Summary

Investors may have encountered terms such as "soft landing", "higher-for-longer" and "immaculate disinflation" over the past year. These are examples of narratives that can drive market sentiment. In this piece, Beutel Goodman’s Fixed Income team looks at the power of narratives, the influence of confirmation and hindsight biases, as well as the importance of focusing on investment fundamentals.

By Beutel Goodman Fixed Income Team (as at February 29, 2024)

“No one ever made a decision because of a number. They need a story.” Daniel Kahneman

As asset managers, we are often consumed by numbers. Data and surprise economic events can change valuations in the market, but frequently, it is something much more intangible that drives investor sentiment.

Changes in market narratives have the power to drive the pricing of stocks and bonds away from fundamentals, creating volatile swings in asset prices. These swings are sometimes referred to as “animal spirits”, “uncertainty”, “bull/bear sentiment”, or “fear and greed”, but the key point is that markets are often driven by a story.

The Narrative Wave

The transformative power of narratives is that they challenge the “efficient market hypothesis”, which argues that asset prices reflect all existing available information, making them fairly valued. However, if we truly analyse market behaviour, an underlying change in information does not always drive asset price fluctuations. Therefore, there must be something else leading the change. This is where a narrative comes in and wields its power to change public opinion and shape investor behaviour.

As Robert J. Shiller explains in his book, Narrative Economics, “Trying to understand major economic events by looking only at data on changes in economic aggregates, such as gross domestic product, wage rates, interest rates, and tax rates, runs the risk of missing the underlying motivations for change.” [1]

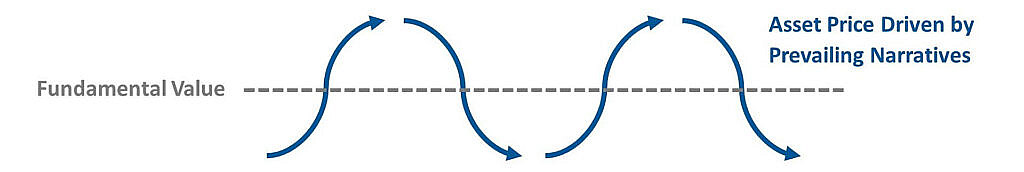

A fitting analogy to visualize this concept is the narrative wave. These waves have the power to drive deviations from fundamental value based on a story. In Exhibit 1 below, the horizontal line is the fundamental value, which is less volatile and only changes with new information. Narratives, represented by the blue line segments, can cause deviations in asset prices around these fundamental values to either the upside or the downside.

Exhibit 1. Narrative Wave. The following chart shows a horizontal dashed line, which represents a relatively stable fundamental value of an asset. Around the line is a wave consisting of line segments. Each line segment represents a narrative that drives asset prices below or above the fundamental value line.

The Power of Stories

Since the dawn of civilization humans have been sharing stories. Stories have the ability to persuade and connect people, while allowing us to store and understand complex information. MRI scans have shown that neural circuits that process emotion light up when someone is listening to a story.[2] It is this emotional aspect of storytelling that can cause a narrative to catch people’s attention and spread.

For example, the feelings of wonder and fear created by narratives of generative AI (artificial intelligence)’s ability to enhance productivity and potentially destroy millions of jobs through automation has contributed to OpenAI’s ChatGPT being the fastest-growing web platform ever created. Stories often begin because of a change in information or data. The intensity of the story then relies on its ability to tap into human emotions until it becomes entrenched and goes viral.

If new information or data corroborates a story, then a feedback loop can develop, making the narrative stronger and more widespread. However, this warrants caution as “confirmation bias” can cause market narratives to latch on to data that corroborates a certain view, creating a more compelling and seemingly consistent story. This confirmation bias can drive a narrative even further away from economic fundamentals, focusing on information that supports the established belief and ignoring evidence to the contrary.

Fueled by emotional intensity and confirmation bias, narratives can be strong and persistent. Therefore, to break a narrative wave can sometimes take a totally new narrative or overwhelming contrary evidence.

Riding the Wave — Lessons from 2023

We identify and monitor market narratives using a variety of tools, including our own research on growing themes in news articles or industry publications. Since narratives are increasingly spread through social media platforms and online news outlets, we can follow narratives through trackers like Google Trends, Google Ngram Viewer, Bloomberg News Themes and other sentiment indicators that can provide clues as to the prevailing market narratives and their relative strengths.

