– By Beutel Goodman’s Fixed Income team

It has been a difficult start to the year for fixed income markets. The asset class is contending with a tug-of-war between stubbornly high CPI prints and central banks that are raising short-term interest rates to combat inflationary pressures. While the former places upward pressure on rates, the latter tends to flatten the yield curve, as investors wager that central banks will opt to quell inflation at the expense of economic growth and might cause a recession in the process. To top it off, war continues to be waged in Ukraine and supply chains remain broken. Credit spreads have widened, exacerbating the pain for bond investors.

We are increasingly fielding questions about whether this is the start of a prolonged bond bear market and why investors should stay in fixed income. While we agree that the start of 2022 has been a difficult one for bond investors, we believe there are meaningful opportunities in the asset class that can translate into alpha for clients who have active managers working on their behalf.

Sorting Through the Noise

Year to date (YTD), the S&P/TSX Composite Index (TSX) is down 2.3% on a price return basis and down 6% vs the all-time highs it hit in March. On the other hand, the FTSE Canada Universe Bond Index is down 10.3% year to date. Understandably, this comes as a shock to many investors – how can the less volatile and “safer” asset class underperform equities?

The fixed income market is inherently forward-looking; constantly incorporating new information and extrapolating those implications into the future. Government yield curves have flattened significantly to this point in the second quarter as market participants price in probabilities of multiple large (i.e., 50 basis point (bps)) rate hikes and listen to central bank officials’ increasingly hawkish rhetoric that has clearly telegraphed their willingness to sacrifice growth if it helps to tame inflation. The effect was a more severe re-pricing in the bond market and a temporary breakdown of the traditional fixed income hedge vs equities.

Inflation: Stickier than Expected

As expected, the U.S. Federal Open Market Committee (Fed) raised the federal funds rate by 50 bps early in May and laid out their roadmap for quantitative tightening (QT) to reduce the amount of monetary stimulus in the economy. The war in Ukraine, supply-chain pressures, high energy prices, an unemployment rate below the “natural rate”, and a relatively healthy consumer have created a perfect storm for inflation to remain stubbornly high.

The inflation data released in May for the month of April came in ahead of expectations both in Canada and the U.S. Canadian core CPI median inflation was 4.4% year-over-year vs expectations, as sourced from Bloomberg L.P., of 3.9%, while the U.S. saw core CPI at 6.2% in April (excluding food and energy) vs expectations of 6%. Fed officials have been telegraphing to the market that further 50 bps hikes are on the table for June and July. Bank of Canada governor Tiff Macklem succinctly captured the mood of the market during his April 13, 2022 Monetary Policy Report press conference when he commented that “Team Transitory has disbanded”. For the better part of 2021, central banks had insisted that inflation was not persistent and have had to abandon that reasoning and renew their inflation-fighting mantra.

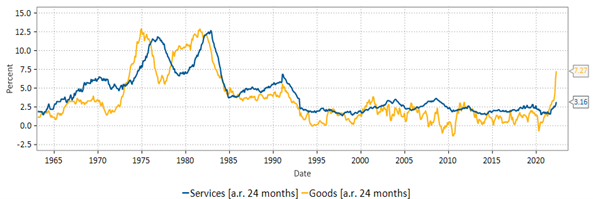

Canadian Services vs. Goods Inflation

This line graph shows that services inflation in Canada is ticking up while goods inflation is stubbornly high and slow to roll-over/fall. This is contrary to the previous consensus view that would have seen goods inflation rapidly deteriorate as people stopped spending on goods.

