By Beutel Goodman’s Fixed Income team

The growth and direction of China is one of the most important evolving narratives for investors. In fact, it has been a story since the 1990s, when the country began to rapidly modernize. With the latest news coming out of China though, many investors are understandably following developments with great interest. The country’s annual GDP growth rate declined to 4.9% in the third quarter, according to the Bureau of Statistics of China, well below the 18.3% growth rate in the first quarter (powered by the rebound from 2020 lockdowns). Perhaps more importantly, Chinese growth has been slowly trending lower since the late 2000s.

Several other recent developments outside of the official economic numbers have drawn more attention to the nation. Crackdowns on technology, slumping real estate sales and the potential for contagion through land developers, and an energy crisis have some observers wondering if China’s slowdown may lead to something even worse, like a global recession.

On the surface, this is a valid concern. However, we believe that it is a worry exacerbated by looking at the situation through a Western mindset. As Westerners, we can often find ourselves taken aback by headlines out of the dominant eastern nation, struggling to understand these stories. If, instead, we examine these issues through a more Sinocentric lens, we can see that China, “the Red Dragon”, has not lost its wings, nor its fire.

Evergrande and the Real Estate Crisis

As a communist nation, China’s leaders have different goals than those of Western democracies. Although economic prosperity is important, the country is more concerned about minimizing and controlling civil unrest. As a result, perhaps the most prominent issue facing the nation at this juncture is the potential collapse of real estate developer Evergrande Group and the reverberations throughout the sector. Evergrande is one of China’s largest property developers. It has been involved in hundreds of projects, including prominent ones like the grandiose Flower City Stadium being built in Guangzhou and the recently completed artificial archipelago, Ocean Flower Island, as well as numerous residences and even entire townships in the country.

Evergrande’s rapid growth over the last decade was financed primarily through large debt issuances – the company holds more than US$300 billion in liabilities. That debt pile, however, morphed into a liquidity crunch after it failed to make payments on a U.S.-dollar-denominated bond issuance in late September. The episode sent shockwaves through the Chinese real estate market as international bond sales by developers effectively evaporated immediately afterwards[1]. Multiple other smaller developers have subsequently defaulted on their obligations, and borrowing costs in the region have soared[2].

It’s not just Evergrande’s size that is a factor to this story. Property represents a significant portion of China’s GDP, at more than a quarter of its entire economic output[3]. This is one of the reasons why the Chinese government has been pressuring developers to reduce their leverage. It is also one of the reasons why global investors are paying attention to the story.

There is a belief among some investors that Evergrande may be China’s “Lehman moment”, in which a default sends a shockwave throughout the entire global economy. However, we do not believe that will be the case, as Evergrande’s bondholders are much more numerous, and its obligations extend to those who have made down payments for new homes, the subcontractors involved in its many projects, and myriad others.

Evergrande has since paid the interest on that U.S.-dollar-denominated debt, at least postponing any default in the near term. Chinese authorities are blaming the developer for its issues, but also say any spillover to the broader financial system is “controllable”[4]. Part of those comments likely stem from Evergrande’s larger portion of foreign-controlled debt, relative to its peers. Reports suggest foreign bondholders are being left out of discussions regarding asset sales or restructuring plans[5].

One of the unfortunate realities of investing in emerging markets as a foreign bondholder is that you may not be treated the same as domestic bondholders; we’ve seen this happen in other emerging markets in the past, such as Argentina, Brazil, and Russia. First and foremost, China wants to avoid social unrest. Hurting foreign bondholders may impact foreign investment flows in the near term – as we’ve seen in the wake of Evergrande’s initial missed payment – but ultimately, it does little to stoke domestic social tensions.

Failing to build homes for which down payments have already been made, however, is a much greater threat to China’s social cohesion. Chinese authorities may be unlikely to simply bail out Evergrande with cash injections, but they have an interest in ensuring there is a resolution for the Chinese citizens who have already handed over their money. Thus, even if foreign bondholders are victims of whatever that resolution may be, we believe the chance of a global spillover effect from a widespread meltdown in the Chinese property sector is low.

The “Crackdown” on Technology

China’s relationship with modern technology might be best described as love/hate. On one hand, technology has been a driving force in the nation’s development and its ability to lift scores of people out of destitute poverty. On the other hand, technology can be a democratizing force with the potential to foment civil unrest. This dichotomy is key, as what many have called a “crackdown” might be more aptly seen as a social restructuring.

