By Beutel Goodman’s Fixed Income Team

The bond story for 2022 can largely be separated into two parts. The first half of the year saw a historically severe sell-off as central banks began an aggressive rate-hiking cycle due to runaway inflation. This was followed by an easing in the second half of the year as inflation started to peak and markets stabilized. The performance of the FTSE Canada Universe Bond Index (“Index”) during 2022 reflects this, with a decline of 12.23% in the first six months of the year and a positive return of 0.62% in the second half. However, even with the small snapback in the second half of the year, 2022 was one of the worst years for bond markets in a long time, with the Index posting a total return of -11.69% for the 12-month period. As such, we have refreshed our thinking on our “Are Bonds Dead?” thesis that we have written about in the past.

The 2022 Hiking Cycle

Inflation levels reached a four-decade high midway through 2022, prompting central banks to commit to the most aggressive interest-rate-hiking cycle since the 1980s, with the U.S. Federal Reserve (Fed) and the Bank of Canada (BoC) raising rates by 425 and 400 basis points (bps), respectively, in the period. Given the scale of the rate increases over a relatively short period of time, it is expected that both the Fed and the BoC will pause their hiking cycle early in 2023. Consequently, bond markets have priced in terminal rates of 5% for the U.S. and 4.50% for Canada. The extent of these measures and the speed with which they were implemented now has many economists predicting a recession in 2023.

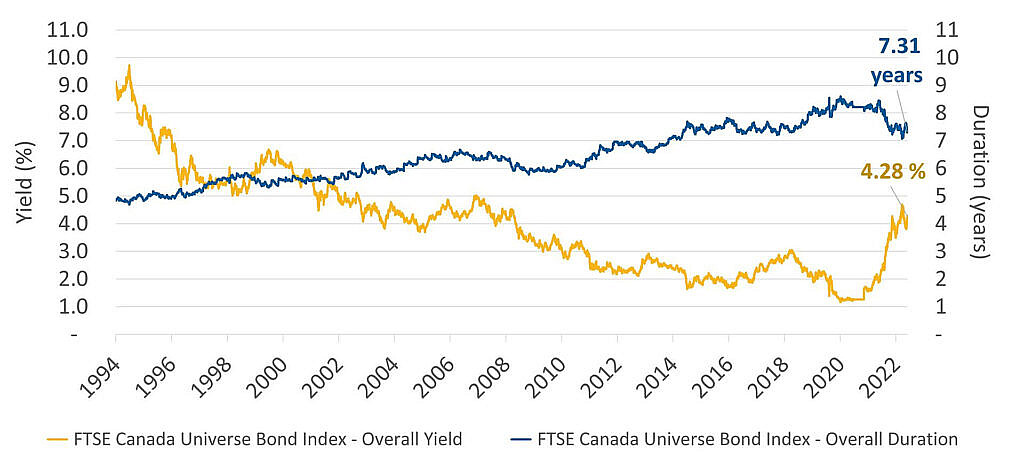

The initial rate hikes in early 2022 caused bond markets a great deal of pain as fixed income markets readjusted; however, the prospects for fixed income investors appear to have improved significantly since then. Bond yields are now much higher than what became the norm after the Global Financial Crisis (GFC). An additional benefit to rising interest rates is that they lower the duration, or interest rate sensitivity, of bonds. Fixed income indices now have the most attractive yield-versus-duration profile since the mid-2000s (Exhibit 1).

Exhibit 1: FTSE Canada Universe Bond Index—Yield and Duration

This line graph shows yield and duration for the main Canadian fixed income index, the FTSE Canada Universe Bond Index. Duration measures how sensitive a bond’s price is to fluctuations in the interest rate. The higher the duration, the riskier the bonds (all else being equal), while lower durations reduce the bonds’ sensitivity to interest rate fluctuations.

Source: Beutel Goodman, Macrobond, FTSE Global Debt Capital Markets, as at December 31, 2022.

The Case for Bonds

Not only has the yield and duration risk/reward improved in 2022, but bonds generally provide income exceeding that of equities. This is evidenced by the yield of 5-year “A” and “BBB” rated corporate bonds, which, at 4.87% and 5.23%, respectively, exceeded the S&P/TSX Composite Index’s (“TSX”) dividend yield of 3.28% as at December 31, 2022 (Exhibit 2). Normally, the dividend on equities would reflect the additional risk that comes with owning stocks versus owning bonds, but as rates have spiked over the last year, this no longer seems to be the case.

