Summary

This piece looks at the “Behaviour Gap” that can often hinder investors, how missing a relatively small number of the markets’ best days can significantly impair investment performance, as well as some of the reasons why Beutel Goodman’s investment approach is focused on the long term.

Long-term investing means navigating through changing market cycles. We may wish for clear sailing along the way, but downturns are a natural part of the market cycle. That was certainly the case in 2022, when a hawkish shift by the U.S. Federal Reserve (Fed) and the Bank of Canada (BoC) led to heightened market volatility and annual returns of -5.84% for the S&P/TSX Composite Index and -18.11% for the S&P 500 Index.

Both indices recovered some of that lost ground in 2023, but with inflation still a significant concern for central banks worldwide, rate hikes and the associated turbulence that usually occurs when rates change could still materialize later in the year.

Historically, periods of high inflation and a tightening cycle by the Fed and its peers have foreshadowed an economic contraction. Recessions, however unwanted, are inevitable as the business cycle moves between expansion and contraction.

As investors, we believe that it is important to remain calm during periods when markets trend downwards and economic storm clouds are gathering. This is more difficult than it sounds, as Wade Pfau describes in his book, Safety-First Retirement Planning: An Integrated Approach for a Worry-Free Retirement. According to Pfau, “[f]alling markets can be stress-inducing events as we witness our wealth evaporating at a quick pace. This stress can trigger short-term fight-or-flight mechanisms in our behavior that may have helped to avoid day-to-day dangers on an evolutionary basis, but which are not adapted toward sustaining long-term investment success.”

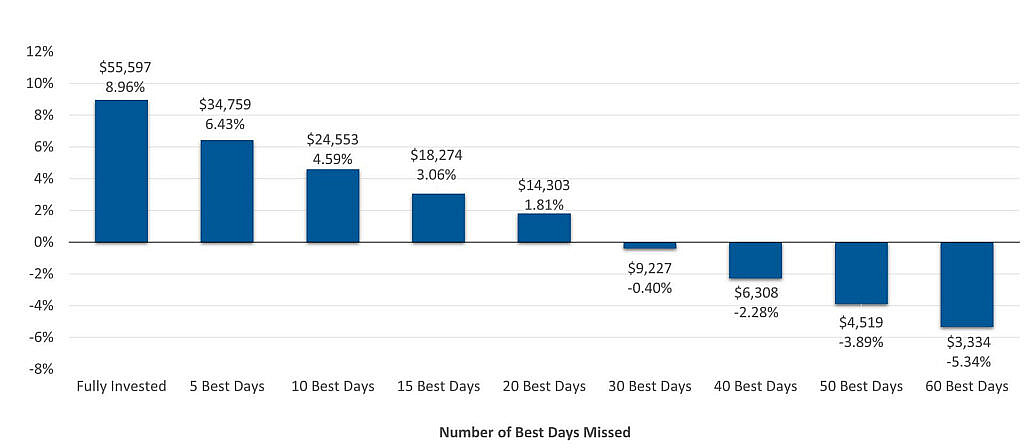

Pfau’s theory appears to be supported by the hypothetical “missing out” scenarios in Exhibit 1 that suggest that short-term thinking is typically incongruous with achieving long-term success in an investment portfolio.

Exhibit 1: Importance of Staying Invested. In the following graph, the implications of not being fully invested on the market’s best-performing days is quantified on a hypothetical basis. The results show a significant difference between staying fully invested in the S&P 500 over an approximate 20-year period as compared to not being fully invested during the index’s best-performing days.

Source: Rimes, converted from USD to CAD using WM Reuters spot rates.

Note: This graph depicts hypothetical return scenarios for not being invested during the S&P 500 Index’s best-performing days (for the period spanning 2003–2022). The rate of return is used only to illustrate the effects of the compound growth rate and is not intended to reflect actual past or future values of this index or actual returns on investment.

Beutel Goodman’s Value Investment Process

At Beutel Goodman, a key component of our investment process is identifying quality companies that we believe are trading at a significant discount to their intrinsic business value (we define this as the present value of a business’s future free cash flow generation). Rather than deciding to sell a stock or bond when it declines in price, we can instead use a dip to evaluate whether we believe the company is undervalued. If that is indeed the case, and the firm also meets our high threshold for quality, we can take a contrary position to the market and add a new position or increase the weight of an existing holding in our portfolios.