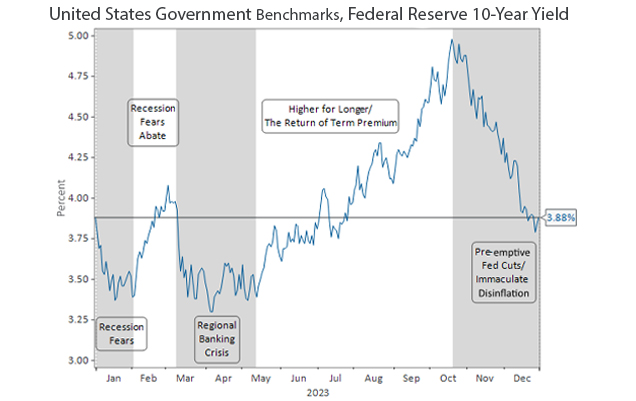

In the bond world, the predominant narrative affecting fixed income investors involves the interest rate policies of the U.S. Federal Reserve (Fed) and the Bank of Canada. In 2023, an interesting phenomenon took place. The beginning and ending yield on U.S. 10-year Treasury bonds ended the year the same as it started, to the basis point. This was not without significant fluctuations and heightened levels of volatility during the year as the round trip included the emergence and decay of several market narratives in 2023.

From our perspective, the five main investment narratives that drove much of the U.S. Treasury bond volatility in 2023 were:

- Recession fears rising;

- Recession fears abating;

- Regional banking crisis contagion;

- Higher-for-longer interest rates and the return of “term premium”;[3] and

- Pre-emptive Fed cuts and “immaculate disinflation”.[4]

Exhibit 2 below shows our view of the timing of those narratives.

Exhibit 2. Investment Narratives in 2023. The following chart shows 10-year U.S. Treasury bond yields during the calendar year 2023. There is a horizontal line at 3.88%, which represents both the beginning and ending yield of the 10-Year U.S. Treasury bond. The shaded areas show our assessment of the narratives that drove interest rates during those periods.

Source: Beutel, Goodman & Company Ltd., U.S. Department of Treasury, Macrobond, as at March 4, 2024

During the first month of 2023, recession fears were high in the U.S.[5] As the year progressed, the recession narrative took a turn as fears abated and better-than-expected economic data created a bout of exuberance that spread to the bond markets. In February, yields rose and credit markets rallied as terms such as “Goldilocks economy” (an economy that is growing at a moderate pace with inflation at central banks’ target), “soft landing” and even “no landing” became more prevalent.

In March, a new narrative took hold of the market as Silicon Valley Bank collapsed, sparking a wave of uncertainty and worry of financial contagion. The regional banking crisis changed the story as the focus shifted from the Goldilocks economy to concerns regarding the stability of the U.S. regional banking system. The market reaction was a swift sell-off in risk assets and a flight to safety as interest rates rallied.

This regional banking crisis narrative brought us all the way to the summer as fears of a banking system collapse began to dissipate and the market shifted its focus to a no-landing scenario for the economy and higher-for-longer interest rates. The U.S. also entered a tenuous period amid the U.S. debt-ceiling debate and the expected wave of Treasury issuance, and we began to hear about the return of term premium.

The two narratives of higher-for-longer interest rates and the return of term premium dominated much of the second and third quarters of 2023. An interesting aspect of confirmation bias is that even neutral data may be seen as supportive if it doesn’t go against the base hypothesis. During this period, most data was cited in support of these narratives, including an interest rate sell-off that seemed to have no end in sight. U.S. Treasury yields reached a peak of 5% and market participants began to talk about 6–7% Treasury yields becoming the “new normal”.

Turning the tides of the higher-for-longer narrative took an overwhelming amount of evidence. A dovish shift in tone by the U.S. Federal Open Market Committee in October laid the groundwork for interest rate cuts in early to mid-2024 and for a new narrative of immaculate disinflation to emerge.

Remarkably, the resilient economic data that broadly underpinned the higher-for longer narrative and U.S. Treasuries yields did not really change during this new immaculate disinflation narrative. The key difference was the interpretation by the market that the resilient economic data and normalizing inflation would allow the Fed to pre-emptively ease policy and engineer a soft landing. This showcased the true, unrelenting power of narratives to create dramatic and rapid swings in market behaviour, based on stories and interpretations.

Narrative Dangers: Beware the Monday Morning Quarterback

Essayist and Mathematical Statistician Nassim Nicholas Taleb’s famous quote that “we are wired to seek patterns and meaning in the chaos of the world, even when they may not exist” is pertinent and warns us of the dangers of trying to draw meaning from past events by constructing narratives after the fact. It is therefore important to make the distinction between “hindsight narratives” and “forward-looking narratives”. The problem with hindsight narratives is that they are underpinned by hindsight bias, which Taleb explored in his book, The Black Swan. [6] Taleb highlighted the idea of narrative fallacy, which describes how inaccurate stories of the past shape our views of the world and our expectations for the future.

