Summary

In this piece, Beutel Goodman's Canadian Equity team looks at some of the lessons from the past from the TSX, and in doing so, outlines its distinct investment process, which is focused on the long-term fundamentals of a company.

Lessons to be Learned from some TSX Heavyweights of the Past

By Beutel Goodman’s Canadian Equities team

Speaking to Benefits Canada back in October 2001, Beutel Goodman discussed the limitations of using an index to evaluate investments: “By its very construction, an index does not take valuation into account. This means that at any given time, an index may include significantly overvalued securities. Common sense says that a Value portfolio, containing only a subset of undervalued securities, is less risky than an index in its entirety.”

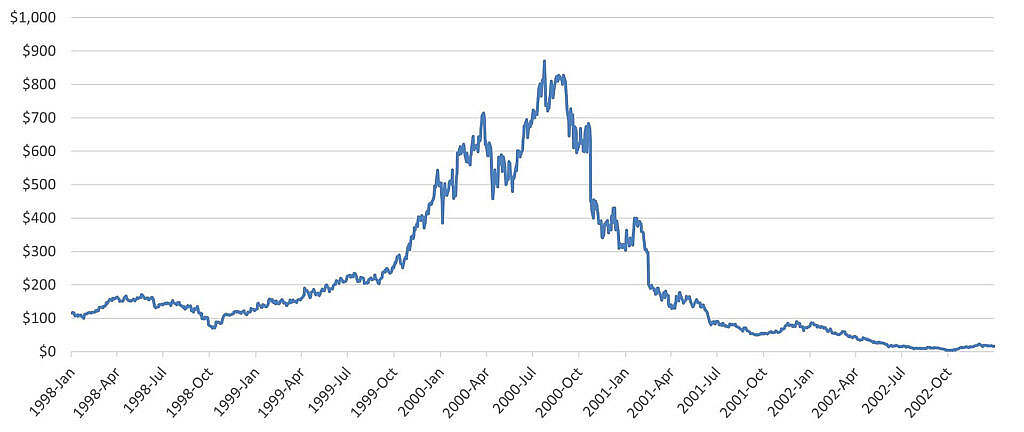

Risk was front of mind for many investors at that time, given the bear market brought on by the dot-com bubble bursting in 2000. In Canada, Nortel Networks Inc. (“Nortel”) was the most high-profile casualty of that crash, experiencing an Icarus-like rise and fall before ultimately filing for bankruptcy in 2008.

That ignominious end was a long way from the company’s peak in 2000 when it was valued close to $400 billion and accounted for more than a third of the entire S&P/TSX Composite Index (formerly the TSE 300 Composite Index until it was renamed in May 2002).

Exhibit 1. Nortel Networks Share Price 1998–2002. Nortel Networks experienced a dramatic rise and fall with its stock price either side of the new millennium, becoming one of Canada’s most high-profile victims of the dot-com crash.

The Rise and Fall of Nortel between 1999 and 2000

| S&P/TSX Composite, December 31, 1998–December 31, 1999 (%) | |||

| Issue Name | Average Portfolio Weight | Market Return | Contribution to Index Return |

| S&P/TSX Composite | 31.714 | ||

| Nortel Networks | 8.84 | 282.019 | 13.871 |

Source: RBC Capital Markets Quantitative Research.

| S&P/TSX Composite, December 31, 1999–December 31, 2000 (%) | |||

| Issue Name | Average Portfolio Weight | Market Return | Contribution to Index Return |

| S&P/TSX Composite | 7.409 | ||

| Nortel Networks | 23.46 | -33.750 | -19.041 |

Source: RBC Capital Markets Quantitative Research.

In Canada, we haven’t seen a company dominate the main equity index to that extent since then, although there have been other cases of extreme stock price growth and decline over a relatively short period of time.

