Summary

The Bank of Canada has cut its policy rate three times in a row and all signs point to the U.S. Federal Reserve moving to reduce rates at its September meeting. In this piece, the Beutel Goodman Fixed Income team considers the implications of lower interest rates for investors, borrowers and the wider economy.

By Beutel Goodman’s Fixed Income Team (as at September 13, 2024)

Monetary policy has been big news in recent years and that’s certainly the case as we reach the end of summer 2024. With inflation levels now much closer to central banks’ targets, attention has turned to policy rate cuts. In early September, the Bank of Canada (“BoC”) reduced the policy rate for the third time in succession (to 4.25%), reflecting ongoing concerns for the Canadian economy.

All eyes are now on the next Federal Open Market Committee (FOMC or Fed) meeting on September 18 and expectations have grown that Fed Chair Jerome Powell will announce a reduction in the key rate, which has remained at a range of 5.25%–5.50% since July 2023.

Given Powell’s comments regarding the Federal Funds target rate at the Jackson Hole symposium[1] in August, it appears to be a case of “how much” and “how quickly” rather than “if” rates will come down in September. In addition to inflation normalizing, economic data has provided the Fed with greater justification to move to a more dovish stance, following the lead of other central banks globally, including the BoC, the European Central Bank and the Bank of England.

Policy makers have broadcast that they are now in the process of determining the level of rate cuts required to move monetary policy out of restrictive territory and hopefully spur economic growth. Canada’s economic performance per capita has been anemic for some time now and the U.S. economy has started to cool after confounding many economists’ predictions for a slowdown.

The Fed still harbours ambitions of achieving the much-discussed “soft landing” for the economy, which historically has proven rare coming out of a tightening cycle. Currently, bond markets are indicating the Fed will cut rates at an aggressive pace. In turn, bond prices have rallied strongly over the summer as yields have declined — the three-month return of the FTSE Canada Universe Bond Index at the end of August was 3.86%, while the Bloomberg U.S. Aggregate Bond Index returned 4.79%. Over the same period (June 1 to August 31, 2024), the Government of Canada two-year bond yield has fallen 85 basis points (bps) to 3.33% and two-year U.S Treasuries have declined 95 bps to 3.92%.

Ahead of the Curve

The bond rally of recent months suggests that policy rate cuts have already been priced into yields. In the U.S. and Canada, the front end of the yield curve remains deeply inverted (mid-term yields are below short term), even as the rest of the curve is steepening. So how many cuts have been priced in? This question is very important to us as bond investors, because it is the gap between our own view and what is priced into markets that provides an opportunity to add value in a portfolio.

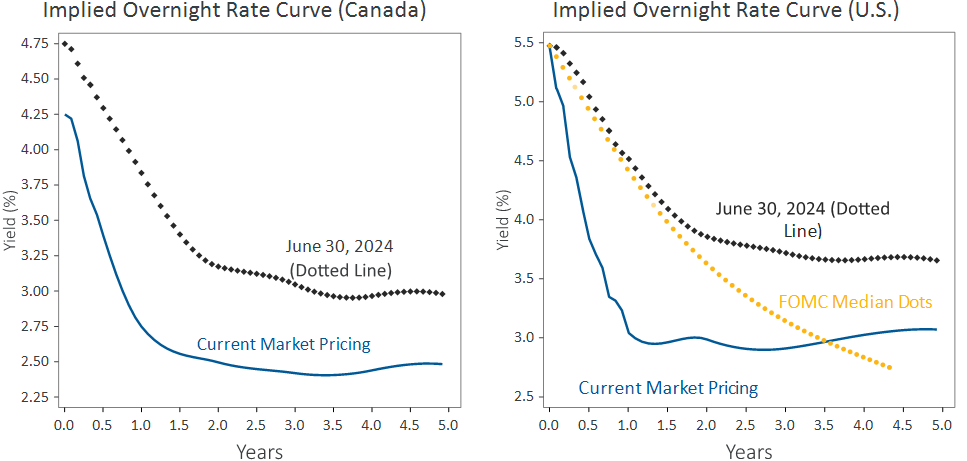

The Overnight Index Swap (OIS)[2] curve is a useful tool, providing guidance on the market’s expectations for the path of central bank policy rates. Exhibit 1 below shows the OIS curves for both Canada and the U.S., with a series of cuts expected in the coming years. In Canada, the market currently expects 1.75% more in rate cuts to reach a terminal policy rate (i.e., the level central banks end their cutting cycle) of 2.50% in the next year and a half. In the U.S., the market expects 2.25% in rate cuts, to reach a terminal policy rate of 3.00–3.25% in the next 12 months.

