A Warning and a Pledge

The UN-sponsored Intergovernmental Panel on Climate Change (IPCC) reports that greenhouse gas emissions (GHGs) from human activities are responsible for approximately 1.1°C of global warming above pre-industrial levels, and warns that, averaged over the next 20 years, the global temperature is expected to reach or exceed 1.5°C of warming.1 In order to meet the goals of the Paris Agreement, the global climate treaty that aims to limit the rise in global average temperatures to well below 2°C compared to pre-industrial levels, a significant commitment will be required by sovereigns, companies, and individuals.

Currently, approximately 70% of world emissions are either already covered by net-zero legislation, have net-zero emissions legislation under discussion, or occur where net zero is the stated policy position of the government. The Net Zero Asset Managers (NZAM) initiative that was launched in December 2020 now has 236 signatories representing US$57.5 trillion in assets under management. The initiative, part of the Glasgow Financial Alliance for Net Zero, is an international group of asset managers committed to supporting the goal of net-zero greenhouse gas emissions by having portfolios that are net-zero by 2050 or sooner. According to NetZero Tracker, 683 of the 2,000 largest publicly traded companies globally (by revenue) have committed to net zero by 2050.

A Brave New World

The journey to net zero by 2050 will likely completely alter the way we produce, transport, process and consume energy. It leads to questions around possible stranded assets and will likely highlight the winners and losers. Companies need to adapt and embrace a long-term vision of how their business could change. Just imagine: in a future of electric vehicles (EVs), what happens to the traditional gas station and convenience store?

The electrification of everything (i.e., switching from natural gas to electric, powered by renewables) requires significant investment in new power capacity and requires the electricity transmission grid to be reconfigured. Switching from natural gas to hydrogen, meanwhile, requires pipelines to be modified and new appliances that can run on hydrogen. Looking through the UN Sustainable Development Goals (SDG) lens, there will also likely need to be a focus on critical infrastructure that enables climate mitigation, climate adaptation, and improved quality of life. This includes infrastructure to secure access to clean water and sanitation, affordable and clean energy, telecommunications services, and international/intranational transport. Some of the technology to reach the net-zero goals exists today, although much of it is not yet economical. Significant innovation is also required, especially for difficult-to-abate sectors such as long-haul trucking, aviation, and shipping.

The Reign of Hydrocarbons Is Over

According to the International Energy Agency (IEA)’s pathway to net zero analysis, the demand for coal, crude oil and natural gas will likely decline by approximately 90%, 75% and 55%, respectively, by 20502. The fossil fuels that remain in use will be for the production of non‐energy goods where the carbon is embodied in the product (like plastics), in plants with carbon capture, utilization and storage (CCUS), and in sectors where low‐emissions technology options are scarce. If correct, the magnitude of change envisioned by the IEA is significant. In 2020, crude oil provided 30% of total energy supply, while coal supplied 26% and natural gas, 23%.

The death of coal is already well underway as power companies in North America are shuttering coal-fired electric plants or converting them to natural gas. Under the IEA scenario, the assumption is that zero capital is invested in crude oil production, which we know is not currently occurring as energy companies are still drilling. Production may be flat or growing more slowly than it has historically, but global demand for crude oil remains robust and is prone to volatility, as evidenced by the impact of the current Russia-Ukraine war.

While the IEA may be aspirational, the reality is that we have likely surpassed peak oil and that new alternative fuels and technologies should continue to decrease demand for hydrocarbons. We believe demand for oil will decline between now and 2050, but likely not as rapidly as the IEA envisions. In our view, there is a long pathway for natural gas to act as transition fuel as new technologies, processes, and investments proceed. The path to net zero is expected to be slow and uneven, but the way we consume hydrocarbons will be forever changed.

