep into the structural minutiae of the instruments, OSFI has outlined the following elements required in order to recognize the LRCNs as hybrid capital:

- They must have an initial term to maturity of at least 60 years;

- They must not include an incentive to redeem (e.g., a coupon step-up or dividend stopper);

- They may be redeemable only if carrying cost exceeds the cost of replacement capital of similar quality (i.e., hybrid), unless replaced by higher-quality capital (e.g., common shares or retained earnings); and

- They are subject to a cap of 0.75% of risk-weighted assets (RWAs).

What Are the Big Risks Associated with LRCNs?

Under normal circumstances, LRCNs should behave like a standard callable bond with a final maturity of at least 60 years. There will be a discrete call feature — typically every five years — and coupons will reset at each call date at the prevailing GoC five-year rate plus the initial credit spread. In addition, the decision to call will be explicitly based on whether the cost of replacement hybrid capital is cheaper than the reset coupon. However, in a distressed scenario such as non-payment of interest or principal, capital buffer breach, event of default or liquidation, the LRCNs will be converted into preferred shares with an identical dividend rate, call schedule, reset spread and benchmark reference rate. In the event of a further non-viability declaration by the regulator, LRCN holders will receive common shares, with convertibility features similar to existing preferred shares; that is, a 1x conversion factor and a $5 floor price.

Will this Affect Other Securities within a Bank’s Capital Structure?

Not surprisingly, the preferred share market has seen the biggest impact thus far, with the S&P/TSX Preferred Share Index and the BMO Laddered Preferred Share Index ETF (ZPR:TSX) up 5.80% and 7.73%[1], respectively, since OSFI’s announcement. Until recently, investors had begun to assume nearly all existing preferred shares would remain outstanding into perpetuity, given their continuing qualification as hybrid capital and relatively low cost versus prior alternatives (e.g., common shares or retained earnings). LRCNs’ tax-deductibility, however, has materially changed the economics of replacement capital for preferred shares, and the likelihood of a call has now increased for issuances with relatively high floating rates. LRCN’s will also have a negative impact on the future supply of preferred shares, given that their capacity within a bank’s funding profile has essentially been halved.

With respect to Tier 2 NVCC notes, spreads initially widened marginally as investors worked out how to properly assess relative value between the two security types, and some investors sold Tier 2 NVCC in order to raise funds to purchase Royal Bank’s new deal. However, they have since recovered to pre-announcement levels.

How Big Will this Market Become?

Given OSFI has capped the allowable issuance of LRCNs to 0.75% of RWAs, we don’t envision this market growing disproportionately over the near term as compared to other bank securities. Rather, we believe each regulated institution will continue to take a holistic view of its funding profile, and issue in accordance with its own internal cost targets and external market backdrop.

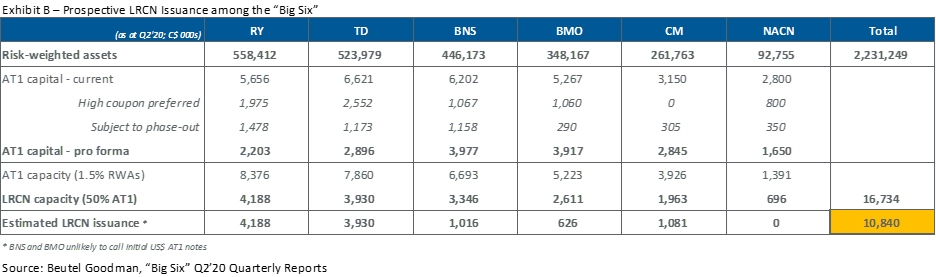

That said, as shown on Exhibit B, a number of the “Big Six” banks have existing capacity in their hybrid buckets to issue LRCNs over the near term. Between the phasing out of certain existing hybrid securities and the calling of high-cost preferred shares, the Canadian market for LRCNs has room to grow to over $10 billion over the next couple of years.