Exhibit 1: Market Policy Rate Expectations: Canada & the U.S. OIS Curves. The charts below show the OIS curves for Canada and the U.S. with tenors up to five years. The solid blue lines in both charts represent the current market expectations as at September 4 (the date of the latest BoC interest rate cut) and the dotted black lines show the June 30 market pricing. The U.S. chart on the right also shows the current path of the FOMC Summary of Economic Projections (SEP) median Dots curve expectations. Currently, the U.S. and Canadian markets are both pricing in a much more aggressive path of rate cuts in the next 12–18 months than they were pricing in June. In the U.S., the current path of expected hikes is much more rapid than the expectations outlined in the FOMC Median Dots. However, the FOMC Median Dots project a lower terminal rate than the market currently expects.

Source: Beutel, Goodman & Company Ltd, Macrobond, Bank of Canada, Federal Reserve. As at September 4, 2024.

At this stage, the Fed’s cutting of rates is largely considered inevitable, but despite current market projections, the terminal rate is still up for debate.

Estimating the terminal policy rate is a difficult exercise. As a goal post, we can use the neutral rate, which occurs when interest rates are neither accommodative nor restrictive to economic growth. In Canada, the BoC has estimated a long-run neutral rate of approximately 2.75%.[3] Meanwhile, in the U.S., the most recent FOMC Summary of Economic Projections[4] show the median estimate for the longer-run federal funds rate to be 2.75%. This level can be interpreted as the neutral rate communicated by the committee.

These projections of the neutral rate mean the terminal rate will likely be in a similar range in Canada and in the U.S. However, the question of how far above or below neutral the terminal rate will actually be for each country will depend on the path of their respective economies.

If the economy achieves a soft landing (i.e., growth slows but doesn’t collapse into recession), the terminal rate would likely be at or slightly higher than the neutral rate. We estimate that the probability of a soft landing remains within reach in the U.S. It is also possible that the Fed potentially cuts by more than the current neutral rate, which would likely happen if the U.S. economy entered a recession. The U.S. bond market has already fully priced in the Fed’s estimates of a neutral rate; therefore, any additional rally in rates would likely be on the back of a significant growth scare or recession.

In Canada, we estimate a higher likelihood of a recession than in the U.S.; however, the Canadian bond market is already pricing in the probability of this outcome, as evidenced by expectations that the terminal rate will be below neutral. The implication of this is that if the outlook improves, or if central banks don’t reduce rates as much as anticipated, yields across the curve are likely to rise again. This scenario would be painful for bond markets.

We would be remiss not to mention the possibility that central banks could stop cutting rates at a level materially higher than the current neutral rate. At this point, this outcome seems unlikely and would likely only occur if there were reaccelerating price levels or economic growth taking off. Reinflation does not appear to be in the cards, however, as at this point, we have seen a well-established trend of prices normalizing towards central bank targets. The pockets of heat in inflation still remaining in both Canada and the U.S. are in traditionally slow-to-adjust sectors such as shelter; auto insurance premiums and health-care services are also factors in the U.S. In August, Chair Powell even declared that victory was near in the battle against inflation, noting that the central bank has made considerable progress in achieving its primary objective of restoring price stability (source: U.S Federal Reserve).

Myth Busting on Rates

It is important to note that with so much easing already embedded in bond yields, the global economy is beginning to benefit from the impact of lower expected policy rates. However, the full impact of easing will take time. Just as hiking rates took many months to make a mark in 2022 and 2023, the same will likely be true for easing in 2024–2025.

Consumer and corporate lending costs, therefore, are unlikely to fall to the extent many expect. Lending rates for most of these borrowers are based on bond yields, not central bank rates, and bond yields already reflect a significant number of expected cuts. In addition, periods when central banks reduce rates normally signal that all is not well in the economy, with recessions typically beginning a few months after central banks start cutting rates.

