By Beutel Goodman’s Fixed Income team

Since the global financial crisis (GFC), investors have navigated a variety of events that have had the potential to change the course of the markets. Some of these events led to notable shifts in sentiment and direction, including, but not limited to, the European debt crisis in 2011, the Taper Tantrum of 2013, the Chinese stock market and oil crashes in 2015, and of course, the 2020 COVID crisis. All of them led to market declines; however, none of them truly changed the market itself.

Despite the challenges posed by these sorts of events, equity markets around the world, led by the U.S., continue to reach all-time highs. The declines powered by negative headlines were relatively short-lived, the recoveries were fairly speedy, and the post-2008 bull market largely remained intact. Bearish periods barely grew into anything lasting – they were more like cub markets than bear markets, thanks largely to the U.S. Federal Reserve (the Fed) and other global central banks.

Markets have been generously supported by central banks since the GFC through a variety of stimulative programs, most of which fall under the banner of quantitative easing (QE). This stimulus has been a constant for much of the post-2008 period. However, with the post-COVID recovery well underway and negative pressures such as inflation on the rise, markets seem poised to stand on their own feet again.

The thought of removing support from the market may be anxiety-inducing for some investors, but it’s now likely a foregone conclusion, barring any catastrophic economic shocks. Given the history of QE, investors may be wondering “why now?”.

We believe it’s more of a matter of “why not?”.

Quantitative Easing: A Tool for the Times (The Rationale for QE)

Rewind to the 2000s, when home prices in the U.S. were rising sharply on the back of lax underwriting standards and government mandates to increase subprime mortgage lending. Few called it what it was at the time – a housing bubble. When delinquencies started to rise in 2006, the wheels were put into motion to burst that bubble and ultimately throw the entire world’s financial system into chaos. Consumers pulled back spending and by 2007, when investment banks and mortgage lenders began to file for bankruptcy, liquidity started to dry up.

The Fed responded with its most traditional tool, by cutting the federal funds rate from its peak at the time of 5.25%. Bankruptcies continued and by the beginning of 2008, markets were in a tailspin. Further rate cuts could not stem the tide as the overnight repo rate was already at the zero bound. By October, the head of the International Monetary Fund declared that the world’s financial system was teetering on “the bring of systemic meltdown.” In November, the Fed pulled out unconventional tools to buy mortgage-backed securities, U.S. Treasuries and bank debt through quantitative easing.

Coming out of the GFC, QE was designed to do one thing: lower term interest rates and keep them there for an extended time, which by extension helped facilitate smoother market operations. This was supported by the Fed’s purchase of high-quality securities to inject liquidity into the banking system, which also led to some asset price inflation. While it took multiple iterations of QE programs, the tool was successful insofar that the economy did not collapse, jobs were eventually recovered and the unemployment rate fell to historically low levels, and U.S. markets entered the longest bull run in history.

In the three rounds of QE after the GFC, the U.S. Federal Reserve added US$4 trillion to its balance sheet, from a starting point of US$900 billion. The Fed began tapering its asset purchases in December 2013 and began reducing the size of its holdings (quantitative tightening) in October 2017. The Fed had reduced the size of its balance sheet to US$3.8 trillion by August 2019.

Table 1: The Dates and Scopes of the Federal Reserve’s QE Programs[i].

| Program | Timeline | Amount |

| QE1 | December 2008 – March 2010 | Total: US$1.725 trillion

(US$1.25 trillion In MBS, US$175 billion in Federal Agency Debt, and US$300 billion in Treasury Bonds) |

| QE2 & Operation Twist | November 2010 – June 2012 | US$600 billion in long-term Treasury bonds purchased.

Through Operation Twist (Maturity Extension Program), the Fed extended the maturity of its holdings by purchasing US$667 billion of long dated treasuries and selling or maturing equal amount of < three-year securities. |

| QE3 | September 2012 – December 2013 | Total: US$1.613 trillion (US$790 billion in Treasuries and US$823 billion in MBS; initial open-ended program of US$40 billion per month increased to US$85 billion per month in December 2012) |

| COVID Response | March 2020 – ? | Total so far: US$3.9 trillion (US$2.8 trillion in Treasuries and US$1.1 trillion in MBS) |

Fast-forward to 2020 when the COVID-19 pandemic hit, mere months after the Fed concluded its tightening program. Central banks once again brought administered rates back down to the zero bound. When liquidity in the bond markets dried up, they turned to unconventional monetary policy tools again (perhaps we should call them conventional, now), such as quantitative easing, as a means to prevent a credit freeze and supress interest rates. This helped governments finance large programs to provide direct stimulus and control or mitigate the effects of the pandemic itself.