Green CapEx

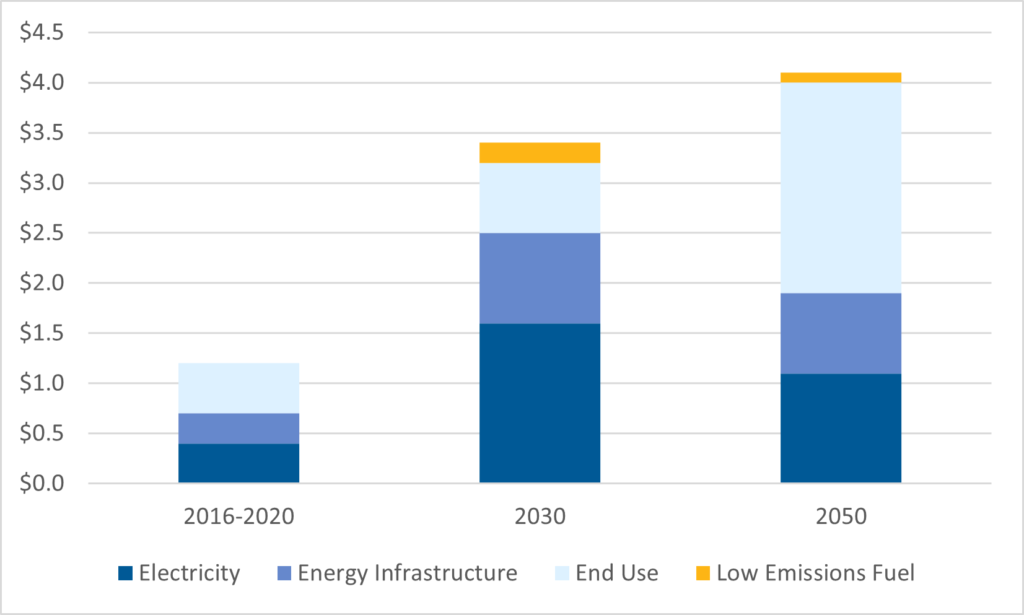

The transformation of energy required to meet the net-zero objectives by 2050 requires massive investment and a significant shift in capital allocation. The IEA forecasts that annual investment in energy will increase to almost US$3.5 trillion by 2030 and to over US$4.0 trillion by 2050, up from an average annual spend of US$1.2 trillion over the past five years, as illustrated in the chart of the month below.

Annual Clean Energy Investment in the Net-Zero Pathway (USD, trillions)

Source: IEA Net Zero by 2050

Transformation

There are four technologies that we currently see emerging as transformational, with a leading role in the path to carbon neutrality:

