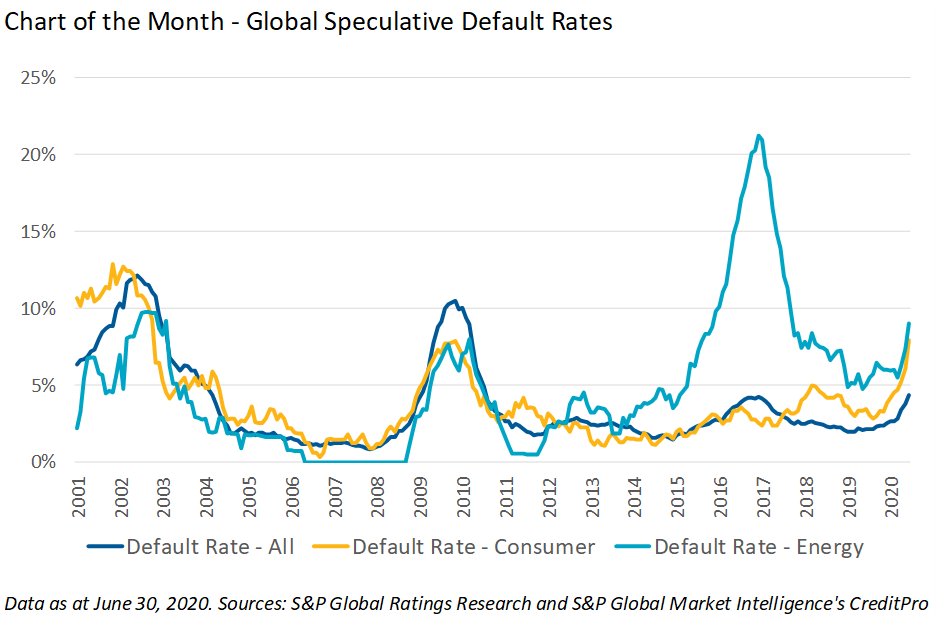

A spike in default rates typically follows an economic recession, credit crunch or commodity price collapse (e.g., energy), and as illustrated in the chart of the month, this time is no different. Data collected from S&P Global Ratings show that global corporate defaults of fixed income securities – encompassing both bonds and loans – have reached 147 as at July 31, 2020. This is already higher than last year’s total of 118 for the full year, and roughly on track with 2009’s year-end tally of 268. In the U.S., there have been 98 events of default through the end of July, while in Canada, four companies have failed to meet their borrowing obligations thus far: Calfrac Well Services, CDS Group, Northwest Acquisitions and Source Energy Services.

Not surprisingly, the majority of U.S. high yield defaults thus far in 2020 come from sectors most disrupted by the COVID-19 pandemic. Apart from two outsized idiosyncratic situations in the Telecommunications sector – Frontier Communications and Intelsat S.A., including its U.S. subsidiary Intelsat Jackson – the sudden stop of the economy has seen businesses in the Energy, Retail and Leisure sectors bear the brunt of the pain. Chesapeake Energy, JC Penney, Neiman Marcus and Hertz are just a few of the household names that have filed for bankruptcy in 2020.

This Time Is Different

The U.S. high yield bond market specifically (i.e., excluding loans) is the most relevant market to focus on when analyzing defaults. In this market, there have been 41 instances of companies filing for bankruptcy, completing a distressed exchange, entering the grace period for or missing an interest payment, and/or reaching a forbearance agreement so far in 2020 – all events that constitute a default. In total, this leaves the trailing 12-month default rate for the U.S. high yield index at 6.97%, higher than the 2016 oil crisis peak of 5.87% (but still well below the 21.42% reached in October 2009[1]). CreditSights is currently forecasting the U.S. high yield issuer-weighted default rate to finish 2020 at 8%.

Alarming as these statistics may be, we have outlined below a few key factors we believe make the current episode different, and likely to be less severe as it pertains to defaults, when compared to previous recessions, particularly the Global Financial Crisis (“GFC”) of 2008/2009. These factors should ultimately lead to a lower peak in defaults than what otherwise might have been expected based on historical precedent.

- The Federal Reserve’s willingness to backstop the corporate debt market – as evidenced by its primary and secondary market corporate credit facilities – is higher than ever. Despite only having purchased US$12 billion through the end of July[2], just knowing the facilities exist, and are likely to remain in operation for the foreseeable future, has increased investor confidence in the corporate debt market. The Federal Reserve’s backstop has also significantly contributed to the tightening of credit spreads since the end of March. This has allowed numerous companies to proactively refinance their debt and extend their maturity profiles well into the future.

- With global interest rates at or near historic lows, the search for yield and associated inflows into U.S. investment grade and high yield funds have been nothing short of relentless over the last four months. Since the middle of April, U.S. investment grade and high yield inflows have totaled US$119.7 billion and US$45.9 billion, respectively[3]. This has perhaps been the biggest contributor to the tightening of credit spreads and the ability of prospective defaulters to refinance.