Source: Beutel, Goodman & Company Ltd., Macrobond, as at June 9, 2022

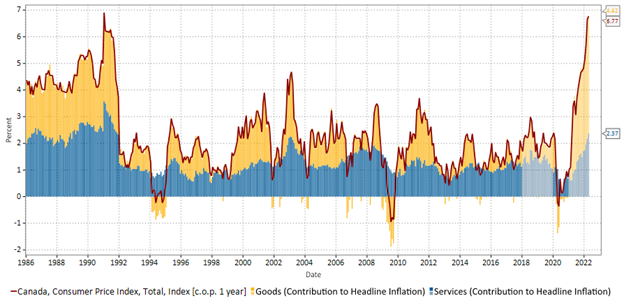

Canadian CPI Breakdown

This bar graph shows Canadian CPI from 1986-2022, as well as the breakdown by goods and services inflation as contributions to headline inflation. The graph shows that services inflation has been ticking up over the past several months, while goods inflation has been slow to roll over.

Source: Beutel, Goodman & Company Ltd., Macrobond, StatCan, as at June 9, 2022

The consensus view has shifted, as market participants note that services inflation is ticking up at a faster-than-expected rate, while goods inflation has been slow to roll over. This is the result of prolonged supply-chain disruption and the war in Ukraine keeping goods inflation stubbornly high, while services inflation is ticking up as economies re-open and people resume travelling, dining out, and opting to spend their money on experiences rather than hard goods.

There is Now an Alternative (TINAA)

A common general argument against bonds is that a portfolio of dividend-paying equities will yield incrementally more than a portfolio of bonds given the risk differential. That is no longer is the case. The yield on a 10-year Government of Canada bond now is the same at the dividend yield on the TSX.

Dividends are the cash paid out, and we concede not truly indicative of the full earning power of the companies in the index. However, comparing dividend yields to bond yields may be a useful comparison for income-seeking investors. If we compare the earnings yield on the TSX to the Canadian 10-year risk-free rate, the earnings yield appears to be approaching 10-year lows. We would also note this is before earnings factor in margin pressures in an inflationary environment (cost-side) and slower growth prospects in a tightening cycle (demand-side). As dividend yields tend to follow earnings yields, it is reasonable to expect tempered dividend growth in periods of earnings pressure. We believe the TINA (“there is no alternative”) trade is over; the year-to-date move in rates and corporate spreads is creating opportunities in fixed income.

Opportunities in Fixed Income

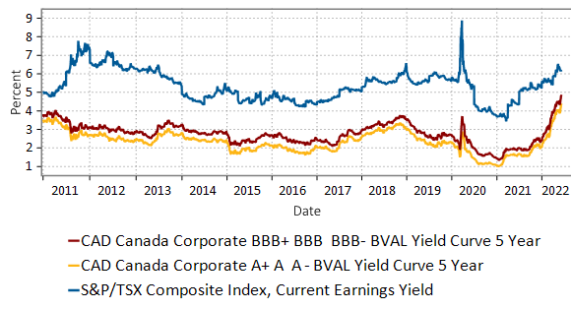

A key tenet of traditional portfolio management theory is that to generate a higher expected return, an investor needs to move out along the risk spectrum. The same holds true for companies’ capital structures; senior secured debt, as the highest-quality part of a capital structure, should have a lower expected return than unsecured debt, which in turn should have a lower expected return than the companies’ equity. We find ourselves in an environment where corporate bond yields are beginning to approximate earnings yields, despite being senior in the capital structure. Below is the current earnings yield on the S&P/TSX Composite Index, versus 5-year “A” rated corporate bonds and 5-year “BBB” rated corporate bonds. The underlying rates movement, coupled with credit spread widening, has caused the basis to collapse in 2022. The yield sacrificed by investors to move from equities into investment-grade bonds is the lowest in a decade.

TSX Current Earnings Yield vs. 5-Year Corporate Bond Yields

This line graph shows the current earnings yield on the S&P/TSX Composite Index, versus 5-year “A” rated corporate bonds and 5-year “BBB” rated corporate bonds from 2011 to June 1, 2022. As at June 1, the current earnings yield of the TSX is 6.18%, vs. a yield of 4.00% for Canadian “A” rated 5-year corporate bonds and 4.50% for “BBB” rated 5-year corporate bonds. This means the yield sacrificed by investors moving from equities into senior investment-grade bonds is the lowest it has been since 2011.