Unlike in the wake of the GFC, the response from central bankers to the COVID crisis was nearly immediate. The economy entered into a manufactured recession, fuelled by lockdowns and restrictions, but shifted into recovery within months. Rather than continually testing the waters with smaller injections of easing, central banks moved all-in from the beginning of the COVID crisis in terms of both the magnitude of QE and its reach (which included buying corporate bonds and commercial paper).

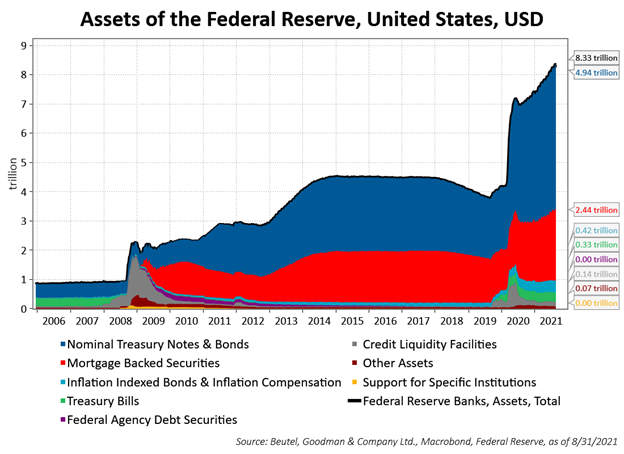

The scope of the COVID response already exceeds that of the previous programs, so we do not expect progressively larger QE programs to continue like we saw throughout the early 2010s. In addition to the increasingly customary quantitative easing, the Fed also initiated numerous other programs to support market functions and avoid systemic collapse. These include, but are by no means limited to, programs designed to support the flow of credit to large employers, consumers, businesses, and municipalities[ii]. Others were built to support liquidity. These additional emergency lending efforts – nine separate programs in all[iii] – totalled another US$300 billion. Figure 1 illustrates the rapid expansion of the Fed’s balance sheet in response to COVID-19.

Figure 1: Balance Sheet of the U.S. Federal Reserve and its Constituent Components

Spread Your Domestic Product and Fly (Rationale for Withdrawal of QE)

The benefits of quantitative easing are likely somewhat apparent, particularly for those who were able to re-enter the job market shortly after a layoff, those who financed major purchases with cheap credit, or those who invested in risk assets after initial market declines. However, central bankers realize they cannot be a constant crutch for the world’s economies. The bankers know that as economies benefit from re-openings after the lockdowns, they need to stand on their two feet again.

The negative effects of QE are currently less apparent, and are longer term in nature, potentially manifesting as bubbles that have yet to burst. QE helps fund deficit spending at more palatable rates. However, as the economy recovers, there is less of a need to continue the deficit spending (we tackled the topic of government debt loads in our last report, “The Debt Hangover”).

At current rates, the Fed is taking about a trillion dollars out of the market from a repo perspective. Given the relative strength of the economy now, there is simply too much cash awash in the system. With the excess cash comes excess leverage, which then fuels concerns over risk assets. We’ve already seen evidence of the excess spilling over into so-called meme stocks and the rallies in cryptocurrencies, as examples.

Ultimately, the reasons to taper QE are two-fold. The first reason is that there is too much excess cash in the system. Second, there is a decreasing need for the system to be continually primed. These two diverging factors leave the Fed in the position of crowding out the market, which is precisely the opposite of what it wants to do. The Fed wants to support the market and the economy, not be the market and the economy.

