The COVID-19 pandemic is now entering its second year. The world has been in some form of lockdown for a year now. Worldwide, almost 117 million people have contracted the virus as at March 8, 2021, and nearly 2.6 million have died. In this report, we look back on the economic transformation that has occurred over the last year, discuss the possible future of the pandemic and consider how assets should perform under different scenarios in the months ahead.

For this analysis, we break down the scenarios into three discrete possible outcomes: the Good, the Bad and the Ugly.

Before we get into the scenarios, however, we note that the recovery is shaping up to be one unlike that of previous recessions. This recession has not been driven by asset bubbles, there has been no excess buildup of debt, and inflation remained well-behaved. The economy came to a dead stop based on a virus. As a result, the recovery could be very swift, with strong GDP growth unleashed by pent-up consumer spending fueled by excess stimulus. So really what we review below is the potential speed of the recovery, not the recovery itself. This is important, as it will likely determine whether stock and bond markets are ahead of themselves in what they expect to happen and when.

The Real Economy

The Canadian economy has seen some major transformations over the last year.

| COVID by the Numbers | ||

| Human cost | Comments | |

| Total Cases: Canada per 1M pop. | 22,634 | As of February 28 2021 |

| Total Cases: U.S. per 1M pop. | 85,433 | |

| Mortality: Canada per 1M pop. | 576 | |

| Mortality: U.S. per 1M pop. | 1,537 | |

| Vaccines: Canada per 1M pop. | 49,580 | |

| Vaccines: U.S. per 1M pop. | 228,132 | |

| Stimulus | Comments | |

| Fiscal: Canada Net Debt Increase | 20.5% | Net Debt, IMF Fiscal Monitor, Percent of GDP from Q4 2019 to Q4 2020 |

| Fiscal: U.S. Net Debt Increase | 22.7% | |

| Monetary: Canada Chg in O/N Rate | -1.50% | From March 2020 |

| Monetary: U.S. Chg in O/N Rate | -1.75% | From March 2020 |

| Markets | ||

| S&P/TSX | 8.0% | YoY Percent Chg (Feb 28 2021) |

| S&P 500 Return | 30.2% | YoY Percent Chg (Feb 28 2021) |

| Canada 10-year Bond Yield | +32 bps | YoY Change in yield (Feb 28 2021) |

| U.S. 10-year Bond Yield | +31 bps | YoY Change in yield (Feb 28 2021) |

| Economy | ||

| Canada GDP from peak | -3.2% | Peak GDP to Q4 2020 |

| U.S. GDP from peak | -2.4% | Peak GDP to Q4 2020 |

| Canada Job Loss from peak | -858,300 | Peak Employment to Jan 2021 |

| U.S. job Loss from peak | -9,475,000 | Peak Employment to Feb 2021 |

| Canada: Appreciation of Housing | 5.4% | YoY Change (to Jan 2021) |

Source: Beutel, Goodman & Company Ltd., WHO, Our World in Data, Macrobond, StatCan, BLS, IMF, TMX, SPDJI, BoC, Fed, U.S. Department of Treasury

Gross Domestic Product (GDP)

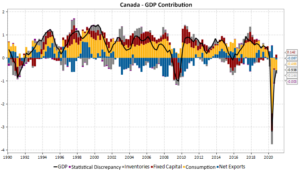

GDP in Canada fell almost entirely due to Consumption. Historically, Consumption has remained stable through the economic cycle; typically Inventories and Fixed Capital have driven recessions. This time, lockdowns prevented people from consuming goods and services, making this recession unique. Looking forward, we expect Consumption to rebound as the economy begins to open and the excess savings that occurred in 2020 are released into the economy.

Figure 1 depicts the nominal GDP quarterly contributions by sector to annual growth (smoothed) from 1990 to February 28, 2021 for Canada. Unlike prior recessions, the COVID-19 recession was driven by a drop in consumption.

Source: Beutel Goodman & Company Ltd., Macrobond, StatCan, as at March 9, 2021

Labour Market

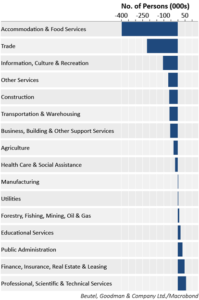

The sectors of the Canadian labour market that were hit hardest over the last year were those most affected by the lockdowns, such as Trade and Accommodation & Food Services.