- Renewable power and battery storage

- Clean hydrogen

- Carbon sequestration

- Alternative fuels

Renewable Power

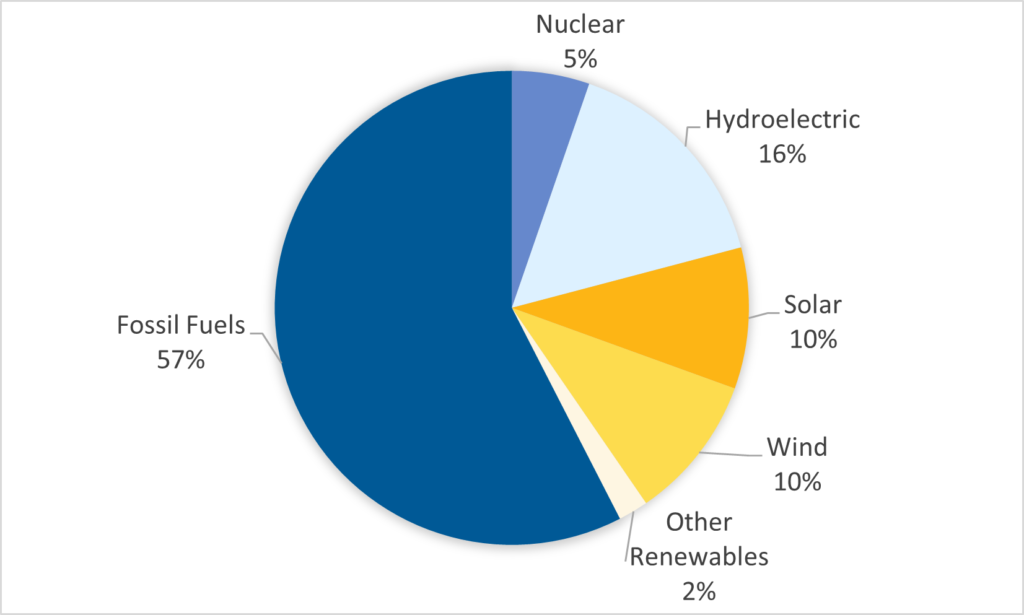

In a world where net zero is reached by 2050, electricity is likely sourced almost solely from renewable energy, with a role for nuclear and possibly natural gas as back-up and/or baseload power sources. For this to occur, electricity battery storage must become economical and deployable on a large scale. The wind does not always blow and the sun does not always shine, so a solution is required to meet the needs of the primary intermittent sources of renewable power. With approximately 57% of current energy capacity provided by fossil fuels (see chart below), the transformation of the electricity industry is a formidable challenge.

Global Electricity Capacity, 2020

Source: U.S. Energy Information Administration

According to BloombergNEF research, the energy transition will likely require adding up to 505 gigawatts (GW) of new wind, 455 GW of new solar, and 245 gigawatt hours of new battery storage on average every year until 2030. This represents greater than 5.2x the amount of wind capacity added in 2020, 3.2x the amount of solar, and 26x the amount of battery storage.3 At the same time, more than 100 GW of coal-fired capacity needs to retire on average each year. Significant investment in electricity transmission grids will also likely be required to connect new sources of power and reinforce the grid for shifts in the demand for electricity (i.e., EVs and residential and commercial heating). Renewable power is the furthest along the cost curve in terms of being deployable and economical; however, it is estimated that it can only reduce up to half of the global CO2 emissions.

Hydrogen

Clean hydrogen is emerging as a critical pillar to any aspiring net-zero path. Hydrogen is not a new alternative, but the technology to commercialize it into an economical and clean fuel source is. Hydrogen’s versatility in production, high energy content per unit, and no emissions at the point of use (combustion) explain its attractiveness as an energy fuel for a carbon-constrained world. As a clean-burning fuel molecule, hydrogen could become a zero-carbon substitute for fossil fuels.

Hydrogen is the most common element on Earth, but it does not exist on its own and must be separated from other elements in a very energy-intensive process. More than 99% of current hydrogen production is from fossil fuels. The turning point for hydrogen is being able to produce it from cleaner sources of power: blue (natural gas with carbon capture and storage), green (renewable power), and pink (nuclear). Hydrogen plays an important role in reducing GHG emissions from harder-to-abate sectors, including long-haul heavy transport and heavy industry.

The challenge for a hydrogen economy is threefold. First, hydrogen conversion is nowhere near economical without a combination of subsidies, tax credits and/or a CO2 tax/penalty. Second, hydrogen requires four times as much space as natural gas (both in gaseous and liquid states), so storage will likely be a challenge. Third, it will require changes to pipeline infrastructure and to household appliances to be able to handle hydrogen. Hydrogen in its ambient form is a highly reactive (combustible) gas, implying the need for careful handling, transport and distribution, as well as the use of high-pressure systems typically for final applications. Natural gas utilities are experimenting with blending hydrogen with natural gas, but 30% hydrogen is the maximum currently possible without requiring significant changes to infrastructure. There have been more than 30 national hydrogen strategies and roadmaps released globally, pledging a greater than 400x increase in clean, installed hydrogen capacity this decade.

The Government of Canada released a hydrogen strategy in December 2020, stating that clean hydrogen has the potential to deliver up to 30% of Canada’s end-use energy by 2050, abating up to 190 metric tons of carbon dioxide equivalent (MtCO2e) of GHG emissions through deployment in transportation, heating, and industrial applications.4 Additionally, Canada could play an important role as a leading global exporter of hydrogen. Canada’s plan involves establishing hydrogen hubs, enacting enabling policy and regulations such as clean fuel standards, fostering strategic partnerships (public and private and with First Nations), and establishing funding programs.