Banning children from playing too many hours of video games, prohibiting cryptocurrency mining and transactions, and heavily censoring any form of internet-based communication (social media, in particular) all sound like anti-technology actions. But what’s often missed are the incentives and praise placed in other areas of China’s technology sector. Earlier this year, President Xi Jinping gave an address to senior scientists in which he applauded China’s scientific and technological progress[6]. Among the areas he specifically called out were space exploration and high-tech manufacturing. The area he didn’t mention was the internet.

While the West has largely embraced the internet as a focal point for technological advancement, China has chosen to focus on advanced manufacturing. The country’s output of integrated semiconductor circuits has nearly doubled in the last two years alone – hardly a statistic you’d expect to find amid a crackdown. However, the restrictions that have been put in place – particularly those that limit communications and transactions – align neatly with the idea of minimizing civil unrest.

Green Promises and an Energy Crisis

Energy is one of, if not the most, important ingredients in the growth of a developing nation. China’s leaders have been aware of this for some time. In the last two decades, Chinese power production and consumption have both grown about three-fold[7], with the vast majority of the growth driven by coal.

The price of coal rose significantly this year, although electricity rates in China are state-regulated and therefore have not risen along with input cost. Power plants held smaller coal inventories as a result of the price disconnect, which led to regional rationing and power shortages early in the year. Coal prices have remained elevated since then, further spiking to record highs in October on expectations of colder-than-normal winter temperatures in China. As a result, the shortages have become a national issue, trickling through industry to residential areas.

Chinese leaders responded by allowing utilities to charge electricity prices more in line with the market and by pushing for increased mining production[8]. As a result, the strain on power companies has eased while coal prices have fallen sharply. China is “managing” its energy crisis in a bid to avoid increasing civil unrest, and thus far, it seems to be working.

This comes at a time when China is publicly sharing its wishes to be more environmentally friendly. The country recently pledged to stop building coal-power plants abroad and focus on supporting clean-energy projects instead[9]. However, it has made no such promises domestically. In the end, global emissions are secondary to the communist leadership’s objectives.

Caution is Warranted; Fear, Perhaps, Is Not

China is slowing down and some investors are worried. However, while these fears are not unreasonable, we do believe they may be misplaced to some degree. China is a very unique place; it is not a “set it and forget it” investment market. The reality is that China is evolving and changing, and these changes flow directly through to its growth potential. The days of consistent double-digit GDP expansion are over.

This all seems quite natural to us. Any developing nation will ultimately see its growth rates slow as part of its evolution. China’s shift towards urbanization has peaked and it likely won’t be attempting to build entire new cities overnight anymore. That’s not to say that there won’t be further migration out of rural areas, but we do not expect to see this happen at the rate it did a decade ago. The same could be said about China’s more recent shift towards a services-focused economy, as simpler manufacturing processes get offshored to other Asian countries that are further back on their development timelines.

At the same time, investors should consider this in the context of Western central bank actions. The U.S. Federal Reserve announced its plan to taper its stimulus programs in November, while the Bank of Canada ended its quantitative easing in late October[10]. This handoff from the central banks back to their economies will likely be a bit shaky given the number of moving parts. This may in turn lead to increased volatility in markets as investors navigate higher gas prices, inflation, supply-chain issues, and pent-up consumer demand.

All of this will undoubtedly have an impact on global growth rates. The heart of this debate is whether China’s unique concerns will drive below-potential growth rates and lead to further negative impact on the rest of the world. We do not believe this is the case, but as with all macro-economic issues that could impact our portfolios, we will continue to monitor it closely.