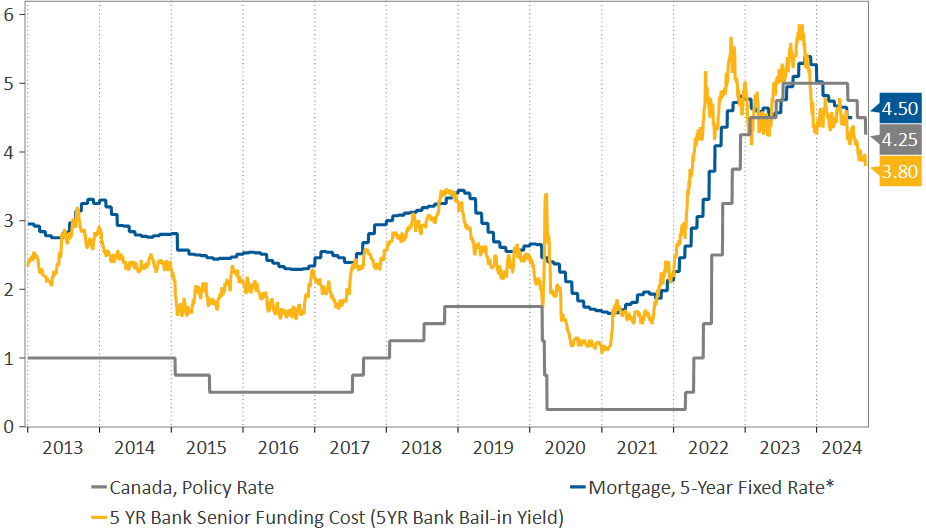

Then there is the issue of mortgage costs, which is especially relevant in Canada, where interest rate risk is elevated. The idea espoused by many in the real estate market that a 2% reduction in the policy rate will translate into a 2% mortgage rate cut is little more than wishful thinking and ignores the inverted yield curve. The vast majority of mortgage rates are based off the five-year funding cost of a bank, not the overnight policy rate.

While each bank has a different funding mix (deposits, GICs, bonds, etc.), a good proxy for a bank’s funding cost is the yield on their five-year senior bonds. Senior funding rates of banks are made up of the five-year Government of Canada yield plus a premium for the bank’s credit risk. This is known as the credit spread (see Exhibit 2). As of September 5, 2024, the five-year senior bank funding rate is about 3.80%, which reflects a Government of Canada five-year yield of 2.80% plus a 1% credit spread.

Exhibit 2: Mortgage Rates Are Driven by Bank Senior Yields: This graph shows the policy rate in Canada, the five-year fixed mortgage rate and the five-year senior funding cost of the average Canadian bank over the period January 1, 2013-September 5, 2024. The graph shows that mortgage rates historically have a much tighter correlation to bank funding costs than they do to the Bank of Canada policy rate.

Source: Beutel, Goodman & Company Ltd, Bank of Canada, Macrobond. As at September 5, 2024.

It is important for mortgage holders to understand that five-year Canadian bond yields, and in turn, five-year mortgage rates, will likely fall materially less than the policy rate because the yield curve has been inverted for a long time and is likely to normalize (disinvert) in time. The current five-year Canadian bond yield is already pricing in the BoC cutting to 2.50%, and if the BoC stops cutting rates at a level higher than 2.50%, five-year yields will increase.

The scenario analysis shown in Exhibit 3 details different terminal rate scenarios and estimates of bank senior funding rates, which can be used as a proxy for mortgage rates based on the historical correlations (as shown in Exhibit 2). For example, a terminal policy rate of 2.75% at current spreads corresponds to a 4.00% implied bank funding rate, or approximately 4.00% mortgage rates.

In the scenario analysis, it appears that five-year fixed mortgage rates are unlikely to fall much below 3.60%–4.00% without a terminal policy rate pricing of less than 2.25%. Our assessment is that an ultra-low-rate scenario with a terminal rate below 2.25% is only likely if we face a severe recession with significant job losses. In this case, however, the risk premium paid by banks to fund their credit spread will increase significantly, offsetting the lower rates. For example, in January 2023, the risk premium paid by banks (140 bps) was higher than current levels (100 bps) reflecting the elevated recession fears and risk-off tone in the market during that time. This higher credit spread put upward pressure on mortgage rates.

Mortgages in Canada are, in our view, therefore unlikely to receive the level of stimulus the public hopes for. The headwind of 2025/2026 mortgage renewals, alongside lower immigration into Canada, is also likely to weigh on domestic spending, and a slower economic recovery.