Carbon Capture Technologies

Carbon capture technologies have been used in various forms for decades and are a key pillar in the path to net zero by 2050. There are two main processes within this group of technologies. First, carbon capture and storage (CCS) is the process of capturing carbon from emission sources and sequestering the carbon permanently in underground storage, such as depleted oil and gas reservoirs or saline formations. Second, carbon capture, utilization and storage (CCUS) is designed to use the captured CO2 commercially in other processes, such as enhanced oil recovery or the production of materials, chemicals, or fuels.

With both processes, the CO2 is first captured at the source, where it is then separated from other gas streams. Typically, CO2 is captured where vast amounts of emissions are created, which includes large-scale industrial sources like ethanol plants, fossil fuel power plants, refineries, petrochemical plants, upgraders, and steel plants, as well as in-basin processing plants. Once the carbon dioxide is captured and separated from other gas streams, it is then compressed into an easily transported, liquid-like state and shipped via pipeline to its destination. Finally, the CO2 is then either injected deep underground for permanent storage (CCS) or is utilized for other products (CCUS). There are several carbon capture pilot projects worldwide; however, the process is currently capital intensive and not economical without government subsidies. The CCS industry is working to reduce the cost of carbon capture developments through research and development to make it economical for companies and help accelerate investment decisions. The large-scale implementation of carbon capture is likely to require a corresponding investment in transportation and intermediate storage facilities.

Alternative Fuels

Cleaner burning fuels than gasoline, diesel, jet fuel, and marine fuel will also likely be required to meet net-zero goals by 2050. Biofuels are transportation fuels such as ethanol and biomass-based diesel fuel that are made from biomass materials (e.g., wood waste, corn, soybeans, sugar cane, animal manure). These fuels are usually blended with petroleum fuels (gasoline and distillate/diesel fuel and heating oil), but they can also be used on their own. Renewable natural gas (RNG) is a pipeline-quality gas that is fully interchangeable with conventional natural gas and thus can be used in natural gas vehicles. RNG is essentially biogas that is created by capturing methane emissions from organic waste, landfills and wastewater treatment plants that have been processed to pipeline purity standards. Like conventional natural gas, RNG can be used as a transportation fuel in the form of compressed natural gas (CNG) or liquefied natural gas (LNG). Several refining companies are currently experimenting with running a slate of biofuels.

Transition Risk in the Investment Process

At Beutel Goodman, we believe that the value of companies may be affected over the long term by direct or indirect exposure to physical risks from severe weather and changing weather patterns, and by transition risks relating to their GHG emissions, including policy and legal risk, technology risk, market risk, and reputation risk. We are an official supporter of the Task Force on Climate Related Disclosures (TCFD), which considers the physical, liability, and transition risks associated with climate change and what constitutes effective financial disclosures across industries. We believe that negative screening of companies that have exposure to fossil fuels is not an optimal way to effect change. Instead, we support active ownership and engagement. We believe that we are more powerful working with companies and engaging with them as their major stakeholders to help influence them along their journey to net zero by 2050.

In our investment process, we identify the potential stranded asset and transition risks in the companies that we cover and then use that understanding to form the basis for our climate-related engagement. We want to explore how well companies understand the risks to their business strategies and what their plans to adapt are. If the transition risks are unquantifiable or we do not believe that the company is taking the necessary steps to adapt to the risks inherent in their business strategy, then we will not invest. As an additional way to further our climate investment process, we are a founding member of Climate Engagement Canada (CEC). CEC is a Canadian investor-led collaborative engagement program designed to educate company boards and the senior leaders of Canadian companies on the concerns and expectations of the financial sector as they relate to a timely transition to net-zero emissions by 2050, to spur organizational change, and to move Canada forward on achieving our commitments to the Paris Accord.

Energy transition is an opportunity for some of the energy and utility companies that we have on our approved lists. Electric utilities like Fortis Inc., Algonquin Power & Utilities Corp. and Emera Inc. are working with regulators and legislators to convert their legacy coal-fired power fleet to natural gas and/or shutter coal-fired stations and replace them with renewable energy. Utilities as well as renewable power companies like Brookfield Renewable Partners LP are investing in battery-storage projects. Gas utilities like Enbridge Gas Inc. and CU Inc. are experimenting with blending hydrogen into the natural gas stream for commercial and residential deliveries. FortisBC Energy has an emerging LNG strategy to source LNG for local use (ferries, trucks) and possibly for export.