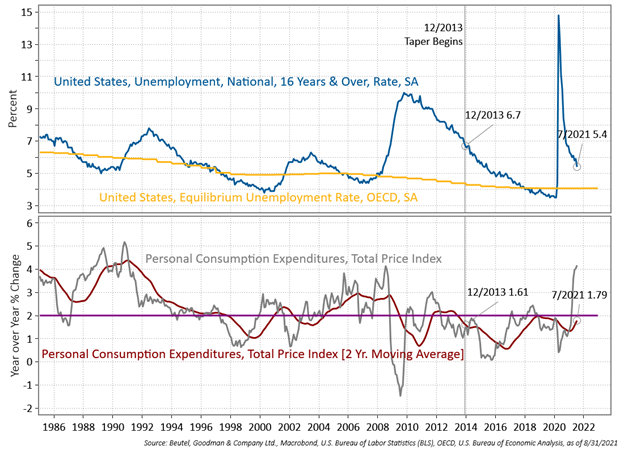

The Fed has stated that to begin tapering, substantial further progress towards the goals of price stability and maximum employment was required. Figure 2 illustrates that both the unemployment rate and price levels, as measured by the two-year average Personal Consumption Expenditures Index, have surpassed the threshold met for the 2013 Taper Tantrum. The Fed believes that it has met the pre-conditions for inflation, but not yet for employment, which is why we are now on the cusp of tapering, waiting for an official announcement.

Figure 2: The Federal Reserve’s Dual Mandate

From a Step to a Stride; Not Without a Slip (Likely Implications of Withdrawal of QE)

While the thought of tapering may get the heart pumping quicker for some, it is no longer uncharted territory. In the 2010s, the process was unprecedented and thus much more experimental. The collective panic from 2013 that we refer to as the Taper Tantrum provided many lessons for both central bankers and investors. The simultaneous interest rate hiking while running off the Fed’s balance sheet in 2018 was another helpful instruction. Things should be a bit different this time.

On the communications front, the Fed has been providing a fairly long runway. There is no surprise about the upcoming round of tapering, unlike in 2013 when the Chair surprised markets with their taper musings. The Fed has been sending out enough speakers to fill a week-long conference about tapering. Stories have been planted in news media to further reinforce the Fed’s views. And the central bank has been blunt as well, with a number of members on record emphasizing the lack of a “link” between tapering and interest rate moves[iv].

In essence, the Fed is saying tapering is a first step in removing monetary policy stimulus. As the Fed often emphasizes, tapering is not tightening. It is a necessary precondition for interest rate hikes and the eventual reduction of the size of the balance sheet.

We currently believe it’s unlikely that we will see interest rate hikes in the U.S. until the tapering process has concluded. Investors should remind themselves that tapering is not removing cash from the system, but merely not adding as much moving forward. The overall environment should remain stimulative and supportive.

Given that the Fed has telegraphed its taper intentions for a few months now, the next shoe to drop will likely be the timing and the scope of the program. Fed Chair Jerome Powell spoke at the Jackson Hole central bank conference in late August. His message was more evolutionary than revolutionary, reiterating that while the necessary condition for tapering on the inflation front has been met, there is still work to do on the employment front. Powell was fairly hawkish on the U.S. economy, even in the midst of the Delta COVID variant wave, and indicated tapering was most likely to occur in 2021.

The August employment report, released September 3, shows the U.S. labour market remains robust, even if the numbers were lower than expected. It was the slowest pace of gains in seven months, but still strong enough to push the unemployment rate down to 5.2%, which likely leaves the Fed on track to announce tapering sometime in the fall. There are three more Fed meetings scheduled for 2021 where the taper could be officially announced: September 21-22, November 2-3, and December 14-15.

For now, until more specific details become available, we believe that the tapering itself will take about eight to ten months. A much slower or faster rate may spook markets, which we believe the Fed will try to avoid. The scope of the taper program is less important than the fact of it happening. The action is more important than the fine details. However, hints and media stories suggest it will be balanced. For example, Dallas Fed President Robert Kaplan recently spoke on a Bloomberg podcast, where he called for Fed purchases of Treasury securities to be reduced by US$10 billion per month and purchases of mortgage-backed securities (MBS) to be reduced by US$5 billion per month[v]. At that pace, the purchasing program would end in eight months.

If there are no surprises regarding the tapering program, we expect there won’t be any major economic implications. After all, tapering is simply allowing the economy to self-sustain, which should be achievable given that it has grown substantially, both from the past QE programs and the more recent one. However, we believe the market and the economy will shift moving forward and fundamentals will become more important again.

One of the concerns around tapering is that it could be inflationary. We believe that inflation is likely a transitory issue though, itself inflated by the base effect of having prices crater at the onset of the pandemic. However, higher inflation has persisted somewhat and the transitory period may be longer or more intense than initial expectations. We may very well see inflation remain in the area of 2.5%-3% for a while. This is a “hot” reading, especially relative to the Fed’s inflation targets, but it does come off an extended period of low inflation[vi].