Source: Beutel, Goodman & Company Ltd., Macrobond, Bloomberg, as at June 9, 2022

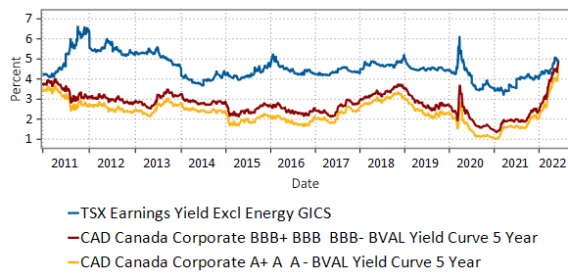

Energy represents approximately 19% of the overall S&P/TSX Composite Index and the sector is experiencing a boom from high oil prices spurred by the war in Ukraine. The sector is also benefitting from a renewed focus on energy security. Currently, energy companies are prioritizing shareholder returns over production growth, so a significant amount of the free cash flow being generated during the period of higher commodity prices is funding dividend increases, further distorting their yield contribution. When we adjust the index earnings yield for Energy’s impact, the equity vs bond basis collapse is even more pronounced.

TSX (Excluding Energy) Current Earnings Yield vs. 5-Year Corporate Bond Yields

This line graph shows the current earnings yield on the S&P/TSX Composite Index, excluding the Energy GICS sector, versus 5-year “A” rated corporate bonds and 5-year “BBB” rated corporate bonds from 2011 to June 1, 2022. As at June 1, the current earnings yield of the TSX ex Energy is 4.89%, vs. a yield of 4.00% for Canadian “A” rated 5-year corporate bonds and 4.50% for “BBB” rated 5-year corporate bonds. This means the yield sacrificed by investors moving from equities into senior investment-grade bonds is marginal. Given the heavy skew the TSX has to the Energy sector (~19%), the adjustment to exclude Energy from this graph shows the distorting effect it has on the Index.

Source: Beutel, Goodman & Company Ltd., Macrobond, Bloomberg, as at June 9, 2022

Summary of All-In Yields vs TSX Earnings Yield (excluding Energy GICS)

| TSX Earnings Yield | Tenor | Sr. Bank Debt | Telco | “A” Rated | “BBB” Rated |

| 4.90% | 2y | 3.9% | 3.7% | 3.8% | 4.1% |

| 5y | 4.3% | 4.4% | 4.0% | 4.5% | |

| 7y | n.a. | 4.6% | 4.2% | 4.7% | |

| 10y | n.a. | 4.8% | 4.4% | 5.0% |

We believe the all-in yields on investment-grade corporate bonds are currently attractive, especially when compared to equity index earnings yields, given their seniority in the capital structure.

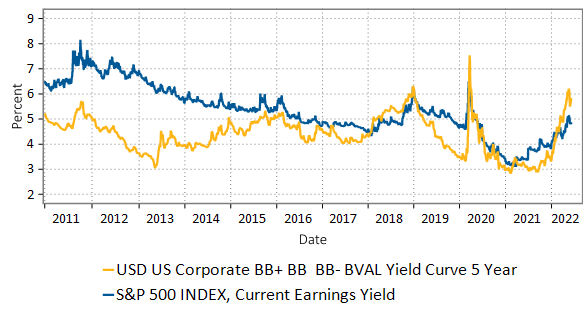

The U.S. Corporate High Yield (HY) Index has returned -8% year to date. The HY market has seen significant outflows, notably from exchange-traded funds (ETFs). These ETF sales cause selling pressure in the market as they look to sell bonds (frequently without regard to relative value) to fund redemptions. The index yield to worst (YTW; the lowest yield to a range of possible call dates) is approximately 7%, well ahead of the S&P 500 Index earnings yield, despite being senior in the capital structure. When we look at the YTW of the BB sub-index, we see the yields offered on BB bonds are approximately 70 bps more than the earnings yield on the S&P. Included in this BB sub-index would be recent rising-star candidates like Ford and Occidental Petroleum and household names like T-Mobile, Tesla and Hilton, as well as the subordinated securities of other well-known investment-grade issuers like Vodafone, whose hybrids are rated BB+.

