Summary

Interest rates are causing waves again after the Bank of Canada’s somewhat surprising hike in June. The U.S. Federal Reserve elected to pause in its June announcement, and in the view of Beutel Goodman’s Fixed Income team, the end may be in sight for hawkish central bank policy.

By Beutel Goodman’s Fixed Income team

Monetary policy has been a major driving force in securities markets over the last 18 months, so it wasn’t surprising that there was a huge amount of anticipation ahead of the U.S. Federal Reserve’s (Fed) June 13–14 meeting. The Fed subsequently announced a pause in its hiking cycle after 10 consecutive hikes since March 2022.

Speaking at a conference in Washington in May, Fed Chair Jerome Powell indicated that a pause was in the cards, saying, “We face uncertainty about the lagged effects of our tightening so far … the risks of doing too much versus doing too little are becoming more balanced.”

Following the Fed’s announcement, U.S. bond markets are pricing in another hike in July or September, highlighting the stubbornness of the inflation problem.

The European Central Bank (ECB) is also contending with elevated inflation as its President Christine Lagarde discussed in a recent speech in Hanover, Germany, “[W]e need to continue our hiking cycle until we are sufficiently confident that inflation is on track to return to our target in a timely manner,” (source: ECB, June 1, 2023).

In Canada, the Bank of Canada (BoC) paused its hiking cycle in March but following higher-than-expected inflation data for April (4.4% year-over-year compared to 4.3% in March), it delivered a somewhat surprising hike of 25 bps in its June 7 meeting. This reversal mirrored the Reserve Bank of Australia (RBA), which delivered surprise rate increases in May and early June after pausing its hiking cycle in April.

It is our view that the Fed, BoC, ECB — and the majority of central banks worldwide — may hike again over the summer, but the end of the hiking cycle remains in sight.

Why Now?

A pause in rate increases will be informed by central banks’ assessment that policy rates are deemed “sufficiently restrictive” to bring inflation back down to target.

In Canada, core inflation is moderating but still above the BoC’s 2% target, with the April three-month annualized Median CPI at 3.79% and Trimmed Mean CPI at 3.65%. The BoC has currently forecast headline CPI working its way down to 3% by the middle of 2023 and a return to target by 2024 (source: Bank of Canada Monetary Policy Report).

Inflation likely peaked in the U.S. last July when the year-over-year Consumer Price Index (CPI) reading reached 8.5%, and we are now starting to see a slowdown in price increases. An important distinction is that this doesn’t mean lower prices for consumers; rather, it’s a reduction in the pace of the increases that ran rampant after the U.S. economy emerged from a series of COVID-19 lockdowns.

The April year-over-year CPI reading of 4.9% for the U.S. was a slight improvement on the March (5% year-over-year) reading. Core inflation, meanwhile, stood at 5.5% year-over-year in April, compared to 5.6% in March. While an inflation rate of 4.9% is still a long way off the Fed’s 2% target, this was the smallest 12-month increase since April 2021.

The fight against inflation is clearly no easy fix, and the Fed has estimated that it won’t likely reach its inflation target until 2025 or later. While the journey to 2% may be long, the hiking cycle appears to be having the desired effect in terms of cooling the economy.

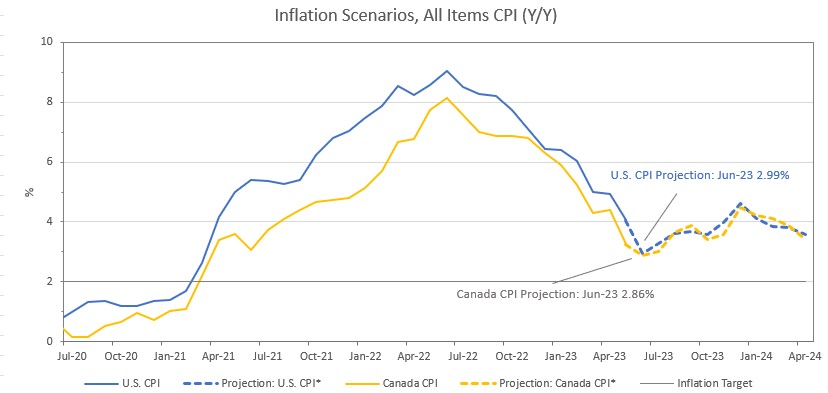

Recent months have seen declines in both food and energy prices, and this is expected to pass through to consumer prices in the next couple of CPI prints. Based on our latest analysis, we note that base effects may put downward pressure on May and June inflation numbers as high inflation prints from 2022 fall out of the sample. The base effect could then reverse in the latter half of the year and may lead to a reacceleration in year-over-year inflation numbers (See Exhibit 1).