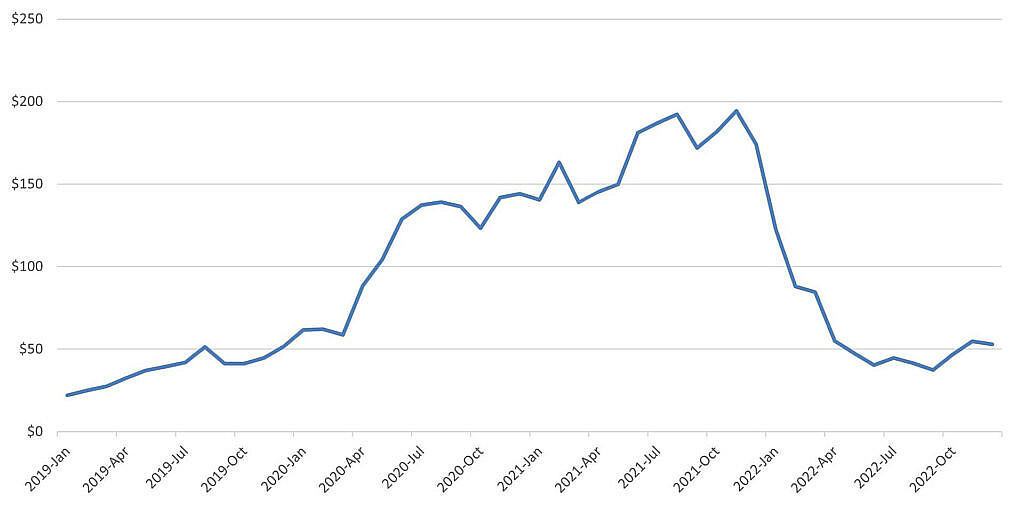

Shopify Inc. (“Shopify”) is the most recent example — the Ottawa based e-commerce powerhouse was the undisputed success story of the COVID-19 era as consumers and businesses shifted to online shopping during the various lockdowns. The company was growing revenue and equity value rapidly even before the coronavirus upended our lives, with an annual return of 48.5% in 2018 and 173.5% in 2019. This continued into the first year of the pandemic with a return of 178.4% in 2020, before slowing to 21.2% for 2021 (source: Refinitiv Eikon).

Such stellar performance saw Shopify become the most valuable publicly listed company in Canada, accounting for approximately 6.4% of the index at the end of 2021. At that time, expectations for revenue growth were high and the company’s valuation followed as Shopify traded at over 50x forecast sales and almost 300x forecast EBITDA. (Source: Capital IQ 2021)

Then came a painful 2022 for the company and a stock decline of 73% over the year; having ended 2021 as the top listing for market cap in the index, it sat in 10th place at the end of 2022. This reversal of fortunes for Shopify has naturally brought comparisons with Nortel. The prospects for Shopify now are different than what Nortel faced in 2001, of course, but what is analogous between the two firms is a market valuation that was so aggressive, it left little margin of safety for investors.

Shopify’s Steep Ascent and Descent During the Pandemic

| S&P/TSX Composite, December 31, 2019–December 31, 2020 (%) | |||

| Issue Name | Average Portfolio Weight | Market Return | Contribution to Index Return |

| S&P/TSX Composite | 5.50 | ||

| Shopify | 5.02 | 178.38 | 4.70 |

Source: Refinitiv Eikon.

| S&P/TSX Composite, December 31, 2021–December 31, 2022 (%) | |||

| Issue Name | Average Portfolio Weight | Market Return | Contribution to Index Return |

| S&P/TSX Composite | -5.85 | ||

| Shopify | 2.42 | -73.01 | -4.49 |

Source: Refinitiv Eikon.

Identifying Intrinsic Value

Shopify’s success from 2018 to 2021, like Nortel’s run from 1999 to 2000, was instrumental to the overall strength of the main Canadian equity index and was an important factor in Growth investing generally proving more in favour than Value investing during those periods.

At Beutel Goodman, we are Value investors at our core. Our investment process is built upon identifying quality companies we believe are trading at a significant discount to their intrinsic business value, which we view as the present value of a business’s future free cash flow generation. While Shopify has increased its revenue rapidly since launching in 2006, it has invested heavily to do so, and has persistently generated negative cash flow. Following our disciplined investment process, this makes it difficult to assess the intrinsic value of the company. In addition, we are currently unable to assess the business’ sustainable operating margins, given its rapid growth and changes in its business model, as well as the rapidly shifting competitive landscape.

Exhibit 2. Shopify Share Price 2019–2022. Shopify was the success story of the first two years of the pandemic, which saw it become the most valuable company by market cap on the TSX.

Source: Refinitiv Eikon

Shopify’s woes in 2022 were part of a wider slump in the tech space, similar to what we saw with the Tech Wreck of 2000. On both occasions, valuations became extreme as investors chased growth at any price, the cost of capital was virtually free for high-revenue growth companies, and there was a general disregard for sustainable positive earnings.

Ultimately, the value of a business requires a sustainable economic advantage, as it depends on the prospects for free cash flow generation. Following the collapse of Nortel, with the firm’s valuation down 70% from its peak, Beutel Goodman invested in the company at what we then assessed was an attractive valuation, only to later find its competitive advantage was gradually eroding. During the early years of the new millennium, Nortel and other telecom equipment providers faced a combination of the loss of intellectual property to competitors and the rapid decline of capital spending on fibre-optic cable for networks, which undermined their business. Nortel was therefore unable to sustain its competitive advantage and later filed for bankruptcy. It was an important lesson for us.