S&P 500 Earnings Yield vs. BB Corporate Bond Yields

This line graph shows the high-quality BB yields vs. the earnings yield on the S&P 500. As at June 1, 2022, the yield of the 5-year US Corporate BB subindex was 5.54% vs. 4.84% for the earnings yield on the S&P 500 Index. This demonstrates that at the present time, you can be in a “safer” security (i.e., in bonds rather than equities) and earn a higher return, something that is not typically the norm

Source: Beutel, Goodman & Company Ltd., Macrobond, Bloomberg, as at June 9, 2022

No Gain Without Pain

As capital becomes scarcer, companies will be evaluated on their standalone creditworthiness. Investors should not expect central banks to intervene with liquidity or support. Central banks’ focus lies in curbing inflation via rate increases and QT – not the repercussions in the equity markets as a result of those measures. While we see opportunities developing in fixed income, moving from risk-free bonds to investment-grade and high-yield corporate bonds does increase risk and therefore, in our view, active portfolio management plays an important role in this strategy, including a rigorous credit process.

The year-to-date performance of fixed income has been challenging. However, we respectfully disagree with those who advocate moving out of the asset class, for several reasons. We believe the worst of the increase in interest rates is likely in the rear-view mirror as the forward-looking bond market has already priced in the aggressive central bank tightening cycle. This has been one big contributor to the year-to-date negative returns in fixed income. Although abrupt, this re-pricing cycle has reset coupons higher and has made corporate bonds increasingly attractive versus equities. Bond investors are going to receive their fixed coupons from their existing portfolio, but with the added benefit of capital appreciation from the “pull to par”’ that discount bonds provide. New issues will have structurally higher coupons that reflect the prevailing yield curves.

Further, fixed income serves a hedging function that can be used to help protect a portfolio if recession fears mount by both improving credit quality and lengthening duration. Finally, we would encourage investors to avoid the herd mentality. When the consensus view is pessimistic and there is capitulation of market participants, pricing dislocations emerge as investors look to sell the asset class. Investors who remain in the asset class should be able to take advantage of instances where risk is inappropriately priced.

We continue to look for value and compelling risk-reward opportunities.

Download PDF

Related Topics and Links of Interest:

- Curve Confusion

- Energy Transition: An Opportunity and a Risk

- Keep Calm and “Carry” On – 2022 Credit Outlook

©2022 Beutel, Goodman & Company Ltd. Do not sell or modify this document without the prior written consent of Beutel, Goodman & Company Ltd. This commentary represents the views of Beutel, Goodman & Company Ltd. as at the date indicated.

This document is not intended, and should not be relied upon, to provide legal, financial, accounting, tax, investment or other advice.

Certain portions of this report may contain forward-looking statements. Forward-looking statements include statements that are predictive in nature, that depend upon or refer to future events or conditions, or that include words such as “expects”, “anticipates”, “intends”, “plans”, “believes”, “estimates” and other similar forward-looking expressions. In addition, any statement that may be made concerning future performance, strategies or prospects, and possible future action, is also forward-looking statement. Forward-looking statements are based on current expectations and forecasts about future events and are inherently subject to, among other things, risks, uncertainties and assumptions which could cause actual events, results, performance or prospects to be incorrect or to differ materially from those expressed in, or implied by, these forward-looking statements.

These risks, uncertainties and assumptions include, but are not limited to, general economic, political and market factors, domestic and international, interest and foreign exchange rates, equity and capital markets, business competition, technological change, changes in government regulations, unexpected judicial or regulatory proceedings, and catastrophic events. This list of important factors is not exhaustive. Please consider these and other factors carefully before making any investment decisions and avoid placing undue reliance on forward-looking statements Beutel Goodman has no specific intention of updating any forward-looking statements whether as a result of new information, future events or otherwise.