While employment fell over the year, the fiscal stimulus measures were net positive. Household disposable income and net worth increased to new highs for all income and age groups as a result of the stimulus cheques. We believe this increase in wealth and income should help accelerate growth in 2021 and bring back output to pre-pandemic levels.

Figure 2 depicts the employment changes of the different sectors of the Canadian economy over the pandemic year. The graph shows that sectors most affected by lockdown measures were more severely hit. Accommodation & Food Services and Trade saw the largest negative changes over the year, while Professional, Scientific & Technical Services and Finance, Insurance, Real Estate & Leasing saw the largest positive changes.

Source: Beutel Goodman & Company Ltd., Macrobond

Inflation

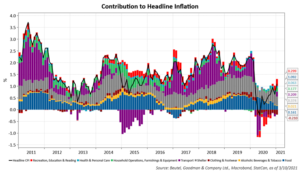

The consumer price index (CPI) inflation measure in Canada fell over the year, due to decreasing inflation in most sectors, but in large part due to the highly cyclical transportation costs and to a lesser degree to the Clothing and Recreation sectors, where demand fell due to the lockdown. We expect these sectors to rebound with the recovery and do not expect inflation to rise too aggressively as overall GDP production remains below potential.

Figure 3 is a line graph that depicts the contribution to Canadian headline inflation by sector between 2011 and February 28, 2021. The graph shows that Transportation was the primary driver of weaker inflation over the pandemic year, followed by clothing & footwear and Recreation, Education & Reading.

Source: Beutel Goodman & Company Ltd., Macrobond, StatCan, as at March 1, 2021

Yield Curve

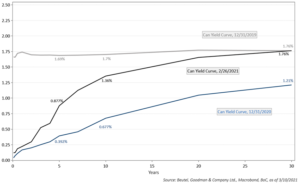

Prior to the pandemic, the yield curve was flat as the Bank of Canada (BoC) was in a tightening cycle and the economy was near full capacity. Once the pandemic arrived and put the economy on pause, the BoC reduced rates to near zero and began buying bonds (quantitative easing) to provide stimulus. This caused yields along the entire yield curve to fall. Since then, the long end of the curve, which is less determined by the BoC and more driven by inflation and growth potential, has returned to pre-pandemic levels, while the front end of the curve remains pinned to the BoC, which is still in easing mode.

Figure 4 is a line graph that depicting the yield curve in Canada at various points in time (i.e., December 31, 2019, December 31, 2020 and February 26, 2021). The graph shows that the long end of the curve has returned to pre-COVID-19 levels of about 1.76% (from 1.21% on December 31, 2020), as expectations of inflation and real growth return.

Source: Macrobond; updated as at March 3, 2021

Credit Spreads

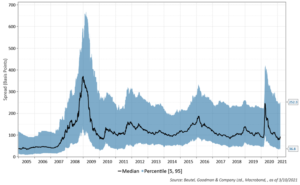

Credit spreads in Canada and globally widened in response to pandemic fears and global lockdown measures in the most significant credit-spread-widening event since the Global Financial Crisis. The indiscriminate credit-spread widening presented an opportunity to initiate positions in credit securities that our deep research and analysis found attractive, but that had previously been fully valued. We were also able to put our contrarian hats on and initiate positions in strong companies in depressed and unloved sectors such as Energy and Airlines. As central banks and governments turned on the fiscal and monetary taps in unprecedented fashion, credit spreads rallied into year-end. In most sectors, credit spreads are back to or through pre-pandemic levels. We believe the background for credit remains constructive, with the economy poised to re-accelerate. However, we remain wary of Merger & Acquisition risk and companies that may have over-levered in a low-interest-rate environment.

Figure 5 is a graph depicting Canadian 5-year corporate bond spreads and dispersion of issuers, from 2005 to 2021. The graph shows corporate spreads have returned to pre-COVID-19 levels, but dispersion is still wide as certain sectors and issuers future risk remains in question.

Source: Beutel, Goodman & Company Ltd., Macrobond, as at March 9, 2021

The Good – Vaccine and Herd Immunity by End of 2021 (High Probability)

The most optimistic of our three cases is the one where vaccine roll out and a return to normal occurs by the end of 2021. We currently believe the probability of this outcome is the highest of the three.

At this time, the vaccine rollout is accelerating, and new types of vaccines continue to be approved. According to U.S. news, it will have enough supply to vaccinate the entire country by the end of May and will continue to administer them. Canada’s vaccination program has been slowed by lack of supply and a patchwork of disjointed provincial government rollout plans; however, expectations are for vaccinations to ramp up quickly in the upcoming months.