In the markets, we expect to see a normalization process occur alongside the taper. Investors should expect more modest returns for risk assets moving forward. With less of a stimulative backstop, the recovery of short-term declines will likely take longer and the recovery process itself will be more volatile.

Lastly, as we anticipate an upward drift in bond yields, we have positioned our portfolios with a short duration position. We would consider this a natural movement; if the goal of QE is to suppress yields, it follows that slowing the pace of QE should have the opposite effect. But, as mentioned before, the overall environment is expected to remain accommodative and as such, we believe the increase in yields will be slight.

Better Late Than Never

The tapering of the Fed’s quantitative easing will likely happen soon. We think it ought to happen as soon as possible. The Fed may be a little late to the game, given the recent strength in economic data. After all, there’s only a certain amount of time in the expansion phase of an economic cycle before the next recession and the next round of monetary policy stimulus is required. So, the Fed can’t risk backing itself up against a wall. But being a bit late is better than not showing up at all.

Investors should be clear-minded on what the taper really is – it’s a hand-off back to the economy. It’s the first steps out of the wheelchair for the patient who broke their leg. It’s the first pedal strokes on the bike for the child who learned to ride with training wheels. It’s part of the process of returning to normalcy, or what central bankers would call ”the gradual removal of emergency accommodation”.

The environment would remain accommodative, just less so than it has been. The Fed has made this as clear as possible and any investors who believe the entire stimulative rug will be pulled out from under them either have not been listening or simply do not believe what they hear.

The taper is not an inherently bad thing – it has to happen. The economy must stand on its own feet again – without emergency assistance – and must produce its own credit. The taper process may even be derailed by an extreme COVID variant or other event; even so, variants ultimately just delay growth, not reverse it. There may be some relapses in the months ahead. There may be some more volatility in the markets. Don’t fear the taper – it’s all part of the process.

[i] https://www.newyorkfed.org/markets/programs-archive/large-scale-asset-purchases

[ii] https://www.federalreserve.gov/monetarypolicy/fomcminutes20210728.htm

[iii] https://www.bloomberg.com/news/articles/2021-08-06/fed-s-kaplan-calls-for-gradual-balanced-tapering-starting-soon

[iv] Since 2009, the annual U.S. inflation has topped the Fed’s target rate of 2% four times, and only breached 3% once, in 2011.

[v] https://www.federalreserve.gov/newsevents/pressreleases/monetary20200323b.htm

[vi] https://www.federalreserve.gov/econres/feds/files/2021035pap.pdf

Download PDF

Related Topics and Links of Interest:

- The Debt Hangover

- Hello Inflation, my old friend – I’ve come to talk about you again

- Ask Us Anything (About Bonds)

©2021 Beutel, Goodman & Company Ltd. Do not sell or modify this document without the prior written consent of Beutel, Goodman & Company Ltd. This commentary represents the views of Beutel, Goodman & Company Ltd. as at the date indicated.

This document is not intended, and should not be relied upon, to provide legal, financial, accounting, tax, investment or other advice.

Certain portions of this report may contain forward-looking statements. Forward-looking statements include statements that are predictive in nature, that depend upon or refer to future events or conditions, or that include words such as “expects”, “anticipates”, “intends”, “plans”, “believes”, “estimates” and other similar forward-looking expressions. In addition, any statement that may be made concerning future performance, strategies or prospects, and possible future action, is also forward-looking statement. Forward-looking statements are based on current expectations and forecasts about future events and are inherently subject to, among other things, risks, uncertainties and assumptions which could cause actual events, results, performance or prospects to be incorrect or to differ materially from those expressed in, or implied by, these forward-looking statements.

These risks, uncertainties and assumptions include, but are not limited to, general economic, political and market factors, domestic and international, interest and foreign exchange rates, equity and capital markets, business competition, technological change, changes in government regulations, unexpected judicial or regulatory proceedings, and catastrophic events. This list of important factors is not exhaustive. Please consider these and other factors carefully before making any investment decisions and avoid placing undue reliance on forward-looking statements Beutel Goodman has no specific intention of updating any forward-looking statements whether as a result of new information, future events or otherwise.