Since our formation in 1967, Beutel Goodman’s primary goal has been to deliver attractive risk-adjusted returns for our clients, while still protecting their capital during volatile markets.

Achieving what we deem to be the correct risk-reward balance is certainly challenging, given the various factors outside of our control that can impact markets. What we can control is how we respond to market conditions and how we implement our process to select holdings for our portfolios. In that respect, we strive to eliminate the “Behavior Gap” that can often hinder investors.

The Behavior Gap

The term Behavior Gap was coined by financial planner Carl Richards in his book, The Behavior Gap: Simple Ways to Stop Doing Dumb Things With Money, and refers to the difference in returns between an investment and an investor. Richards suggests that investors earn lower returns not because of the investments they choose, but because of the way they use those investments.

This can be explained by the simple fact that humans often make irrational decisions that are motivated by a desire to avoid pain and seek pleasure. This proclivity often leads to short-term thinking, which when applied to investing, can lead to a loss of capital resulting from buying or selling a stock at the wrong time. Just like selling a stock or bond after it experiences a dip in price can be misguided, so too can buying investments as they become more expensive — both scenarios can lead to lower returns.

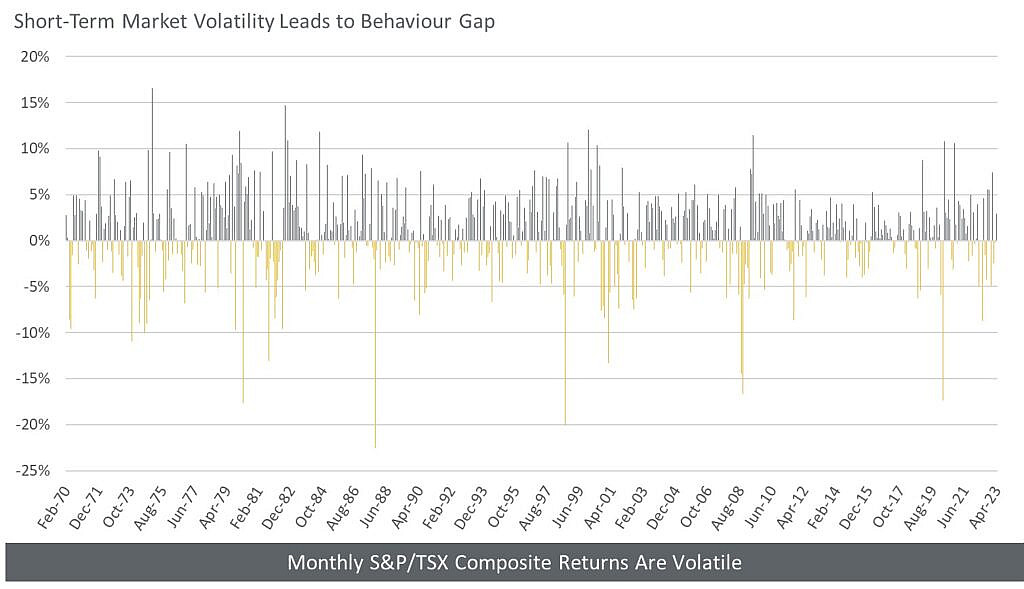

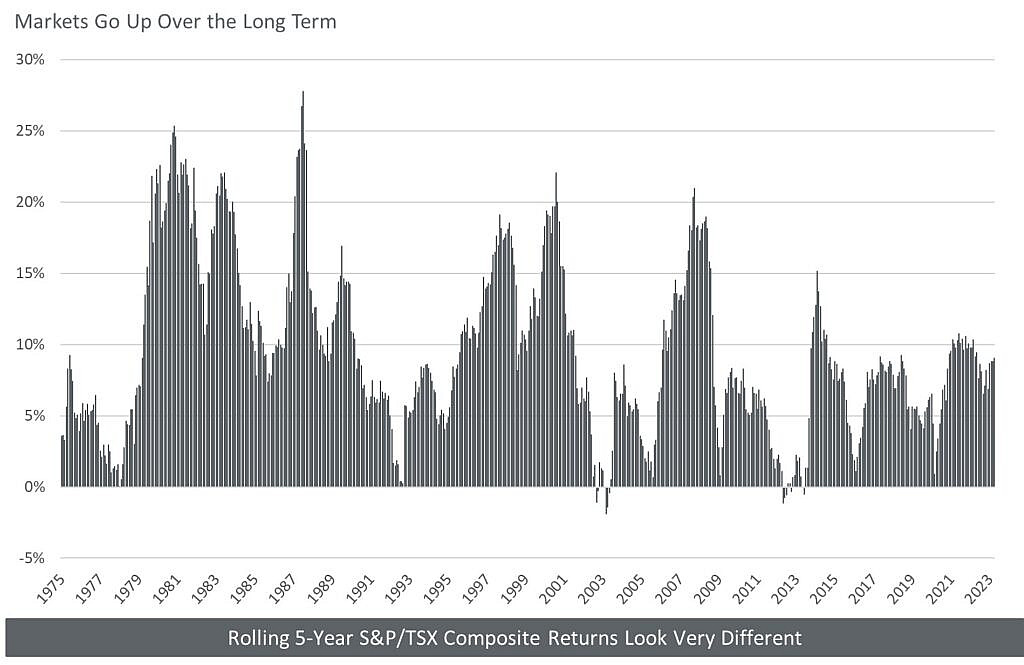

In most cases, taking a long-term approach appears to be the best course of action for an investor, which entails ignoring the short-term volatility that can often characterize equity markets (see Exhibits 2 and 3).

Exhibit 2: How Market Volatility Creates a Behaviour Gap: The graph below illustrates some of the volatility on a month-to-month basis in the S&P/TSX Composite Index over the past five decades.

Source: Morningstar Direct: Monthly Returns of the S&P/TSX Composite Index, February 1970 to March 2023. For illustrative purposes of short-term volatility only.

Exhibit 3: Stability of a Long-Term Approach: The graph below illustrates how the performance of the S&P/TSX Composite Index has been positive for the majority of the past five decades when looking at five-year rolling returns.

Source: Morningstar Direct: Five-year rolling returns of the S&P/TSX Composite Index are based on monthly performance from February 1970 to April 2023. For illustrative purposes of longer-term volatility only.