As the COVID-19 vaccine rolls out globally, it is important to highlight that this is not the first time we have seen a global effort to eradicate a virus. The World Health Organization (WHO) in 1967 began a massive international search for smallpox outbreaks, and by 1980 smallpox was certified by the WHO to be eliminated. Polio, measles, tetanus, and mumps are also illnesses that have fallen victim to vaccines, and though not completely eradicated, remain well under control.

If the COVID-19 vaccines work as planned, we could reach herd immunity in the developed world by the end of 2021. This is mostly what the markets are pricing in as rates sold off dramatically in February, driven partially by expectations of excess fiscal stimulus in the U.S. and that a return to normal, sooner rather than later, would push forward economic growth.

If this scenario plays out, we could see interest rates continue to rise and the yield curve to eventually flatten, as expectations of higher overnight rates get pulled forward. In credit, sectors severely affected by COVID-19 should outperform as should cyclical assets.

The Bad – Slower rollout; Vaccine and Herd Immunity in 2022 (Medium-Low Probability)

A slightly less positive outcome is possible if the rollout takes longer than expected. Governments are not typically known for their ability to work efficiently.

We continue to monitor the rollout of vaccines and believe that this scenario would cause risk assets to sell off, interest rates to fall and the yield curve to steepen. If this were to occur, it would provide, in our opinion, a buying opportunity for risk assets and an opportunity to renew a short-duration position.

In this scenario, we would still reach herd immunity; however, the timing is extended further out, pushing economic liftoff into 2022.

The Ugly – Virus Variations; Vaccine and Herd Immunity Indefinite (Low Probability)

The worst scenario would be the emergence of a severe variant of the virus that is more transmittable and deadly and is resistant to the vaccines. While some variants are springing up, they appear thus far to be contained and manageable. Furthermore, the world is very attuned to these variants, and technology and systems continue to improve the monitoring of the outbreaks and plan to adjust the responsiveness of vaccines.

If this scenario were to occur, we would likely see the same response in markets that occurred during the first wave, where corporate spread widened, and Treasury yields rallied. However, we currently place a low probability on this scenario.

Portfolio Positioning

Our portfolios and current views are mostly aligned with the “good” outcome, though we have slightly reduced our exposure to risk assets and closed out our short-duration position as rates now appear to be stretched. We will look for any widening in spread products to increase our exposure in risk assets. We are also diligently debating and analysing the yield curve and may view any back-up in yields as an opportunity to re-initiate our short-duration position.

The term vaccine is derived from the Latin word vaccinus, meaning of, or derived from a cow. It got its name from the first vaccine, designed by Edward Jenner, who in 1798 inoculated an eight-year-old boy with matter from a cowpox sore on a milkmaid’s hand. Cowpox is a variant of the smallpox virus family, and consequently protected the boy from smallpox. Thus began the age of the vaccine.

Download PDF

Related Topics and Links of Interest

- Central Banks – The Cause and Solution to Bubbles?

- Economic, Interest Rate and Credit Outlook 2021

- Beutel Goodman mutual funds

©2021 Beutel, Goodman & Company Ltd. Do not sell or modify this document without the prior written consent of Beutel, Goodman & Company Ltd. This commentary represents the views of Beutel, Goodman & Company Ltd. as at the date indicated.

This document is not intended, and should not be relied upon, to provide legal, financial, accounting, tax, investment or other advice.

Certain portions of this report may contain forward-looking statements. Forward-looking statements include statements that are predictive in nature, that depend upon or refer to future events or conditions, or that include words such as “expects”, “anticipates”, “intends”, “plans”, “believes”, “estimates” and other similar forward-looking expressions. In addition, any statement that may be made concerning future performance, strategies or prospects, and possible future action, is also forward-looking statement. Forward-looking statements are based on current expectations and forecasts about future events and are inherently subject to, among other things, risks, uncertainties and assumptions which could cause actual events, results, performance or prospects to be incorrect or to differ materially from those expressed in, or implied by, these forward-looking statements.

These risks, uncertainties and assumptions include, but are not limited to, general economic, political and market factors, domestic and international, interest and foreign exchange rates, equity and capital markets, business competition, technological change, changes in government regulations, unexpected judicial or regulatory proceedings, and catastrophic events. This list of important factors is not exhaustive. Please consider these and other factors carefully before making any investment decisions and avoid placing undue reliance on forward-looking statements Beutel Goodman has no specific intention of updating any forward-looking statements whether as a result of new information, future events or otherwise.