Summary

After significant market volatility in early April, investor sentiment has improved in the summer months, even though current U.S. tariff levels closely resemble those announced on “Liberation Day”. In this piece, Beutel Goodman’s Fixed Income team examines this shift in sentiment, as well as the effects tariffs could still have for the economy over the long term.

By Beutel Goodman Fixed Income Team (as at July 31, 2025)

Markets appear to have come full circle since the U.S. government announced “Liberation Day” on April 2. Since then, investor sentiment has shifted from the initial fear-driven selloffs to renewed optimism, which is underscored by positive hard economic data. This journey highlights the resilience and adaptability of global markets in the face of trade barriers, but also emphasizes potential complacency as markets ignore some meaningful shifts in fundamentals. This leaves us at a crossroads between three prevailing market narratives:

- A deregulation and fiscal spending driven economic boom

- A global growth scare, or

- Stagflation (the scenario where prices are rising and the economy is slowing)

Price Action: From Panic to Recovery

Following Liberation Day, markets reacted swiftly and negatively, reflecting deep uncertainty regarding tariffs and restrictions on global trade. Between March 25 and April 8, equities dropped dramatically, with the S&P 500 Index down by more than 13.5%. Credit spreads widened significantly during this period — Bloomberg U.S. BBB Index spreads increased by 36 basis points, and Bloomberg Canada BBB Index spreads rose by 16 basis points. Concurrently, 10-year U.S. Treasury yields fell by 36 basis points from March 25 to April 4, reflecting a classic flight to safety.

Sentiment rapidly reversed once tariffs were paused for 90 days by the U.S. administration as markets adapted to a new reality for trade. From the April 8 lows to July 31, equity markets rebounded strongly, with the S&P 500 gaining 27%. Credit spreads contracted notably during this period, as Bloomberg U.S. BBB Index spreads tightened by 50 basis points and Bloomberg Canada BBB Index spreads were down 43 basis points from their peak. Interest rates rebounded from their April 4 lows, with U.S. rates rising by 38 basis points by July 31. The dramatic recovery underscores how quickly markets adjusted their perceptions about the impact of trade barriers.

While market prices have returned to pre-Liberation Day levels, fundamental realities have changed significantly. At the time of this writing, tariff levels are in fact similar to those introduced on April 2 (see Exhibit 1). Part of the market complacency could be that the successive policy reversals and ongoing delays to tariff threats are making the market unsure of the final destination of tariffs and how long they will be in effect. Another possibility is that trade barriers and tariffs, initially seen as an existential threat to global commerce, are now perceived as familiar and manageable taken in context alongside the other objectives of the U.S. administration outlined in the One Big Beautiful Bill Act such as deregulation and tax cuts.

Exhibit 1. Liberation Day (April 2) Tariff level versus Current Tariff Levels (July 31). The chart contrasts Liberation Day tariff rates with current tariff levels given official government announcements and recent trade agreements. The new trade deals announced in recent months are for the most part very similar to the Liberation Day tariff levels that resulted in a dramatic risk-market sell off.

| Liberation Day (April 2) Tariff level versus Current Tariff Levels | |||

| Country | Liberation Day Tariff Level | Current Tariff Level | Difference |

| China | 34% | 30% | -4% |

| European Union | 20% | 15% | -5% |

| United Kingdom | 10% (baseline) | 10% | 0% |

| Japan | 24% | 15% | -9% |

| India | 26% | 25% | -1% |

| Vietnam | 46% | 20% | -26% |

| Indonesia | 32% | 19% | -13% |

| Philippines | 17% | 19% | +2% |

| Thailand | 36% | 19% | -17% |

| South Korea | 25% | 15% | -10% |

| Taiwan | 32% | 20% | -12% |

| Switzerland | 31% | 39% | +8% |

| Canada | 25% (on non-‑USMCA goods) | 35% (USMCA goods exempt) | +10% |

| Mexico | 25% (on non-‑USMCA goods) | 25% (USMCA goods exempt) | 0% |

| Brazil | 10% (baseline) | 10% (with threats of 50% reciprocal tariff) | 0% |

| Australia | 10% (baseline) | 10% | 0% |

| Malaysia | 10% (baseline) | 19% | +9% |

| Argentina | 10% (baseline) | 10% | 0% |

| Turkey | 20% | 15% | -5% |

| Singapore | 10% (baseline) | 10% | 0% |

Sources: Beutel, Goodman & Company Ltd., whitehouse.gov as at July 31, 2025

Interpreting the Data: Sentiment versus Reality

Economic data since April 2 has exhibited a notable divergence between sentiment-driven “soft” data and objective “hard” economic metrics. Soft data consists principally of surveys and captures market and consumer perceptions. The inherent benefit of soft data is that it is forward looking, giving a potential clue into what is ahead for the economy. However, it’s not always reliable. While economic slowdowns are almost always preceded by soft data weakness (false negatives are rare), soft data can often turn negative with no ensuing weakness (false positives are not uncommon). Hard data, on the other hand, is more reliable as it measures actual past economic performance. The drawback of hard data is that it is only known after the fact. It often comes with a publication lag or with significant revisions well after the initial release date. This means that signals can come when it is too late for investors to act.