The initial dip in headline inflation appears to support central bankers’ shift to pause the hiking cycle in the coming months, but a reacceleration in rising prices in the latter half of the year may delay the onset of rate cuts that are anticipated by both the U.S. and Canadian bond markets.

Exhibit 1: Inflation Expectations and Base Effects. This graph shows that due to base effects of high May and June inflation prints from 2022 falling out of the year-over-year sample range, the June 2023 headline inflation print could fall to under 3% in both U.S. and Canada. The projection then reaccelerates in the second half of 2023, before falling again in 2024. The projections are based on the latest six-month moving average of the month-over-month changes in CPI extrapolated on a monthly basis to illustrate the importance of base effects.

*Note: Projection is based on the latest six-month moving average of the month-over-month changes in CPI. Source: Beutel Goodman & Company Ltd., Statistics Canada, U.S. Bureau of Labor Statistics (BLS). As of June 2, 2023. This chart presents hypothetical scenarios and is for illustrative purposes only.

Spotlight on the Fed

The Fed appears to be in a real quandary as it attempts to find the sweet spot where interest rates are restrictive enough to bring inflation closer to its 2% target, but without leaving an economic crater in its wake. In the early 1980s, Fed Chair Paul Volcker understood that a recession was needed to break the back of inflation. During the current cycle, however, Chair Powell is hoping that inflation can be tamed, while still achieving a soft landing for the economy.

The pandemic meant significant disruptions to supply chains, and this was amplified by Russia’s invasion of Ukraine in February 2022. Although the conflict in Ukraine shows no signs of abating, the commodity shock that resulted from Russia’s incursion appears to have subsided and prices have normalized. Largely speaking, the bottlenecks that have gummed up supply chains since the start of the pandemic have mostly been resolved.

The main area of strength in the economy in the post-pandemic period has been the U.S. labour market. The payroll data released on June 2 by the U.S. Bureau of Labor Statistics showed an addition of 339,000 jobs. The employment gains were broad-based across a number of different sectors, and 93,000 jobs were later added in the bureau’s two-month net revisions.

Payroll data is a lagging indicator in the business cycle, however; when looking at leading indicators such as continuing unemployment claims, it is clear that the resilience of the labour market is starting to fade. Continued claims are up 38.9% from the lows reached midway through 2022, while layoffs have increased and the rate of workers quitting is down. Other signs of cracks include a decline in average weekly hours worked to just 34.3 hours a week — this is the lowest level since the start of the pandemic. There was also a material decline in employment measured by a household survey released on June 2 that showed a 0.3% increase in the unemployment rate from 3.4% in April to 3.7% in May (source: U.S. Bureau of Labor Statistics).

Financial conditions have also tightened considerably in 2023, which was the case even before the collapse of Silicon Valley Bank, Signature Bank and First Republic Bank in the U.S. It has been a tumultuous few months for the global banking sector to say the least, and especially for regional banks in the U.S. This will likely mean tighter lending restrictions for small-to-medium businesses, as well as for the already hard-hit commercial real estate sector. Less capital available for businesses means fewer new offices or stores, less new machinery, and ultimately, fewer workers.

The Fed’s Summary of Economic Projections estimates a 1.1% increase in the unemployment rate (from April’s 3.4% reading to 4.5% by the end of 2023), but it does not foresee a recession in 2023 (source: Federal Open Market Committee Summary of Economic Projections). This is of particular interest due to the incongruity of the unemployment and GDP forecasts. There has never been a period when unemployment has increased by more than 1% over two quarters without an associated recession.

Bank of Canada — Balancing the Scales

The Bank of Canada’s policy rate sits at 4.75% following its June statement when the governing council ended its March hold. At the time of the BoC’s pause in March, the central bank felt secure enough to take a wait-and-see approach, believing that the cooling effect of hawkish monetary policy in the U.S. would be felt on both sides of the border. However, the recent reacceleration in interest rate sensitive sectors of the economy, specifically housing, was cause for concern. The BoC is focused on balancing the effects of supply and demand to create conditions for inflation to sustainably return to 2%.