Exhibit 2: TSX Dividend Yield vs. 5-Year Corporate Bond Yields

This line graph shows the 12-month gross dividend per share of the S&P/TSX Composite Index versus 5-year “A” and “BBB” rated corporate bonds from 2011 to December 31, 2022. As at December 31, 2022, the dividend yield of the TSX is 3.28%, vs. a yield of 4.87% for Canadian “A” rated 5-year corporate bonds and 5.23% for “BBB” rated 5-year corporate bonds. Throughout most of 2022, the yield gained by investors moving from equities into bonds was the highest it has been since 2011.

Source: Beutel Goodman, Macrobond, Bloomberg L.P., as at December 31, 2022.

Dividends are only part of an equity security’s potential return, of course, but when looking at the overall earnings yield for the TSX, bond yields remain attractive on a risk-adjusted basis, especially compared to the previous decade, when the disparity between stock and bond yields was so pronounced.

In Exhibit 3 you can see that investment-grade debt is currently providing an annual yield that is close to the earnings yields of various indices (the earnings yield is the inverse of the more well-known price/earnings ratio). This means that an investor interested in generating income could possibly reduce the risk profile of their portfolio by using bonds, without sacrificing significant yield.

Exhibit 3: Bond Yields Across the Ratings Spectrum Versus the TSX

This table shows how bond yields across different tenors are providing yields that are approaching the earnings yields of equity indices. The most attractive investment-grade bonds from a yield perspective can be found in ”BBB” rated debt.

| S&P 500 Earnings Yield | TSX Earnings Yield | TSX ex. Financials Earnings Yield | Tenor | Sr. Bank Debt | Telco | “A” Rated | “BBB” Rated |

| 5.50% | 7.91% | 6.40% | 2 year | 4.99% | 4.99% | 5.02% | 5.39% |

| 5 year | 5.42% | 4.88% | 4.87% | 5.23% | |||

| 7 year | n.a. | 5.03% | 4.86% | 5.25% | |||

| 10 year | n.a. | 5.28% | 4.90% | 5.37% |

Source: Beutel Goodman, Macrobond, Bloomberg L.P., as at December 31, 2022.

In our view, the case for bonds is much stronger today than for most of the post-GFC period. After the financial crisis, monetary policy remained fairly accommodative for a lengthy period. This was amplified during the COVID-19 pandemic as central banks combined quantitative easing with historically low interest rates to support the fiscal spending of governments across the globe. As the threat of a global economic contagion was considerable in the early days of COVID-19, significant stimulus measures were deemed necessary to avoid a crash. Debate has since ensued as to whether the stimulus went too far, leading to the inflation problems we are now seeing in the economy.

The Inflation Question

In our view, the key questions for markets now are: “When will the central banks stop tightening?” and “What does that mean for the interest rate outlook?”

The BoC indicated in its latest monetary policy announcement that it will likely be pausing hikes for a period of time. The Fed, meanwhile, hiked by a moderated rate of 25 bps on February 1, although Fed Chair Jerome Powell noted at the subsequent press conference that, while the growth has slowed, the labour market remains extremely tight and inflation too high. Thus, further rate hikes are expected in the U.S. In Canada, the Consumer Price Index (CPI) rose 6.3% year over year in December, down from 6.8% in November (source: Statistics Canada). In the U.S., the CPI rose 6.5% year over year in December, down from 7.1% in November (source: U.S. Bureau of Labor Statistics). The headline CPI number has been steadily tracking downward in both countries since peaking in June, but this appears to be largely attributable to the decline in oil prices. Core inflation, meanwhile, remains stubbornly high.

Our base case is that 2023 could be the year of the pause. Markets are currently pricing in a series of cuts in 2023 after the rate hiking cycle ends. We do not believe that this is likely, though. Central banks have historically tended to reverse course immediately when an asset bubble has burst or when tightening has led to a credit event such as the Asian currency crisis. It is our view that neither scenario is likely this time around, as we appear to be in a business cycle rather than a credit cycle – and business cycles typically end in a recession. As a result, we believe that fixed income will likely resume its role as a safe-haven during an impending economic slowdown. A further case for bonds is that, under our base case scenario, the worst of the increases in interest rates (and decline in bond prices) is likely over.