Exhibit 3: Scenario Analysis: The table below shows the implied five-year bank senior funding rate under different Bank of Canada terminal policy rate scenarios and spread levels.

|

Policy Rate Scenarios |

Implied Bank Funding Rate |

||

|

BoC Terminal Policy Rate |

Implied 5 YR Government of Canada Yield | Current Spreads (100 bps) |

Spreads at Jan 2023 Levels |

|

3.50% |

3.51% | 4.51% | 4.91% |

|

3.25% |

3.65% | 4.65% |

5.05% |

|

3.00% |

3.34% | 4.34% | 4.74% |

| 2.75% | 3.00% | 4.00% |

4.40% |

|

2.50% |

2.80% | 3.80% |

4.20% |

| 2.25% | 2.60% | 3.60% |

4.00% |

| 2.00% | 2.45% | 3.45% |

3.85% |

Source: Bloomberg L.P., Bank of Canada, Beutel Goodman calculations. As at September 4, 2024. The scenario analysis is based on 25 bps cuts at every Bank of Canada meeting beginning in July 2024. The implied five-year Canada yield is based on a boot-strapped[5] forward rate pricing model. The grey highlighted row represents the calculation using market pricing as at September 4, 2024. The assumptions of the model should not be viewed as a forecast and are used for illustrative purposes only, to conduct scenario analysis on the potential impact of a variety of changes in the BoC terminal policy rate. Any securities, sectors or allocations listed should not be perceived as investment recommendations.

Implications of Lower Rates

In summary, central bank easing has largely been priced into bond markets, while a slowdown in the economy is already apparent.

In the credit space, we are seeing a relatively tight level of overall credit spreads, as well as the compression of spreads across ratings and sectors, forecasting central bank easing to achieve an economic soft landing. If that does occur, credit spreads could remain in a tight range. However, any divergence from the soft-landing outcome driven by economic weakness will likely lead to wider credit spreads due to higher risk.

There are also nascent warning signs that the credit rally is long in the tooth, including increased merger and acquisition activity (often a signal that companies cannot grow organically), higher cash levels on balance sheets, and increased bond issuance.

In addition, the fact that lower interest rates have been largely priced into bond markets means that more serious economic deterioration would need to occur for yields to fall much further. All of these issues factor into the implications of lower central bank policy rates and will continue to be closely watched.

[1] https://www.kansascityfed.org/research/jackson-hole-economic-symposium/jackson-hole-economic-policy-symposium-reassessing-the-effectiveness-and-transmission-of-monetary-policy/

[2] https://www.traditiondata.com/market-education/overnight-index-swaps/

[3] https://www.bankofcanada.ca/2024/04/staff-analytical-note-2024-9/

[4] https://www.federalreserve.gov/monetarypolicy/files/fomcprojtabl20240612.pdf

[5] https://www.educba.com/bootstrapping-examples/

Download PDF

Related Topics and Links of Interest:

©2024 Beutel, Goodman & Company Ltd. Do not sell or modify this document without the prior written consent of Beutel, Goodman & Company Ltd. This commentary represents the views of Beutel, Goodman & Company Ltd. as at the date indicated.

This document is not intended, and should not be relied upon, to provide legal, financial, accounting, tax, investment or other advice.

Certain portions of this report may contain forward-looking statements. Forward-looking statements include statements that are predictive in nature, that depend upon or refer to future events or conditions, or that include words such as “expects”, “anticipates”, “intends”, “plans”, “believes”, “estimates” and other similar forward-looking expressions. In addition, any statement that may be made concerning future performance, strategies or prospects, and possible future action, is also forward-looking statement. Forward-looking statements are based on current expectations and forecasts about future events and are inherently subject to, among other things, risks, uncertainties and assumptions which could cause actual events, results, performance or prospects to be incorrect or to differ materially from those expressed in, or implied by, these forward-looking statements.

These risks, uncertainties and assumptions include, but are not limited to, general economic, political and market factors, domestic and international, interest and foreign exchange rates, equity and capital markets, business competition, technological change, changes in government regulations, unexpected judicial or regulatory proceedings, and catastrophic events. This list of important factors is not exhaustive. Please consider these and other factors carefully before making any investment decisions and avoid placing undue reliance on forward-looking statements Beutel Goodman has no specific intention of updating any forward-looking statements whether as a result of new information, future events or otherwise.