Summary

Beutel Goodman’s Fixed Income team looks at the “January Effect” phenomenon, which saw stocks and bonds rally in the first month of 2023, despite the various headwinds facing the global economy and securities markets.

By Beutel Goodman’s Fixed Income team

A new year generally brings a renewed sense of optimism that often finds its way into securities markets. The “January Effect” was clearly on display in 2023 as stocks and bonds experienced a surge of inflows in the first month of the year. In January, on a total-return basis, the S&P 500 Index (US$) rose 6.28%, the S&P/TSX Composite Index advanced by 7.41%, the FTSE Canada Universe Bond Index gained 3.09% and the Bloomberg Corporate High Yield Index returned 3.81%.

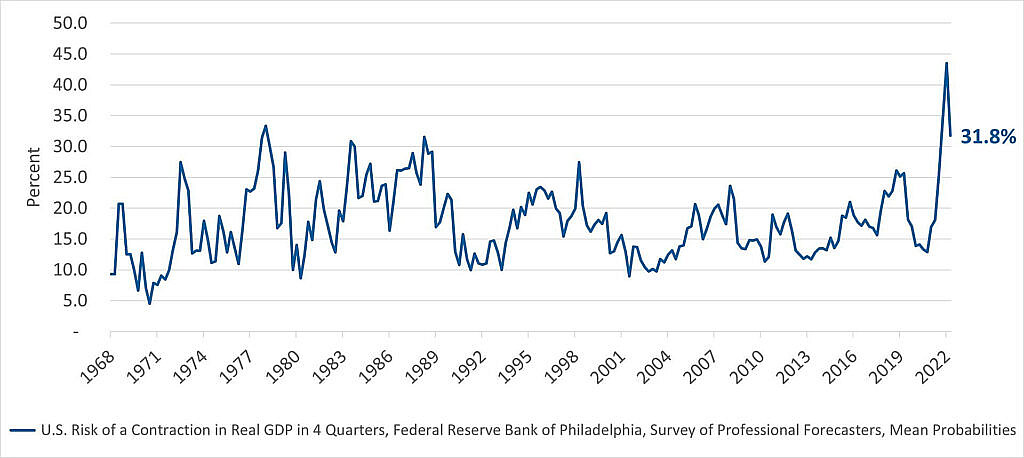

The likelihood of a recession in 2023—which was the consensus view among economists at the end of 2022—is also being re-evaluated. In Exhibit 1, you can see that the U.S. Federal Reserve Bank of Philadelphia’s Survey of Professional Forecasters shows a decline in recession probability for the next four quarters from 43.5% in Q4/2022 to 31.8% in Q1/2023.

Exhibit 1. Recession Probability Coming Down. In this line graph, showing the period from 1968 to the present day, the Federal Reserve Bank of Philadelphia’s Survey of Professional Forecasters shows that the outlook for the economy has improved since the end of 2022. At the end of Q4 2022, the likelihood of a recession was at its highest point for the entire period mapped out in this chart, which spans just over 54 years.

Source: Beutel Goodman & Company Ltd., Macrobond, Federal Reserve Bank of Philadelphia, as at February 10, 2023.

In our view, the January rally was not built on solid foundations. Instead, it seems that markets were experiencing a case of emperor’s new clothes syndrome. The shift in investor sentiment in January appears to be attributable in large part to strong job numbers in Canada and the U.S., as well as a growing perception that central banks’ fight against inflation was winding down. This shift in sentiment drove a significant amount of cash back into equities and bonds, which further propelled the rally in somewhat of a self-reinforcing feedback loop as markets chose to cling to the hope of a “soft landing”.

In addition to the much-discussed soft-landing scenario, the possibility of “no landing” started to gain credence in January as markets rallied. No landing in this case would mean unemployment remaining low, inflation moving towards 2% and economic growth reaccelerating.

Economic Resilience

There are reasons for optimism that an economic downturn, should it occur, may not be as severe as in the inflation-breaking market cycles of the 1970s and 1980s. The U.S. added 517,000 jobs in January, completely reversing a five-month trend of slowing employment growth and bringing the unemployment rate (3.4%) to a 53-year low. Canada also saw employment increase by an impressive 150,000 jobs in January, with unemployment remaining at 5%. Employment in Canada has been trending upward since last September, with cumulative job gains since then amounting to 326,000 (source: Statistics Canada).

Across the Atlantic, sentiment also shifted somewhat after a bleak 2022 in Europe. The E.U. Winter Interim Forecast lifted the bloc’s growth outlook for 2023 to 0.8%; it also lowered its projections for inflation for both 2023 and 2024. Sentiment in the euro zone benefited from milder winter weather, which alleviated fears of increased heating costs taking a bite out of consumers’ wallets. The reopening of China’s economy after years of draconian COVID-19 lockdowns also contributed to the positive shift in global economic sentiment in early 2023.

The scale of employment growth in January came as a surprise to many economists and played a significant part in the more bullish investment sentiment. However, we would caution that the strong January 2023 economic data may have benefitted from significant positive seasonal adjustment due to the Omicron outbreak occurring in January 2022.

Downbeat Earnings

It is also important to note that the average corporate earnings for Q4/2022, released in early 2023, provided guidance for some tough times ahead for many companies. Better-than-expected earnings results can often lead to a rally in risk assets, including corporate bonds, but that wasn’t the case in this particular rally. For the S&P 500 Index, 67.4% of companies reported Q4 earnings above analyst expectations, but this is well below the previous four-quarter average of 75.5% and represents the lowest beat rate since the fourth quarter of 2015 (source: Lipperalpha.Refinitiv.com).