Return to Balance

Traditionally, bonds have been viewed as a buffer to equity market volatility, as bonds and stocks have historically been inversely correlated. In 2022, however, bonds did not live up to this expectation, causing some to question the 60/40 balanced portfolio. Going forward, we expect this asset class to once again provide a hedge against scenarios such as recession and any subsequent correction in equity markets (Exhibit 4).

Exhibit 4: Estimated 12-month Total Return for FTSE Canada Universe Bond Index, Assuming a Parallel Shift in Interest Rates

This table shows the estimated 12-month total return from carry and price change of the FTSE Canada Universe Bond Index for a given move in yields. Yield changes are assumed to be parallel across the curve and are based on index duration and yield as at January 13, 2023.

| Change in Index Yield | Index Yield | Average Carry | Capital Gain/(Loss) | Expected Return |

| +100 bps | 5.27% | 4.77% | -7.3% | -2.5% |

| +50 bps | 4.77% | 4.52% | -3.7% | 0.9% |

| +25 bps | 4.52% | 4.40% | -1.8% | 2.6% |

| +10 bps | 4.37% | 4.32% | -0.7% | 3.6% |

| +0 bps | 4.27% | 4.27% | 0.0% | 4.3% |

| -10 bps | 4.17% | 4.22% | 0.7% | 5.0% |

| -25 bps | 4.02% | 4.15% | 1.8% | 6.0% |

| -50 bps | 3.77% | 4.02% | 3.7% | 7.7% |

| -100 bps | 3.27% | 3.77% | 7.3% | 11.1% |

Source: Beutel Goodman. Note: this analysis is for illustrative purposes only and is not indicative of future returns. Calculations as at December 31, 2022.

GICs and the Importance of Remaining Liquid

Another point in their favour is that bonds are liquid, which is a benefit that sets them apart from most GICs. The guaranteed income of a GIC can be alluring given the different market and economic headwinds we are facing; however, it must be noted that that periods of volatility have the potential to create significant investment opportunities. Having assets locked in (as is the case with a GIC) means not being able to take advantage of those potential opportunities as they present themselves, whether they are in the stock or bond market.

Positioning

Within our own portfolios, we began 2023 with a neutral to marginally long duration positioning, and agree with the markets’ pricing of terminal rates. In the credit space, we are positioned defensively, with a focus on safe-haven assets such as Utilities and Infrastructure, as well as Canadian banks. Spreads are likely to continue to widen if we enter a recession and our experienced credit research team will seek to take advantage of pockets of value, should they emerge.

The beginning of 2022 undoubtedly tested the resolve of bond investors, but that experience, rough as it was, looks to have paved the way for a potentially brighter fixed income world in 2023.

Download PDF

Related Topics and Links of Interest:

- This Time is Different: No Monetary Safety Net for Markets in 2023

- Truss Me, I Don’t LDI—Global Lessons from a U.K. Omnishambles

- The Risky Business of a Hiking Cycle

- Beutel Goodman Core Plus Bond Fund

©2022 Beutel, Goodman & Company Ltd. Do not sell or modify this document without the prior written consent of Beutel, Goodman & Company Ltd. This commentary represents the views of Beutel, Goodman & Company Ltd. as at the date indicated.

This document is not intended, and should not be relied upon, to provide legal, financial, accounting, tax, investment or other advice.

Certain portions of this report may contain forward-looking statements. Forward-looking statements include statements that are predictive in nature, that depend upon or refer to future events or conditions, or that include words such as “expects”, “anticipates”, “intends”, “plans”, “believes”, “estimates” and other similar forward-looking expressions. In addition, any statement that may be made concerning future performance, strategies or prospects, and possible future action, is also forward-looking statement. Forward-looking statements are based on current expectations and forecasts about future events and are inherently subject to, among other things, risks, uncertainties and assumptions which could cause actual events, results, performance or prospects to be incorrect or to differ materially from those expressed in, or implied by, these forward-looking statements.

These risks, uncertainties and assumptions include, but are not limited to, general economic, political and market factors, domestic and international, interest and foreign exchange rates, equity and capital markets, business competition, technological change, changes in government regulations, unexpected judicial or regulatory proceedings, and catastrophic events. This list of important factors is not exhaustive. Please consider these and other factors carefully before making any investment decisions and avoid placing undue reliance on forward-looking statements Beutel Goodman has no specific intention of updating any forward-looking statements whether as a result of new information, future events or otherwise.