Nortel isn’t the only example of a Growth company rising to the top of the TSX, only to experience a rapid descent soon after. Research In Motion (RIM), the creator of the once ubiquitous BlackBerry, became the most valuable company on the TSX in 2007, but its time at the top was short lived. RIM was regarded as a great innovator, but intense competition and rapid changes in technology meant other firms such as Apple and Samsung eventually displaced it to become industry leaders in smartphones. This was not only a problem for RIM; at that time, firms such as Nokia and Motorola also lost their once-dominant market share.

Valeant Pharmaceuticals is another case of pole position on the TSX leading to a sharp decline. The Quebec-based firm went on a series of debt-fueled acquisitions and ascended to the top of the index mid-way through 2015, peaking at close to $350 per share, before becoming embroiled in a series of corruption scandals that ultimately saw it lose approximately 90% of its value over a two-year period. The damage to the company’s reputation was so severe, it eventually rebranded as Bausch Health Companies Inc. in 2018.

In contrast to our experience with Nortel, we have never held Shopify, RIM or Valeant in our portfolios, which, in part, is based upon our experience that aggressive valuations are problematic and leave little margin of safety for investors.

Valuation and Business Sustainability Always Matters

Up until 2022, the period following the Global Financial Crisis (GFC) was characterized by historically low interest rates — this was an important factor driving valuations higher across the index, and Growth stocks generally outperforming Value. Central banks were comfortable keeping rates low to stimulate the economy/markets because inflation wasn’t a concern, but clearly this isn’t the case anymore. In a higher interest-rate environment, the question of Value versus Growth is being raised again, but that debate is often overly simplistic in our view.

From our perspective, valuation always matters over the long term. For us, the “margin of safety” in investing is based on owning sustainable high-quality businesses at a discount to their assessed intrinsic value. Investing in undervalued securities and preserving capital is key for effectively compounding capital over the long term. No one can know whether Value will outperform Growth, but given the valuation gap that has existed recently between the two investment styles, as well as recent capital losses for investors who have paid high prices for potential growth, we believe this environment is likely to remain constructive for Value investing.

Looking at the broader picture, the most difficult time to invest is when uncertainty increases, such as when investors are concerned about macro issues like a recession. Uncertainty usually drives lower valuations, however, leading to higher potential future returns. The opposite is true when there is high conviction about the prospects for businesses or the overall market and valuations usually rise — this means the potential for future investment returns is usually lower.

At Beutel Goodman, we use a long-term time horizon (approximately three years) and invest as owners of a business. We cannot predict short-term moves in the market; instead, we aim to take advantage of market pessimism that may cause the businesses we find attractive to be undervalued versus our assessment of intrinsic value. We seek out companies with strong fundamentals (defined by sustainable free cash flows, high returns, financial flexibility via under-leveraged balance sheets, and strong management alignment). History has taught us that even the highest-flying market leaders can find themselves in a downward spiral that can be hard to reverse. Our investment process and goal at Beutel Goodman is to compound investor capital efficiently, while controlling the risk of capital loss. We do not waver from this process and goal, whether Value or Growth are in favour, or a flavour of the month/year is driving the performance of an index.

Download PDF

Related Topics and Links of Interest

©2023 Beutel, Goodman & Company Ltd. Do not sell or modify this document without the prior written consent of Beutel, Goodman & Company Ltd. This commentary represents the views of Beutel, Goodman & Company Ltd. as at the date indicated.

This document is not intended, and should not be relied upon, to provide legal, financial, accounting, tax, investment or other advice.

Certain portions of this report may contain forward-looking statements. Forward-looking statements include statements that are predictive in nature, that depend upon or refer to future events or conditions, or that include words such as “expects”, “anticipates”, “intends”, “plans”, “believes”, “estimates” and other similar forward-looking expressions. In addition, any statement that may be made concerning future performance, strategies or prospects, and possible future action, is also forward-looking statement. Forward-looking statements are based on current expectations and forecasts about future events and are inherently subject to, among other things, risks, uncertainties and assumptions which could cause actual events, results, performance or prospects to be incorrect or to differ materially from those expressed in, or implied by, these forward-looking statements.

These risks, uncertainties and assumptions include, but are not limited to, general economic, political and market factors, domestic and international, interest and foreign exchange rates, equity and capital markets, business competition, technological change, changes in government regulations, unexpected judicial or regulatory proceedings, and catastrophic events. This list of important factors is not exhaustive. Please consider these and other factors carefully before making any investment decisions and avoid placing undue reliance on forward-looking statements Beutel Goodman has no specific intention of updating any forward-looking statements whether as a result of new information, future events or otherwise.