For corporate bonds, our focus is on the impact of lower earnings on balance sheets and on management’s capital-allocation policies. Declines in cash-flow generation could start to lead to an uptick in leverage metrics such as Debt/EBITDA. Declines in earnings could also pressure dividend payout ratios. We are mindful of companies that use debt to pay dividends or execute on share buybacks.

All Roads Lead Back to Inflation

The strong job numbers clearly show resilience in the economy, but the inflation problem that dictated market performance (and monetary policy) last year remains and isn’t going away anytime soon. To think otherwise is wishful thinking (as we discussed in our January commentary), and to drive home that point, the January Consumer Price Index in Canada and the U.S. showed an increase month over month.

Sticky inflation won’t be remedied by simply wishing it away, which is why we currently expect at least another two rate hikes by the U.S. Federal Reserve (Fed). Raising the Federal Funds rate to 5.00–5.25% would send a strong signal regarding inflation and how the market exuberance at the beginning of the year was contrary to the views of the world’s major central banks. We do not currently expect that the Bank of Canada (BoC) will hike at its next meeting, as Governor Tiff Macklem has already prepared markets for a pause. Should the economic data continue to show resilience, however, another hike is possible by mid year. In addition, we do not currently expect the BoC to start cutting rates during 2023.

The belief that resilient economic data and sticky inflation will result in no landing for the economy is an example of post hoc fallacy, in our view. Inflation remains the largest threat facing the global economy, and in that respect, conditions have not changed much since December, when markets were down. While ‘China’s reopening will likely contribute marginally to global growth in 2023, it may also lead to higher energy and metal prices, which would then have an inflationary impact worldwide. Entrenched inflation, whether it is with commodities or core goods and services, will likely mean further rate hikes and inevitably push any potential rate cuts further into the future.

Rules of Thumb

Upon reflection, it appears that the January rally can be attributed in large part to a collective sense of wishful thinking. That is somewhat understandable after a difficult 2022 for investors when both stocks and bonds were down significantly for the year. As we have discussed, markets can be dictated by sentiment, but the reality of negative earnings guidance will likely dampen the outlook for corporate bonds for even the most bullish of investor.

Central bank policy is another powerful force, and although we believe the Fed and the BoC are highly unlikely to move as aggressively in 2023 as they did last year, further hikes are certainly a possibility if inflation continues to remain stubbornly high.

Progress is being made on that front, and the January year-over-year CPI reading in Canada moved down to 5.9% (4.9% for core), compared to 6.3% in December (5.3% for core). In the U.S., CPI in January had a year-over-year reading in January of 6.4% (5.6% for core), compared to 6.5% in December (5.7% for core). The month-over-month figures showed an uptick, however. The readings are down markedly since the peaks of last summer, but are still a long way off the 2% target of the Fed and BoC. We therefore believe rates are likely to remain higher for longer.

It also means fixed income should continue to provide attractive yields for investors. The rally of January wasn’t just a stock story, as corporate bonds also saw a significant influx during the month, led by mutual funds keen to reduce the risk profile of their portfolios while still generating a healthy income stream. From January 1 to February 19, 2023, US$19 billion flowed into funds that buy global investment grade corporate debt, which is the most ever at that point in the year (source: Financial Times). In our February 8 insights piece, The Return of Income, we discussed how bonds were in a much stronger position than the majority of the post Global Financial Crisis period. Fixed income can also act as an important hedge against equity market volatility.

In our view, the positive economic data in January does not mean a downturn won’t occur; rather, we have received a stay of execution. The 2-year/10-year government bond spread in Canada has been inverted since last July, which historically has been a leading indicator for forecasting a recession. The pandemic created some unique economic conditions, but certain economic rules of thumb always apply, and particularly when it comes to inflation.

Strong job numbers will continue to contribute to wage inflation, which will lead to higher core CPI. At this stage of the market cycle, lower inflation and strong job growth are incongruous. We expect this to be a key factor for the Fed at the next FOMC announcement in March, when the rally of January may seem less of a bellwether.

Download PDF

Related Topics and Links of Interest:

- Putting in the Hard Yards on Inflation

- The Return of Income

- This Time is Different: No Monetary Safety Net for Markets in 2023

- Beutel Goodman Core Plus Bond Fund

©2023 Beutel, Goodman & Company Ltd. Do not sell or modify this document without the prior written consent of Beutel, Goodman & Company Ltd. This commentary represents the views of Beutel, Goodman & Company Ltd. as at the date indicated.

This document is not intended, and should not be relied upon, to provide legal, financial, accounting, tax, investment or other advice.

Certain portions of this report may contain forward-looking statements. Forward-looking statements include statements that are predictive in nature, that depend upon or refer to future events or conditions, or that include words such as “expects”, “anticipates”, “intends”, “plans”, “believes”, “estimates” and other similar forward-looking expressions. In addition, any statement that may be made concerning future performance, strategies or prospects, and possible future action, is also forward-looking statement. Forward-looking statements are based on current expectations and forecasts about future events and are inherently subject to, among other things, risks, uncertainties and assumptions which could cause actual events, results, performance or prospects to be incorrect or to differ materially from those expressed in, or implied by, these forward-looking statements.

These risks, uncertainties and assumptions include, but are not limited to, general economic, political and market factors, domestic and international, interest and foreign exchange rates, equity and capital markets, business competition, technological change, changes in government regulations, unexpected judicial or regulatory proceedings, and catastrophic events. This list of important factors is not exhaustive. Please consider these and other factors carefully before making any investment decisions and avoid placing undue reliance on forward-looking statements Beutel Goodman has no specific intention of updating any forward-looking statements whether as a result of new information, future events or otherwise.