Inflation has eroded both consumer savings and the purchasing power built up during the pandemic, leaving consumers more vulnerable to further rate hikes. This is a part of the balancing act that the BoC is aiming to address with its monetary policies.

Housing prices have fallen by 9% from their peak, according to Teranet, but appear to have stabilized for now. Regardless, rising debt levels and debt services costs are creating financial stability concerns. In its Financial System Review — 2023, the BoC stated that, “In light of higher borrowing costs, the Bank of Canada is more concerned than it was last year about the ability of households to service their debt. More households are expected to face financial pressure in the coming years as their mortgages are renewed. The decline in house prices has also reduced homeowner equity, and some signs of financial stress — particularly among recent homebuyers — are beginning to appear,” (source: Bank of Canada Financial System Review). This financial stress will have the second-order effect of limiting spending in other areas of the economy, such as goods and services.

Housing affordability continues to be a huge concern in Canada’s largest cities, which in turn has led to elevated levels of household debt — a recent report by Canada Mortgage and Housing Corporation (CMHC) found Canada’s household debt is the highest among G7 countries and approximately 75% of that debt is from mortgages.

Canada experienced a surge in home buying during the first two years of the pandemic, a period when interest rates were close to zero. Properties purchased in 2020 and 2021 with a typical five-year mortgage term will be due to refinance in 2025 and 2026, respectively. In our view, it is a safe assumption that interest rates will be higher at that time than during the pandemic, which will entail higher mortgage payments.

Those who purchased mortgages with variable rate terms have so far been able to forgo an increase in monthly payment costs by extending the amortization of their mortgages. This extension feature has resulted in most variable rate mortgages having an amortization of greater than 30 years — this will require a lump sum payment at renewal to bring the mortgage back to a 25-year schedule. The BoC is aware that the increase in payments for both fixed and variable rate mortgage holders resulting from higher policy rates has not yet been fully felt and the financial stress on the market will operate with a lag as these loans come up for renewal in the next five years.

Throughout this hiking cycle, the BoC has had the difficult task of balancing the scales of monetary policy, with the management of financial stability risks on one side and upside inflation risks on the other.

Reading the Tea Leaves on Rate Hikes

Our latest base case is that the U.S. and Canadian economies may slow in the next 12 months. As central banks get close to pausing their hiking cycles, with one or two more hikes likely, rates may be sufficiently restrictive to slow down growth, weaken employment and lead us into a mild recession. In our view, engineering a soft-landing for the economy looks extremely difficult to achieve.

At this stage, we have taken a defensive position on credit, with a focus on liquid safe-haven assets in the Utilities and Infrastructure sectors, as well as Canadian banks.

The intransigence of post-pandemic inflation makes predicting central bank policy difficult, but given the series of rate hikes throughout 2022 and 2023, we believe it’s likely that the much-predicted economic slowdown is already in play and that the 2% inflation target could soon be coming over the horizon.

Download PDF

Related Topics and Links of Interest:

©2023 Beutel, Goodman & Company Ltd. Do not sell or modify this document without the prior written consent of Beutel, Goodman & Company Ltd. This commentary represents the views of Beutel, Goodman & Company Ltd. as at the date indicated.

This document is not intended, and should not be relied upon, to provide legal, financial, accounting, tax, investment or other advice.

Certain portions of this report may contain forward-looking statements. Forward-looking statements include statements that are predictive in nature, that depend upon or refer to future events or conditions, or that include words such as “expects”, “anticipates”, “intends”, “plans”, “believes”, “estimates” and other similar forward-looking expressions. In addition, any statement that may be made concerning future performance, strategies or prospects, and possible future action, is also forward-looking statement. Forward-looking statements are based on current expectations and forecasts about future events and are inherently subject to, among other things, risks, uncertainties and assumptions which could cause actual events, results, performance or prospects to be incorrect or to differ materially from those expressed in, or implied by, these forward-looking statements.

These risks, uncertainties and assumptions include, but are not limited to, general economic, political and market factors, domestic and international, interest and foreign exchange rates, equity and capital markets, business competition, technological change, changes in government regulations, unexpected judicial or regulatory proceedings, and catastrophic events. This list of important factors is not exhaustive. Please consider these and other factors carefully before making any investment decisions and avoid placing undue reliance on forward-looking statements Beutel Goodman has no specific intention of updating any forward-looking statements whether as a result of new information, future events or otherwise.