LRCNs in a Global Context

Although new to the Canadian market, LRCN-like hybrid structures have been around globally for nearly a decade, with several small Swiss banks having issued them as far back as January 2012. The preponderance of these outstanding hybrids can still be traced to European institutions, but jurisdictions such as the U.S., China and India, among others, have begun to allow for them in their banks’ capital structures. Overall, there is an estimated over C$250 billion[2] in outstanding LRCN-like hybrids today around the world.

As their prevalence within bank funding profiles has grown over the years, so too have they risen in popularity among investors. Initial purchasers of these instruments included mostly non-high yield asset managers, hedge funds and private wealth clients, whereas today, some estimates now have dedicated preferred share/contingent convertible bond funds, high yield managers and family offices making up approximately one-third of the global investor base. Their growing acceptance can be largely attributed to their performance; since inception, LRCN-like hybrids from European issuers are estimated to have delivered an average annualised total return of nearly 6.5%[3].

Our Outlook

Royal Bank has come to market first with an LRCN. Following global trends, and the slow deterioration of the Canadian-dollar preferred share market, we’ve been expecting something of this nature for the past year or so. Royal Bank seemed the most likely issuer to us, given its scale, lower hybrid ratio than its peers and history of being the first to issue a new structure within the Canadian marketplace (e.g., bail-in debt, Tier 2 NVCC).

Ultimately, with an all-in yield of 4.50%, we view the pick-up versus Tier 2 NVCC as attractive, and in-line with Tier 2/hybrid spread differentials in other jurisdictions for similarly rated issuers. Although exclusion from the index may hamper domestic participation and have a negative impact on liquidity, the lack of withholding taxes should generate support from international players over time, and we consider the additional carry as compared to Tier 2 NVCC bonds as an appropriate offset. We also view the likelihood of conversion as remote, given the financial health of our banking system, and expect the institutional investor base will decrease the volatility of LRCNs, when compared to the more retail-focused preferred share market.

Furthermore, we see this as constructive for the banks themselves. With pricing inside that of preferred shares and interest deductibility, access to the much larger institutional market at the hybrid level, and the aforementioned decrease in funding cost volatility, this should be positive for all stakeholders, and further solidifies our favourable outlook on the sector overall.

NOTES

[1]Source: Bloomberg L.P

[2]Source: Bloomberg L.P; Beutel Goodman

[3]Sources: Bloomberg L.P; Beutel Goodman; as at July 20, 2020; excluding issuances less than 1 year old

Download PDF

Related Topics and Links of Interest:

©2020 Beutel, Goodman & Company Ltd. Do not copy, distribute, sell or modify this document without the prior written consent of Beutel, Goodman & Company Ltd. All opinions and estimates expressed in this document are as at July 24, 2020 and are subject to change without notice.

This document is not intended, and should not be relied upon, to provide legal, financial, accounting, tax, investment or other advice. This is not an invitation to purchase or trade any securities. Beutel, Goodman & Company Ltd. does not endorse or recommend any securities referenced in this document.

Certain portions of this commentary may contain forward-looking statements. Forward-looking statements include statements that are predictive in nature, that depend upon or refer to future events or conditions, or that include words such as “expects”, “anticipates”, “intends”, “plans”, “believes”, “estimates” and other similar forward-looking expressions. In addition, any statement that may be made concerning future performance, strategies or prospects, and possible future portfolio action, is also forward-looking statement. Forward-looking statements are based on current expectations and forecasts about future events and are inherently subject to, among other things, risks, uncertainties and assumptions which could cause actual events, results, performance or prospects to be incorrect or to differ materially from those expressed in, or implied by, these forward-looking statements.

These risks, uncertainties and assumptions include, but are not limited to, general economic, political and market factors, domestic and international, interest and foreign exchange rates, equity and capital markets, business competition, technological change, changes in government regulations, unexpected judicial or regulatory proceedings, and catastrophic events. This list of important factors is not exhaustive. Please consider these and other factors carefully before making any investment decisions and avoid placing undue reliance on forward-looking statements. Beutel Goodman has no specific intention of updating any forward-looking statements whether as a result of new information, future events or otherwise.