At Beutel Goodman, we use a long-term time horizon (approximately three years) and invest as owners of a business. This means we seek out companies with strong fundamentals (defined by sustainable free cash flows, high returns, financial flexibility via under-leveraged balance sheets, and strong management alignment). Our goal is to compound investor capital efficiently, while controlling the risk of capital loss. We do not waver from this process, regardless of which investment style is in favour. It is our view that short-term market volatility can mean company fundamentals are being overlooked by market participants in the near term, which provides us with opportunities to invest in high-quality businesses at discounts to their intrinsic value.

Our success as investors comes as a result of decades of experience and our belief that the fundamentals of a company will ultimately dictate its stock performance over the long term. In our view, the best way for investors to limit the Behavior Gap in their portfolios is to stay invested.

Download PDF

Related Topics and Links of Interest

©2023 Beutel, Goodman & Company Ltd. Do not sell or modify this document without the prior written consent of Beutel, Goodman & Company Ltd. This commentary represents the views of Beutel, Goodman & Company Ltd. as at the date indicated.

This document is not intended, and should not be relied upon, to provide legal, financial, accounting, tax, investment or other advice.

Certain portions of this report may contain forward-looking statements. Forward-looking statements include statements that are predictive in nature, that depend upon or refer to future events or conditions, or that include words such as “expects”, “anticipates”, “intends”, “plans”, “believes”, “estimates” and other similar forward-looking expressions. In addition, any statement that may be made concerning future performance, strategies or prospects, and possible future action, is also forward-looking statement. Forward-looking statements are based on current expectations and forecasts about future events and are inherently subject to, among other things, risks, uncertainties and assumptions which could cause actual events, results, performance or prospects to be incorrect or to differ materially from those expressed in, or implied by, these forward-looking statements.

These risks, uncertainties and assumptions include, but are not limited to, general economic, political and market factors, domestic and international, interest and foreign exchange rates, equity and capital markets, business competition, technological change, changes in government regulations, unexpected judicial or regulatory proceedings, and catastrophic events. This list of important factors is not exhaustive. Please consider these and other factors carefully before making any investment decisions and avoid placing undue reliance on forward-looking statements Beutel Goodman has no specific intention of updating any forward-looking statements whether as a result of new information, future events or otherwise.