Soft Data: Slow Sentiment Improvement

Soft data indicators deteriorated dramatically post-Liberation Day, suggesting that either stagflation or a recession was on the horizon. The Institute for Supply Management’s (ISM) Purchasing Managers’ Indices (PMI) dipped well below the 50-point contraction threshold and while they have rebounded since, remain in negative territory. The Conference Board’s Consumer Confidence Survey fell to pandemic era levels in April before rebounding over the past two months but remains at historically depressed levels.

Inflation expectation surveys continue to signal elevated price pressures. In Canada, the Bank of Canada’s Business Outlook Survey reflected net pessimism, improving only modestly from -25 in May to -12 in July, underscoring ongoing caution among Canadian businesses.

In summary, these surveys illustrate pronounced fear post-Liberation Day, followed by a gradual sentiment recovery, albeit still below levels prior to April 2.

Hard Data: Resilient Economic Activity

Contrasting some of the negative sentiment expressed in soft data, hard data remains quite resilient across both the U.S. and Canada. In the United States, retail sales rose 0.6% in June (source: U.S. Census Bureau), while industrial production climbed 0.3% (source: U.S. Federal Reserve), highlighting continued consumer and manufacturing activity. In Canada, household spending is also holding up relatively well, with data showing that retail sales likely rose 1.6% in June (source: Statistics Canada).

On the labour market front, employment in Canada grew by 83,100 (+0.4%) in June and the unemployment rate moved lower to 6.9% (source: Statistics Canada). In the U.S., job openings remain ample, while layoffs remain at low levels — initial jobless claims averaged 221,000 in July. However, there are some signs of impending weakness in the labour market with significant negative revisions to the payroll numbers, with May and June prints revised down by 258,000 jobs. Negative revisions can sometimes be a sign of underlying weakness in the jobs market. However, the U.S. unemployment rate remains low at 4.2% in July (source: U.S. Bureau of Labor Statistics).

Interestingly, while headline inflation has moved higher, it has not surged dramatically despite the large increase in tariffs and currency shifts. U.S. headline CPI rose a modest 0.3% in June; core import prices were flat month-on-month, and producer price inflation ticked up only 0.3%, indicating limited passthrough from higher duties (Source: Bureau of Labor Statistics). Some inflation pass-through is becoming evident in core goods inflation, which increased by 0.2% in June. The upward pressure on inflation will likely continue to manifest itself over the next few quarters as corporations continue to slowly pass through tariff costs to consumers.

Riding the Sentiment Roller Coaster: Narratives and Fundamentals

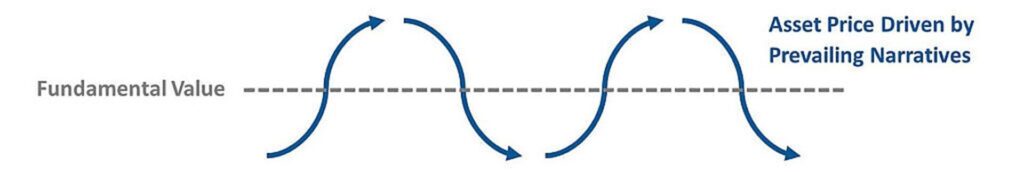

Markets often react with narrative swings fueled as much by emotion as by economics, but over time they invariably return focus to fundamentals. Since April 2, markets have oscillated around fundamental value going from fear to greed, mirroring the narrative waves (see Exhibit 2) we described previously in our insight piece, How Narratives Shape the Markets. Initially, markets were gripped by pessimism, with surveys and soft data dragging sentiment downwards. As hard data held up and policymakers signaled ample support, risk assets rebounded, and market positioning shifted toward optimism, even amid fresh tariff announcements.

Exhibit 2. Narrative Wave. The following chart shows a horizontal dashed line, which represents a relatively stable fundamental value of an asset. Around the line is a wave consisting of line segments. Each line segment represents a narrative that drives asset prices

Source: Beutel, Goodman & Company Ltd. The graphic is meant to be a stylized representation of asset prices as they deviate from fundamental value. It is meant to be viewed as a model and is not indicative of exact pricing changes.

Within this broader swing, three prevailing narratives have emerged:

- The Reacceleration narrative was the prevailing market narrative driving markets in July 2025. This narrative asserts that tariffs are a non-event because economies are adaptable and will remain resilient because any negative tariff impacts will be more than offset by significant deregulation and fiscal stimulus.

- Growth Scare — some analysts caution that markets are overly optimistic, ignoring classical/neoclassical economic theory suggesting tariffs inherently reduce efficiency and slow global activity. This viewpoint anticipates eventual labour market weakening, an economic slowdown and interest rate cuts.

- In contrast, the Stagflation narrative highlights that tariffs are inherently inflationary, limiting central banks’ ability to cut rates as inflation pressures remain stubbornly high. The notable rally in gold in the second quarter of 2025 aligns with this perspective.