In our view, an important factor in an effective fixed income investing process is to focus on forward-looking narratives, alongside a deep understanding of the fundamentals of any investment. In combining the two, an investor can catch a narrative wave in its early stages and then monitor for when a wave has crested. When fundamentals and a narrative diverge, the narrative usually collapses.

A Story with Substance

Understanding forward-looking narratives is part of the art of investing. In our view, over the long term, fundamentals are the most important factor when assessing an investment. This is at the core of how we look at fixed income. That said, we cannot ignore the power of narratives, as they drive asset prices away from fundamentals, causing valuation gaps. Thus, our process aims to navigate narratives with a two-fold strategy.

- Catching the Wave: Identifying the Momentum in the Narrative

First, we try to keep our ear to ground to detect emerging narratives early and attempt to grasp their investment implications. Since narratives with richer sources of support in terms of data and sentiment tend to build over time, we seek to understand which narratives are built on solid foundations and which are likely to flame out quickly. By identifying narratives early, we may benefit as they become increasingly prevalent, driving market behaviour. - Getting Out When the Wave Crests: When Fundamentals and Narratives Diverge

As a narrative becomes increasingly prevalent, it can go too far and reach a level of contagion, at which point intrinsic values and market prices diverge. An extreme example of this is a classic financial bubble, which is so fragile that it leads to a collapse, such as the bubble of Dutch Tulip Mania of the 17th century or the famed Dot-com Bubble of 2000. Narrative crests do not always result in bubbles. They can also happen on a smaller scale with more frequency throughout market cycles when narrative waves cause valuations to become stretched and vulnerable to reversal.

An example of this could be found at the end of 2023 when the immaculate disinflation and Fed-cut narratives drove a dramatic rally in interest rates. Market pricing had deviated far from fundamentals. Subsequently, in the first two months of 2024, these narratives shifted, as the market digested higher-than-expected inflation data alongside ongoing economic strength, particularly in the U.S., making a March interest rate cut appear unlikely. This shift precipitated a large sell-off in bonds, showing that the late-2023 narratives for rate cuts were not realistic.

In conclusion, as active fixed income investors, our investment philosophy is to have a clear, objective view of the fundamental value of investments. Narratives can provide opportunities to analyze market inefficiencies that may impact the returns on investments. We recognize the power of narratives on economic behaviour and acknowledge that ultimately as investors and humans, we live in the Land of Stories.

[1] Shiller, Robert. Narrative economics: How stories go viral & drive major economic events. Princeton, NJ: Princeton University Press, 2019.

[2] Amygdala and heart rate variability responses from listening to emotionally intense parts of a story. Mikkel Wallentin, Andreas Højlund Nielsen, Peter Vuust, Anders Dohn, Andreas Roepstorff, Torben Ellegaard Lund. NeuroImage, Volume 58, Issue 3, 2011,

[3] Term premium refers to the additional yield that investors demand to compensate for the uncertainty of holding securities with a longer term to maturity.

[4] Immaculate disinflation describes when inflation comes down to central banks’ target without a recession or significant labour market slowdown.

[5] The Bloomberg contributor survey’s recession probability forecast reached a post-pandemic high of 67.5% in January 2023

[6] Taleb, Nassim Nicholas. The Black Swan. Harlow, England: Penguin Books, 2008.

Download PDF

Related Topics and Links of Interest:

©2024 Beutel, Goodman & Company Ltd. Do not sell or modify this document without the prior written consent of Beutel, Goodman & Company Ltd. This commentary represents the views of Beutel, Goodman & Company Ltd. as at the date indicated.

This document is not intended, and should not be relied upon, to provide legal, financial, accounting, tax, investment or other advice.

Certain portions of this report may contain forward-looking statements. Forward-looking statements include statements that are predictive in nature, that depend upon or refer to future events or conditions, or that include words such as “expects”, “anticipates”, “intends”, “plans”, “believes”, “estimates” and other similar forward-looking expressions. In addition, any statement that may be made concerning future performance, strategies or prospects, and possible future action, is also forward-looking statement. Forward-looking statements are based on current expectations and forecasts about future events and are inherently subject to, among other things, risks, uncertainties and assumptions which could cause actual events, results, performance or prospects to be incorrect or to differ materially from those expressed in, or implied by, these forward-looking statements.

These risks, uncertainties and assumptions include, but are not limited to, general economic, political and market factors, domestic and international, interest and foreign exchange rates, equity and capital markets, business competition, technological change, changes in government regulations, unexpected judicial or regulatory proceedings, and catastrophic events. This list of important factors is not exhaustive. Please consider these and other factors carefully before making any investment decisions and avoid placing undue reliance on forward-looking statements Beutel Goodman has no specific intention of updating any forward-looking statements whether as a result of new information, future events or otherwise.