Midstream and pipeline companies will play a key role in the path to net-zero as the developers and operators of the enabling technologies required for energy transition. Canadian midstream companies have several energy-transition projects in development, including carbon hubs, CCUS, renewable power, renewable natural gas, storage, carbon grid, pumped storage and renewable diesel, as well as small modular nuclear reactors. Pipeline companies such as Enbridge Inc. and TC Energy Corp. are also looking inwardly and are in the process of electrifying their pipeline systems by converting diesel or natural-gas-fired compressor stations to ones powered by renewables. The Oil Sands Pathways to Net Zero is a collaborative initiative by the six largest oil sands producers (Suncor, Imperial Oil, Canadian Natural Resources, Cenovus, MEG Energy, and ConocoPhillips). Their goal is to reduce current total oil sands GHG emissions of 68 MtCO2e per year to zero in three phases by 2050. The plan relies heavily on CCUS but also involves process improvements, electrification, energy efficiency and emerging technologies such as direct air capture of CO2.

The path to net zero by 2050 will likely require significant capital, collaboration, government carrots and sticks (direct funding, tax credits, subsidies, and carbon taxes), and private financing. Fixed income has two key ways to participate. First, we believe that a large amount of the private financing will likely find its way to the bond market, thereby providing an incremental opportunity for direct engagement with companies when they embark on their debt financing roadshows. Second, a large amount of these projects will likely be financed with green, social, and/or sustainable bonds that allow fixed income investors to directly participate in enabling the energy transition. Our credit discipline still applies and each sustainable financing will be evaluated through the lens of credit quality, relative value, and structure.

EndNotes

1 IPCC Working Group I report, “Climate Change 2021: the Physical Science Basis”, August 2021

2 IEA (2021), Net Zero by 2050, IEA, Paris https://www.iea.org/reports/net-zero-by-2050

3 BloombergNEF, “New Energy Outlook”, July 2021

4 Government of Canada, Ministry of Natural Resources “Seizing the Opportunities for Hydrogen: A Call to Action” December, 2020

Download PDF

Related Topics and Links of Interest:

- Responsible Investing at Beutel Goodman: What We Achieved in 2021

- A Touch of Consumption Can Be a Good Thing

- Keep Calm and “Carry” On – 2022 Credit Outlook

©2022 Beutel, Goodman & Company Ltd. Do not sell or modify this document without the prior written consent of Beutel, Goodman & Company Ltd. This commentary represents the views of Beutel, Goodman & Company Ltd. as at the date indicated.

This document is not intended, and should not be relied upon, to provide legal, financial, accounting, tax, investment or other advice.

Certain portions of this report may contain forward-looking statements. Forward-looking statements include statements that are predictive in nature, that depend upon or refer to future events or conditions, or that include words such as “expects”, “anticipates”, “intends”, “plans”, “believes”, “estimates” and other similar forward-looking expressions. In addition, any statement that may be made concerning future performance, strategies or prospects, and possible future action, is also forward-looking statement. Forward-looking statements are based on current expectations and forecasts about future events and are inherently subject to, among other things, risks, uncertainties and assumptions which could cause actual events, results, performance or prospects to be incorrect or to differ materially from those expressed in, or implied by, these forward-looking statements.

These risks, uncertainties and assumptions include, but are not limited to, general economic, political and market factors, domestic and international, interest and foreign exchange rates, equity and capital markets, business competition, technological change, changes in government regulations, unexpected judicial or regulatory proceedings, and catastrophic events. This list of important factors is not exhaustive. Please consider these and other factors carefully before making any investment decisions and avoid placing undue reliance on forward-looking statements Beutel Goodman has no specific intention of updating any forward-looking statements whether as a result of new information, future events or otherwise.