Our perspective is more nuanced than the three narratives presented above, recognizing some validity in each scenario. While we anticipate price increases from tariffs, our view is that these are likely to be limited. Our estimates suggest that the price increase associated with the tariffs will amount roughly to a 0.5% increase to the PCE Index,[i] which would be noticeable but modest compared to historical inflationary episodes such as the 1970s’ stagflation or the post-pandemic 8% year-over-year inflation levels. However, this uptick will likely keep inflation above central bank targets, reducing the ability of central banks to ease policy rates, and thereby pushing output downward in the near term, which would likely result in a muted growth backdrop.

In addition, we foresee some headwinds as the global economy adapts to the passthrough of tariffs. It is important to not lose sight of the fact that tariff duties at current levels are already drawing roughly US$27 billion in monthly revenue for the U.S. federal government, so it’s hard to believe that there will be no negative impact on global economic growth. At this time, whether corporations, importers or exporting nations will absorb tariff costs through margin compression, or whether they eventually pass on these costs onto consumer prices is too early to fully discern. That said, our current view is that the economy is likely to prove more resilient than the growth-scare narrative anticipates.

Longer term, we maintain a constructive outlook for Canada, supported by its relatively accommodative monetary policy and an effective tariff rate (estimated at 5–8%) that is significantly below the global average due to USMCA exemptions. Trade talks between the two nations are still in progress, however, which could change the outlook for Canada considerably.

Looking ahead, the next three to four months will be critical in resolving these divergent narratives. Key data points, where even a couple of releases can be enough to challenge a prevailing narrative, will clarify whether economic growth concerns, inflation risks or reacceleration will dominate the narrative. Labour market signals, such as U.S. initial jobless claims and Canadian employment trends, will test the economy’s resilience. Inflation metrics, including CPI and import price trends, will shed light on the extent of the tariff pass-through, thereby probing the viability of the stagflation thesis. Looking beyond the next three to four months, fiscal policy support is likely to provide a medium-term economic buffer, which is why short-term data remains pivotal.

Regardless of the near-term outcome, we believe that ultimately fundamentals will prevail and that in time, hard data will override the emotional swings. This is why we are prepared to update our outlook given changes in the data and remain deeply committed to the value of research-driven analysis and using a disciplined investment approach.

[i] Projected U.S. inflation impact is based on the following assumptions: imported goods make up just over 10% of PCE (source: San Francisco Fed); a 12.5% average effective tariff level (10 pts above 2024 levels) with 50% passthrough to prices (remainder absorbed via exporter and margin compression) yields an estimated ~0.5% inflation impact: 10% × 10% × 50% = 0.5%.

Download PDF

Related Topics and Links of Interest:

©2025 Beutel, Goodman & Company Ltd. Do not sell or modify this document without the prior written consent of Beutel, Goodman & Company Ltd. This commentary represents the views of Beutel, Goodman & Company Ltd. as at the date indicated. This document is not intended, and should not be relied upon, to provide legal, financial, accounting, tax, investment or other advice.

The S&P 500 data (“Index”) is a product of S&P Dow Jones Indices LLC and has been licensed for use by Beutel, Goodman & Company Ltd. All rights reserved. S&P 500® is a registered trademark of Standard & Poor’s Financial Services LLC (“S&P”). Neither S&P Dow Jones Indices LLC or S&P, their affiliates nor their third party licensors make any representation or warranty, express or implied, as to the ability of any index to accurately represent the asset class or market sector that it purports to represent and none such entities shall have any liability for any errors, omissions, or interruptions of any index or any data related thereto.

Bloomberg Index Services Limited. BLOOMBERG® is a trademark and service mark of Bloomberg Finance L.P. and its affiliates (collectively “Bloomberg”). Bloomberg or Bloomberg’s licensors own all proprietary rights in the Bloomberg Indices. Bloomberg does not approve or endorse this material, or guarantee the accuracy or completeness of any information herein, or make any warranty, express or implied, as to the results to be obtained therefrom and, to the maximum extent allowed by law, it shall not have any liability or responsibility for injury or damages arising in connection therewith.

Certain portions of this report may contain forward-looking statements. Forward-looking statements include statements that are predictive in nature, that depend upon or refer to future events or conditions, or that include words such as “expects”, “anticipates”, “intends”, “plans”, “believes”, “estimates” and other similar forward-looking expressions. In addition, any statement that may be made concerning future performance, strategies or prospects, and possible future action, is also forward-looking statement. Forward-looking statements are based on current expectations and forecasts about future events and are inherently subject to, among other things, risks, uncertainties and assumptions which could cause actual events, results, performance or prospects to be incorrect or to differ materially from those expressed in, or implied by, these forward-looking statements.

These risks, uncertainties and assumptions include, but are not limited to, general economic, political and market factors, domestic and international, interest and foreign exchange rates, equity and capital markets, business competition, technological change, changes in government regulations, unexpected judicial or regulatory proceedings, and catastrophic events. This list of important factors is not exhaustive. Please consider these and other factors carefully before making any investment decisions and avoid placing undue reliance on forward-looking statements Beutel Goodman has no specific intention of updating any forward-looking statements whether as a result of new information, future events or otherwise.