- The U.S. government’s CARES Act has not only provided direct relief to certain hard-hit industries, such as airlines, cargo, national security and healthcare – much like the bailouts during the GFC – but also to those individuals who have been laid off or furloughed due to COVID-19. These individuals have kept the economy chugging along when it otherwise might have cratered for a longer period of time.

All told, the number of issuers considered “distressed” or near default (i.e., those with credit spreads 1,000 basis points or higher) sits at 9% of the U.S. high yield index currently, versus 32% in the depths of March[4]. While all of this liquidity is certain to have kept a number of so-called “zombie companies” alive[5], we believe the societal benefits of the programs have outweighed the potential cons. It simply means that meticulous due diligence around investment decisions has been rendered all the more necessary. We expect that the overall default rate will thus be lower than previous cycles such as 2008 and most of the defaults will be sector-specific (retail, travel, etc.), much like the energy default wave in 2016.

Portfolio Positioning

Considering all of these factors, we believe our unique investment strategy, which combines both top-down macroeconomic analysis with rigorous bottom-up research, positions us to navigate these especially uncertain times and a heightened default backdrop.

Incorporating the broader macro economy into decision-making processes helps to isolate key data points and overarching trends and identify at an early stage those industries most vulnerable to changes in the economic landscape. This helps inform our sector selection while narrowing our focus to individual issuers that stand most to benefit or be negatively impacted over the medium-to-long term. Additionally, from an issuer-selection standpoint, our proprietary credit models allows for the balance sheets of all issuers under coverage to be stress tested and measured for the capacity to withstand adverse shocks to their business models. Finally, when credit analysts have full ownership over their coverage universe and associated investment recommendations, they are empowered to constantly monitor each individual company’s performance and trajectory. Our analysts’ work does not stop at making the initial recommendation to the fixed income team, but extends to relative value analysis, as well as buy and sell decisions.

Having experienced zero bankruptcies in our portfolios since team inception in 1994, we can truly attest to the quality and thoroughness of this methodology. Moreover, behind the strength of this approach, we have been able to identify several undervalued opportunities in the U.S. investment-grade and high yield sectors for our Core Plus strategy over the last few months. In these cases, we believe the market has overestimated an issuer’s risk of default, thus creating an attractive entry point and long-term hold. For example, in June, United Airlines (UAL) came to the market with a unique secured transaction that used their loyalty program as collateral (MileagePlus). While UAL is rated below investment grade by all agencies, the MileagePlus issue was given an investment-grade rating by Moody’s and Fitch, the two current agencies with a rating on the issue. Our analysis gave us conviction that MileagePlus’s default risk is materially different from UAL’s. However, the market’s association of the two entities led to attractive pricing on the new issue.

While we continue to remain vigilant about our credits, our macroeconomic analysis currently suggests that the economy will continue to recover and the default rate will likely moderate as most corporates have been able to shore up liquidity through the central bank liquidity programs.

Download PDF

Related Topics and Links of Interest

©2020 Beutel, Goodman & Company Ltd. Do not copy, distribute, sell or modify this document without the prior written consent of Beutel, Goodman & Company Ltd. All opinions and estimates expressed in this document are as at September 15, 2020 and are subject to change without notice.

This document is not intended, and should not be relied upon, to provide legal, financial, accounting, tax, investment or other advice. This is not an invitation to purchase or trade any securities. Beutel, Goodman & Company Ltd. does not endorse or recommend any securities referenced in this document.

Certain portions of this commentary may contain forward-looking statements. Forward-looking statements include statements that are predictive in nature, that depend upon or refer to future events or conditions, or that include words such as “expects”, “anticipates”, “intends”, “plans”, “believes”, “estimates” and other similar forward-looking expressions. In addition, any statement that may be made concerning future performance, strategies or prospects, and possible future portfolio action, is also forward-looking statement. Forward-looking statements are based on current expectations and forecasts about future events and are inherently subject to, among other things, risks, uncertainties and assumptions which could cause actual events, results, performance or prospects to be incorrect or to differ materially from those expressed in, or implied by, these forward-looking statements.

These risks, uncertainties and assumptions include, but are not limited to, general economic, political and market factors, domestic and international, interest and foreign exchange rates, equity and capital markets, business competition, technological change, changes in government regulations, unexpected judicial or regulatory proceedings, and catastrophic events. This list of important factors is not exhaustive. Please consider these and other factors carefully before making any investment decisions and avoid placing undue reliance on forward-looking statements. Beutel Goodman has no specific intention of updating any forward-looking statements whether as a result of new information, future events or otherwise.

[1] Source: Bank of America Merrill Lynch. High Yield Credit Chartbook, July 2020

[2] Source: Federal Reserve. Periodic Report: Update on Outstanding Lending Facilities, August 8, 2020

[3] Source: Refinitiv Lipper

[4] Source: Bloomberg L.P.

[5] Zombie companies are those that generate enough funds to service the interest on their debt, but not repay the principal under normal circumstances.