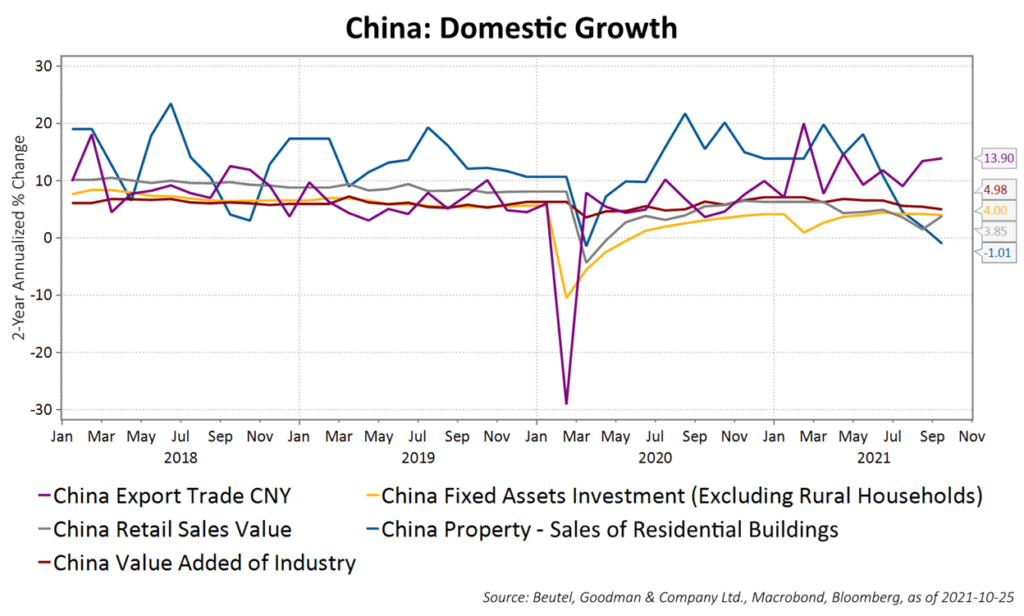

Figure 1 shows China’s current slowdown is driven primarily by declining property sales while other segments, particularly export trade, remain fairly robust.

[1] Financial Times, “Evergrande crisis leaves Chinese developers shut out of global debt markets”; October 13, 2021 (https://www.ft.com/content/b8effeb7-e553-4bb1-8ece-a610fcbcdbb2).

[2] Financial Times, “Chinese developer Sinic defaults as Evergrande deadline looms”; October 19, 2021 (https://www.ft.com/content/1e79c466-c813-41de-a0b3-cbd27a983aaa).

[3] Kenneth Rogoff, Vox EU: “Can China’s outsized real estate sector amplify a Delta-induced slowdown?”; September 21, 2021 (https://voxeu.org/article/can-china-s-outsized-real-estate-sector-amplify-delta-induced-slowdown).

[4] Financial Times: “China’s central bank says spillover from Evergrande crisis ‘controllable’”; October 15, 2021 (https://www.ft.com/content/3d797dac-85f4-409d-b1e9-6e8ffb9fcc78).

[5] The Wall Street Journal: “Evergrande Is Leaving Foreign Bondholders in the Dark, Advisers Say”; October 10, 2021 (https://www.wsj.com/articles/evergrande-is-leaving-foreign-bondholders-in-the-dark-advisers-say-11633707966).

[6] Xinhua: “Xi Focus: Xi stresses sci-tech self-strengthening at higher levels”, May 29, 2021

(http://www.xinhuanet.com/english/2021-05/29/c_139976311.htm).

[7] International Energy Agency (https://www.iea.org/data-and-statistics/data-product/world-energy-statistics-and-balances).

[8] Reuters: “China coal prices notch worst week since May on govt intervention”; October 22, 2021 (https://www.reuters.com/world/china/china-coal-prices-dive-11-beijing-plans-intervene-ease-power-crunch-2021-10-22/).

[9] Statement by H.E. Xi Jinping, President of the People’s Republic of China at the General Debate of the 76th Session of the United Nations General Assembly, September 21, 2021 (https://estatements.unmeetings.org/estatements/10.0010/20210921/AT2JoAvm71nq/KaLk3d9ECB53_en.pdf).

[10] Bank of Canada (https://www.bankofcanada.ca/2021/10/fad-press-release-2021-10-27/)

Download PDF

Related Topics and Links of Interest:

- (Don’t Fear) The Taper

- The Debt Hangover

- Hello Inflation, my old friend – I’ve come to talk about you again

©2021 Beutel, Goodman & Company Ltd. Do not sell or modify this document without the prior written consent of Beutel, Goodman & Company Ltd. This commentary represents the views of Beutel, Goodman & Company Ltd. as at the date indicated.

This document is not intended, and should not be relied upon, to provide legal, financial, accounting, tax, investment or other advice.

Certain portions of this report may contain forward-looking statements. Forward-looking statements include statements that are predictive in nature, that depend upon or refer to future events or conditions, or that include words such as “expects”, “anticipates”, “intends”, “plans”, “believes”, “estimates” and other similar forward-looking expressions. In addition, any statement that may be made concerning future performance, strategies or prospects, and possible future action, is also forward-looking statement. Forward-looking statements are based on current expectations and forecasts about future events and are inherently subject to, among other things, risks, uncertainties and assumptions which could cause actual events, results, performance or prospects to be incorrect or to differ materially from those expressed in, or implied by, these forward-looking statements.

These risks, uncertainties and assumptions include, but are not limited to, general economic, political and market factors, domestic and international, interest and foreign exchange rates, equity and capital markets, business competition, technological change, changes in government regulations, unexpected judicial or regulatory proceedings, and catastrophic events. This list of important factors is not exhaustive. Please consider these and other factors carefully before making any investment decisions and avoid placing undue reliance on forward-looking statements Beutel Goodman has no specific intention of updating any forward-looking statements whether as a result of new information, future events or otherwise.